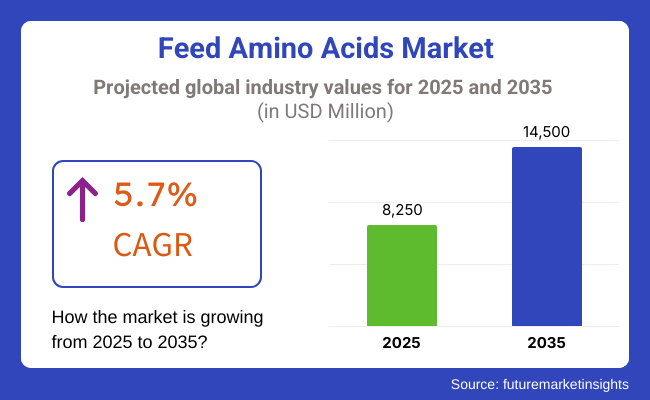

The global feed amino acids market is estimated to be worth USD 8,250 million in 2025 and is projected to reach USD 14,500 million by 2035, expanding at a CAGR of 5.7% over the assessment period of 2025 to 2035.

Globally, the industry is witnessing a remarkable rise due to the growing necessity of super-quality livestock nutrition, better feed efficiency, and environmentally friendly animal farming. Amino acids like lysine, methionine, threonine, and tryptophan are basic elements of animal feed, which are responsible for muscle formation, metabolic activity, and overall growth of the animals.

The increased global requirement for superior meat, dairy, and chicken products has resulted in a significant movement toward nutrient-optimized feed formulations, better feed conversion ratios (FCR), improved animal health, and decreased environmental effects.

Moreover, the livestock industry is struggling with issues like the fluctuation of feed costs and the urge to cut greenhouse gas emissions; thus, amino acids have become the efficient means for livestock producers to attain maximum yield along with lower nutrient wastage.

The poultry and swine divisions are still the biggest consumers of feed amino acids in view of the increasing global requirement for protein-rich food and competitive livestock manufacturing. The aquaculture sector is experiencing the same trend in employing amino acids for feed, as fish and shrimp farming undertakings desire to improve their growth rates, immunity, and sustainability.

Additionally, worldwide authorities are putting restrictions on the use of antibiotic growth promoters (AGPs) in feed, which are boosting the demand for functional feed additives such as amino acids to maintain gut health and to resist diseases in livestock.

The breakthrough in fermentation technology, the production of amino acids from biotechnological and customized feed formulations together, and the market potential for significant growth are the main driving forces.

On the other hand, the livestock producers and feed manufacturers first keep on focusing on precision nutrition, cost-efficiency, and eco-friendly solutions, thereby helping the feed amino acid demand to sustain strong performance all the time, and this is why feed amino acids form an integral part of modern animal nutrition and sustainable livestock farming.

The ever-increasing global meat demand for protein has resulted in a greater emphasis on the utilization of protein in livestock feed. Amino acids like lysine, methionine, and threonine are pivotal in muscle growth, metabolism, and feed conversion efficiency (FCR), thus ensuring that animals are fed with the required essential nutrients.

Since the poultry and swine industry is behind the demand, they need high-protein diets to ensure the criteria of fatter& rations and consumers who want to have lean cuts of meat and bigger productivity. On top of that, feed manufacturers have adopted the trend of replacing expensive protein sources with synthetic ones, i.e., amino acids, which in turn lowers the overall feed costs. However, it keeps livestock health and growth at optimal levels.

Explore FMI!

Book a free demo

There was a notable growth between 2020 and 2024, driven by increasing demand for protein-rich animal feed and enhanced livestock productivity. Essential amino acids such as lysine, methionine, threonine, and tryptophan became critical in improving animal health, growth rates, and feed efficiency.

The growth of the world population and meat consumption maintained the demand for more efficient animal production, hence enhancing the reliance on amino acid supplementation. The progress in chemical synthesis and fermentation provided more economically produced products, and feed amino acids became more available and affordable.

Greater focus on environmental well-being and the implementation of more sustainable farm animal production systems also facilitated this, where amino acids are employed to ensure lower nitrogen discharge and improved feeding conversion ratios, as well as lower the environmental footprint of farm animal production.

Regulatory pressure towards the abolition of antibiotic supplements also precipitated the adoption of amino acid-based feeding principles as a substitute for safer growth stimulants. Between 2025 and 2035, the industry will be defined by advances in precision nutrition and environmentally friendly production.

Increased synthetic biology and biotechnology will be more efficient and tailored in the production of amino acids at a lower cost and with higher bioavailability. Synthesis driven by artificial intelligence will provide tailored amino acid profiles that address the specific requirements of an animal and deliver maximum health and productivity.

More use of novel protein sources like insect meal and single-cell proteins will offer access to a new array of amino acid supplementations. Environmental policies will increasingly push the application of amino acids in waste reduction and emissions from animal agriculture. Increased knowledge of gut health and microbiome modulation will further embed amino acids in functional feed solutions to enhance immune response and overall animal well-being.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growing demand for lysine, methionine, threonine, and tryptophan in animal feed. | Precision nutrition with AI-driven amino acid profiles. |

| Increased use to enhance feed efficiency and growth rates. | Tailored amino acid supplementation for maximum animal health. |

| Technological advancements in fermentation and synthetic manufacturing. | Synthetic biology and biotechnology enhance the efficiency of production. |

| Regulatory impetus for antibiotic-free production of animals. | Greater involvement in gut health and microbiome modulation. |

| Environmental issues promoting efficiency and low nitrogen excretion. | Sustainability is emphasized through low emissions and environmental footprint. |

The industry is growing as a result of the increasing need for nutritionally enriched animal feed to enhance livestock health and productivity. Amino acids such as lysine, methionine, threonine, and tryptophan play key roles in protein synthesis, growth, and immunity in animals, thereby becoming essential as additives in commercial feed.

In the swine and poultry markets, amino acids promote meat quality, growth rate, and feed efficiency, and nutritional efficacy and digestibility are, therefore, key buying considerations. The beef segment targets amino acids that enhance milk production and rumen fermentation. Aquaculture feed prioritizes high digestibility and sustainability through environmental considerations

As cost consciousness is also a challenge, companies are opting for fermentation-based production and importing plant-derived amino acids to drive sustainability needs. Regulations also heavily contribute to making sure that the feeds are safe and of quality and drive buying behavior in every segment.

The increasing uptake of feed amino acids by farmers who are dealing with low humidity and livestock that eat high-quality feed has contributed to the overall growth. Yet, the strict government regulations on feed additives, as well as the safety standards set by the state, continue to pose compliance challenges.

Businesses must ensure that they are primarily adhering to the conditions that are related to innovation. They must also follow the methods required and pass all the tests to obtain the right things and do the right thing at each level to gain the trust of the consumer and regulatory bodies.

Supply chain disruptions, including the inconsistency of raw materials, delays in transportation, and increasing production costs, are the main reasons behind the turbulent industry. The intensive use of soybean, corn, and synthetic amino acid sources makes the business uncertain under the influence of weather, trade laws, and geopolitical conflicts. Enterprises could reduce the risk by diversifying the supplier chain and using environmentally friendly sourcing techniques.

A radical change in consumer tastes, with a preference for cultivated and antibiotic-free meat, which in turn increases the need for natural feed additives, creates a tough for synthetic amino acid producers. Companies are compelled to come up with new varieties of plant-based or fungal-based products rather than the existing ones to meet the changing demands of the industry while still achieving the goal of efficiency in production and cost.

The growing pressure of industry diversification as insect-based and algae-derived feeds become more popular leads to the need for companies to be more creative in their advertising campaigns. When it comes to staying in the race, the key for businesses is to work on the improvements of new products.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| The USA | 4.8% |

| The UK | 4.2% |

| France | 4.5% |

| Germany | 4.7% |

| Italy | 4.3% |

| South Korea | 4.9% |

| Japan | 4.1% |

| China | 5.2% |

| Australia | 4.0% |

| New Zealand | 3.8% |

The USA feed amino acids market will register a CAGR of 4.8% over the forecast period 2025 to 2035. The growth is attributed to the expanding poultry and hog sectors, as amino acid supplementation supports feed efficiency and animal growth. Growing demand for high-protein food and antibiotic-free meat products has driven the use of lysine, methionine, and threonine-based products to substitute traditional protein sources like soybean meal.

Furthermore, greater precision in livestock nutrition and government subsidies on sustainable agriculture lead the feed producers towards actively bioavailable amino acids. Low nitrogen emissions and sustainable animal production are priorities in the United States, and amino acids form part of the new feeds for efficient livestock and improved meat quality.

The market is expected to grow at a CAGR of 4.2% from 2025 to 2035. Animal nutrition regulation in the UK and sustainability drive are driving the shift towards amino acid-containing feed. The need for alternative protein products has necessitated applications of amino acids obtained through fermentation.

Besides that, leading UK-based animal feed producers are also investing in research to optimize ruminant and monogastric animal amino acid mixtures. Expansion of organic industries also underpins functional absorption of amino acids such as valine and tryptophan for added gut health, immunity, and stress resilience applications in animals.

The feed amino acid market for France is projected to grow at 4.5% CAGR in the years 2025 to 2035. Increasing demand for precision feed technology and organic dairy farming across the nation has fueled an increase in the use of synthetic amino acids as a way to maximize the efficiency of the feed. The dairy and poultry segments are the drivers for the demand, and methionine and lysine are key drivers of maximizing animal growth and protein utilization.

French feed manufacturers are producing own-label mixtures of amino acids to address different livestock production systems. The government's focus on sustainable agriculture and reduced nitrogen emissions has also encouraged the use of amino acids for waste reduction in feed and environmental sustainability.

Germany's feed amino acid market will expand at a CAGR of 4.7% during 2025 to 2035. EU animal nutrition and sustainability regulations are fueling the adoption of amino acid-enriched feed to optimize animal performance and reduce waste nitrogen. Amino acids such as methionine and tryptophan are becoming increasingly important in the dairy, poultry, and pig industries to maintain gut function and immunity.

German animal feed producers are investing in the manufacture of amino acids through breeding, and green feed substitutes are now prevalent. Also driving the use of amino acid technology in Germany's animal feed sector has been the demand for antibiotic-free meat as well as precision nutrition technologies.

Italy's feed amino acid market is expected to develop at a CAGR of 4.3% during the period 2025 to 2035. Greater focus by the nation on the production of high-quality meat and milk has led to a growing consumption of amino acids to achieve maximum protein synthesis in animals. Pig and poultry industries are facing rising demand for lysine and methionine to improve meat quality and feeding efficiency.

In addition, Italian animal feed producers also seek new amino acid molecules to support high-value animal production. As there is increased movement towards organic and antibiotic-free meat, functional amino acids are greatly sought after to contribute to the health of animals as well as the effectiveness of production.

South Korea's animal feed industry, which consists of amino acids, shall grow at 4.9% CAGR between 2025 and 2035. Nation-wise, sophisticated rearing of animals and the use of precision feeding technology fuel the requirement for amino acid supplementation. Pig and poultry sectors are reliant to a large degree on lysine and threonine to get optimal feed efficiency and reduce environmental burden.

South Korean top feed manufacturers are launching biotechnology-based amino acid solutions in their feeds, which provide high-performance and cost-effective feed solutions. The growing application of smart farming technology is accompanied by the increasing application of amino acids in animal nutrition.

The Japan feed amino acid market will grow at a CAGR of 4.1% between 2025 and 2035. Precision nutrition practices are driven by Japan's aging farming population and increased need for sustainable farming. Amino acids find large applications in the poultry and aquaculture segments, and methionine and lysine help improve feed efficiency.

Japanese feed producers use fermentation amino acids to support sustainability goals further. The government encourages less waste in the feed and improves nutrition, which further drives the demand for amino acid-supplemented feed solutions.

China's feed amino acid market will expand at a CAGR of 5.2% from 2025 to 2035. Pig and aquaculture sectors demand superior-performance protein substitutes to enhance feed efficiency and productivity. The Chinese government's initiatives towards protein self-sufficiency have compelled the industry towards amino acid-enriched feed, easing the dependence on soybean meal.

Besides, China's entry into biotechnology-based amino acid production is reducing costs, and synthetic amino acids are now available to feed manufacturers. The expansion of aquaculture operations has also raised the demand for amino acids such as lysine, methionine, and threonine.

Australia's feed amino acid market will grow at a CAGR of 4.0% during 2025 to 2035. Australia has a strong livestock export industry and a focus on optimizing feed nutrition that necessitates the use of amino acid supplementation. Beef and dairy sectors are significant consumers, utilizing amino acids to maximize protein development and growth rates.

Australian feed manufacturers are resorting to specially formulated amino acids in order to increase rangeland cattle production. The growing need for ecologically sustainable forms of feed also necessitates amino acid-supplemented formulation.

New Zealand's feed amino acid market is also expected to rise at a CAGR of 3.8% from 2025 through 2035. New Zealand's dairy business, which continues to expand, relies on amino acids to enhance milk productivity and overall animal health.

Demand for lysine and methionine has increased, particularly within pasture-based feeding systems. New Zealand dairy is shifting towards sustainability and nitrogen emission reduction via precision nutrition. The shift towards high-performance dairy farming systems also drives amino acid use.

Rising Global Demand for Lysine in High-Performance Livestock Feed

| Segment | Value Share (2025) |

|---|---|

| Magnesium glycinate (Type) | 51.6% |

The growth in the Feed Amino Acids Market is attributed to the demand for Magnesium Glycinate and Lysine inclusion in animal diets, as they help improve growth and contribute to metabolism.

The Magnesium Glycinate segment occupies the highest market share in 2025, 51.6%. It holds its dominance among end users due to its high bioavailability, better absorption, stress reduction, and role in livestock muscle functions.

In poultry, swine, and dairy production, one Widely used amino acid-Magnesium glycinate, is known to be supplemented in the form of feed supplements for the improvement of bones, activation of enzymes, and immunity. Magnesium-based feed additives offered by top suppliers like BASF, Balchem, and DSM promote animal performance and well-being.

The Lysine Segment holds 8.5% and is an important amino acid in swine and poultry feed. Lysine is a fundamental micronutrient for protein synthesis, supporting muscle development and feed conservation. Lysine is critical in plant-based feed alternatives and is being used to offset the lower amino acid content characteristic of corn- and soybean meal-based diets.

This segment is primarily dominated by companies like Ajinomoto, Evonik, and CJ CheilJedang, providing high-purity lysine solutions in animal nutrition. Key drivers include increasing demand for high-performance feed ingredients, the need for efficient nutrient absorption, and the shift toward sustainable livestock production.

| Segment | Value Share (2025) |

|---|---|

| Poultry | 43.9% |

The Feed Amino Acids Market is led by the poultry segment, which is projected to hold 43.9% of the share in 2025. Poultry farming depends on essential amino acids like lysine, methionine, and threonine, which enhance muscle development, egg production, and feed efficiency.

As worldwide poultry consumption grows (driven largely by Asia-Pacific and North American demand), producers are reformulating feed for greater nutrient absorption and overall flock health. Specialized poultry feed solutions are also made available by companies such as Evonik (DL-methionine, MetAMINO®), Ajinomoto, and ADM.

The swine segment accounts for 27.0% share due to the demand for high-protein feed to improve the growth rate and lean muscle mass of pigs, requiring amino acids such as lysine, tryptophan, and threonine to improve feed conversion ratios (FCR) and reduce nitrogen emission, which is vital for economic and environmental sustainability.

As feed costs increase, swine producers look to synthetic amino acids to boost precision. Companies like ADM and CJ CheilJedang are spearheading fermentation-based lysine and tryptophan production to meet growing demands.

The booming demand for protein-rich diets, sustainability-driven feed formulations, and amino acids' innovation in production is propelling growth as they ensure optimal livestock performance while reducing the pollutants released into the environment.

The feed amino acid market is very competitive due to the increasing demand for nutrient-rich animal feed and cost-efficient formulations for sustainable livestock production. Several amino acids, including lysine, methionine, threonine, and tryptophan, are critically important for the enhancement of animal growth and health as well as feed efficiency, thereby fueling growth.

Top players currently dominating the industry include Evonik Industries, Ajinomoto, ADM, CJ CheilJedang, and Novus International, all of which apply biotechnology-driven amino-acid synthesis, fermentation advancement, and production scalability. Start-ups and regional manufacturers are focusing on customized feed solutions while offering competitive pricing to hold larger shares in this market segment.

Plant-based and precision-formulated feed solutions distinguish the next growth stage of the market as it moves toward reduced dependence on traditional protein sources. Such examples include Evonik and ADM, which have expanded the scope of methane production through increased reliance on fermentation; lesser environmental impacts are also possible.

Similarly, CJ CheilJedang is investing in microbial fermentation technology as an improved measure of the efficiency of amino acid production in concert with trends in the global feed industry. Strategic factors in this environment are cost optimization, sustainable raw material sourcing, and regulatory compliance competition.

Such movements are meant to position businesses as they build on developing their global supply chains, entering partnerships with livestock producers, and expanding their product offerings to meet the rising demand for high-performance, eco-friendly feed solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Evonik Industries AG | 20-24% |

| Ajinomoto Co., Inc. | 15-19% |

| Archer Daniels Midland (ADM) | 12-16% |

| CJ CheilJedang Corporation | 9-13% |

| Novus International | 6-10% |

| Other Players (Combined) | 25-35% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| Evonik Industries AG | Leading producer of DL-Methionine (MetAMINO®), focusing on sustainable, bio-based production methods and precision livestock nutrition. |

| Ajinomoto Co., Inc. | Strong in Lysine, Threonine, and Tryptophan production, utilizing advanced fermentation technologies for cost-efficient amino acid synthesis. |

| Archer Daniels Midland (ADM) | Expanding its feed-grade amino acid portfolio, integrating plant-based fermentation processes to enhance supply chain sustainability. |

| CJ CheilJedang Corporation | Innovating biotechnology-driven amino acid production, investing in microbial fermentation for L-lysine and L-threonine. |

| Novus International | Specializing in methionine alternatives such as MHA® (methionine hydroxy analog), targeting efficiency and bioavailability in poultry and swine feed. |

Key Company Insights

Evonik Industries AG (20-24%)

A leader in DL-Methionine production, emphasizing sustainability and minimizing nitrogen emissions in livestock farming.

Ajinomoto Co., Inc. (15-19%)

Investing in fermentation-based amino acid manufacturing, maximizing nutrient utilization and gut health in animals.

Archer Daniels Midland (ADM) (12-16%)

Growing biotech-based L-Lysine manufacturing, emphasizing sustainable agriculture and alternative protein offerings.

CJ CheilJedang Corporation (9-13%)

Developing its microbial fermentation technology for high-purity lysine and threonine.

Novus International (6-10%)

Leader in non-DL-Methionine substitutes, with an emphasis on optimizing feed conversion and lowering the environment's impact.

The global feed amino acids market is estimated to be worth USD 8,250 million in 2025. It is projected to reach USD 14,500 million by 2035, expanding at a CAGR of 5.7% over the assessment period of 2025 to 2035.

Sales of feed amino acids increased at a CAGR of 5.4% between 2020 and 2024 due to rising demand for high-efficiency livestock nutrition and sustainable feed formulations.

Some of the leading players in this industry include Evonik Industries AG, Ajinomoto Co., Inc., Archer Daniels Midland Company (ADM), CJ CheilJedang Corporation, Novus International, Adisseo, Kemin Industries, Meihua Group, Bluestar Adisseo Company, and Global Bio-Chem Technology Group.

The Asia-Pacific region is projected to hold a revenue share of 42% over the forecast period, supported by strong demand for poultry and aquaculture feed formulations.

North America holds a 30% share of the global demand space for feed amino acids in 2025, with increasing adoption in precision livestock nutrition and antibiotic-free feed solutions.

This segment is further categorized into Lysine, Tryptophan, Glutamic Acid, Threonine, Valine, Arginine, L-histidine, L-Isoleucine, Leucine, and Phenylalanine.

This segment is further categorized into Cattle (Dairy, Beef, Calf), Swine (Sow, Piglet, Others), Poultry (Broilers, Layers, Turkey), Aquaculture (Salmon, Trout, Shrimp, Others), Pet Food (Dog, Cat, Others).

Industry analysis has been carried out in key countries such as North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus, and the Middle East & Africa.

Calcium Caseinate Market Analysis by End Use Application and Functionality Through 2025 to2035

Calorie Supplements Market Analysis by Form, Packaging, Flavor, Sales Channel and Region Through 2025 to 2035

Chickpea Milk Market Analysis by Category, Flavor and End Use Through 2025 to 2035

Coconut Butter Market Analysis by End-use Application Sales Channel Through 2025 to 2035

Hydrotreated Vegetable Oil Market Analysis by Type and Application Through 2035

Children’s Health Supplement Market Analysis by Product Type, Application and Age Group Through 2025 to 2035.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.