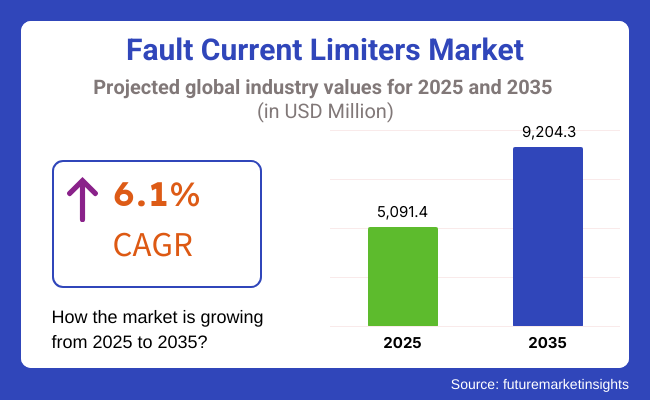

The global fault current limiters market is projected to witness substantial growth between 2025 and 2035, driven by increasing grid modernization efforts, rising adoption of renewable energy sources, and the growing demand for advanced power protection systems. The market is expected to reach USD 5,091.4 million in 2025 and expand to USD 9,204.3 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.1% over the forecast period.

Fault current limiters (FCLs) preserve the thermal limits of equipment and ensure system security due to the formation of excessive fault currents that may lead to damage, thus rendering them as critical components in electrical power systems.

Growth in the market is driven mainly by integration of Distributed Energy Resources (DERs), smart grid infrastructure expansion and urbanization. The use of next-generation FCLs is gaining traction due to growing investments in industrial power networks, increased transportation electrification, and rising sophisticated superconducting technologies.

Implementing advanced technologies that help limit fault currents and reduce electrical interruptions will aid in the generation of high-performance, cost-effective fault current limiters. The global market will continue to develop in coming decade, with solid state and superconducting FCL technologies continuously improving, along with influencing regulatory standards that encourage higher levels of grid reliability.

Growing adoption of advanced technologies such as smart grids, increasing usage of renewable energy, and rising investments in industrial automation are significant factors to boost market growth for fault current limiters. Moreover, growing focus on improving power system efficacy and reliability in commercial, industrial, and utility scales has been driving the market.

Explore FMI!

Book a free demo

The North American region is one of the prominent markets for fault current limiters due to grid modernization initiatives, stringent investments in the integration of renewable energy, and strict power reliability standards. The growing investment in sectors such as smart grids, distributed generation, and high-voltage power networks in countries like the United States and Canada, is expected to drive demand for these FCL technologies.

The increasing utilization of superconducting fault current limiters (SFCLs) in high voltage applications along with initiatives to enhance the resilience of power grids by governments are anticipated to crescendo in market growth. Besides, growing network expansion through electric vehicle (EV) charging infrastructure and power transmission networks as well as wind and solar farms grid interconnection are propelling demand for fault current mitigation solutions in the region.

The European market for fault current limiters has been experiencing consistent growth owing to strict power systems regulations, rising renewable energy integration and the network extension of high-voltage direct current (HVDC) transmission. Countries such as German, UK, and France are taking advantage of the introduction of FCL solutions to ease their transition to decentralized energy systems and smart grid.

The push towards carbon neutrality in the European Union and the quest for sustainable power distribution are the primary factor propelling the investments in superconducting and solid-state fault current limiter technologies. Railway electrification system, urban metro network, and industrial automation infrastructure modernization are also anticipated to have a significant impact on the growth of the market.

Fault current limiters market is growing in regions like Asia-Pacific region, which is growing at the highest rate owing to the rapid urbanization, rapidly rising power infrastructure and growing demand for energy. The grid expansion and smart grid deployment efforts of these countries including China, India, and Japan, make them key markets for FCL adoption.

The coupling of large-scale renewable energy integration with investment in HVDC transmission in China has driven increasing demand for advanced current-limiting solutions. India’s power sector reforms and thrust towards reduction of power outages are further adding the demand for economical fault current limiters.

Japan's focus on energy efficiency, disaster-resilient power infrastructure, and optimization of the electrical grid is leading to the adoption of smart grid solutions and FCL technologies. Additional support for demand across the Asia-Pacific region is coming from high-speed railway networks, industrial automation and data centers complementing the rising need for fault current mitigation systems.

The MEA region is witnessing increasing investments in energy infrastructure, urban electrification, and industrial automation, resulting in an upsurge in adoption of fault current limiters in the region. Countries e.g., Saudi Arabia, UAE, and South Africa are increasing their power transmission networks, connecting renewable energy projects and enhancing smart grid infrastructure, are increasing demand for fault current mitigation solutions.

The increasing energy demand, attention to minimize transmission losses, and industrial zone development needs hi-reliability energy protection system. The growth of the inner city surface arterial rail transit systems, also known as metro rail projects, airport expansion and mining activities also help to drive the market of FCL in the region.

Challenges

High Installation and Operational Costs in Large-Scale Deployments

One of the major challenges in the fault current limiters market is the high initial investment required for installation and integration into existing power grids. The superconducting FCLs (SFCLs) are especially costly to develop and deploy, often rendering them unsuitable for small-scale utilities and industries. Moreover, the technical and financial challenges associated with the operational complexity of integrating FCLs into aging power networks also creates technical and financial challenges.

Furthermore, the recurring maintenance costs associated with advanced fault current limiters, predominantly related to cryogenic cooling in the context of SFCLs, contribute to prolonged operational expenses. These cost-related challenges are a barrier to accessing these technologies at a national level, especially in developing economies where investments in grid modernization are limited.

Complex Regulatory Frameworks and Standardization Issues

The regulatory landscape around power grid reliability and fault current mitigation is also a major challenge. Diverse regional standards for grid safety, electrical codes, and voltage regulation requirements act as barriers to market expansion.

It presents technical challenges in the certification of FCL along each voltage level. Next-generation FCL solutions are underutilized as utilities and industrial players grapple with the need for interoperability of FCL systems with existing electrical networks.

Opportunities

Rising Adoption of Smart Grids and Renewable Energy Integration

The increasing shift to smart grids, the expansion of renewable energy sources, and decentralization of electrical power generation are likely to provide significant growth opportunities for fault current limiters. When utilities incorporate large solar, wind and energy storage systems into the grid, the risk of disruptive fault currents grows. FCL is the perfect means to balance various power networks and achieve smooth energy delivery with power outages.

Countries across the globe are investing in grid automation, real-time monitoring systems, and advanced fault detection technologies which has arisen a tremendous demand for fault current mitigation solutions. The same applies to digital substations and energy-efficient industrial facilities driving the uptake of communication enabled smart fault current limiters (SFCLs) with remote monitoring and control capabilities.

Advancements in Superconducting and Solid-State Fault Current Limiters

These innovations on superconducting (SFCL) and solid-state fault current limiters (SSFCL) capability improvements are driving product development. Commonly used as gate-keeper devices, SFCLs have gained support in high-voltage applications owing to their fast responses with minimal energy losses and enhanced ability to counteract faults.

At the same time, the field of solid-state fault current limiters is also heating up for industrial automation, railway electrification, and metro grid applications, as they enable faster fault handling and improved grid stability. The development of next-generation fault current limiters is also facilitated by the integration of digital monitoring and AI-driven grid analytics, which creates lucrative market opportunities for manufacturers.

Between 2020 and 2024, the FCL Market was driven by growing demand for Grid Reliability, Renewable Energy Integration, and Aging Power Infrastructure. Superconducting and solid-state fault current limiters were used by utilities and industrial sectors to boost grid resilience, transformer protection, and short-circuit current mitigation.

Moreover, the evolution of smart grid technologies is anticipated to further propel the development and integration of FCLs, while growing high-voltage DC transmission networks would enhance the viability of these devices. Nonetheless, factors like the high installation costs, the lack of commercial availability of superconducting FCLs, and the challenges of integration hindered large scale deployment.

Looking ahead to 2025 to 2035 the fault current limiters market will witness a radical transformation with AI-powered grid monitoring, modular FCL designs and progress in high-temperature superconducting (HTS) materials. The marketplace will also be influenced by the maturity of smart microgrids, the growth of hybrid AC/DC transmission networks, and ultra-fast solid-state limiters.

The future of FCL applications will also witness the evolution of hydrogen-based power systems, AI-driven predictive grid analytics and blockchain-enabled fault monitoring.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Grid Reliability & Smart Grid Expansion | Demand for high-voltage fault current limiters was driven by increasing investments in grid modernization projects, smart substations, and grid automation. |

| Renewable Energy Integration & Power Quality | The ongoing boom of solar, wind and distributed energy resources (DERs) have increased the risk of short circuit and the needs for the superconducting and solid-state fault current limiter |

| Advancements in Superconducting & Solid-State FCLs | Deployment of LTS FCLs in high-voltage transmission networks and industrial grids. |

| Electrification & Decarbonization Trends | Carbon-neutral grid operations were encouraged by governments, creating a demand for energy-efficient fault protection solutions. |

| Industrial & Utility Adoption Trends | FCLs were deployed in high-voltage transmission networks, industrial power plants, and offshore wind farms to enhance grid stability. |

| AI & Digitalization in Fault Monitoring | IoT-connected FCLs were used by some utilities for real-time monitoring and fault analysis. |

| Market Growth Drivers | Driven by the expansion of grids, the electrification of industry and the penetration of high-capacity renewables. |

| Market Shift | 2025 to 2035 |

|---|---|

| Grid Reliability & Smart Grid Expansion | AI grid optimization, self-healing networks, and blockchain aid fault detection to enable smart grid FCL deployment. |

| Renewable Energy Integration & Power Quality | Enhanced protection schemes for hybrid AC/DC grid architectures with AI-driven power balancing require adaptive, AI-assisted FCLs. |

| Advancements in Superconducting & Solid-State FCLs | High-temperature superconducting (HTS) FCLs, next-gen AI-integrated fault detection, and decentralized and modular design current limiters boost grid efficiency. |

| Electrification & Decarbonization Trends | FCL applications are also now being redefined with grid systems powered with hydrogen along AI guided real time current limiting as well as net-zero transmission networks. |

| Industrial & Utility Adoption Trends | AI-enabled industrial, power systems; autonomous smart factories; and solid-state limiters for data centers and electrified transport hubs. |

| AI & Digitalization in Fault Monitoring | Predictive maintenance, digital twin grid simulations, and fault tracking using a blockchain strengthens system security. |

| Market Growth Drivers | Market growth, the self-healing smart grids, AI-driven fault analytics, and advanced superconducting materials for low-loss energy transmission. |

The United States fault current limiter (FCL) market is growing steadily due to rising investments in power grid modernization, increasing renewable energy integration, and stringent regulations on electrical safety. The USA power grid has been undergoing massive upgrades, and utilities have concerned themselves with improving system reliability through the use of advanced grid protection technologies.

The large-scale deployment of wind and solar projects has posed challenges for grid stability, increasing demand for superconducting fault current limiters (SFCLs) and other solid-state limiters to mitigate system overload.

Furthermore, government investment in smart grid development and grid resilience initiatives is creating a demand for next-generation fault current limiters in power transmission and distribution networks. Moreover, with growing short circuits and fault currents in factories and commercial facilities, the demand for high-voltage fault currents limiters (FCLs) in data centers, manufacturing plants, and transportation networks is increasing.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.3% |

UK fault current limiter market is developing with a moderate pace because the nation is supporting energy transition and expand renewable energy in its generation portfolio, with achieving their goals through grid modernization. The UK government is focused on the decarbonisation of the power sector and this approach is driving the demand for advanced grid protection devices to manage the variable power flows from wind and solar farms.

The National Grid ESO (Electricity System Operator) of the country is focusing on grid flexibility and fault mitigation, which is expected to increase solid-state and hybrid fault current limiter adoption. Finally, the rapid growth of electric vehicle (EV) charging infrastructure, and associated stress on power distribution networks is a clear mandate for solutions that can help control the dynamic flow of fault current.

Furthermore, as the UKPP’s 2023 report notes on the impact of the aging of the electrical grid particularly in major cities like London, Manchester and Birmingham, the demand for retrofit-friendly current limiters is on the rise, which improves grid stability and helps prevent power disruptions.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.9% |

The European Union market for fault current limiters is proliferating due to mounting concerns regarding the reliability of the grid as well as growing demand for renewable energy and strict electrical safety regulations. In countries like Germany, France and the Netherlands, large investments are being made in upgrading power transmission to support the respective integration of offshore wind farms, solar power plants and battery energy storage systems (BESS).

There is growing demand for superconducting and hybrid FCLs that can improve the stability of future power grids and protect against equipment damage caused by high fault currents, which is physiognomy the decarbonized and resilient power grid the EU has committed to achieve.

Moreover, smart cities and energy-efficient power distribution systems is also being driven by metro rail networks, industrial zones, and high-voltage substations, which are further likely to propel the demand for fault current limiters in the region. As the electricity trade between nations increases and HVDC (high-voltage direct current) interconnections, demand for high-performance fault current limiters in transmitting corridors and offshore power grids is also increasing.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.1% |

The Japan fault current limiter market is anticipated to witness steady growth during the forecast period, owing to the need for the management of aging power infrastructure in the country along with the growing adoption of renewable energy and the expanding unit for industrial automation. Targeting Japan's high dependence on solar and wind distributed power generation, GE's grid solution enables increasingly complex grids to operate at higher levels without risk of short circuits or equipment failure.

The country’s emphasis on energy security and disaster resilience is fueling investments in fault-tolerant electrical grids, especially in quake-prone areas. Furthermore, in Japan, research institutions and energy companies are developing a new superconducting material to make superconducting fault current limiters (SFCLs) more efficient for high-voltage and low-voltage applications.

Additionally, increasing adoption of robotics along with high-precision electronics in manufacturing is expected to continue driving the need for precision-based current limiters to keep sensitive industrial equipment safe from current distortions.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.8% |

The South Korea fault current limiter market is expanding due to growing investments in smart grid infrastructure, increasing demand for power quality solutions, and the rise of electric vehicle (EV) charging networks. The country’s major utility companies and industrial sectors are integrating high-performance fault current limiters to prevent grid disturbances and electrical failures.

High-speed current limiters are in demand as South Korea aggressively pursues hydrogen energy, battery storage systems, and ultra-fast EV charging stations, which knock performance limits off power systems. For instance, the rise of semiconductor manufacturing and AI-focused data centers has panel around more high-tech industrial zones adopting solutions for fault current mitigation.

Similarly, developments in digital substations and AI-based grid monitoring in South Korea are propelling the demand for intelligent fault current limiters (FCLs) with self-healing capabilities.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.2% |

Fault current limiters (FCLs) of 5000-15000 A holds the largest market share, owing to their large scale application in power transmission and distribution (T&D) utilities, manufacturing sectors, and railway. Thus, these FCLs can protect the grid from excessive fault currents when the load is large and make it easily stable, protect sensitive equipment, and minimize overall downtime in large-scale power networks.

To control these high, short-circuit currents, T&D utilities and manufacturing industries use a class of FCLs of 5000-15000 A that protect transformers, switchgear, and circuit breakers by preventing electrical faults from reaching them.

These have a higher fault suppression capability than lower-rated FCLs and is suitable for heavy industrial applications, renewable energy integration, and metro rail power systems. The extensive expansion of high-voltage transmission networks and grid modernization projects are also contributing to the demand for medium to high-rated fault current limiters as countries upgrade aging electrical infrastructure.

Fault current limiters rated above 15000 A is increasing amid ultra-high-voltage transmission systems, offshore wind farms, and industrial power hubs due to the intense electrical surge that needs advancing protection. Similarly, as FCLs are high-capacity devices, they have been developed to deal with extreme fault situations, maintaining and stabilizing a grid, and keeping cascading failures from occurring in interconnected power grid systems.

Above 15000 A-rated FCLs are among the most important protections for offshore wind farms and utility customers of solar facilities (whose power output changes unpredictably and with high fault current). With growing integration of renewable energy sources, utility grid operators are investing in superconducting and solid-state fault current limiters that can respond to even high-amplitude fault currents in a matter of milliseconds.

Furthermore, ultra-high-capacity FCLs are increasingly sought after for use in HVDC (High Voltage Direct Current) transmission systems, which provide uninterrupted power transmission between large-scale renewable energy developments and national grids.

T&D utilities continue to account for the majority of fault current limiter end-user segmentation as power grids fight the growing prevalence of short-circuit issues driven by higher power needs, integration with distributed energy and aging infrastructure. Medium- and high-capacity FCLs are used by utilities for lowering substation fault levels, protecting critical transformers and switchgear from grid faults, lightning hits, or equipment failures.

The demand for superconducting FCL and hybrid FCL technologies is increasing as governments and power companies make investments in grid modernization projects, which require instantaneous current limitation without sacrificing network stability. They offer fast-acting, compact FCL solutions that include fault isolation and less fault recovery time, and are also vital in microgrid expansions and smart grid deployments.

Renewable energy plants are rapidly increasing their use of fault current limiters, as integrating solar, wind, and battery storage systems into traditional power grids presents new fault current challenges. In contrast to traditional power plants, renewable energy sources are characterized by variable and intermittent power flows that need to be managed and safeguarded by FCLs connected to power grid.

As offshore wind farms, hybrid power plants, and grid-scale energy storage continue to proliferate, the role of FCLs in ensuring power system stability and preventing widespread outages will only become more vital.

Single-phase and three-phase FCLs of pre-qualifying PCs, especially superconducting and solid-state vol. 3, are utilized inside the renewables power structures by utilities and personal strength manufacturers (PSP); whilst satisfy adapting, outdated finding out on sustain the electric must-cut-inside-be-range of operations in without inferring a feverishness get rid of ~ plant without hunger and satisfying them define second time positivity to adapt fault safety encirclement.

The global fault current limiter (FCL) market is growing steadily due to rising demand for smart grid infrastructure, increasing industrialization, and the need for enhanced electrical system protection. Fault current limiters play a crucial role in preventing overcurrent damage to electrical grids, industrial power networks, and renewable energy systems, ensuring grid stability and reducing downtime caused by electrical faults.

Increasing investments in renewable energy integration, advancements in superconducting technology, and the expansion of high-voltage power transmission networks are key factors influencing the market. Top manufacturers develop state-of-the-art technologies for high-efficiency current-limiting, modular designs, and automation for fault detection and subsequent protection systems for utilities and industrial power grids, as well as commercial electrical infrastructure.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Siemens AG | 9-11% |

| ABB Ltd. | 8-10% |

| Superconductor Technologies Inc. | 7-9% |

| Zenergy Power Limited | 5-7% |

| American Superconductor Corporation (AMSC) | 4-6% |

| Other Companies (combined) | 57-67% |

| Company Name | Key Offerings/Activities |

|---|---|

| Siemens AG | An international pioneer of superconducting fault current limiters (SFCLs), combining AI-based predictive fault detection to ensure grid safety. |

| ABB Ltd. | It creates modern current limiters for use in high-voltage transmission networks, with a particular emphasis on smart grid protection and automation. |

| Superconductor Technologies Inc. | Specializes in HTS (high-temperature superconducting) fault current limiters, ensuring fast response and energy-efficient fault protection. |

| Zenergy Power Limited | Offers low-maintenance current limiting solutions, integrating resistive and superconducting FCL technology for industrial applications. |

| American Superconductor Corporation (AMSC) | Provides next-gen superconducting FCLs that enhance the efficiency of energy transmission and grid stability. |

Key Company Insights

Siemens AG

Siemens is a world leader in providing power grid solutions and provides superconducting fault current limiters (SFCLs) for improved grid stability and fault protection. The company’s high-performance current limiting devices are used in high-voltage networks, power distribution grids and industrial applications.

Siemens incorporates AI-powered predictive maintenance systems, offering real-time fault diagnostics and actionable insights. The company is broadening its portfolio of smart grid technologies by adding IoT-capable current limiters, which could automate grid monitoring as well as increase fault mitigation.

ABB Ltd.

ABB, a leading provider of electrical protection solutions, provides transmission and distribution networks with compact and highly efficient fault current limiters. The company's FCL technology aims to enable faster response times, providing better power loss and seamless grid integration.

ABB is focusing on hybrid and solid-state fault limiters to remain relevant in high-power industrial applications. The company also is developing advanced digital tools that enable utilities and grid operators to optimize current limiting strategies in real-time.

Superconductor Technologies Inc.

Superconductor Technologies Inc. is the premier provider of high-temperature superconducting (HTS) fault current limiters offering the lowest resistance, energy-efficient solution for your power grids. Its HTS-based current limiters suppress faults while limiting losses in the overall system.

Superconductor Technologies is also leveraging its international footprint in renewable energy applications, intertwining FCL with wind and solar generation transmission networks. The firm is also working on low-cost superconducting materials that bring down manufacturing prices for next-gen FCLs.

Zenergy Power Limited

Zenergy Power is the leading innovator of resistive and superconducting fault current limiter technology, delivering compact, low-maintenance current-limiting solutions for industrial and commercial applications.

The company specializes in fast fault isolation, thermal efficiency and scalable modular designs-delivering seamless integration with existing power grid infrastructure. Redirects] Zenergy is investing in autonomous fault detection systems, allowing for real-time response to grid instability and transient faults.

American Superconductor Corporation (AMSC)

AMSC is leading the world in superconducting fault current limiter technology designed for the next generation of high-efficiency current limiters that makeup energy transmission networks, data centers, as well as industrial power systems.

The high-capacity fault limiters of the company minimize damage to equipment and power disturbances, thus ensuring improved reliability and efficiency of the grid. AMSC is expanding its product range in smart FCLs, incorporating real-time fault analytics and AI-based grid optimization.

The global fault current limiters market is projected to reach USD 5,091.4 million by the end of 2025.

The market is anticipated to grow at a CAGR of 6.1% over the forecast period.

By 2035, the fault current limiters market is expected to reach USD 9,204.3 million.

The T&D Utilities segment is expected to dominate due to the rising demand for grid stability, increasing power generation capacity, and the need to protect electrical infrastructure from excessive fault currents in high-voltage networks.

Key players in the fault current limiters market include Siemens AG, ABB Ltd., Toshiba Corporation, SuperPower Inc., and American Superconductor Corporation (AMSC).

Superconducting FCL (SFCL), Solid-State FCL (SSFC), Electromagnetic FCL, Hybrid FCL

Upto 1000 A, 1000-5000 A, 5000-15000 A, Above 15000 A

T&D Utilities, Manufacturing Industries, Renewable Energy Plants, Railway Electrification, Data Centers & Telecom Infrastructure, Commercial Infrastructure, Others

North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, Middle East & Africa

Immersion Heater Market Growth - Trends & Forecast 2025 to 2035

Tire Curing Press Market Growth - Trends & Forecast 2025 to 2035

Turbidimeter Market Growth - Trends & Forecast 2025 to 2035

Marine Cranes Market Growth - Trends & Forecast 2025 to 2035

Industrial Exhaust System Market Growth - Trends & Forecast 2025 to 2035

Marine Bearings Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.