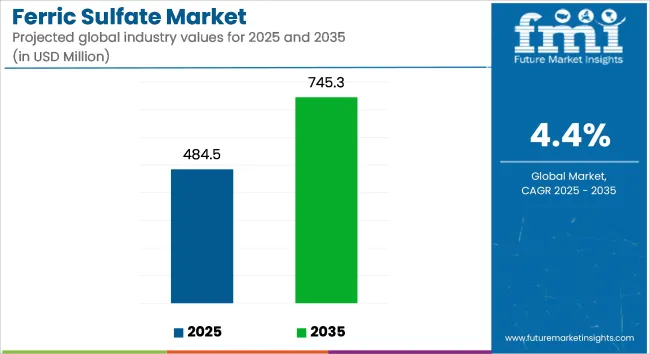

The global ferric sulfate market is estimated to record sales of USD 484.5 million in 2025, with the value expected to reach USD 745.3 million by 2035, reflecting a CAGR of 4.4% over the forecast period. Market growth is being driven by rising demand across water treatment, pulp and paper, and mining sectors, supported by environmental regulations and infrastructure investments.

| Attributes | Key Insights |

|---|---|

| Estimated Market Value, 2025 | USD 484.5 Million |

| Projected Market Value, 2035 | USD 745.3 Million |

| Value CAGR (2025 to 2035) | 4.4% |

Ferric sulfate is being utilized primarily as a coagulant for the treatment of municipal and industrial wastewater. Its effectiveness in removing suspended solids, organic matter, and phosphates has positioned it as a preferred choice for water purification processes. With increasing urbanization and industrial expansion, particularly in developing regions, investments in water treatment infrastructure are being scaled up, thereby increasing the need for efficient coagulation agents.

Municipalities are relying on ferric sulfate to meet rising clean water demands while addressing regulatory pressures related to effluent discharge. National programs focusing on sustainable water recycling and clean river systems have further contributed to the compound's consistent market growth. Countries implementing stricter environmental discharge standards have facilitated the adoption of ferric sulfate-based solutions in both public and industrial sectors.

In the pulp and paper industry, ferric sulfate is being used for process water clarification, pitch control, and brightness enhancement. Its application aligns with the growing demand for biodegradable and recyclable paper packaging, particularly in response to green packaging initiatives and restrictions on plastic use. Manufacturers are optimizing chemical consumption and wastewater reuse, with ferric sulfate playing a central role in these process improvements.

In mining and metallurgy, ferric sulfate is being employed in ore beneficiation and wastewater treatment. It is facilitating metal extraction processes by acting as a separating and purifying agent for minerals such as copper and zinc. The increased focus on environmentally responsible mining operations has further supported the product’s use as part of green metallurgy solutions.

Compliance with environmental directives, such as the European Union Water Framework Directive and North America’s EPA wastewater standards, is shaping procurement strategies. Producers are enhancing product purity and performance to align with evolving regulatory and sustainability benchmarks.

The market is expected to sustain growth through 2035 as ferric sulfate remains integral to water sustainability, industrial process efficiency, and environmental compliance frameworks.

The below table represents the global ferric sulfate annual growth rates from 2025 to 2035. In this study, we took into consideration the trend of growth in the industry from January to December but differentiated the first half of the year (H1) with respect to H2 for a given year 2025 against the base year 2025. Stakeholders get a full view of the performance of the sector throughout time, which can also be used to identify potential future trends.

Graphs contain sectoral growth in the first and second halves of 2025 to 2035. Originally forecasted to have an annual growth rate of 4.1% in H1 2025, it seems the proposed switch-over into H2 will deliver a much higher increase in that forecast trend.

| Particulars | Value CAGR |

|---|---|

| H1(2025 to 2035) | 4.1% |

| H2(2025 to 2035) | 4.7% |

| H1(2025 to 2035) | 3.9% |

| H2(2025 to 2035) | 5.0% |

For the next period, H1 2025 to H2 2025, the CAGR is expected to dip slightly down to 3.9% in first half and pick up some pace at about 5.0% in second half. The sector has seen a 20 BPS dip in the first half (H1), but there was a marginal gain of 30 BPS recorded for this sector in the second half (H2).

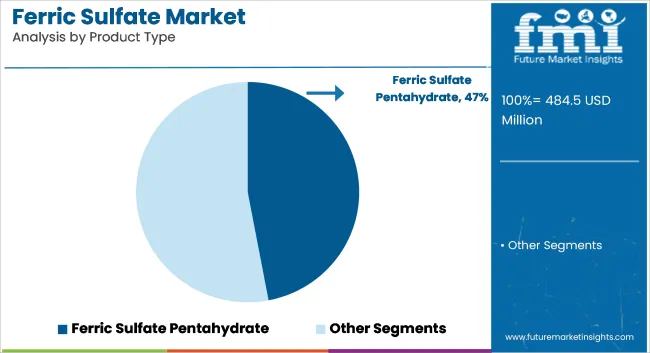

Ferric sulfate pentahydrate is estimated to account for approximately 47% of the global ferric sulfate market share in 2025 and is projected to grow at a CAGR of 4.3% through 2035. Its high solubility and coagulating ability make it particularly effective for removing suspended solids, phosphorus, and organic matter in municipal and industrial water treatment processes.

This form is favored for its efficiency in rapid mixing systems and compatibility with a wide pH range, making it suitable for varied water chemistries. Suppliers continue to enhance process yields and impurity control in pentahydrate formulations to meet quality requirements for both drinking water and industrial discharge management.

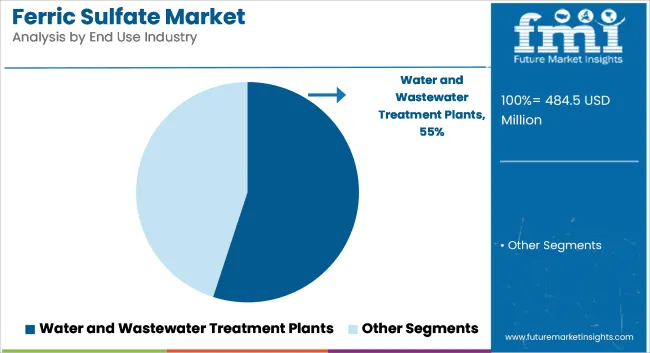

The water and wastewater treatment segment is projected to hold approximately 55% of the global ferric sulfate market share in 2025 and is expected to grow at a CAGR of 4.2% through 2035. Ferric sulfate is a widely used coagulant in municipal water treatment facilities and industrial effluent systems, where it aids in removing turbidity, heavy metals, and phosphorus.

As urban populations grow and wastewater reuse becomes more critical, governments across Asia, the Middle East, and parts of North America are increasing funding for treatment plant upgrades and phosphate-removal compliance. Ferric sulfate also supports sludge volume reduction, making it economically attractive for municipalities. With regulatory frameworks tightening globally around nutrient discharge and surface water contamination, the water treatment sector remains the dominant driver of ferric sulfate demand.

Environmental Regulations Affecting the Ferric Sulfate Market

Environmental regulations are arguably the biggest determinants of the ferric sulfate market; they are especially vital in water and wastewater treatment operations. Worldwide, stricter laws imposed by both governments and regulatory authorities are the solutions to reduce water pollution and improve the quality of water.

Ferric sulfate, which is the main chemical for the process and is effective in the removal of pollutants, such as suspended solids, heavy metals, and phosphates, is the optimal choice to meet all abovementioned strict conditions.

The regulatory initiative addressing the need for eco-friendly production processes has been the main reason for the manufacturers to change their ways and go green. The processes introduced include the reduction of carbon emissions during the production phase and a shift to by-products or recycled material.

Eco-friendly behaviors in the eyes of the international community not only help ferric sulfate manufacturers comply with the regulations but also attract the interest of environmentally friendly companies and municipalities.

Digitalization in the Ferric Sulfate Sector

The operational and application dimensions of ferric sulfate in water treatment are now being digitally transformed. The newest digital gadgets and automated mechanisms are the ones making the chemical dosing necessarily precise, adding to the efficiency of the system by minimizing the application of chemicals, waste, and the costs involved.

The cutting-edge monitoring system based on real-time data and analytical capabilities gives the water managers crucial information not only about the quality of the water but also about the effectiveness of the treatment process.

The production of ferric sulfate is also affected by digital proposals for product improvement by the marketing department. They include the introduction of more stable and effective in the coagulation of particles in water across a range of conditions.

Scientific research, designed specifically for the development of hybrid coagulants which are needed in certain industries, speeds up the process even more; hence ferric sulfate application is diversified and productivity is increased.

New Uses for Ferric Sulfate in Water Treatment

The utilization of ferric sulfate in water treatment is broadening amid the heightened interest from industrial sectors such as pulp and paper, textiles, mining, and food processing. These industries generate wastewater with specific harmful pollutants, and with its diverse functionalities, ferric sulfate could be a solution.

Joint efforts undertaken by chemical manufacturers, industrial water treatment providers, and academic research institutions have thereby been the strong driving force for innovations. It is the alliances that help brainstorm specific ferric sulfate solutions in accordance with the industrial preferences, which in turn, will lead to wider penetration of the market and technological advancement.

High Initial Investment and Operational Cost to Impede Growth

Although the coagulant is cost-effective, the situation is adversary for manufacturers due to challenges in the market which arises from the high initial investments and operational costs. Issues related to procurement of key materials such as iron ore and sulfuric acid, along with supply chain variances are the most paramount for manufacturers.

Also, the risks associated with geopolitics, price fluxes in addition to the environmental policies imposed on the extraction of raw materials affect the cost of production.

In order to cope with these difficulties, the vendors are seeking to improve the quality of their operational procedures and are turning towards more resource-efficient and less wasteful technologies. Asset management in the supply chain and pricing strategies based on changing costs play a significant role in the continuity of market operations.

Finding a delicate balance between ceding resources to producing high-quality, eco-friendly products, and fending off the threat of cost cutting is a very tough nut to crack for the ferric sulfate sector.

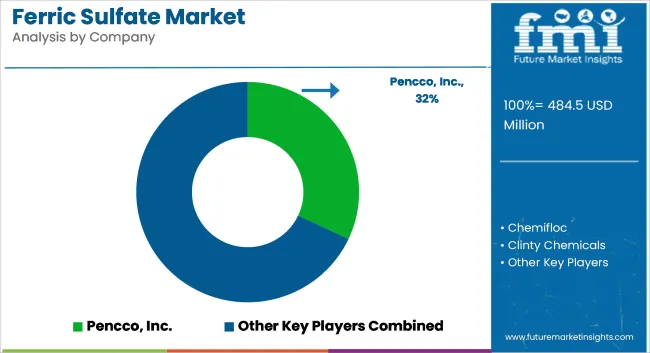

The ferric sulfate sector is under a medium level of concentration, and the main contenders being the Kemira Oyj, Chemtrade Logistics Inc., and Pencco, Inc.

Tier 1 companies which posses around 30% to 40% of the total market share. These have reaped the benefits from their global presence, high production ability, and solid relations with their industrial clients across the water treatment and mining sectors.

These companies which dominate the market do so through offering quality, reliable products in big volumes, thus, they impress both developed and underdeveloped areas.

The second tier companies such as Altivia Chemicals, Chemifloc Limited, and Henan Aierfuke Co., Ltd., own around 20-30% of the market share. These are the companies that are mainly dealing with regional markets and manage to work with lower overhead costs, thus being cheaper. They tend to produce and distribute products locally. However, they do not have a global network that is abundant in Tier 1 companies.

Tier 3 which is made up of companies like Lubon Industry Co., Ltd. and Clinty Chemicals, represents the smaller players in the market with a generally lower share percentage.

These businesses are focused on serving niche or rural markets and they operate predominantly in product applications or as alternatives that are low in cost, which hinders them from detaching from their larger competitors on the basis of market share. However, as the market for ferric sulfate rises, they may experience a little growth or the need for mergers.

| Countries | CAGR 2025 to 2035 |

|---|---|

| Brazil | 5.8% |

| India | 5.5% |

| Turkiya | 5.2% |

| Mexico | 5.0% |

| Poland | 4.7% |

China is the critical player in the global ferric sulfate market, accounting for a large part of the total product and consumption volumes. The sector’s industrialization process, especially in water treatment, mining, and chemical processing, is the main driver of this leadership.

Ferric sulfate is the most preferable chemical in water treatment in China, owing to the rapid growth of urbanization and the need for solutions having higher productivity.

Additionally, China's mining sector is one of the primary users of ferric sulfate, specifically for metal extraction technology that includes gold, copper, and iron.

The government’s strong emphasis on green environmental protection and technologies has further emphasized the need for ferric sulfate, thus promoting it as an integral part of the achievement of sustainable industrial practices.

China's dedicated efforts to infrastructure development, together with the introduction of new technologies in the areas of extraction and recycling, confirm the country's position as the world leader in ferric sulfate production and consumption. This level of global control is anticipated to be continuous as it relies on the country’s strategic plans and its supreme placement in the community chain.

The United States market is a significant participant in the global ferric sulfate market which is benefitted from the substantial demand through its mature water treatment and mining industries.

Ferric sulfate is the product that is mostly used at municipal and industrial water treatment facilities throughout the country, and this process is approached by environmental regulations and sanitation concerns. Yet another sector which uses ferric sulfate in considerable quantities is solid minerals mining specifically petroleum and copper mining.

As government is concerned about promoting sustainability and the country’s dependence on foreign sources the domestically produced ferric sulfate is triggered to catch on.

Novel extraction methods and the federal government incentives for recycling partnerships pave the way for the USA ferric sulfate market to thrive. So the plant for ferric sulfate should manifest the long-term growth due to the USA willingness to go green.

Germany market emerges as a vital influencer in the European ferric sulfate market, being mainly characterized by its efforts in environmental regulations and its water treatment infrastructure. As an innovative company in sustainable technology, Germany’s the ferric sulfate's primary driver is spearheaded by the country’s strictness to living up to high water quality requirements.

The highly effective water treatment systems in the country run on ferric sulfate as a big part of their input used to meet the binding federal and municipal water purification regulations. More so, Germany's developed mining Sector leverages ferric sulfate for various types of growth such as gold and copper extraction.

The government of Germany constantly supports the development of the green sector, which through expansion in the renewables sector also promotes the use of ferrous sulfate.

With the regulatory frameworks and a strong industrial base, Germany has become a key market for ferric sulfate in Europe by powering the demand for environment-friendly water treatment and mining techniques.

The ferric sulfate market is becoming more competitive as companies invest in regional supply chain expansion and production optimization. Players are focusing on on-site manufacturing units, especially near water treatment facilities, to lower transportation costs and ensure product consistency. Mergers and acquisitions are being pursued to secure raw material supply, particularly sulfuric acid and iron oxide.

Product innovation is limited due to the commodity nature of the compound, but packaging solutions and delivery systems are being enhanced for better storage and handling. As regulatory scrutiny around water quality intensifies, the market is poised for stable, long-term growth supported by infrastructure modernization and environmental sustainability trends.

Based on product type the market is segmented into ferric sulfate monohydrate, ferric sulfate pentahydrate, and ferric sulfate basic.

Based on end use industry the market is segmented into water and wastewater treatment plants, chemical manufacturing, agriculture, pulp and paper, and textiles

Regions considered in the study include North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia and Pacific, and the Middle East and Africa.

The global market was valued at USD 411.1 million in 2020.

The global market is set to reach USD 484.5 million in 2025.

Global demand is anticipated to rise at 4.4% CAGR.

The industry is projected to reach USD 745.3 million by 2035.

Ferric sulfate monohydrate segment dominates in terms of share.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ferric Sulfate & Polyferric Sulfate Market 2024-2034

UK Ferric Sulfate Market Trends – Size, Share & Industry Growth 2025-2035

USA Ferric Sulfate Market Analysis – Demand, Growth & Forecast 2025-2035

Polyferric Sulfate Market

Japan Ferric Sulfate Market Report – Demand, Trends & Industry Forecast 2025-2035

ASEAN Ferric Sulfate Market Trends – Size, Share & Growth 2025-2035

Germany Ferric Sulfate Market Analysis – Size, Share & Forecast 2025-2035

Ferric Chloride Market Size and Share Forecast Outlook 2025 to 2035

Ferric Phosphate Market

Sulfate-Free Shampoos Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Persulfates Market Size and Share Forecast Outlook 2025 to 2035

Crude Sulfate Turpentine Market Analysis by Product Type, Source, Processing Method, Application, and Region through 2035

Nickel Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Barium Sulfate Market Analysis - Size, Share & Forecast 2025 to 2035

Calcium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Diethyl Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Ferrous Sulfate Market - Size, Share & Forecast 2025 to 2035

Ammonium Sulfate Food Grade Market Report - Industry Insights 2025 to 2035

Magnesium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA