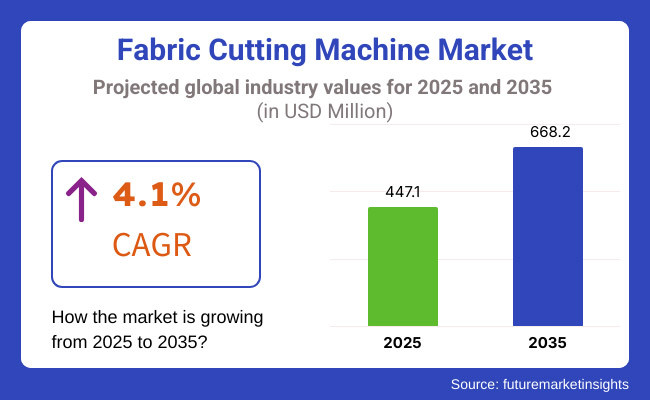

The market for fabric cutting machines is estimated to generate a market size of USD 447.1 million in 2025 and would increase to USD 668.2 million by 2035. It is expected to increase its sales at a CAGR of 4.1% over the forecast period 2025 to 2035. Revenue generated from fabric cutting machines in 2024 was USD 429.5 million.

Textile industry will continue to hold over 43% of the fabric cutting machine market share in 2035.The textile industry is the largest end-user of fabric cutting machines due to increasing demand for clothing, home textiles, and industrial fabrics. Fast fashion and digital textile printing have propelled the demand for accurate and high-speed cutting equipment. Automatic cutting and laser cutting machines have changed the textile sector by facilitating large-scale production with minimal errors and are hence manufacturers' go-to option.

In the fabric type segment, almost half of the market capture by woven fabric. Woven textiles are dominating the market because they are extensively used in apparel, home furnishing, and industrial textiles. Woven fabrics provide excellent durability, strength, and versatility and are thus perfectly suited for fashion as well as functional uses. The need for accurate cutting of woven textiles positions them as a leading user of cutting-edge cutting technologies.

The fabric cutting machines market will expand with lucrative opportunities during the forecast period, as it is estimated to provide an incremental opportunity of USD 238.7 million and will increase 1.6 times the current value by 2035.

Explore FMI!

Book a free demo

The below table presents the expected CAGR for the global fabric cutting machines market over several semi-annual periods spanning from 2024 to 2034.

| Particular | Value CAGR |

|---|---|

| H1 | 3.9% (2024 to 2034) |

| H2 | 4.3% (2024 to 2034) |

| H1 | 3.5% (2025 to 2035) |

| H2 | 4.7% (2025 to 2035) |

In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 3.9%, followed by a slightly higher growth rate of 4.3% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 3.5% in the first half and remain relatively moderate at 4.7% in the second half. In the first half (H1) the market witnessed a decrease of 40 BPS while in the second half (H2), the market witnessed an increase of 40 BPS.

Increasing Need for Automation in Textile Production

The textile industry worldwide is changing fast toward automation, leading to the demand for sophisticated fabric cutting machines. The conventional cutting techniques are giving way to computer-controlled, laser, and CNC fabric cutting machines with greater accuracy, speed, and efficiency. Automation eliminates human errors, waste of fabric, and labor, thus becoming a first choice for mass production in garment, automobile, and home furnishing industries.

With the increasing necessity for fast fashion, manufacturers have been investing in digital cutting systems for fabrics so that they could fulfill high cutting volumes while upholding uniformity in quality. Industry 4.0 tools like AI-supported pattern recognition and IoT-supported cutting systems are optimizing fabric processing as well, as automated fabric cutting becomes a foremost driving force across the world.

Technical Textiles and Nonwoven Fabrics in Growth

The growing needs of technical textile for end-application industries like construction, medical, aerospace, and automotive are compelling the demand for fabric cutting machinery. Medical textiles, protection wear, and industrial textiles need cutting machines of the highest level having special characteristics in order to cut composite and heavier materials that possess high performance levels.

Advanced cutting systems based on laser and ultrasonic are gaining widespread acceptance because the industries have now started expecting precision cutting tools. The nonwoven fabric market, stimulated by uses for hygiene, filtration, and medical textiles, also demands effective cutting technology for volume production. Additional investments to develop technical textiles globally will automatically create demand for automated cutting parameters for production and material efficiency.

Exorbitant Initial Outlay and Ongoing Maintenance Costs

The enormous expenses incurred in acquiring state-of-the-art machines are the main hindrances in the fabric cutting machine sector. Capital expenditures for laser, CNC, and computerized automated fabric cutters are enormous and therefore restrict the small and medium producers from offering these machines into production. Upgrades, maintenance of these machines, and sewing technicians would be additional expenses incurred in operating the system.

Even as automated machines are used to boost productivity and retain long-term expenditure low, there are still large numbers of textile firms, particularly in the third world, whose use of either manual or partially automated fabric cutting is sustained on account of expense. Another challenge advanced fabric cutting machine capitalization poses to small-scale textile operators is overcoming the issue of upfront capital and cost of maintenance.

| Key Investment Area | Why It’s Critical for Future Growth |

|---|---|

| Automation & Computer Cutting Technology | Purchase of automated and computer-based cutting machines (e.g., CNC, laser, ultrasonic) will enhance accuracy, speed, and material wastage minimization. |

| Sustainability & Energy Efficiency | Creating energy-efficient equipment and implementing environmentally friendly cutting methods will decrease environmental footprints and cost. |

| Customization & Multi-Material Capability | Machine enhancement to support a range of fabrics (cotton, polyester, leather, composites) will broaden market opportunities across fashion, automotive, and industrial industries. |

| High-Speed & Precision Cutting | Advances in ultra-precise high-speed cutting technologies will enhance productivity while ensuring top-quality output for mass production. |

| Integration with Smart Manufacturing | The use of AI, IoT, and workflow automation solutions will facilitate predictive maintenance, real-time monitoring, and enhanced operational efficiency. |

The global fabric cutting machines market achieved a CAGR of 3.4% in the historical period of 2020 to 2024. Overall, the fabric cutting machines market performed well since it grew positively and reached USD 429.5 million in 2024 from USD 375.7 million in 2020.

The market for fabric cutting machines had a steady rise between 2020 and 2024 as a result of growing demand for automation in the textile industry, rising usage of precision cutting technology, and growth in digital and laser-based cutting solutions for fabrics.

| Market Aspect | 2020 to 2024 (Past Trends) |

|---|---|

| Material Trends | Predominantly used for cotton, polyester, and synthetic fabrics in fashion and home textiles. |

| Regulatory Environment | Compliance with safety standards for textile machinery and workplace regulations. |

| Consumer Demand | High demand from garment manufacturers, furniture upholstery, and automotive textiles. |

| Technological Advancements | Adoption of laser cutting, CNC cutting, and ultrasonic fabric cutting for improved precision. |

| Sustainability Efforts | Efforts to reduce fabric waste through automated nesting and digital pattern cutting. |

| Market Aspect | 2025 to 2035 (Future Projections) |

|---|---|

| Material Trends | Shift towards cutting eco-friendly fabrics such as recycled polyester, hemp, and bio-based textiles. |

| Regulatory Environment | Stricter regulations on textile waste, promoting energy-efficient and low-emission fabric cutting technologies. |

| Consumer Demand | Increasing need for customized, on-demand cutting solutions for sustainable fashion, smart textiles, and industrial applications. |

| Technological Advancements | Integration of AI-driven automated cutting, IoT-enabled monitoring, and robotic fabric handling to enhance efficiency. |

| Sustainability Efforts | Emergence of zero-waste cutting technologies, waterless cutting systems, and circular economy-based textile manufacturing. |

| Factor | Consumer Priorities (2019 to 2024) & (2025 to 2035) |

|---|---|

| Performance (Durability, Strength, Moisture Resistance) |

|

| Automation & Smart Technologies |

|

| Product Availability & Convenience |

|

| Customization & Adaptability |

|

| Reusability & Circular Economy |

|

| Factor | Manufacturer Priorities (2019 to 2024) & (2025 to 2035) |

|---|---|

| Performance (Durability, Strength, Moisture Resistance) |

|

| Automation & Smart Technologies |

|

| Product Availability & Convenience |

|

| Customization & Adaptability |

|

| Reusability & Circular Economy |

|

During 2025 to 2035, demand for fabric cutting machines is likely to increase with growing applications in apparel, automotive, and technical textiles, rising focus on eco-friendly and waste-minimizing cutting processes, and mounting developments in AI-based and robotic cutting systems for greater efficiency and productivity.

Tier 1 companies comprise market leaders capturing significant market share in global market. These market leaders are characterized by high production capacity and a wide product portfolio. These market leaders are distinguished by their extensive expertise in manufacturing across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base. They provide a wide range of series including recycling and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within tier 1 include Brother Industries, Ltd., Eastman Machine Company, Gerber Technology, Inc., Lectra, Zünd Systemtechnik AG.

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market. These are characterized by a strong presence overseas and strong market knowledge. These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in tier 2 include Calemard, Juki Corporation, Eastman Machine Company, Kuris Spezialmaschinen AG, Aeronaut Automation Pty Ltd., Pathfinder Cutting Technology, Tukatech Inc., OMNI CNC, Dematron Automation.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment. They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

| Region | 2019 to 2024 (Past Trends) |

|---|---|

| North America | Demand driven by increasing preference for mass customization and fast fashion. |

| Latin America | Increasing adoption of semi-automated fabric cutting machines in small-scale industries. |

| Europe | Leading market due to advanced textile industry and high adoption of Industry 4.0 solutions. |

| Middle East & Africa | Emerging market with increasing investments in textile and garment production. |

| Asia Pacific | Fastest-growing market due to rapid expansion of the textile and apparel industry in China, India, and Bangladesh. |

| Region | 2025 to 2035 (Future Projections) |

|---|---|

| North America | Expansion of sustainable and energy-efficient cutting technologies. |

| Latin America | Government support for local textile and garment production to reduce import dependency. |

| Europe | Strong shift toward AI-integrated cutting solutions with minimal material wastage. |

| Middle East & Africa | Growth in demand for high-speed and eco-friendly cutting technologies. |

| Asia Pacific | Large-scale adoption of robotic and AI-assisted fabric cutting machines. |

The section below covers the future forecast for the fabric cutting machines market in terms of countries. Information on key countries in several parts of the globe, including North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe and MEA is provided. USA is expected to account for a CAGR of 3% through 2035. In Europe, Spain is projected to witness a CAGR of 3.7% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 3.0% |

| Germany | 2.6% |

| China | 5.0% |

| UK | 2.5% |

| Spain | 3.7% |

| India | 5.2% |

| Canada | 2.8% |

Evolved till now Sustainably and Smartly fabrics in America are increasing in need for sophisticated fabric cutting machines. The greener the production process gets, textile companies are exploring precision cutting systems for minimizing fabric wastage and energy usage. America is also leading the way for the evolution of smart fabrics like wearables, conductive fabrics, and military fabrics that need a precise laser and ultrasonic cutting machine.

Computerized automated cutting systems are also in demand as American manufacturers move towards Industry 4.0 and IoT-based manufacturing for textiles. As businesses seek out efficient, waste-free, and high-tech cutting of fabrics, the American market for fabric cutting machines continues to expand.

Germany, a center of the automobile and technical textile manufacturing business, is a leading market for fabric cutting devices. The domestic automotive sector in the country is reliant on well-cut textiles as used in vehicle seats, airbags, internal panels, and insulation materials and thus requires enormous demand for computerized laser and CNC fabric cutting machines. Moreover, Germany's medical and industrial textile industries demand specialized cutting systems for protective apparel, filtration media, and advanced composite textiles.

With high quality standards and high emphasis on automation, German producers are investing in high-performance, digital cutting machines for fabrics to improve efficiency, accuracy, and material optimization. The growing use of robotic and AI-based cutting systems further supports the demand for fabric cutting machines in Germany.

The section contains information about the leading segments in the industry. In terms of machine type, automatic machines are being estimated to account for a share of 58.3% by 2025. By cutting method, Laser Cutting are projected to dominate by holding a share above 31% by the end 2025.

| Machine Type | Market Share (2025) |

|---|---|

| Automatic Fabric Cutting Machines | 58.3% |

Automatic Fabric Cutting Machines (50%) The automatic fabric cutting machine is a precise cost-saving tool, and mass production can be achieved with it. Another benefit is that it can be coupled with CAD and CAM systems, thus enabling manufacturers to maximize their usage of fabric and thereby eliminate wastage. Automatic fabric cutting machines are renowned in all the industries where precision and velocity are the concerns; from apparel to cars to airplanes.

Along with the growing penetration of Industry 4.0 technologies and automation, these machines require minimal human intervention, thereby contributed to further boosting demand, as they are less labor-intensive. Automatic cutting machines for textiles provide flexibility to cut all kinds of textiles, such as woven, nonwoven, knitted, etc. Their speed and capacity to cut entirely uniform pieces are assets in settings that have high production volumes.

| Cutting Method | Market Share (2025) |

|---|---|

| Laser Cutting Method | 31% |

Laser cutting is used widely in industries because of its accuracy and speed. The laser cutter is capable of cutting all types of fabrics, including knitted, woven, and non-woven fabrics, making the machines highly versatile. Because of its accuracy, speed, and capacity to handle complex designs, the most appropriate cutting method in the fabric-cutting machines industry today is laser cutting.

Since laser cutting does not involve transferring a mechanical force to the work piece, there are usually fewer wear and-the-cuts occurred consistently because of good quality. Another outstanding benefit is that they provide clean and precise cutting, with minimal material loss, hence reducing fabric wastage.

Automation is a second major strength of laser cutting, which couples well with CAD software to streamline patterns and maximize productivity. The world of high-speed, contactless cutting is now nearly a buzzword for expansion as the industry seeks the next advanced technology for maximum efficiency and ongoing high production levels.

The current market for cutting machines for textiles is growing significantly due to the demand for accuracy and automation in different manufacturing processes. Computer-aided cutting solutions, laser cutting techniques, and AI-pattern recognition are definitely enhancing cut accuracy and output levels in the cutting sectors like apparel, automotive, upholstery, and industrial textiles.

In the market, it is focusing on velocity, material intensity, and minimal labor dependency through the use of AI-enabled pattern matching, automatic depth sensing, and cloud-based production monitoring in an effort to remain competitive. Players in this market are the top textile machinery firms, firms providing automation technology, and research firms that specialize in precision-cutting solutions. More significant improvement was expected to result from higher demand in the sector for customization, smart factories, and green production processes.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Lectra S.A. | 20-25% |

| Gerber Technology | 15-20% |

| Eastman Machine Company | 10-15% |

| Bullmer GmbH | 8-12% |

| Tajima Industries Ltd. | 5-10% |

| Company Name | Key Offerings/Activities |

|---|---|

| Lectra S.A. | Develops automated fabric cutting solutions for apparel, automotive, and furniture industries, integrating AI and IoT. |

| Gerber Technology | Offers precision fabric cutting machines with digital patterning and automated workflows for fashion and technical textiles. |

| Eastman Machine Company | Manufactures CNC and manual fabric cutting machines for industrial applications, including composites and aerospace textiles. |

| Bullmer GmbH | Produces high-speed fabric cutting systems with laser and knife technologies, optimized for textile and leather industries. |

| Tajima Industries Ltd. | Specializes in computerized fabric cutting machines for embroidery, garment manufacturing, and customization. |

Key Company Insights

Lectra S.A. (20-25%)

Lectra is the pioneer in the fabric cutting machine sector with AI-powered automated solutions, serving apparel, automotive, and furniture producers. Its high-end software integration maximizes precision and efficiency to enable manufacturers to obtain maximum utilization of material and minimal waste. Lectra's innovation focus puts it at the top of textile manufacturing digital transformation.

Gerber Technology (15-20%)

Gerber specializes in digital cutting of fabric, offering computerized solutions for fashion, upholstery, and industrial textiles. Its CAD/CAM systems automate production processes, enhancing speed and precision in pattern cutting. With dominant presence in mass production, Gerber's equipment enables companies to become more efficient while delivering high-quality output.

Eastman Machine Company (10-15%)

Eastman specializes in high-accuracy CNC and manual cutting machines that cater to aerospace, composites, and technical textile manufacturing sectors. Its equipment is commonly employed for heavy-duty and complex cutting operations, establishing it as the go-to partner for manufacturers needing durability and precision.

Bullmer GmbH (8-12%)

Bullmer specializes in high-speed fabric cutting with laser and blade technology, optimizing material usage in textile and leather industries. The company’s focus on automation and efficiency has made it a go-to provider for manufacturers looking to scale production without compromising accuracy.

Tajima Industries Ltd. (5-10%)

Tajima excels in computerized fabric cutting and embroidery machines, catering to the customized apparel and garment industry. Its solutions offer seamless integration of cutting and stitching processes, making it easier for businesses to produce intricate and detailed designs at scale.

Other Key Players (30-40% Combined)

Several emerging and independent manufacturers drive innovation in fabric cutting through AI-powered automation, energy-efficient designs, and precision cutting technologies. These include:

The global fabric cutting machines industry is projected to witness CAGR of 4.1% between 2025 and 2035.

The global fabric cutting machines industry stood at 429.5 million in 2024.

Global fabric cutting machines industry is anticipated to reach USD 668.2 million by 2035 end.

East Asia is set to record a CAGR of 5.2% in assessment period.

The key players operating in the global fabric cutting machines industry include Brother Industries, Ltd., Eastman Machine Company, Gerber Technology, Inc., Lectra, Zünd Systemtechnik AG.

The fabric cutting machines market is categorized based on machine type into manual, semi-automatic, and automatic machines.

The market is segmented by cutting method into band knife cutting, straight knife cutting, round knife cutting, die cutting, water jet cutting, laser cutting, and air jet cutting.

The market includes different fabric types such as woven fabric, knitted fabric, and non-woven fabric.

The end-use market consists of aerospace, automotive, textile, luggage, industrial fabrics, medical, leather, and other industries.

Key Countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East & Africa are covered.

Tape Banding Machine Market Overview - Demand & Growth Forecast 2025 to 2035

Takeaway Containers Market Report - Key Trends & Forecast 2025 to 2035

PVC Packing Straps Market Report – Key Trends & Forecast 2025 to 2035

Reusable Packing Market Analysis – Size, Share & Forecast 2025 to 2035

Printed Boxes Market Analysis – Trends, Demand & Forecast 2025 to 2035

Poultry Packaging Market Insights - Trends & Future Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.