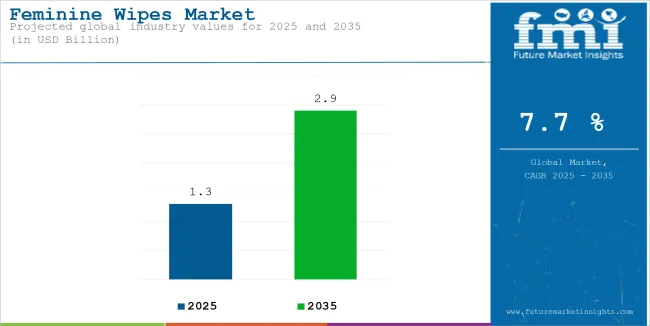

The feminine wipes market is estimated to reach USD 1.3 billion in 2025. It is estimated to rise at a CAGR of 7.7 % during the assessment period 2025 to 2035 and get a value of USD 2.9 billion by 2035.

| Attributes | Description |

|---|---|

| Estimated Feminine Wipes Market Size (2025E) | USD 1.3 billion |

| Projected Feminine Wipes Market Value (2035F) | USD 2.9 billion |

| Value-based CAGR (2025 to 2035) | 7.7% |

Feminine wipes are feminine hygiene products marketed to clean the vulvar area and control odor. Like other feminine hygiene products, they are typically used by younger women. The use of these products has surged over time due to rising number of working females owing to increased urbanization.

| Attributes | Details |

|---|---|

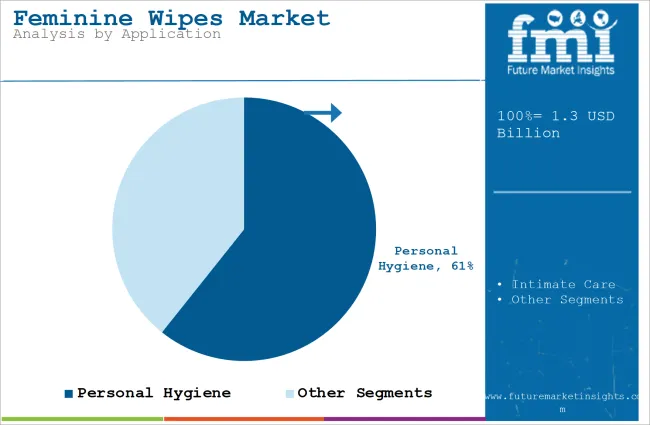

| Top Application Type | Personal Hygiene |

| Market Share in 2025 | 60.7 % |

Based on application, the market is divided into personal hygiene and intimate care. The personal hygiene segment holds 60.7% market share in 2025. The growing awareness of health and personal hygiene among women is augmenting the sales of feminine wipes.

Nowadays, these wipes are also being designed with both convenience and portability in mind, as they give a very quick and instantly available method for maintaining personal hygiene for women with on the go lifestyles.

| Attributes | Details |

|---|---|

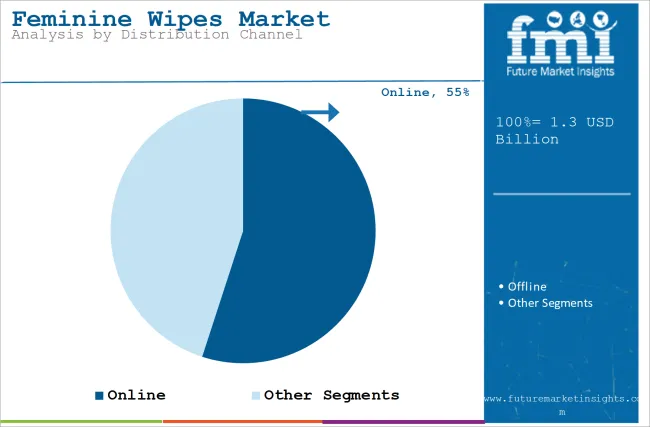

| Top Distribution Channel Type | Offline |

| Market Share in 2025 | 55.8 % |

Based on distribution channel, the market is divided into online and offline. The offline segment holds 55.8% market share in 2025.

Offline retail outlets, including convenience stores, supermarkets, and pharmacies, offer immediate access to feminine wipes, making them easily available to customers who need them immediately.

This is especially important for women who prefer to purchase hygiene products in person and may not want to wait for shipping or deal with delivery.

Moreover, feminine wipes are often placed in stores of regions where customers may make impulse purchases, like near the checkout counters or alongside other personal care products.

This strategic placement grows visibility and encourages spontaneous buying, particularly when consumers are reminded of their need for hygiene products during their shopping tour.

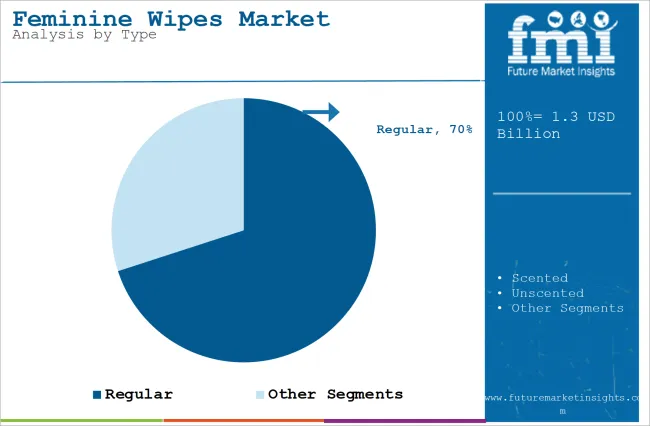

Based on type, the market is divided into regular, scented, and unscented. Regular feminine wipes are often preferred over strictly scented or unscented varieties because they offer a balance of gentleness and practicality, making them suitable for a wider range of needs.

Due to this factor, they are suitable for individuals seeking freshness without strong perfumes or an entirely neutral experience. Additionally, they are often formulated to be hypoallergenic and pH-balanced, catering to the sensitive skin of the vulva while minimizing the risk of irritation or disruption to the natural vaginal situation.

As awareness about the significance of personal hygiene increases, mostly in the context of women health and well-being, the demand for feminine wipes is likely to increase.

Additionally, these wipes provide convenience and comfort for maintaining hygiene throughout the day, especially during post-exercise or menstruation. These factors are positively affecting the market and contributing to product sales.

Many conventional feminine wipes contain potentially harmful chemicals, including fragrances, parabens, and phthalates, which can irritate the sensitive vaginal area.

Additionally, consumers are becoming growingly aware of these risks and are seeking safer alternatives. This demand for safe, eco-friendly, and gentle products is pushing brands to develop wipes with plant-based and organic elements.

Women are becoming more conscious of their overall health and well-being. As societal conversations around women health and empowerment gain momentum, there is greater focus on products that support overall well-being.

Additionally, this shift in consumer mindset encourages more women to focus on personal hygiene products. Governments globally are also spreading awareness about female hygiene, which is favoring market growth.

Rising Focus on Sustainability

Biodegradable and eco-friendly wipes are in high demand. Consumers are looking for products with minimal environmental impact, such as eco-friendly packaging.

Moreover, brands are introducing wipes made of sustainable materials, such as plant-based fibers, that decompose more easily and have a smaller ecological footprint. This trend is appealing to eco-conscious consumers who prioritize sustainability.

Moreover, consumers are increasingly preferring natural and organic ingredients. As many women seek natural and gentle products, there is a growing demand for feminine wipes formulated with organic and chemical-free ingredients. Furthermore, wipes infused with natural oils such as essential oils and gentle cleansers are gaining popularity due to their soothing properties, specifically for sensitive skin.

Development of Multi- Functional Products

Feminine wipes are evolving beyond basic hygiene products. These wipes could be formulated with specific ingredients to address common feminine health concerns, including odor dryness and irritation. Additionally, these might contain soothing botanical extracts, pH-balancing agents, or probiotics to promote a healthy vaginal microbiome.

Enhanced Accessibility in Diverse Retail Channels

Feminine wipes are growingly available in a wider range of retail outlets, ranging from supermarkets and drugstores to online platforms and specialty stores. Additionally, drugstores offer access to expert advice from pharmacists and a wider range of specialized products.

The rise of e-commerce has made it easier for customers to access a broader variety of wipes, such as premium and niche options, driving market penetration.

Growing Customization and Personalization

The trend of customization, accompanied by the introduction of feminine wipes specialized to different requirements, is being witnessed in the market. These wipes are now being designed specifically for the menstrual cycle, sensitive skin, and extra freshness. Moreover, this trend is a clear reflection of the customer-centric requirement for individual hygiene products designed according to various personal choices and ways of living.

Rising Environmental Concerns May Hamper Product Adoption

Despite an expanding scope for product uptake, the growing concerns pertaining to the environment may restrain consumers from adopting the product.

Many products are formulated using non-biodegradable materials, contributing to waste and pollution. Due to the growing preference for sustainability, the product faces a challenge with regard to bulk adoption.

Concerns Regarding Skin Sensitivity May Pose Challenge

The growing concerns regarding allergic reactions are negatively impacting market growth. Moreover, feminine wipes are often infused with fragrances and preservatives that result in allergic reactions.

This hampers product adoption, specifically amongst those with more delicate skin or conditions such as eczema. Due to the increasing awareness of skin sensitivity, consumers are growingly becoming more conscious of the products they use, which can hinder massive uptake of feminine wipes.

The USA is poised to grow at a CAGR of 2.9% from 2025 to 2035. In North America, there has been increasing importance on personal wellness, hygiene, and personal health, specifically in the context of female health, contributing to regional growth.

Additionally, the growing fast-paced lifestyles are boosting the adoption of feminine wipes in the region. These wipes offer an easy-to-use solution for maintaining hygiene during busy days filled with work.

In Europe, growing sustainability concerns are fueling the growth of the feminine wipes market. With increasing concerns about the environment and the decrease in waste, European customers are increasingly seeking eco-friendly personal care products. Moreover, brands are responding to this demand by providing a biodegradable, organic, or recyclable alternative, which has contributed to a rise in the popularity of green hygiene products.

Japan is slated to expand at a CAGR of 8.1% during the study period. The growing urbanization and transformation of lifestyle are the two main aspects responsible for the growing sales of feminine wipes. The increasing disposable income is also leading to a surge in the sales of the product.

The pricing of feminine wipes varies widely depending on factors such as target demographics, brand positioning, and product ingredients. Cost-efficient wipes, generally priced between USD 3.50 and USD 5.00, are mainly known for their affordability and convenience.

Mid-range products considerably mention the features of being made from natural, non-toxic components, and hypoallergenic properties, which are attractive to the health-conscious population.

| Region/Country | Key Products |

|---|---|

| North America | Eco-friendly, biodegradable wipes, organic cotton wipes |

| Europe | Biodegradable wipes, plant-based wipes |

| Asia-Pacific | Natural ingredient wipes, travel-sized wipes |

| Latin America | Affordable, basic wipes, organic options |

| Middle East & Africa | Natural, gentle wipes, travel wipes |

The trade in feminine wipes is focused on the growing demand for hygiene products across various areas.

North America and Europe are among the largest importers, specifically of eco-friendly and organic wipes, with products often sourced from Germany, China, and Mexico. Moreover, the trend toward natural and biodegradable ingredients is pushing these markets to import products that align with increasing customer concerns over sustainability.

Significant players in the feminine wipes market devise various plans to improve their market position, enhance consumer loyalty, and capture a larger share by catering to the growing demand for personal hygiene products.

Companies are adopting various strategies such as mergers & acquisitions, joint ventures, capacity expansions, and others.

P&G is focusing on diversification strategy and releasing feminine wipes with sustainability in mind. Other companies are also focusing on launching enhanced capabilities of products to outshine the competition.

| Company | Area of Focus |

|---|---|

| Procter & Gamble | Focuses on diversification, introducing wipes under its "Always" and "Tampax" brands |

| Kimberly-Clark | Focuses on leveraging its long-established reputation in the personal care sector to build trust with consumer |

| Edgewell Personal Care | Focuses on producing feminine wipes that cater to sensitive skin |

Some of the startups operating in the market are Good wipes, Cora, and Lola. Good Wipes is a start-up offering environmental, plant-based feminine wipes that are marketed as 100 % biodegradable and free from harsh organic products, which focuses on sustainability, organic ingredients and eco-conscious packaging. Additionally, Cora started a direct-to-consumer brand emphasizing organic feminine hygiene products.

Its wipes are marketed as both environmental and effective, catering to women who want safe, non-toxic products for their hygiene needs. Moreover, Lola is a female-led start-up providing a range of feminine care products, like wipes. The company focuses on offering natural, chemical-free options for menstrual and personal hygiene.

In terms of application, the feminine wipes market is segmented into personal hygiene and intimate care.

In terms of type, the market is segmented into regular, scented, and unscented.

In terms of distribution channel, the market is segmented into online and offline.

The market is predicted to reach a size of USD 2.9 billion by 2035.

The market size is poised to reach USD 1.3 billion in 2025.

The prominent companies in the market include Kimberly-Clark, Procter & Gamble, Hengan International, and Rael.

North America is a lucrative market for product manufacturers.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Feminine Hygiene Product Market Analysis – Growth & Forecast 2025 to 2035

Feminine Care Pouch Film Market

Wipes Market Size and Share Forecast Outlook 2025 to 2035

Wet Wipes Canister Market - Demand & Forecast 2025 to 2035

Wet Wipes Market - Trends & Forecast 2025 to 2035

Electronic Wipes Market Size and Share Forecast Outlook 2025 to 2035

Dry and Wet Wipes Market Size and Share Forecast Outlook 2025 to 2035

Toilet Care Wipes Market Size and Share Forecast Outlook 2025 to 2035

Personal Care Wipes Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Wipes Market - by Product Type, Material Type, Sales Channel, End-User, and Region - Trends, Growth & Forecast 2025 to 2035

Household Care Wipes Market Size and Share Forecast Outlook 2025 to 2035

Furniture Polish Wipes Market Size and Share Forecast Outlook 2025 to 2035

Dry Electrostatic Wipes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA