Manufacturers in the FFS rigid films market drive growth by delivering high-performance, cost-effective, and sustainable packaging solutions. They use advanced materials and production techniques to serve industries such as food and beverage, healthcare, and personal care.

The global FFS rigid films market will exceed USD 38.4 billion by 2035, growing at a compound annual growth rate (CAGR) of 4.3%. Companies focus on eco-friendly practices, innovation, and operational efficiency to meet consumer and industrial demands.

Business houses are widening the market through recyclable and durable packaging material. Multilayer extrusion and barrier film technologies enable advanced manufacturing processes to give brands more opportunities for high customization, product protection, and waste reduction. Manufacturers work in close coordination with industries to comply with regulatory standards to ensure consumer safety.

| Attribute | Details |

|---|---|

| Projected Value by 2035 | USD 38.4 billion |

| CAGR (2025 to 2035) | 4.3% |

Explore FMI!

Book a free demo

Factors Driving Market Growth

| Category | Market Share (%) |

|---|---|

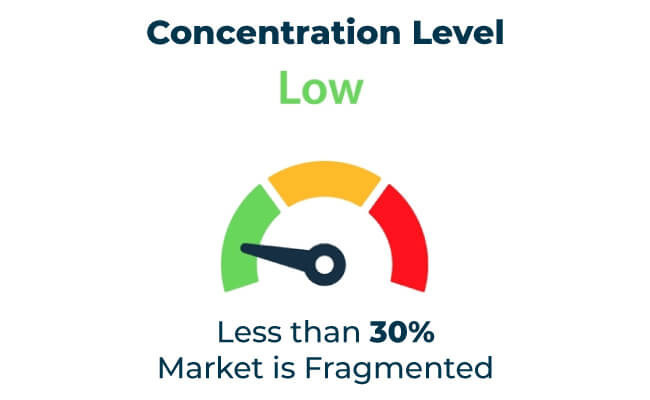

| Top 3 Players (Klöckner Pentaplast, Amcor, Berry Global) | 13% |

| Rest of Top 5 Players (Toray, Sealed Air) | 08% |

| Next 5 of Top 10 Players | 04% |

Type of Player & Industry Share

| Type of Player | Market Share (%) |

|---|---|

| Top 10 Players | 25% |

| Next 20 Players | 43% |

| Remaining Players | 37% |

There is vast export potential in the emerging markets of Asia-Pacific, Africa, and Latin America. The regions require safe, sustainable, and attractive packaging solutions. Exporters can take advantage of growing consumer markets and government policies that encourage recyclable materials.

| Region | North America |

|---|---|

| Market Share (%) | 30% |

| Key Drivers | Focuses on sustainability and advanced barrier technologies. |

| Region | Europe |

|---|---|

| Market Share (%) | 35% |

| Key Drivers | Adopts eco-friendly practices and high-barrier solutions. |

| Region | Asia-Pacific |

|---|---|

| Market Share (%) | 25% |

| Key Drivers | Expanding with increasing demand for cost-effective packaging. |

| Region | Other Regions |

|---|---|

| Market Share (%) | 10% |

| Key Drivers | Markets expand with growing demand for rugged, sustainable packaging. |

The FFS rigid films market will grow through sustainability, advanced manufacturing techniques, and customization. Companies investing in biodegradable materials and lightweight designs will gain competitive advantages. Growth in e-commerce and global trade will open opportunities for market players.

| Tier | Key Companies |

|---|---|

| Tier 1 | Klöckner Pentaplast, Amcor, Berry Global |

| Tier 2 | Toray, Sealed Air |

| Tier 3 | Mondi, Flex Films |

The FFS rigid films market is growing steadily as sustainability, innovation, and operational efficiency drive trends. Companies prioritizing eco-friendly practices, advanced manufacturing, and market expansion maintain leadership positions. Automation and recycling advancements enhance efficiency and reduce environmental impact.

Key Definitions

Abbreviations

Methodology

This report is an integration of primary research, secondary data, and expert insights. Analysts verified the findings by conducting interviews with industry professionals and end-users. The methodology is designed to ensure a holistic and accurate market perspective.

The FFS rigid films market refers to the production and application of durable, high-barrier, and customizable films for industries such as food, healthcare, and personal care. These films offer sustainability, efficiency, and product protection.

FFS rigid films are high-performance packaging materials used in form-fill-seal processes. They are designed to offer durability, protection, and customization for industries like food, healthcare, and personal care.

These films provide key benefits such as extended shelf life, reduced material waste, and cost efficiency, making them an attractive option for industries with high packaging demands.

Companies are prioritizing recyclable materials, biodegradable solutions, and energy-efficient production to meet global sustainability goals.

Asia-Pacific, Europe, and North America are key growth regions due to rising demand for sustainable packaging and the expansion of the food and healthcare industries.

Technologies like high-barrier films, smart packaging, and multilayer extrusion improve product protection, extend shelf life, and offer new customization opportunities.

High capital investments, recycling limitations in certain regions, and navigating complex global regulations are some of the major challenges in this market.

Compostable Straws Market Growth - Demand & Forecast 2025 to 2035

Convertible Shipper Display Market Trends - Growth & Demand Forecast 2025 to 2035

Japan Premade Pouch Packaging Industry Analysis by Material Type, Closure Type, End Use, and Region through 2025 to 2035

Coffee Capsules Market Analysis - Growth & Forecast 2025 to 2035

Coffee Bottles Market Insights & Industry Trends 2025 to 2035

Autoclaving Trays Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.