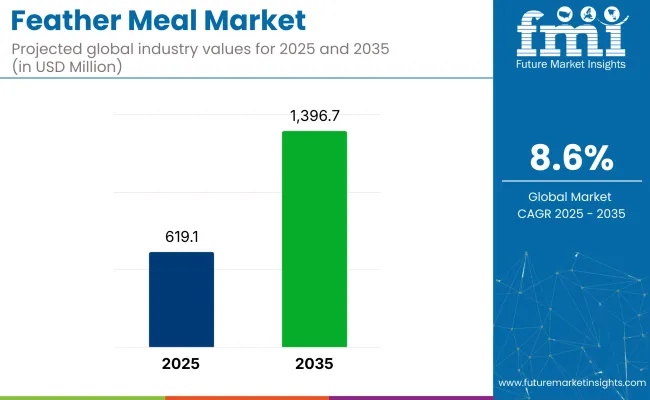

The global feather meal market is valued at USD 619.1 million in 2025 and is slated to reach USD 1,396.7 million by 2035, reflecting a CAGR of 8.6%.

| Metric | Value |

|---|---|

| 2025 Market Value | USD 619.1 million |

| 2035 Market Value | USD 1,396.7 million |

| CAGR (2025 to 2035) | 8.6% |

Growth is driven by increasing demand for sustainable high-protein animal feed ingredients, expanded applications in organic fertilizers, and potential in bioplastic production. Additionally, significant investments are being made in hydrolysis technology to enhance digestibility, particularly in aquaculture feed formulations across key regions.

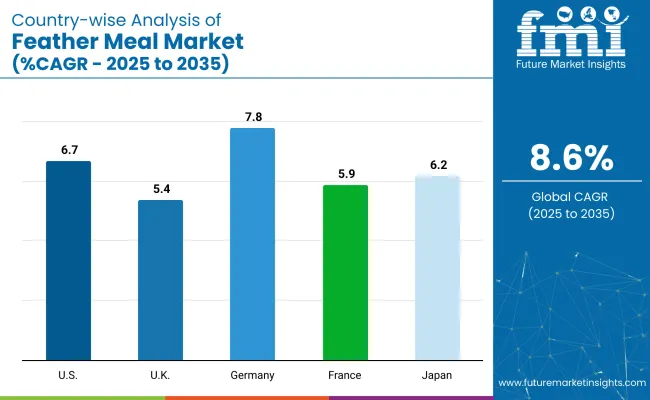

Germany is expected to record a CAGR of 7.8%, driven by strong adoption of organic fertilizers and circular economy initiatives in animal nutrition. The USA is forecasted to grow at a CAGR of 6.7% due to its technological advancements in hydrolysis rendering processes and robust domestic consumption in livestock and aquaculture feed markets.

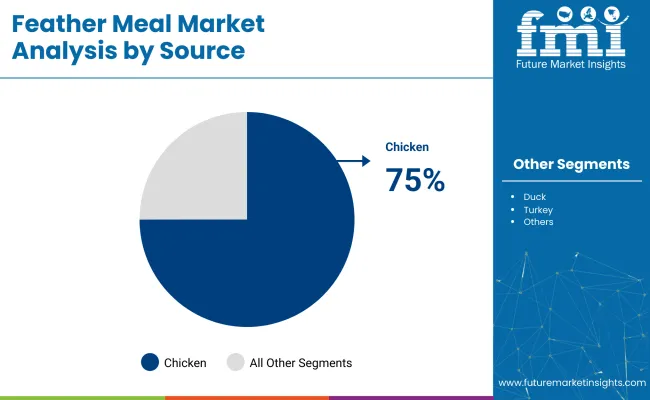

Japan is projected to grow at a 6.2% CAGR, supported by strong demand from the aquaculture feed sector and increasing dependence on imported feather meal products. Chicken feathers are expected to lead the source segment with a 75% market share, while feed grade will lead the product grade segment with a 68% market share in 2025.

Government regulations mandating sustainable waste management and restricting landfill disposal of poultry by-products have been driving feather meal production globally. For instance, the European Union enforces strict animal by-product processing standards under Regulation (EC) No 1069/2009 to ensure safety in feed applications.

Recent innovations include advancements in hydrolysis technology to improve keratin digestibility, enabling feather meal to replace expensive fishmeal in aquaculture feeds effectively. Companies are investing in novel rendering processes that reduce environmental impacts while enhancing amino acid availability. Additionally, research into keratin-based bioplastics from feather meal is gaining traction, reflecting regulatory emphasis on sustainable material development.

The market holds a relatively small but significant share within its parent markets. It accounts for approximately 3% of the global animal feed market, driven by its use as an alternative high-protein ingredient. Within the animal nutrition market, it represents around 2% due to its niche application compared to soybean and fish meals. In the rendered products market, feather meal holds a larger share of approximately 12%, as it is a key output from poultry rendering processes. Its share in the organic fertilizer market remains under 1%, while in protein feed ingredients, it contributes close to 4% globally.

The feather meal market is segmented by source, product type, grade, end use industry, distribution channel, and region. By source, the market is categorized into chicken, duck, turkey, and others such as goose and quail feathers. By product type, it is segmented into hydrolyzed feather meal, unprocessed feather meal, and processed feather meal.

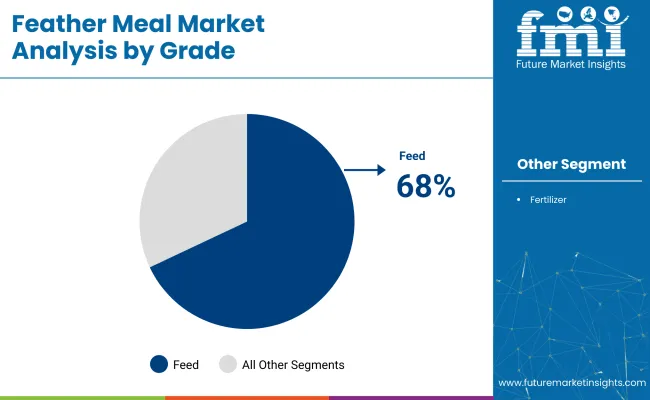

By grade, it is classified into feed grade and fertilizer grade. Based on end use industry, the market is segmented into agriculture (commercial farming, organic farming), animal feed, aquaculture, and horticulture. By distribution channel, it is divided into direct sales and indirect sales (specialty stores, online stores, distributors/wholesalers). Regionally, the market is segmented into North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and Middle East & Africa.

Chicken hold the most lucrative share in the market, accounting for approximately 75% of the market in 2025.

Hydrolyzed feather meal dominates the product type segment, holding approximately 62% market share in 2025.

Feed grade feather meal leads the grade segment, holding approximately 68% market share in 2025. Its dominance comes from the rising demand for high-protein and cost-effective feed ingredients in livestock, poultry, and aquaculture sectors globally.

Animal feed holds the largest share in the end use industry segment, accounting for approximately 44.1% market share in 2025.

Direct sales lead the distribution channel segment, holding 54% market share in 2025.

The global feather meal market is experiencing steady growth, driven by rising demand for sustainable high-protein animal feed ingredients, increasing adoption of hydrolyzed feather meal in aquaculture and livestock feed formulations, and rapid integration of advanced rendering technologies for enhanced digestibility and environmental sustainability.

Recent Trends in the Feather Meals Market

Challenges in the Feather Meals Market

Among the top five countries, Germany is projected to register the highest CAGR at 7.8%, driven by robust poultry processing and strong organic farming practices. The USA follows with a 6.7% CAGR, supported by advanced hydrolysis technology and strong feed demand. Japan’s market is expected to grow at 6.2% CAGR, driven by aquaculture feed demand and import reliance. France is projected to grow at 5.9% CAGR, supported by its poultry industry and organic fertilizer use. The UK shows the slowest growth among these, with a 5.4% CAGR, driven mainly by organic fertilizer demand and circular economy initiatives.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The feather meal demand in the USA is projected to grow at a CAGR of 6.7% from 2025 to 2035.

Sales of feather meals in the UK are projected to grow steadily at a CAGR of 5.4% from 2025 to 2035.

The Germany feather meal revenue is projected to grow at a CAGR of 7.8% from 2025 to 2035.

Sales of feather meal in France are projected to grow at a CAGR of 5.9% from 2025 to 2035.

The feather meal revenue in Japan is projected to grow at a CAGR of 6.2% from 2025 to 2035.

The market is relatively consolidated, with a few tier-one companies holding major market shares due to their large-scale rendering operations and global feed distribution networks. Leading players such as Darling Ingredients, Tyson Foods, and JBS USA Holdings dominate through vertical integration and extensive rendering capacities.

Top companies primarily compete on pricing, technological innovation, and feed formulation partnerships. Darling Ingredients focuses on enhancing hydrolysis rendering processes to improve product digestibility and environmental sustainability. Tyson Foods invests in expanding its feather meal processing capacity to cater to the growing demand in livestock and aquaculture feed.

Recent Feather Meals Industry News

January 2024: Darling Ingredients acquired the Polish rendering company Miropasz Group. This acquisition added three poultry rendering plants in southeastern Poland that produce 250,000 metric tons of poultry byproducts annually.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 619.1 million |

| Projected Market Size (2035) | USD 1,396.7 million |

| CAGR (2025 to 2035) | 8.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD million/Volume in Metric Tons |

| By Source | Chicken, Duck, Turkey, Others ( Goose Feathers, Quail Feathers, Guinea Fowl Feathers , Pheasant Feathers ) |

| By Product Type | Hydrolyzed Feather Meal, Unprocessed Feather Meal, Processed |

| By Grade | Feed Grade, Fertilizer Grade |

| By End Use Industry | Agriculture (Commercial Farming, Organic Farming), Animal Feed, Aquaculture, Horticulture |

| By Distribution Channel | Direct Sales, Indirect Sales (Specialty Stores, Online Stores, Distributors/Wholesalers) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Valley Proteins, Inc., Darling Ingredients Inc., Tyson Foods, Inc., JBS USA Holdings, Inc., Pilgrim’s Pride Corporation, Sanimax , West Coast Reduction Ltd., Baker Commodities Inc., FASA Group, Nature's Intent, Farbest Foods, Inc., Ridley Corporation Limited, APC Inc. (Ag Processing Inc.), Perdue Farms Inc., Susheela Group, K-Pro USA, JG Pears, Kleingarn Agrarprodukte , Dave Mallin Products Ltd, LaBudde Group, Inc. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis . |

Chicken, Duck, Turkey, Others (Goose Feathers, Quail Feathers, Guinea Fowl Feathers , Pheasant Feathers).

Hydrolyzed Feather Meal, Unprocessed Feather Meal, Processed.

Feed Grade, Fertilizer Grade.

Industry Agriculture (Commercial Farming, Organic Farming), Animal Feed, Aquaculture, Horticulture.

Direct Sales, Indirect Sales (Specialty Stores, Online Stores, Distributors/Wholesalers).

Regions Covered North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa.

The market is valued at USD 619.1 million in 2025.

The market is expected to grow at a CAGR of 8.6% during 2025 to 2035.

The market is projected to reach a value of USD 1,396.7 million by 2035.

Chicken feathers hold the largest market share among sources in 2025, accounting for approximately 75% of the market.

Hydrolyzed feather meal is the leading product type in 2025, holding 62% market share due to its high digestibility.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Defeathering Machine Market Analysis & Forecast for 2025 to 2035

Down and Feather Market - Trends, Growth & Forecast 2025 to 2035

Meal Voucher Market Size and Share Forecast Outlook 2025 to 2035

Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Meal Tray Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

Meal Replacement Bars Market Size, Growth, and Forecast for 2025 to 2035

Meal Replacement Products Market Analysis by Product type, source, application and region Through 2035

Meal Kit Delivery Service Market - Trends & Forecast 2025 to 2035

Meal Replacement Shake Market Trends - Powder & Liquid Analysis

UK Meal Replacement Products Market Trends – Growth, Demand & Forecast 2025-2035

Oatmeal market Analysis by Nature, Type and Sales Channel Through 2025 to 2035

Fishmeal and Fish Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

USA Meal Replacement Products Market Insights – Size, Share & Forecast 2025-2035

Fish Meal Alternative Market Size and Share Forecast Outlook 2025 to 2035

Fish Meal Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Market Leaders & Share in the Fish Meal Industry

Ready Meals Packaging Market Size and Share Forecast Outlook 2025 to 2035

Vegan Meals Market Size, Growth, and Forecast for 2025 to 2035

Krill Meal Market Analysis - Size, Growth, and Forecast 2025 to 2035

Competitive Overview of Ready Meals Packaging Market Share

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA