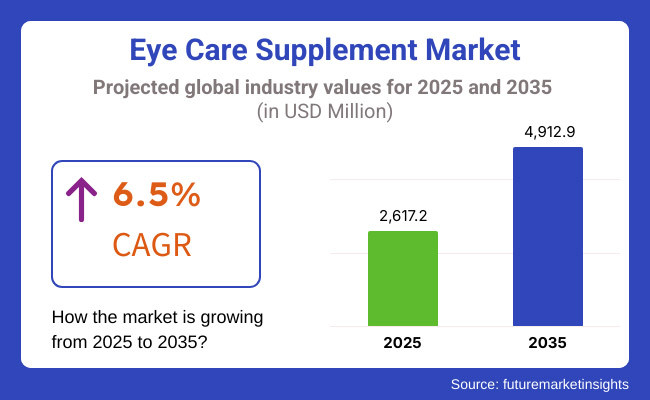

The global eye care supplement industry is expanding as more people prioritize vision health. Valued at USD 2,617.2 million in 2025, it is projected to reach USD 4,912.9 million by 2035, growing at a CAGR of 6.5%.

With increasing screen exposure and aging populations, demand for supplements rich in lutein, zeaxanthin, and other antioxidants is rising. This growth presents opportunities for innovation in eye health and wellness.

Explore FMI!

Book a free demo

| Key Drivers | Key Restraints |

|---|---|

| Rising Screen Time: Increased digital exposure is leading to more eye strain and vision issues. | High Product Cost: Premium supplements can be expensive, limiting accessibility. |

| Aging Population: Growing elderly demographics drive demand for age-related vision support. | Lack of Awareness: Many consumers are unaware of the benefits of eye supplements. |

| Increasing Health Consciousness: More people are proactively investing in eye health. | Regulatory Challenges: Strict guidelines and approvals can slow product launches. |

| Innovation & Research: New formulations with clinically proven ingredients boost market growth. | Availability of Alternatives: Dietary sources and prescription treatments compete with supplements. |

| E-commerce Growth: Online retail expands accessibility and consumer reach. | Skepticism & Misinformation: Doubts over supplement effectiveness may impact sales. |

Impact Assessment of Key Drivers

| Key Drivers | Impact |

|---|---|

| Rising Screen Time | High |

| Aging Population | High |

| Increasing Health Consciousness | Medium |

| Innovation & Research | High |

| E-commerce Growth | Medium |

Impact Assessment of Key Restraints

| Key Restraints | Impact |

|---|---|

| High Product Cost | Medium |

| Lack of Awareness | High |

| Regulatory Challenges | Medium |

| Availability of Alternatives | Medium |

| Skepticism & Misinformation | High |

Retail pharmacies will remain dominant, offering easy access to eye health supplements and expert recommendations. Specialist products or compounded products prescribed by healthcare professionals will be supplied through a hospital pharmacy.

Online pharmacies will continue to grow significantly, providing ease of use, discounts, and subscribing models to a wider audience. Ophthalmic store will always serve specific market for patients who are looking for an expert guidance or quality eye health formulations.

Awareness for eye health will drive the market growth in different indications. The demand for preventive and therapeutic solutions will be fuelled by age-related macular degeneration, especially in aging populations. Expect cataract-related supplements and treatments to be in vogue, as others seek alternatives to surgery.

Dry eye syndrome will also remain an impetus for innovation, and new formulations will provide long-lasting hydration and relief. There will be more emphasis on glaucoma management with nutraceutical innovations to support optic nerve health. Industry growth resulting from the active effort from consumers to take better care of their eye health will include other indications like diabetic retinopathy and general vision enhancement.

As different routes of administration meet different consumer needs, the market will grow. The few ways of orally administration will still be the most widely accepted and most advantageous over time. Targeted relief for user-originated issues, such as eye strain, irritation, and dryness, will lead to topical applications becoming more prominent.

The administration of parenteral route is not as frequent as topical, but will be an essential aspect in clinical settings in life-threatening eye conditions that require immediate intervention.

Over the forecast period, different dosage forms are expected to show their presence constantly in the industry. Tablets will also lead such as their easy storage and a consumer’s choice. Capsules will have their moment as an easy-to-swallow alternative with better bioavailability.

Gels will be preferred because they provide fast relief and targeted application. Consumers seeking faster absorption and enhanced effectiveness will gravitate toward liquid formulations. Gummies will remain the most popular form for eye health supplement drivers, especially among younger consumers and those who prefer a more enjoyable delivery method.

The market for eye care supplements in the USA is expected to grow at a moderate pace owing to high consumer awareness and the aging population. Also, the soaring incidence of digital eye strain resulting from extended daily screen time will continue to drive demand.

With an eye to science, consumers will gravitate toward clinically validated ingredients in product formulations, including lutein, zeaxanthin, and omega-3 fatty acids. Distribution will be predominantly by e-commerce, with subscription models on the rise.

Regulatory review will become more stringent, and the need for high-quality, transparent formulations will drive companies to invest. These trends in preventive healthcare will bring more Americans comprehensive eye care supplements in their daily wellness routines.

This situation will convince more consumers to invest in eye care to avoid problems. An increase in the use of digital devices will boost demand for formulations designed to relieve digital eye strain and dry eye syndrome.

As consumers look for clean-label products, natural and organic supplements will garner growth. Regulatory agencies will focus on product transparency and efficacy leading the companies to conduct clinical studies.

The growth of e-commerce and development of online pharmacies will increase access for consumers to specialized eye health products. This will drive growth for vegan and sustainably sourced supplements too, given Canada’s particular focus on sustainability.

The rising prevalence of age-related macular degeneration and cataracts in the UK will create a demand for eye care supplements. Consumer will focus on high-quality and clinically validated supplement and companies will focus on research backed formulations.

Distribution will be dominated by online retail and pharmacy chains that offer subscription models and personalized recommendations. Consumer preferences will be driven by sustainability with a greater demand for plant-based and ethical products.

More stringent guidelines imposed by regulatory authorities will ensure that the mesh/devices are safe and efficacious. Anticipating the increasing awareness of blue light exposure, especially among professionals and their students, is expected to fuel the demand for supplements formulated to protect the eyes against the effects of digital eye strain.

In France, sales will grow in response to the rising adoption of preventive healthcare practices. And consumers will look towards scientifically backed solutions, and lutein, zeaxanthin, and astaxanthin will be household names.

Products will reflect the growing interest in organic and natural ingredients, and companies will invest in portions which are sustainably harvested. Pharmacy chains will continue to be the mainstay distribution channel, but e-commerce will increase dramatically as they are more convenient and have better access to products.

Government regulations will lead to more transparency and push for clinical validation as well, which will have implications for brand credibility. Increasing screen exposure towards a broader population of professionals and students will continue to drive the demand for blue-light protective supplements.

The German eye care supplements sector will be favored by a health-conscious population and a robust pharmaceutical industry. Consumers will find high-quality, clinically tested formulations a must-use, leading to more innovation driven by bioavailable ingredients.

Strict quality standards will be maintained by regulatory bodies to ensure that products are safe and effective. Sales will also be boosted by online and retail pharmacies, along with a growing reliance among consumers on expert advice.

The growing population will also fuel ongoing demand for supplements for age-related macular degeneration and cataracts. Germany is characterized by environmentally conscious and ethical consumerism, which will likely position sustainable and vegan supplements in a stronger field.

With a digitally exposed and technologically proficient population, South Korea will see the fastest growth in the eye care supplement industry. Consumers are likely to look for supplements specifically designed to target digital eye strain, dryness, and fatigue.

The report also points towards the innovation of functional foods & beauty-nutraceuticals, which in turn will drive eye care products formulated with antioxidants & herbal extracts. E-commerce will also lead to distribution, allowing brands to use social media and online platforms to sell individualized solutions. As such, the need for premium and scientifically validated supplements will grow, prompting firms to partner with research institutions to create tomorrow’s generation of eye health products.

Japan’s growing geriatric population, coupled with its aversion to preventive healthcare, will augment the eye care supplement market in the country. Manufacturers will produce high-quality, clinically backed supplements that contain lutein, astaxanthin, and omega-3 fatty acids, which will be at the demand of consumers.

You will still be seeing traditional ingredients like herbal extracts make their way into modern formulations. Distribution will be led by convenience stores, pharmacies and e-commerce, with online sales becoming increasingly important.

As for older adults, the government will keep pushing proactive eye health, including introducing supplements for macular degeneration and other vision-related ailments. The increasing penetration of functional foods, which focus on infusing eye health benefits into everyday nutrition, will also drive the growth of the market.

The eye care supplements in China will grow rapidly. Consumers will become increasingly health conscious, which will create demand for preventive solutions against digital eye strain, dry eye syndrome, and myopia. International players will also enter to meet growing demand, in addition to expansion of domestic brands. Distribution will consolidate in e-commerce. Alibaba, JD. com are key sales channels. Standards and regulatory compliance will be a focus for the government that will ensure consumer confidence in the safety and efficacy of products.

Driven by growing awareness for vision health and a rising middle-class segment, India’s eye care supplement market will expand rapidly. Digital eye strain will be prevalent, thus increasing the need for supplements that can counter the effects of blue light exposure. Products that are both affordable and effective will be in great demand in the market with brands both local and foreign vying for market share.

The product will be widely available through retail pharmacies and e-commerce platforms as the primary distribution channels. Consumers will lean towards herbal and Ayurvedic formulations in demand for natural replacements. Such factors, in turn, will bolster its market expansion plans, particularly with the government encouraging preventive healthcare.

The eye care supplement industry is consolidated globally, wherein Tier 1 players account for 90% of the total market share. European countries also account for some of the major market players, including the leading pharma and nutraceutical companies, who drive the industry through strong branding, wide-ranging distribution networks, and ongoing product development to meet diverse consumer needs.

Their capital muscle and knowledge of regulatory environment make it difficult for new entrants, resulting in a concentrated market that’s dominated by a few big players.

However, niche opportunities persist for smaller and emerging firms with well-defined targeting, special formulations, or naturally derived ingredients, and region-focused consumers. A rising focus on eye health, growing awareness of the usefulness of personalised user-specific supplements, technological readiness and increasing e-commerce platforms are fueling markets for new entrants.

The eye care supplement landscape has already seen the advent of key manufacturers with new product developments and clever expansion strategies. Some companies, like Bausch + Lomb, launched supplements like Blink NutriTears, which is infused with lutein, zeaxanthin, curcumin and vitamin D, that claim to assist dry eyes and enhance tear production.

HealthyCell also debuted Eye Health MicroGel, a highly bioavailable supplement filled with nutrients, including astaxanthin and lycopene to support vision and retinal health. These brands are harnessing such new research to deliver far better solutions for consumers whose focus on eye health is growing.

Startups are changing the game with specialized products and unique approaches. Wellbeing Nutrition hit the headlines with Melts Eye Care, the world’s first natural eye vitamin that rather than consume through the digestive system applies nanotechnology to allow for better absorption.

Enabling that type of innovation is helping smaller brands stake a claim in a industry that has been historically dominated by big names.” Most of these startups are around natural ingredients and innovative delivery methods, aiming at a growing consumer segment that wants clean-label, scientifically supported supplements.

And that goes beyond only new products; both big companies and startups are also delving into personalized nutrition and digital health tools. A few brands are incorporating telehealth consultations for personalized diets and eye care supplements, while others are working on AI products to automatically monitor and optimize eye health. As individuals take a more active approach towards their well-being, the future of eye care supplements is moving towards more customized, tech-enabled and personalized options that suit personal lifestyles.

Key factors driving demand include increased screen time, aging populations and rising eye health awareness.

These are commonly used (Lutein, zeaxanthin, omega-3 fatty acids, and antioxidants) for vision support.

They can be found in retail and hospital pharmacies, in online retailers and in specialized ophthalmic stores.

Growing awareness and investments in health care led to the fastest growth of East Asia and South Asia.

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Cardiovascular Diagnostics Market Report- Trends & Innovations 2025 to 2035

Venous Ulcer Treatment Market Overview - Growth, Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.