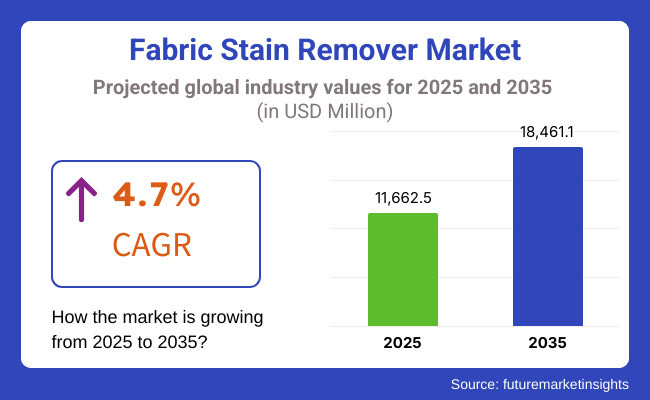

The global fabric stain remover market is poised for substantial expansion, increasing from USD 11,662.5 million in 2025 to USD 18,461.1 million by 2035. The market is expected to grow at a CAGR of 4.7% from 2025 to 2035.

Fabric stain removers have gained popularity rapidly because of their convenient formulations and efficiency, which are found in many modern households. Market expansion happens swiftly because consumers seek out efficient stain removal solutions that are super flexible and eco-smart. Demand spans multiple economic segments, with fabric stain removers catering predominantly to busy professionals and small-space households in urban areas.

Rising interest in sustainable cleaning products fuels market growth rapidly amidst surging disposable incomes. Modern consumers prioritize functionality with features like enzyme-based formulas enhancing product appeal pretty significantly nowadays overall. Eco-friendly practices gain traction fast, with substantial energy-efficient stain removal solutions driving market expansion forward really quickly nowadays.

Eco-friendly fabric stain removers with advanced features drive market growth rapidly due to their substantial investment potential. Wealthy buyers perceive fancy stain removal technologies as financially savvy moves that boost sales in upscale cleaning markets rapidly. Sustainable products greatly influence purchasing decisions among buyers who prioritize environmental responsibility.

Digital platforms revolutionize the fabric stain remover market, offering consumers remarkably easy access via online portals to numerous models featuring transparent pricing. Younger folks rapidly drive up online sales, leveraging e-commerce platforms for super convenient purchasing and somewhat detailed product comparisons.

Explore FMI!

Book a free demo

The table below presents the expected CAGR for the fabric stain remover industry over semi-annual periods spanning from 2025 to 2035.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 5.2% (2024 to 2034) |

| H2 2024 | 4.3% (2024 to 2034) |

| H1 2025 | 5.5% (2025 to 2035) |

| H2 2025 | 3.9% (2025 to 2035) |

The CAGR exhibits a fluctuating trend, initially increasing by 52 BPS from H1 (2024 to 2034) to H2 (2024 to 2034), indicating stronger growth momentum in the latter half. However, a slight increase of 55 BPS in H1 (2025 to 2035) suggests temporary market stabilization or external constraints.

Growth rebounds in H2 (2025 to 2035) with a 39 BPS decrease, reflecting renewed demand or industry expansion. This pattern suggests cyclical variations, with stronger growth in the second half of each period, possibly driven by evolving market conditions and strategic investments.

Rising Demand for Convenient and Eco-Friendly Cleaning Solutions Drives Fabric Stain Remover Market Growth

The global fabric stain remover market is undergoing very rapid growth today, mainly due to rising demand for daily convenience and eco-efficiency in fabric care solutions. Modern urban dwellers prefer sleek products that fit snugly into busy lifestyles in densely populated city apartments. Luxury consumer goods lean heavily toward advanced fabric stain removers featuring smart application capabilities and superior sustainability.

Manufacturers respond with sleek, multifunctional designs, enhancing convenience beneath remarkably high standards of stain removal performance. Sustainable products gaining popularity rapidly accelerate market growth due to low environmental impact and reduced chemical usage. Digital platforms offer augmented reality previews with personalized recommendations that boost buying experiences significantly, driving sales upward rapidly online.

Growing Popularity of Enzyme-Based and Sustainable Stain Removers Boosts Market Expansion

Sustainability efforts, coupled with hygiene needs, fuel the daily demand for extremely eco-efficient fabric stain removal units. Eco-conscious shoppers perceive sustainable products as savvy financial moves that lower environmental footprints beneath sprawling green initiatives. Globally, governments promote eco-certified stain removers, which significantly influence consumer buying habits daily.

Manufacturers integrate fairly sophisticated enzyme systems, low-impact technology, and enhanced stain-lifting mechanisms that appeal directly to environmentally conscious consumers. Sophisticated stain detection systems coupled with AI-driven formula tweaks become major distinguishing factors somehow. Eco-efficient products will probably thrust market growth upward fairly rapidly over the next few years. Rising Focus on Fabric Care and Convenience Drives Demand for Fabric Stain Removers.

Now, homeowners are getting very fussy about convenience and are thus adopting super compact, easy-to-use, and versatile stain removers for themselves and their consumers. Unlike traditional methods, these units offer easy application, portability, and compatibility with multiple fabric types, making them attractive for renters and travelers.

Innovations like spray applicators and portable sticks enhance product versatility in multiple ways, catering directly to diverse consumer needs. Compact living trends accelerate market growth rapidly in urban areas as consumers opt for efficient fabric care solutions daily.

E-Commerce and Digital Platforms Revolutionize the Fabric Stain Remover Buying Experience

Digital platforms transform the fabric stain remover market with seamless access via various online tools and expert reviews that are readily available everywhere now. Digital stores provide numerous models at fixed prices with flexible payment plans, making fancy stain removers pretty affordable overall nowadays. Virtual product demos boost online shopping with AR-based fabric previews and AI-driven personalized recommendations.

Social media significantly impacts consumer behavior through highly targeted digital marketing campaigns and effective influencer partnerships, steadily boosting sales online. Doorstep delivery convenience and easy return policies will likely keep fueling e-commerce growth rapidly in fabric stain remover market segments overall.

The global fabric stain remover market saw fairly rapid expansion from 2020 to 2024 at an annual rate of 2.7% during that timeframe. Market expansion was fueled rapidly by increasing demand for convenient fabric care solutions, rising urbanization, and growing adoption of eco-friendly cleaning products. The market value has seen a massive upsurge and is expected to touch USD 11,065.0 million by 2024, driven by consumer interest in sustainable convenience.

While the COVID-19 pandemic initially disrupted supply chains, it also accelerated demand for home-cleaning products as consumers shifted their focus toward enhancing hygiene routines for deeper cleaning. In this, e-commerce platforms played a vital role, providing online demonstrations for product purchases, consumer reviews, and flexible financing options that improved accessibility. The rapidly increasing demand for eco-friendly, highly efficient stain removers has considerably boosted market momentum.

The global fabric stain remover market is projected to show rapid growth at a CAGR of 4.7% from 2025 up to USD 18,461.1 million by 2035. Various factors bring in rapid growth due to tremendous technological developments in the integration of enzymes and increased disposable incomes. Buyers would likely prefer stain removers, which offer a sustainable approach with technological features that ensure real-time stain analysis.

The sustainable trends drive market demands hard; companies are using eco-friendly substances and introducing water-saving innovations. Digital platforms will completely change the faces of markets by enhancing the buying experiences by introducing augmented reality previews and AI-enabled virtual assistants. Current fast-growing compact living trends indicate huge expansion opportunities for the fabric stain removers market.

Tier-1 players dominate the global fabric stain remover market, holding a 35-40% share. These firms capitalize on cutting-edge production methods, strong brand recognition, and sprawling international networks to maintain dominance. They prioritize novelty, offering smart-enabled, eco-efficient stain removers with cutting-edge features like enzyme-driven cleaning cycles and IoT connectivity somehow seamlessly. These brands cater to upscale consumers looking for best-in-class sustainable products. Reckitt Benckiser, The Clorox Company, Procter & Gamble, and Unilever are Tier-1 players.

Tier-2 companies, accounting for 30-35% of the market, mainly provide stain removers for mid-range consumers who seek efficacy and affordability. Such organizations channel their efforts on efficacy, using green formulations and products that suit living conditions in crowded cities. They emphasize the regional expansion of their markets through tie-ups with various retailers and e-commerce platforms. Noteworthy examples of Tier-2 companies include Henkel, S.C. Johnson & Son, Church & Dwight, and Colgate-Palmolive.

Tier-3 players work in the niche to value-for-money segment, holding a market share of 15-20%. They focus on compact, low-cost stain removers designed specifically for tiny urban dwellings and frugal buyers. These brands fiercely compete on price, offering basic models with remarkably simple functionalities amidst decent overall quality levels. Notable Tier-3 players include Folex, OxiClean, Spray ‘n Wash, and various private-label brands on online marketplaces.

| Country | United States |

|---|---|

| Population (millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 5.6 |

| Country | Germany |

|---|---|

| Population (millions) | 84.3 |

| Estimated Per Capita Spending (USD) | 4.75 |

| Country | Japan |

|---|---|

| Population (millions) | 123.2 |

| Estimated Per Capita Spending (USD) | 3.9 |

| Country | France |

|---|---|

| Population (millions) | 68.2 |

| Estimated Per Capita Spending (USD) | 3.6 |

| Country | United Kingdom |

|---|---|

| Population (millions) | 67.4 |

| Estimated Per Capita Spending (USD) | 3.5 |

The USA fabric stain remover market, valued at USD 189.2 million, is driven by the high consumer spending on cleaning products, rising inclination toward eco-friendly and efficient stain removers, and a thriving DIY culture. Compact-sized stain removers with attractive designs often appeal to urban consumers, while app-enabled products with smart features are attractive to premium buyers.

Germany's fabric stain remover market, valued at USD 103.4 million, immensely benefits from strong sustainable practices and eco-conscious habits. Green-minded consumers chiefly drive innovation in low-impact stain removers through their preference for sustainable products. Compact models have gained popularity amid urban living trends and the small living spaces of many apartments.

Japan’s fabric stain remover market, valued at USD 36.5 million, thrives heavily on cutting-edge high-tech innovation alongside super compact cleaning solutions. Many households have small living spaces, so demand remains high for slim-profile stain removers. Japanese consumers favor products with sleek designs and numerous features that seamlessly blend into modern lifestyles quietly.

France’s fabric stain remover market, valued at USD 108.7 million, is shaped by urbanization rising rapidly amidst growing single-person households and a huge preference for smart cleaning solutions. French consumers love ultra-sleek stain removers that are beautifully integrated into modern routines. Market insiders notice surprisingly robust interest in portable stain removers and those that work efficiently on delicate fabrics.

The UK fabric stain remover market, valued at USD 113.3 million, is being largely driven by the increased penetration of eco-friendly products alongside fluctuations in busy lifestyles. Contained within densely populated urban areas residing in tight living spaces, there was a high demand for stain removers that would be efficient and easy to carry around. Consumers strongly prefer high-efficacy products featuring adaptable formulations and sustainable packaging mechanisms to meet their various needs.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

| Canada | 6.5% |

| UK | 5.7% |

| China | 10.2% |

| India | 12.1% |

The USA fabric stain remover market will likely grow at a stupendous rate at 4.8% CAGR from here to the year 2025 and beyond, driven by increasing demand of eco-efficient products. Urbanization fuels demand for tiny homes and fabric stain removers, making small rentals super desirable nowadays.

Consumers prioritize sustainability and effectiveness amidst government efforts promoting green products. Smart tech significantly impacts buying decisions as app-connected, enzyme-enhanced stain removers gain popularity very rapidly online. Strong online retail platforms significantly boost market growth by facilitating consumer comparisons of features and providing easy access nearby.

The fabric stain remover market in the UK is estimated to expand at a fervent growth rate of CAGR 5.7% over the next decade, driven by eco-conscious folks. Manufacturers are introducing low-impact models amid concerns about sustainability and hygiene requirements.

Busy urban lifestyles likewise fuel demand since tenants generally prefer portable products that facilitate easy application somehow. Younger buyers seek convenient solutions with sustainable stain removers, which are rapidly gaining traction in today’s fast-paced lifestyle. Nowadays, e-commerce players offer at-home trials and flexible financing options for buyers through various online platforms.

India’s fabric stain remover market is set to grow at an impressive CAGR of 12.1% from 2025 to 2035, fueled by rapid urbanization, an expanding middle class, and increasing adoption of modern cleaning products. Nuclear families rising alongside disposable incomes drive demand for convenient stain removal solutions that don’t need dedicated space.

Growing awareness of hygiene and eco-friendly gizmos fuels the emergence of fabric stain removers as a preferred alternative in urban hubs. The e-commerce boom has made these products extremely accessible through leading platforms offering enormous discounts under easy EMI options and doorstep services. Global brands eye the Indian market, introducing super compact stain remover models suited perfectly for local fabric care habits daily.

| Segment (Product Type) | CAGR (2025 to 2035) |

|---|---|

| Liquid Stain Removers | 5.3% |

The liquid stain remover segment leads the fabric stain remover market and is projected to grow at a CAGR of 5.3% from 2025 to 2035. This growth is fueled by rising adoption in small households and rental apartments, where convenience is a major priority. The increasing demand for eco-efficient and enzyme-based products further propels this segment’s expansion.

Consumers prefer versatile, easy-to-apply stain removers requiring minimal effort, so liquid models have become a highly sought-after option nowadays. Manufacturers integrate smart features like precision applicators and biodegradable formulas, making stain removers more convenient for modern users.

| Segment (Sales Channel) | CAGR (2025 to 2035) |

|---|---|

| Online Retail | 8.2% |

The online retail segment dominates the sales of fabric stain removers and is expected to grow at a CAGR of 8.2% from 2025 to 2035. The convenience of doorstep delivery facilitates easy to access to guides and wide product choices, thus accelerating online purchases rapidly every day. Consumers rely heavily on customer reviews and flexible payment options, making e-commerce platforms a preferred shopping spot online nowadays.

Manufacturers’ shift towards direct-to-consumer sales substantially fortifies this particular sales pathway, allowing brands to offer bespoke models alongside comprehensive post-purchase support services. Partnerships between leading brands and e-commerce giants significantly enhance visibility and accessibility, promoting robust expansion of online sales.

The global fabric stain remover market is highly competitive, with key players such as Reckitt Benckiser, The Clorox Company, Procter & Gamble, Unilever, and Henkel dominating the industry through innovation, sustainability, and advanced technology integration. Reckitt Benckiser is a leading brand recognized for its effective operation and cutting-edge eco-efficient stain removers, particularly its Vanish technology, which enhances stain removal and fabric care. Procter & Gamble stands out with its smart stain remover features, including enzyme-based cycles and app connectivity, catering to tech-savvy consumers looking for convenience.

Apart from these major brands, emerging players like OxiClean and Spray ‘n Wash are redefining the market with affordable and convenient solutions, targeting small households and urban apartments. OxiClean specializes in versatile, portable stain removers with intuitive applicators and quick action, making them ideal for renters. Spray ‘n Wash, on the other hand, focuses on budget-friendly models with targeted stain removal, enhancing accessibility and effectiveness.

The market is witnessing a strong shift toward eco-efficient and smart-enabled stain removers, with brands investing in AI-powered stain detection, sustainability optimization, and voice assistant compatibility. Sustainability and eco-friendly initiatives also play a crucial role as manufacturers develop low-impact stain removers and introduce biodegradable packaging to align with growing environmental concerns.

Recent Industry Developments

Reckitt Benckiser introduced a new AI-powered fabric stain remover that optimizes enzyme use and energy consumption based on stain type and fabric level. This innovation enhances efficiency and sustainability, catering to the growing demand for smart cleaning products with eco-friendly features.

Procter & Gamble expanded its range of compact stain removers by introducing models with app connectivity and voice assistant integration. These stain removers allow users to control applications remotely via a mobile app, improving convenience for consumers in small apartments and busy homes.

The Clorox Company launched an eco-friendly fabric stain remover featuring a biodegradable formula to eliminate stains and odors, ensuring a more sustainable clean. This development aligns with rising consumer concerns about environmental impact and health-conscious cleaning products.

The global fabric stain remover industry is projected to witness a CAGR of 4.7% between 2025 and 2035.

The global fabric stain remover industry stood at USD 11,065.0 million in 2024.

The global fabric stain remover industry is anticipated to reach USD 18,461.1 million by 2035.

The GCC region is set to record the highest CAGR of 8.9% in the assessment period.

The key players operating in the global fabric stain remover industry include Reckitt Benckiser, The Clorox Company, Procter & Gamble, Unilever, and OxiClean, among others.

In terms of product type, the industry is divided into liquid fabric stain removers and others.

The industry is further divided by sales channels that are online retailers and other sales channels.

Key countries of North America, Latin America, Europe, East Asia, South Asia, Middle East and Africa (MEA), and Oceania have been covered in the report.

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.