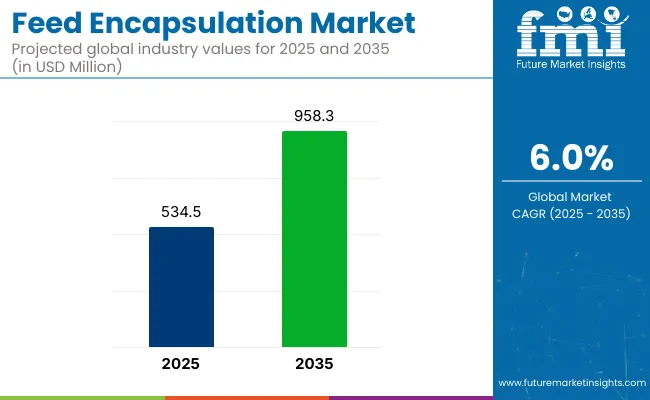

The global feed encapsulation market is valued at USD 534.5 million in 2025 and is expected to reach USD 958.3 million by 2035, reflecting a CAGR of 6.0%. The adoption of encapsulated nutrients in animal feed is being accelerated by the need for targeted nutrient delivery, improved feed efficiency, and reduced waste.

| Metric | Values |

|---|---|

| Estimated Size (2025E) | USD 534.5 million |

| Projected Value (2035F) | USD 958.3 million |

| CAGR (2025 to 2035) | 6.0% |

Increasing demand for high-quality animal protein, along with rising awareness regarding livestock nutrition, has driven the implementation of this technology. Microencapsulation and polymer-based coatings are leading materials and technologies utilized.

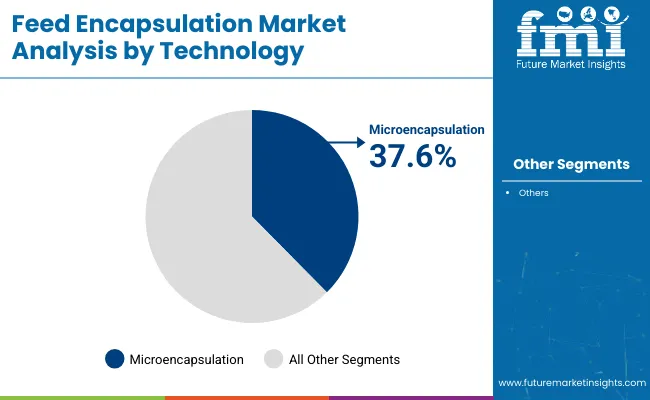

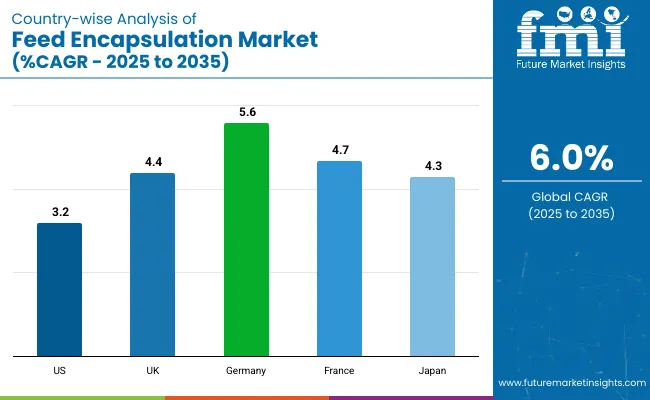

The USA is expected to remain the largest market by value, though expanding at a moderate CAGR of 3.2% by 2035, driven by its advanced agricultural infrastructure. Germany is anticipated to register the fastest growth at a CAGR of 5.6% closely followed by France with 4.7% CAGR. Microencapsulation is projected to retain dominance with a 37.6% share in 2025 due to its superior protection of active ingredients and improved bioavailability. The poultry segment by animal type accounts for 35.8% of the market share in 2025.

The market forms a small but strategic segment within its parent markets. It accounts for approximately 2-3% of the overall animal feed market and around 5-7% of the feed additives market, given its role in enhancing additive stability and efficiency. Within the animal nutrition market, it holds 3-5%, mainly through encapsulated amino acids, enzymes, and probiotics.

Its share in the broader animal health market remains under 1%, as it is indirectly linked via nutritional health. In the encapsulation technology market, feed encapsulation constitutes 5-8%, driven by growing adoption in livestock for controlled nutrient release.

The global market is segmented into product type, encapsulation material, technology, application, animal type, and region. By product type, the market includes vitamins & minerals, amino acids, enzymes, probiotics & prebiotics, essential oils & phytogenics, antibiotics & drugs, organic acids, and pigments.

By encapsulation material, the key categories are lipid-based coatings, polymers, protein-based coatings, carbohydrates, and natural materials. By technology, the segments comprise spray drying, fluidized bed coating, extrusion, coacervation, centrifugal encapsulation, emulsion-based encapsulation, microencapsulation, and nanoencapsulation.

By application, the market is divided into nutrient delivery, gut health improvement, growth promoters, feed preservation, health & immunity boosters, and palatability enhancers. By animal type, the main categories include poultry, ruminants, swine, aquaculture, companion animals, and equine. By region, it covers North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and Middle East & Africa.

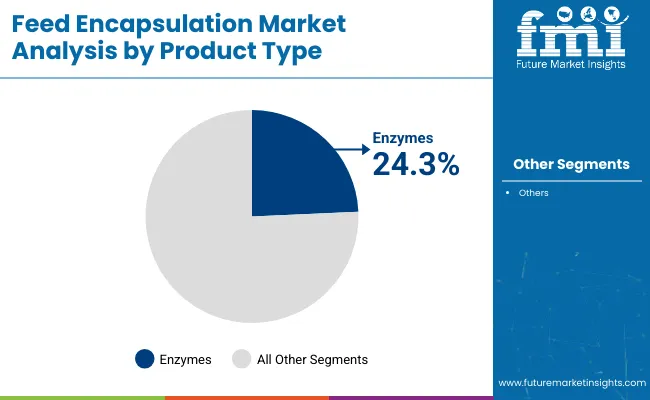

Among all feed encapsulated product types, enzymes are projected to retain dominance, holding a market share of 24.3% in 2025, due to their key role in improving digestion and nutrient utilization.

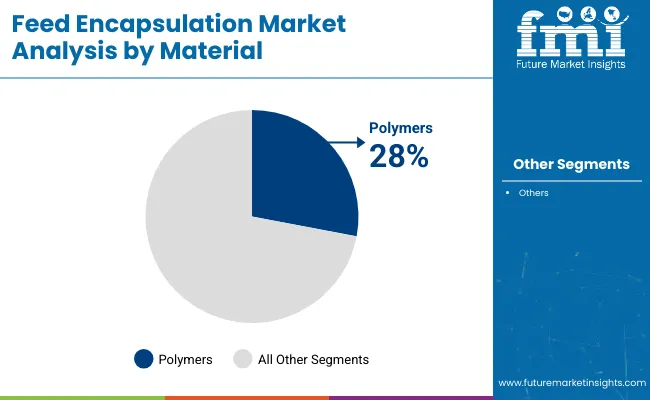

Polymers are set to lead this category, holding a 28% share in 2025, owing to their controlled release capabilities and excellent protection against environmental factors. They enable customized nutrient delivery in livestock and aquaculture.

Microencapsulation is anticipated to dominate, capturing a 37.6% market share in 2025, supported by its versatility across multiple feed additives. This technology ensures better protection, masking of unpleasant flavors, and optimized release profiles.

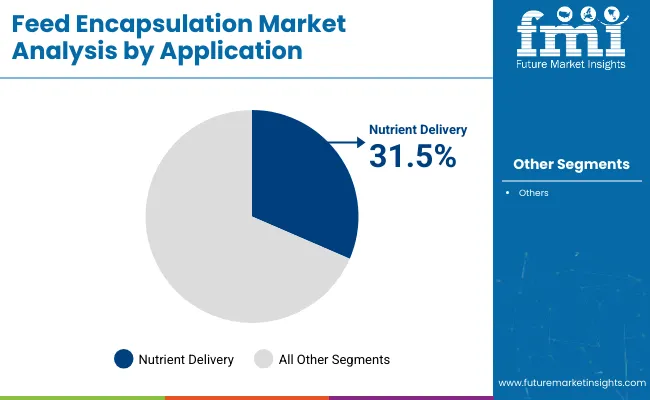

Nutrient delivery is expected to lead the application segment, accounting for a 31.5% share in 2025, as precise nutrient targeting becomes vital in modern livestock nutrition. With growing consumer demand for antibiotic-free meat and sustainable farming, encapsulated nutrients are enabling efficient utilization while reducing feed costs.

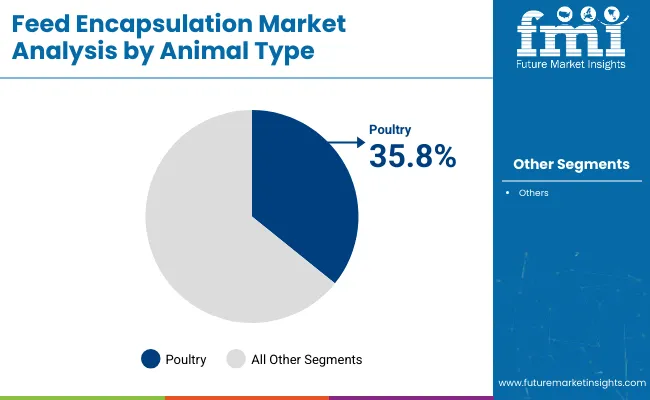

Poultry is projected to dominate with a 35.8% share in 2025, driven by its high feed turnover and the need for precise nutrition. Encapsulated enzymes, amino acids, and probiotics are widely used in broiler and layer operations to enhance digestion and immunity. The sector benefits significantly from cost-saving innovations and consistent feed performance, especially in Asia and North America.

Recent Trends in the Feed Encapsulation Market

Key Challenges in the Feed Encapsulation Market

Between 2025 and 2035, Germany is projected to lead feed encapsulation market growth with a CAGR of 5.6%, driven by strong sustainability initiatives and advanced R&D. France follows at 4.7%, supported by its clean-label and animal welfare focus.

The UK anticipates 4.4% growth due to its antibiotic reduction strategies and premium livestock sectors. Japan expects a 4.3% CAGR, driven by technological solutions addressing labor shortages and efficiency needs. The USA shows a comparatively modest CAGR of 3.2%, driven by large-scale livestock production and regulatory backing. Overall, Europe dominates with higher growth rates compared to North America and Japan.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The feed encapsulation revenue in the USA is projected to expand at a CAGR of 3.2% between 2025 and 2035, driven by advanced livestock production systems and the rapid adoption of precision animal nutrition technologies.

The revenue from feed encapsulation in the UK is forecasted to grow at a CAGR of 4.4% from 2025 to 2035, supported by rising concerns over antibiotic resistance and animal welfare. Encapsulated probiotics and phytogenics are increasingly being used as natural growth promoters.

The feed encapsulation market in Germany is expected to witness a CAGR of 5.6% through 2035, driven by innovations in green farming and increasing regulatory pressures on antibiotic use.

The sales of feed encapsulation solutions in France are expected to rise at a CAGR of 4.7% from 2025 to 2035, underpinned by the country’s emphasis on animal welfare and clean-label production. The market is experiencing increased adoption of encapsulated phytogenics and essential oils to enhance palatability and health benefits in livestock feed.

The feed encapsulation market in Japan is slated to flourish at a CAGR of 4.3% through 2035, driven by a shrinking agricultural workforce and the need for technological solutions that improve efficiency. Precision livestock farming in Japan increasingly relies on encapsulated amino acids, probiotics, and gut-health enhancers to maintain productivity.

The global market is moderately consolidated, with key players such as Balchem Corporation, Kemin Industries, and DSM Nutritional Products holding significant market shares. These companies leverage advanced research capabilities, extensive product portfolios, and global distribution networks to maintain their competitive edge. Their focus on innovation, particularly in microencapsulation technologies, allows for enhanced nutrient stability and controlled release, optimizing livestock health and productivity.

Companies are competing through various strategies, including pricing, innovation, partnerships, and expansion. For instance, strategic collaborations between feed manufacturers and encapsulation technology providers are facilitating innovations and broadening application scopes.

Recent Feed Encapsulation Market

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 534.5 million |

| Projected Market Size (2035) | USD 958.3 million |

| CAGR (2025 to 2035) | 6.0% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD million/Volume in Units |

| By Product Type | Vitamins & Minerals, Amino Acids, Enzymes, Probiotics & Prebiotics, Essential Oils & Phytogenics, Antibiotics & Drugs, Organic Acids, Pigments |

| By Encapsulation Material | Lipid-Based Coatings, Polymers, Protein-Based Coatings, Carbohydrates, Natural Materials |

| By Technology | Spray Drying, Fluidized Bed Coating, Extrusion, Coacervation, Centrifugal Encapsulation, Emulsion-based Encapsulation, Microencapsulation, Nanoencapsulation |

| By Application | Nutrient Delivery, Gut Health Improvement, Growth Promoters, Feed Preservation, Health & Immunity Boosters, Palatability Enhancers |

| By Animal Type | Poultry, Ruminants, Swine, Aquaculture, Companion Animals, Equine |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Balchem Corporation, Kemin Industries, DSM Nutritional Products, Bialtec, Delacon Biotechnik, Adisseo, Evonik Industries, Novus International, Phytobiotics |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

As per product type, the market has been categorized into vitamins & minerals, amino acids, enzymes, probiotics & prebiotics, essential oils & phytogenics, antibiotics & drugs, organic acids, and pigments.

As per encapsulation material, the market has been categorized into lipid-based coatings, polymers, protein-based coatings, carbohydrates, and natural materials.

This segment is further categorized into spray drying, fluidized bed coating, extrusion, coacervation, centrifugal encapsulation, emulsion-based encapsulation, microencapsulation, and nanoencapsulation.

As per application, the market has been categorized into nutrient delivery, gut health improvement, growth promoters, feed preservation, health & immunity boosters, and palatability enhancers.

This segment is further categorized into poultry, ruminants, swine, aquaculture, companion animals, and equine.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The market size is valued at USD 534.5 million in 2025.

The market is forecasted to reach USD 958.3 million by 2035, reflecting a CAGR of 6.0%.

Microencapsulation is expected to lead the market with a 37.6% share in 2025.

Poultry is projected to hold a 35.8% share of the market in 2025.

Germany is anticipated to be the fastest-growing market with a CAGR of 5.6% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Feed Mixer for Livestock Market Size and Share Forecast Outlook 2025 to 2035

Feed Preparation Machine Market Size and Share Forecast Outlook 2025 to 2035

Feed Additive Nosiheptide Premix Market Size and Share Forecast Outlook 2025 to 2035

Feeder Container Market Size and Share Forecast Outlook 2025 to 2035

Feed Machine Market Forecast Outlook 2025 to 2035

Feed Pigment Market Forecast and Outlook 2025 to 2035

Feed Mixer Market Forecast and Outlook 2025 to 2035

Feed Grade Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Feed Electrolytes Market Size and Share Forecast Outlook 2025 to 2035

Feed Micronutrients Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Feed Flavors Market Size and Share Forecast Outlook 2025 to 2035

Feed Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Mycotoxin Binders Market Size and Share Forecast Outlook 2025 to 2035

Feed Phytogenics Market Size and Share Forecast Outlook 2025 to 2035

Feed Carbohydrase Market Size and Share Forecast Outlook 2025 to 2035

Feed Grade Oils Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Packaging Market Size, Share & Forecast 2025 to 2035

Feed Mycotoxin Detoxifiers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Premix Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA