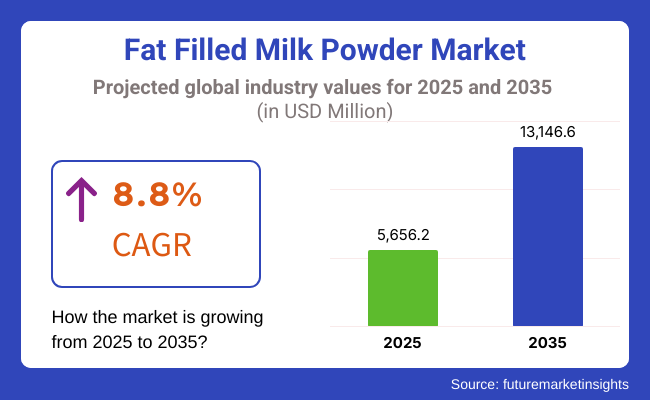

The global Fat Filled Milk Powder market is estimated to be worth USD 5,656.2 million in 2025 and is projected to reach a value of USD 13,146.6 million by 2035, expanding at a CAGR of 8.8% over the assessment period of 2025 to 2035

The dairy industry is experiencing significant growth, especially in emerging markets such as Asia, Africa, and Latin America. Rising population levels, urbanization, and increasing disposable incomes are driving higher consumption of dairy products.

As consumers become more aware of the nutritional benefits of dairy, products like fat-filled milk powder are gaining popularity. This trend is further supported by the expansion of retail channels and the introduction of innovative dairy products tailored to local tastes and preferences.

Countries with surplus milk production, such as New Zealand, the United States, and Australia, are capitalizing on the growing global demand for fat-filled milk powder by increasing exports. These nations leverage their advanced dairy farming practices and processing technologies to produce high-quality FFMP.

As international markets expand, particularly in developing regions, exporters are finding new opportunities to meet the needs of diverse consumers. This trend not only boosts local economies but also strengthens global trade relationships in the dairy sector.

Explore FMI!

Book a free demo

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for global fat filled milk powder market.

This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision about the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 6.3% (2024 to 2034) |

| H2 | 6.9% (2024 to 2034) |

| H1 | 7.2% (2025 to 2035) |

| H2 | 8.0% (2025 to 2035) |

The above table presents the expected CAGR for the global fat filled milk powder demand space over semi-annual period spanning from 2025 to 2035. In the first half (H1) of the year 2024, the business is predicted to surge at a CAGR of 6.3%, followed by a slightly higher growth rate of 6.9% in the second half (H2) of the same year.

Moving into year 2025, the CAGR is projected to increase slightly to 7.2% in the first half and remain relatively moderate at 8.0% in the second half. In the first half (H1 2025) the market witnessed a decrease of 16 BPS while in the second half (H2 2025), the market witnessed an increase of 34 BPS.

Convenience and Ready-to-Use Products

The fast-paced nature of modern life has significantly increased the demand for convenient food solutions, leading to a surge in popularity for fat-filled milk powder (FFMP).

As consumers seek quick and easy meal options, FFMP is frequently incorporated into instant mixes, ready-to-eat meals, and snack products. Its versatility allows it to be used in various culinary applications, from soups to sauces, catering to the needs of busy individuals and families.

Additionally, the growing trend of meal prepping and on-the-go consumption further drives the demand for FFMP, as it provides a nutritious and hassle-free ingredient that can enhance the flavor and texture of a wide range of dishes, making it an essential component in the convenience food market.

Rising Demand in Emerging Markets

Emerging economies, particularly in Asia and Africa, are experiencing a notable increase in the demand for dairy products, including fat-filled milk powder (FFMP). This surge is primarily driven by rising disposable incomes, urbanization, and changing dietary habits among consumers. As more people transition to urban lifestyles, there is a growing preference for convenient and nutritious food options, leading to increased consumption of dairy and dairy products.

FFMP is becoming a staple ingredient in local food production, as it offers a cost-effective alternative to whole milk powder while maintaining a similar nutritional profile. This trend not only supports the growth of the dairy industry in these regions but also enhances food security by providing affordable nutrition to a burgeoning population.

Innovative Product Development

The fat-filled milk powder (FFMP) market is witnessing a wave of innovative product development as manufacturers strive to meet the evolving needs of consumers. Companies are increasingly focusing on creating new formulations that cater to specific dietary requirements, such as lactose-free, fortified, or organic options. This innovation is driven by a growing awareness of health and wellness among consumers, who are seeking products that align with their dietary preferences and restrictions.

By offering a diverse range of FFMP products, manufacturers can attract a broader consumer base and enhance market appeal. Additionally, these innovations often incorporate advanced processing techniques that improve the quality, taste, and shelf-life of FFMP, further solidifying its position in the competitive dairy market.

Global Fat Filled Milk Powder sales increased at a CAGR of 6.1% from 2020 to 2024. For the next ten years (2025 to 2035), projections are that expenditure on fat filled milk powder will rise at 8.8% CAGR

Fat-filled milk powder (FFMP) is often more affordable than whole milk powder, providing a significant cost advantage for manufacturers. This lower price point allows producers to maintain product quality while reducing overall production costs, making FFMP an attractive ingredient in various food applications.

In price-sensitive markets, where consumers are increasingly conscious of their spending, the affordability of FFMP enables manufacturers to offer competitive pricing without compromising on nutritional value, thereby appealing to a broader customer base.

The versatility of fat-filled milk powder (FFMP) is a key factor driving its popularity among manufacturers. FFMP can be seamlessly incorporated into a diverse array of food products, including confectioneries, sauces, baked goods, and instant mixes.

This adaptability allows manufacturers to experiment with different formulations and create innovative products that cater to various consumer preferences. By utilizing FFMP, producers can diversify their product offerings, enhance flavor profiles, and meet the growing demand for convenient and versatile food solutions in the market.

Tier 1 companies represent the industry leaders in the global FFMP market, typically generating revenues exceeding USD 20 million and commanding a market share of approximately 40% to 50%. These companies are characterized by their high production capacities, extensive product portfolios, and robust distribution networks. They possess significant expertise in manufacturing processes and are adept at reconditioning products across multiple packaging formats.

Their broad geographical reach is supported by a strong consumer base, enabling them to cater to diverse market needs. Prominent players in this tier include Fonterra Co-operative Group, FrieslandCampina, and Danone, which leverage their established brand reputation and innovation capabilities to maintain a competitive edge.

Tier 2 companies consist of mid-sized players with revenues ranging from USD 5 million to USD 20 million. These companies have a notable presence in specific regions and significantly influence the local retail landscape. They are characterized by a strong understanding of consumer preferences and regional market dynamics, allowing them to tailor their offerings effectively.

While they may not possess the extensive technological advancements or global reach of Tier 1 companies, they ensure regulatory compliance and maintain a solid operational framework. Notable companies in this tier may include regional dairy cooperatives and specialized manufacturers that focus on niche markets.

Tier 3 comprises a large number of small-scale companies operating primarily at the local level, with revenues below USD 5 million. These companies are often oriented towards fulfilling specific local marketplace demands and serve niche segments within the FFMP market.

Due to their limited geographical reach and smaller operational scale, Tier 3 companies are often classified within an unorganized sector, characterized by a lack of extensive structure and formalization compared to their organized counterparts. They play a crucial role in catering to localized consumer needs and preferences, contributing to the overall diversity of the market.

| Countries | Market Value (2035) |

|---|---|

| United States | USD 3,687.7 million |

| Germany | USD 702.2 million |

| China | USD 201.3 million |

| India | USD 102.4 million |

| Japan | USD 89.2 million |

Rising export opportunities for fat-filled milk powder (FFMP) are significantly influencing the USA dairy market. As global demand for FFMP increases, American producers are well-positioned to capitalize on this trend due to their advanced production capabilities and established reputation for quality.

This export potential not only encourages domestic manufacturers to ramp up FFMP production but also drives investment in innovative processing technologies and product development.

By tapping into international markets, USA companies can diversify their revenue streams and enhance competitiveness, ultimately contributing to the overall growth of the FFMP sector and strengthening the country's position in the global dairy industry.

The expansion of Germany's food processing industry is a significant driver of the rising demand for fat-filled milk powder (FFMP). This sector encompasses a wide range of applications, including baked goods, confectionery, dairy products, and ready-to-eat meals.

As manufacturers seek to improve product quality while managing costs, FFMP emerges as a versatile ingredient that enhances flavor, texture, and nutritional value. Its ability to serve as a cost-effective substitute for whole milk powder allows food processors to maintain competitive pricing without compromising on quality. Consequently, the growth of this industry directly correlates with the increasing utilization of FFMP in various food formulations.

The Indian government's initiatives to promote the dairy sector play a crucial role in boosting the demand for fat-filled milk powder (FFMP). Through various programs aimed at increasing milk production and enhancing processing capabilities, the government encourages investment in dairy processing facilities.

This support not only leads to higher production levels but also improves the quality of dairy products, including FFMP. Additionally, the rising global demand for dairy products presents significant export potential for Indian producers.

As they seek to tap into international markets, domestic manufacturers are incentivized to expand their production capacity and invest in FFMP. This dual focus on domestic growth and export opportunities is driving increased consumption and solidifying FFMP's position in India's evolving dairy landscape.

| Segment | Value Share (2025) |

|---|---|

| Confectionaries (End Use) | 18% |

The rising popularity of premium and artisanal products in the confectionery market is significantly driving the demand for fat-filled milk powder (FFMP). As consumers increasingly seek high-quality, indulgent treats that offer unique flavors and textures, FFMP serves as an ideal ingredient to enhance these gourmet experiences. Its rich, creamy profile contributes to the luxurious mouthfeel and taste that premium confectioneries are known for.

Additionally, FFMP allows manufacturers to create innovative formulations that cater to discerning consumers who prioritize quality and craftsmanship. This trend towards premiumization not only elevates product offerings but also positions FFMP as a key component in the development of upscale confectionery items.

The competition in the global fat-filled milk powder (FFMP) market is intensifying as manufacturers focus on innovation, product diversification, and cost efficiency.

Companies are investing in advanced processing technologies to enhance product quality and shelf life while developing specialized formulations, such as lactose-free and fortified options, to cater to diverse consumer preferences. Strategic partnerships and collaborations with food manufacturers and retailers are also being pursued to expand market reach and improve distribution channels, ensuring a competitive edge in this growing sector.

For instance

The global Fat Filled Milk Powder industry is estimated at a value of USD 5,656.2 million in 2025.

Sales of Fat Filled Milk Powder increased at 6.1% CAGR between 2020 and 2024.

Nestlé S.A., Danone S.A., Fonterra Co-operative Group Limited, FrieslandCampina, Lactalis Group, Arla Foods are some of the leading players in this industry.

The South Asia domain is projected to hold a revenue share of 26% over the forecast period.

North America holds 34% share of the global demand space for Fat Filled Milk Powder.

This segment is further categorized into Fat Filled Milk Powder 26%, Instant Fat Filled Milk Powder 26%, Fat Filled Milk Powder 28% and Instant Fat Filled Milk Powder 28%.

This segment is further categorized into Supermarkets and Hypermarkets, Convenience Stores, Department Stores, Specialty Stores, and Online.

This segment is further categorized into Dairy Products, Bakery Products, Confectionaries, Ice Cream, and Others.

Industry analysis has been carried out in key countries of North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus and the Middle East & Africa.

A Detailed Analysis of Brand Share Analysis for Herbs and Spices Industry

A detailed analysis of the Australia Bakery Ingredient Market and growth outlook covering product type, and application segment

USA Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Europe Aqua Feed Additives Market by Additive Type, Species, Ingredient, and Country through 2035

UK Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Herbs and Spices Market by Product Type, Form, End Use, and Country through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.