Fast-food reusable market is expected to grow at a moderate pace during 2025 to 2035 owing to growing consumer demand for sustainable packaging, increasing government regulations on single-use plastics and technologic development in reusable materials.

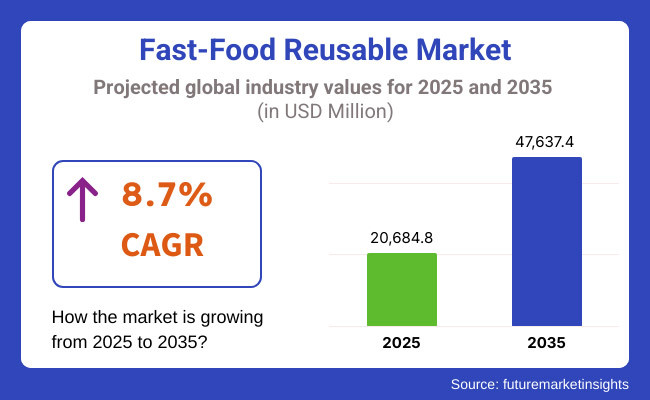

The global market for this industry is expected to have a significant valuation of USD 20,684.8 million by 2025 and 47,637.4 million by 2035 and is projected to show a considerable growth at a CAGR of 8.7% over the period of 2035.

Reusable from the fast-food sector like cups, containers, cutlery, and packaging are becoming more mainstream as many food chains and QSRs are moving towards a circular economy. Increasing demand for sustainable and cost-effective substitutes for disposables is driving market growth. Meanwhile new opportunities in the sector are being driven by the introduction of deposit-return schemes, digital tracking systems for reusable packaging and new materials such as bioplastics and stainless steel.

Although, high initial cost, logistics complexity and hygiene awareness are the restraints for the market which is expected to limit the market growth. These challenges are being met by industry players through scalable return-and-reuse programs, consumer awareness initiatives, and durable material innovations. Each of these segments of fast-food reusable market is further segmented into sub-segments.

The United States and Canada are viewed as key markets for fast-food reusable, with adoption being driven by regulations to reduce plastic waste in North America and greater corporate sustainability commitments. Market growth is driven by the major QSR brands expanding reusable packaging trials and government incentives for waste reduction programs.

Furthermore, adoption is further driven by growing consumer adoption for sustainable and zero-waste dining experiences and innovative returnable packing disposal methods. Although consumer hesitance towards hygiene and other logistical challenges serve as compromises for automated cleaning companies, continual investment into automated cleaning applications and easy-to-use returns systems are likely to promote the market growth.

Fast-food reusable, the type of reusable that are served at fast food outlets, comprise a large market in Europe, with Germany, UK and France particularly contributing to the figures. A push to cut plastic waste across the region, led by European Union directives, is boosting interest in sustainable alternatives to packaging, such as bioplastics.

Governments are accelerating market adoption through the increasing implementation of deposit-refund schemes and reusable packaging mandates. Food service providers are also working with reusable packaging start-ups to create scalable solutions. Although high operational costs and the absence of standardization are roadblocks in adoption, continuous material innovation and advances in digital solutions for traceability are expected to fuel market growth.

The fast-food reusable market is anticipated to witness the fastest growth during the forecast period in the Asia-Pacific region due to rising environmental consciousness, increasing urbanization, and the growth of food delivery services in regions such as China, Japan, India, and South Korea. Demand is being fuelled by an expanding middle-class population in the region and government-sponsored efforts to reduce plastic waste.

Investment in eco-friendly packaging materials such as bioplastics is also picking up steam from domestic manufacturers. Yet widespread adoption may be affected by inconsistent enforcement of regulations and consumer adaptation issues. With all of these reservations, note, partnerships between worldwide brands and regional policymakers are projected to create extended growth.

Challenge: Cost and Logistical Barriers in Large-Scale Reuse Systems

When it comes to the fast-food reusable space, a key barrier is the expense behind reusable packaging system development, along with the corresponding return infrastructure. Implementing washing and redistribution logistics, especially for multinational QSR chains, adds another layer of complexity.

Moreover, hygiene issues need to be addressed as well as the acceptance of the consumer and it needs investment in educational and transparency activities. Overcoming such challenges will need low-cost return frameworks, incentives to adopt sustainable packaging and sophisticated sterilizing solutions to guarantee public confidence.

Opportunity: Expansion of Digital Tracking and Smart Reusable Systems

Rise in digital tracking technologies and smart reusable packaging systems for enhanced process control and process efficiency being prominent growth might contribute significantly in the fast food reusable packaging market. QR-coded, returnable packaging, blockchain-based verification and traceability systems, and AI-driven logistics optimization are making reuse programs more efficient.

Consumer incentives are also helping boost engagement with reusable initiatives, including gamified reward systems and loyalty programs. As the regulatory mandate and consumer appetite for waste reduction ramps up, the opportunity for scalable, tech-driven reusable packaging solutions is expected to grow significantly into the next decade.

The compound annual growth rate (CAGR) from 2020 to 2024 for the Fast-Food Reusable Market was driven by rising consumer input to sustainable packaging, government drive to prohibiting single use plastics and corporate initiatives to reducing trash. Fast-food chains and quick-service restaurants (QSRs) piloted reusable food containers, drink cups, and cutlery programs to meet new environmental initiatives and build brand reputation.

Also, deposit-return systems, rental-based reusable models and closed-loop recycling initiatives became more popular. Barriers to widespread adoption during the last two decades, however, barriers to widespread adoption were identified such as the complexity of logistics, high upfront capital costs and consumer reluctance to return packaging.

The market will be very different 2025 to 2035 with AI-directed smart return systems and install-it-once biodegradable and yet reusable packaging-metrics, and blockchain powered waste tracking capacity. Antimicrobial coatings can self-clean, RFID-tagged reusable packaging can track inventory, and AI will analyse customer behaviour for optimal placement and convenience.

Bio-persistent non-micro plastics for food packaging and post-consumer trash along with advertising reimbursement for composting and recycling containers or packaging sanitization stations for isolating infectious particles will only drive further transformation in the market. Similarly, automated return kiosks, app-based loyalty rewards for reusable container use, and carbon-neutral fast-food supply chains will change the landscape of sustainability initiatives by prioritizing minimization impact and long-term savings in businesses.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with plastic ban, extended producer responsibility (EPR) laws, and voluntary corporate sustainability pledges. |

| Material Innovation | Use of stainless steel, silicone, and rigid plastic reusable containers. |

| Industry Adoption | Growth in fast-food chains, QSRs, coffee shops, and delivery services experimenting with reusable. |

| Smart & AI-Enabled Systems | Early adoption of deposit-return programs, QR-code tracking for reusable containers, and basic refill stations. |

| Market Competition | Dominated by fast-food giants implementing pilot programs, third-party sustainable packaging suppliers, and waste management firms. |

| Market Growth Drivers | Demand fuelled by regulatory pressure, corporate sustainability goals, and consumer eco-consciousness. |

| Sustainability and Environmental Impact | Early adoption of compostable plastics, low-carbon transportation for reusable packaging, and limited regional trials. |

| Integration of AI & Digitalization | Limited AI use in tracking reusable container returns and digital ordering incentives. |

| Advancements in Manufacturing | Use of traditional moulded plastic, glass, and stainless steel reusable packaging. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global zero-waste mandates, AI-powered compliance monitoring, and blockchain-based packaging traceability. |

| Material Innovation | Adoption of biopolymer-based reusable materials, self-cleaning antimicrobial coatings, and AI-designed ultra-durable packaging. |

| Industry Adoption | Expansion into fully circular packaging models, AI-optimized waste reduction strategies, and dynamic rental-based reusable packaging networks. |

| Smart & AI-Enabled Systems | Large-scale deployment of AI-powered customer usage analytics, self-sanitizing reusable packaging, and RFID-based real-time inventory tracking. |

| Market Competition | Increased competition from AI-driven circular economy platforms, smart packaging start-ups, and IoT-integrated supply chain innovators. |

| Market Growth Drivers | Growth driven by AI-assisted waste tracking, loyalty-based consumer incentives, and hyper-personalized sustainable fast-food packaging solutions. |

| Sustainability and Environmental Impact | Large-scale transition to zero-waste fast-food models, AI-optimized material recovery processes, and carbon-negative packaging production. |

| Integration of AI & Digitalization | AI-powered dynamic packaging lifecycle optimization, automated cleaning and sanitization hubs, and predictive demand forecasting for reusable materials. |

| Advancements in Manufacturing | Evolution of 3D-printed biodegradable reusable containers, self-repairing packaging materials, and energy-efficient AI-assisted manufacturing. |

Rising consumer awareness regarding sustainability coupled with numerous government regulations usually a pro-active approach towards phased ban of single-use plastic is mandating fast-food service chains to adopt reusable products which is further boosting the market growth in the region. The market growth is also driven by the adoption of reusable containers and cutlery by major fast-food chains in line with their sustainability commitments.

Materials science has also accomplished several material advancements, including newer, biodegradable products and durable reusable substitutes, all of which can increase the use of these products. Increasing demand for little food packaging is also powered by fast-casual dining & food delivery services.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 9.0% |

Efforts to transform the food and beverage sector are the need of the time, driven by bans on single-use plastics in the United Kingdom, government regulations and policies, as well as growing investments in circular economy initiatives, driving the UK fast-food reusable market billion growth. Major food service brands are adopting deposit return schemes for their reusable packaging.

Urban food container reuse rental schemes are transforming market trends too. Digital platforms also keep driving investment in reusable packaging return and tracking, increasingly boosting sustainability in the fast-food industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 8.3% |

Germany, France, and Italy dominate the fast-food reusable landscape in the EU, bolstered by robust regulatory frameworks supporting waste reduction initiatives, a growing consumer preference for sustainable packaging, and an ever-increasing uptake of reusable alternatives in quick-service dining venues. Market growth is further fuelled by EU circular economy policies, and extended producer responsibility programs.

In addition, smart packaging solutions with RFID and QR codes can help improve the efficiency of reusable packaging systems. The trend towards reusable alternatives which are plant-based and compostable is another driver of industry growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 8.6% |

Japan’s fast food reusable market is growing on the back of a spate of government policies encouraging sustainable packaging, increasing consumer interest in reducing waste, and high adoption of reusable bento and takeaway containers. With a strong emphasis on innovation in reusable material technology such as silicone and bamboo-based alternatives, the country is standing apart in the market.

Moreover, the underlying trends of convenience store chains also extending reusable meal packaging and rental schemes for food containers are all influences on the Industry. This will also optimise reuse strategies, as AI-enabled waste management and digital deposit return systems are integrated.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.1% |

The fast-food reusable solutions market is witnessing growth in South Korea owing to robust governmental policies aimed at reducing plastic waste, rising consumer demand for environmentally friendly eating, and rapid growth of digital food delivery based platforms. The country’s leadership in smart city initiatives is encouraging app-based tracking and return programs for reusable packaging systems.

Also, partnerships between fast-food brands, packaging start-ups and municipal waste management agencies are speeding adoption. Key players are also espousing a trend towards minimal-waste dining, and more and more investment is being plied into revolutionary reusable packaging technologies, creating additional inflections in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.9% |

Food service providers, consumers, and regulating bodies are increasingly prioritizing sustainable packaging and durable food storage solutions. Material types are integral in reducing single-use plastics, improving food safety, and increasing product lifespan. As sustainability regulations grow stricter and consumer demand for environmentally friendly packaging is booming, reusable containers for fast food made from glass and metal are taking off around the world.

Glass recyclable materials of reusable containers are so popular and is because they can be recycled, resistant to chemicals, and are considered non-toxic. Not only does glass not cause chemicals to leach into food like plastic alternatives do, glass has superior heat resistance, making it ideal for hot and cold fast-food applications.

This has propelled the market adoption owing to the rapid demand for premium, reusable food storage solutions, especially among cafes, quick service restaurants and meal delivery services. Research shows that more than 65% of eco-friendly consumers choose glass based reusable food containers because of their eco-friendliness and reusability.

The availability of tempered glass containers, which have its shatterproof construction, thermal shock resistant ability and provided with airtight silicone-sealed lids, has reinforced market demand as it increase food preservation and shelf life.

The food and beverage sector with the inclusion of smart glass containers with RFID enabled tracking, microwave-safe, UV-light sterilization has increased adoption, thus providing users with greater convenience, ease and food safety.

Printed brand logos that use a frosted finish and premium aesthetics of the glass content have been on the rise aiding in the growth of the Reusable Custom-branded Glass Packaging Market with designs that outstand and showcase the product to the satisfyingly ease the eyes of customers.

Market proliferation propelled by the adoption of closed-loop recycling programs surrounding glass reusable by means of deposit return schemes, restaurant take-back initiatives and incentive-based sustainability campaigns and so forth intensified market penetration wherein almost all end-users are mandated to float CO2-friendly system and therefore comply as a dear part of regulatory system.

While glass reusable options are a step forward in sustainability, food safety, and premium look-and-feel, they come with disadvantages like fragility, cost of production, and weight compared to common plastic alternatives.

Nonetheless, new advancements in lightweight reinforced glass technology, Artificial Intelligence-based optimization of supply chains for glass recycling, and anti-shatter coating technologies, will revolutionize the durability, affordability, and scalability of glass reusable, establishing a steadfast market for glass in the recycling industry across the globe.

Due to its high durability, thermal retention properties, and lightweight structure, metal reusable containers still hold a large share in Fast-Food Reusable Market. Unlike glass, metal food packages are greatly impact resistant with corroding prevention, which makes them uncommon for fast food storage and transport item.

Adoption has been further supported by the increasing preference for durable and long-lasting food containers, especially in fast-casual dining, meal prep service, and outdoor catering. According to studies, over 60% of restaurant chains and meal service providers have started shifting from using single-use packaging to metal-based reusable containers to combat packaging waste and comply with their sustainability goals.

The popularity of stainless steel food storage containers, which offer features such as double-walled insulation, leak-proof locking lids, and environmentally friendly manufacturing processes, has also boosted demand in the market, making them a more functional choice that satisfies consumers.

The introduction of antimicrobial-coated metal containers, which provide a high degree of hygiene protection, scratch-resistant finish, and food-grade safe materials, has also increased adoption, as these factors ensure compliance with food safety regulations.

The innovation of collapsible metal food storage items, including foldable designs, space-saving configurations, and modular stack ability, has contributed to market growth optimization with improved portability and storage efficiency.

Market growth is bolstered by the fusion of hybrid metal-polymer food packaging that includes aluminium-based lightweight figures, silicone-sealed hoods, and thermally saved sidewalls that ensure enhanced heat retention, as well as spill-proof in the case of takeaway food.

From tensile strength and thermal efficiency to breakage resistance, the hard-wearing material reusable segment has some major advantages, but also presents challenges, including high up-front pricing, limited microwave capability, and a higher risk of absorbing the taste of metallic foods, especially when acidic.

Fortunately, newer capabilities in non-reactive metal-coated plating, AI food storage monitoring systems, and zero-waste metal production processes are increasing the usability, affordability, and eco-friendliness of metal reusable, ensuring continued proliferation of reusable across the globe.

As quick-service restaurants, organic food vendors, and health-conscious consumers look for sustainable food packaging options, the Fast-Food Reusable Market shares a dominant portion under the Vegetables and Juices upon which the segment is reliant. They make sure that the food is fresh, has a longer shelf life, limits food waste and protects the environment.

Strong market adoption owing to the strong ability to maintain freshness, and avoid contamination along with easing one-time plastic usage. Reusable vegetable storage solutions provide long-term cost savings and better product integrity than disposable containers.

Factors such as growing demand for zero-waste disposal of food packaging, including in salad bars, meal prep services, and farm-to-table establishments, have driven adoption. Reusable vegetable packaging are being used to improve sustainability by more than 70% of Organic food retailers and farm markets.

Because of all these innovations, the availability of breathable reusable vegetable containers, some moisture-regulating, some with anti-microbial coatings, some with transparent viewing panels, and more, has encouraged market demand, including product longevity and less food spoilage.

However, initial investment costs, maintenance requirements associated with reusable containers, and a lack of awareness among consumers regarding return-and-reuse programs are some of the factors restraining the growth of the vegetable packaging market segment, despite the advantages offered by ready-meal packaging in terms of freshness, sustainability, and cost efficiency.

Emerging innovations in biodegradable hybrid packaging, AI-driven freshness monitoring sensors, and smart tracking for reusable containers are improving functionality, engagement, and adoption, they ensure that reusable vegetable packaging continues to expand worldwide.

Sustainable drinkware solutions like reusable food packaging for juices have a high growth in the market nowadays as they are being accepted and used by cafes, smoothie bars, beverage brands. Reusable juice containers are far better than a regular disposable cup since they are far more insulated, spill-proof, and most importantly serve longer.

Rising functionality demand for environmentally sustainable beverage packaging especially among cold-pressed juice brands, organic smoothie franchises, and health-focused drink chains has propelled its adoption. Studies of sustainable beverage businesses show that over 65% have adopted reusable juice packaging as a key to achieving the goals of a circular economy.

The proliferation of insulated reusable juice containers with double-walled vacuum insulation, leak-proof silicone seals, and temperature retention technology, has bolstered market demand while enhancing consumers experience and promoting brand differentiation.

While it offers advantages in sustainability, durability and brand marketing, the reusable juice packaging segment faces challenges in the form of elevated production costs, higher cleaning and sanitation requirements, and limited infrastructure to support widespread return and reuse based systems.

Yet, novel advancements in self-cleaning drinkware, AI-integrated container return tracking, and biocompatible polymer technology for reusable cups are benefitting affordability, accessibility and consumer connection, thereby promising sustainable growth for reusable juice packaging around the globe.

Consumer demand for more sustainable packaging alternatives, regulatory action on single-use plastics, and innovation in durable, food-safe materials drive the fast-food reuse market. As eco-conscious dining habits and corporate sustainability initiatives are finding more acceptance, the market is growing steadily.

The industry is gradually being reshaped by circular economy principles, with three key trends: replacing single-use plastics with biodegradable and recyclable alternatives, increasing smart tracking of reusable containers, and renewed partnerships between food service providers and sustainability-focused start-ups.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Loop (TerraCycle) | 12-16% |

| Eco-Products, Inc. | 10-14% |

| GO Box | 8-12% |

| RECUP | 6-10% |

| Preserve | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Loop (TerraCycle) | Develops reusable container systems for fast-food brands with closed-loop return programs. |

| Eco-Products, Inc. | Specializes in compostable and reusable foodservice packaging for eco-friendly dining. |

| GO Box | Offers a subscription-based reusable container service for takeout and delivery markets. |

| RECUP | Focuses on reusable coffee cup programs with deposit-return models in food service. |

| Preserve | Provides durable, BPA-free reusable food packaging made from recycled materials. |

Key Company Insights

Loop (TerraCycle) (12-16%)

Loop leads in reusable packaging innovation, partnering with major food brands to implement closed-loop returnable container systems.

Eco-Products, Inc. (10-14%)

Eco-Products specializes in sustainable food packaging, integrating reusable and compostable solutions for fast-food chains.

GO Box (8-12%)

GO Box focuses on subscription-based reusable takeout container programs, reducing single-use waste in urban dining environments.

RECUP (6-10%)

RECUP pioneers reusable coffee cup programs with a deposit-refund system, promoting waste reduction in beverage consumption.

Preserve (4-8%)

Preserve manufactures BPA-free reusable containers made from recycled plastic, enhancing sustainability in fast-food packaging.

Other Key Players (45-55% Combined)

Several sustainability-driven companies contribute to the expanding Fast-Food Reusable Market. These include:

The overall market size for the fast-food reusable market was USD 20,684.8 million in 2025.

The fast-food reusable market is expected to reach USD 47,637.4 million in 2035.

The demand for fast-food reusable products will be driven by increasing environmental concerns, rising government regulations on single-use plastics, growing consumer preference for sustainable packaging, and advancements in durable, food-safe reusable materials.

The top 5 countries driving the development of the fast-food reusable market are the USA, China, Germany, France, and Canada.

The Metal Reusable Food Containers segment is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Product Outlook , 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 6: Global Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Product Outlook , 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 12: North America Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: Latin America Market Value (US$ Million) Forecast by Product Outlook, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 18: Latin America Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Western Europe Market Value (US$ Million) Forecast by Product Outlook, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 24: Western Europe Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: Eastern Europe Market Value (US$ Million) Forecast by Product Outlook, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 30: Eastern Europe Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 34: South Asia and Pacific Market Value (US$ Million) Forecast by Product Outlook, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 36: South Asia and Pacific Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: East Asia Market Value (US$ Million) Forecast by Product Outlook, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 42: East Asia Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: Middle East and Africa Market Value (US$ Million) Forecast by Product Outlook, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 48: Middle East and Africa Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Product Outlook , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Size, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Value (US$ Million) Analysis by Product Outlook , 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Product Outlook , 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Product Outlook , 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 23: Global Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 24: Global Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 25: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 26: Global Market Attractiveness by Application, 2023 to 2033

Figure 27: Global Market Attractiveness by Product Outlook , 2023 to 2033

Figure 28: Global Market Attractiveness by Size, 2023 to 2033

Figure 29: Global Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Product Outlook , 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Size, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 36: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 46: North America Market Value (US$ Million) Analysis by Product Outlook , 2018 to 2033

Figure 47: North America Market Value Share (%) and BPS Analysis by Product Outlook , 2023 to 2033

Figure 48: North America Market Y-o-Y Growth (%) Projections by Product Outlook , 2023 to 2033

Figure 49: North America Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 55: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 56: North America Market Attractiveness by Application, 2023 to 2033

Figure 57: North America Market Attractiveness by Product Outlook , 2023 to 2033

Figure 58: North America Market Attractiveness by Size, 2023 to 2033

Figure 59: North America Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Product Outlook , 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Size, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 67: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 71: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 72: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 74: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 75: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) Analysis by Product Outlook , 2018 to 2033

Figure 77: Latin America Market Value Share (%) and BPS Analysis by Product Outlook , 2023 to 2033

Figure 78: Latin America Market Y-o-Y Growth (%) Projections by Product Outlook , 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 83: Latin America Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 84: Latin America Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 85: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Product Outlook , 2023 to 2033

Figure 88: Latin America Market Attractiveness by Size, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Product Outlook , 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Size, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 97: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 101: Western Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 102: Western Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 103: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 104: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: Western Europe Market Value (US$ Million) Analysis by Product Outlook , 2018 to 2033

Figure 107: Western Europe Market Value Share (%) and BPS Analysis by Product Outlook , 2023 to 2033

Figure 108: Western Europe Market Y-o-Y Growth (%) Projections by Product Outlook , 2023 to 2033

Figure 109: Western Europe Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 113: Western Europe Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 114: Western Europe Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 115: Western Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Product Outlook , 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Size, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Product Outlook , 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Size, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 127: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 131: Eastern Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 132: Eastern Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 133: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 135: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 136: Eastern Europe Market Value (US$ Million) Analysis by Product Outlook , 2018 to 2033

Figure 137: Eastern Europe Market Value Share (%) and BPS Analysis by Product Outlook , 2023 to 2033

Figure 138: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Outlook , 2023 to 2033

Figure 139: Eastern Europe Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 143: Eastern Europe Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 144: Eastern Europe Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 145: Eastern Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Product Outlook , 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Size, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Product Outlook , 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Size, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 157: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 162: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 164: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 165: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 166: South Asia and Pacific Market Value (US$ Million) Analysis by Product Outlook , 2018 to 2033

Figure 167: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Outlook , 2023 to 2033

Figure 168: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Outlook , 2023 to 2033

Figure 169: South Asia and Pacific Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 173: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 174: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 175: South Asia and Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Product Outlook , 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Size, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Product Outlook , 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Size, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 191: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 192: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 193: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 194: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 195: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 196: East Asia Market Value (US$ Million) Analysis by Product Outlook , 2018 to 2033

Figure 197: East Asia Market Value Share (%) and BPS Analysis by Product Outlook , 2023 to 2033

Figure 198: East Asia Market Y-o-Y Growth (%) Projections by Product Outlook , 2023 to 2033

Figure 199: East Asia Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 203: East Asia Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 204: East Asia Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 205: East Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Product Outlook , 2023 to 2033

Figure 208: East Asia Market Attractiveness by Size, 2023 to 2033

Figure 209: East Asia Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Product Outlook , 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Size, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 217: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 221: Middle East and Africa Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 222: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 223: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 224: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 225: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 226: Middle East and Africa Market Value (US$ Million) Analysis by Product Outlook , 2018 to 2033

Figure 227: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Outlook , 2023 to 2033

Figure 228: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Outlook , 2023 to 2033

Figure 229: Middle East and Africa Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 233: Middle East and Africa Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 234: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 235: Middle East and Africa Market Attractiveness by Material Type, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Product Outlook , 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Size, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Reusable Transport Packs Market Size and Share Forecast Outlook 2025 to 2035

Reusable Oil Absorbents Market Size and Share Forecast Outlook 2025 to 2035

Reusable Grocery Tote Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Reusable Period Panties Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Reusable Tumblers Market Size and Share Forecast Outlook 2025 to 2035

Reusable Laparoscopic Instruments Market is segmented by Reusable Laparoscopic Scissors and Reusable Hand Instruments from 2025 to 2035

Reusable Incontinence Products Market Analysis - Size, Share & Forecast 2025 to 2035

Reusable Nursing Pads Market Size and Share Forecast Outlook 2025 to 2035

Reusable Cold Chain Packaging Market Size and Share Forecast Outlook 2025 to 2035

Reusable Wine Bags Market Size and Share Forecast Outlook 2025 to 2035

Reusable Packing Market Size, Share & Forecast 2025 to 2035

Reusable Straws Market Analysis - Trends, Growth & Forecast 2025 to 2035

Reusable Sanitary Pads Market Growth - Size, Demand & Forecast 2025 to 2035

Reusable Egg Containers Market Trends – Growth & Forecast 2025 to 2035

A Detailed Global Analysis of Brand Share for the Reusable Incontinence Products Market

A Detailed Global Analysis of Brand Share for the Reusable Period Panties Market

Industry Share Analysis for Reusable Wine Bags Companies

Evaluating Reusable Cold Chain Packaging Market Share & Provider Insights

Reusable Box Market Trends & Industry Growth Forecast 2024-2034

Reusable Water Bottle Market Insights – Growth & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA