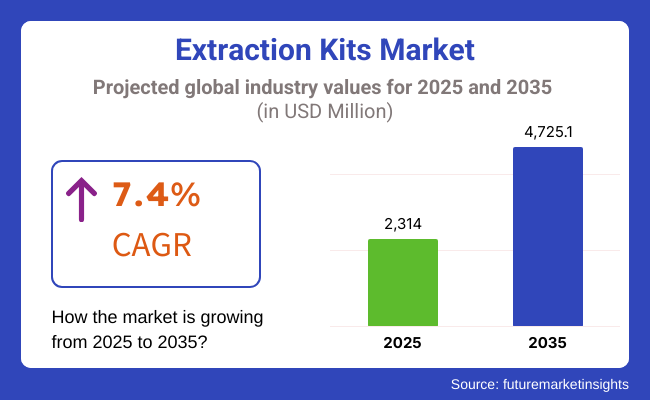

The global market for extraction kits is forecasted to attain USD 2,314.0 million by 2025, expanding at 7.4% CAGR to reach USD 4,725.1 million by 2035. In 2024, the revenue of extraction kits was around USD 2,134.4 million.

The emerging demand within research, clinical diagnostics, and pharmaceuticals drives the fast-growing global extraction kits market. Researchers and clinicians now emphasize efficiency and accuracy with regard to sample preparation, especially as they relate to disease diagnostics, drug discovery, and biotechnology research; hence making extraction kits an essential part in the sample preparation process.

The prevalence of the increasing infectious diseases, along with the need for high-throughput testing, presents a market key growth factor, as laboratories have now invested a significant amount in automated and effective solutions.

Upcoming technologies are presenting new opportunities, despite regulatory issues, expensive advanced kits, and skilled personnel needs as a resounding barrier. Firms are revolutionizing extraction methods through advances in microfluidics and automation, enhancing speed, accuracy, and scalability which remains a key driver of additional market growth and new expansion opportunities.

Global health events and increasing needs for effective sample preparation have considerably re-defined the market for extraction kits. The 2020 pandemic spectacularly accelerated this trend; with sudden spikes in demand for extraction kits in clinical diagnostics for large-volume viral testing. Laboratories and health facilities scrambled to implement new, advanced extraction technology to meet the sudden critical requirement for reliable high-throughput sample preparation.

Even after the pandemic's peak effects, the market trend continues to expand with an increasingly wide range of applications in genomics, proteomics, and drug discovery. Pharmaceutical firms and research institutions continue to include extraction kits in their research, extending beyond infectious disease diagnostics. This is where the development is going from 2021 to 2023-the emphasis on technological advancement in areas of automation, ease of workflow, and high efficiency in clinical and research laboratories.

By 2023, the market is headed towards maturity with a significant rise in high-throughput, ease-of-use systems reducing manual involvement. In spite of the adversity brought by strict regulations and exorbitant prices associated with advanced extraction kits, the market kept on moving smoothly due to ongoing innovation in addition to an emerging demand.

Explore FMI!

Book a free demo

The North American kits market for extraction is expanding gradually as life science firms heavily invest in research, healthcare organizations require individualized medicine, and laboratories utilize sophisticated infrastructure. The USA dominates the region, with large biotech firms and diagnostic labs increasingly using nucleic acid and protein extraction kits for research and clinical use.

The high incidence of chronic illness and infectious outbreaks is compelling laboratories to implement high-performance extraction kits for molecular diagnostics. Moreover, increasing competition among major market players is propelling the creation of cost-efficient and automated extraction technologies that improve efficiency and minimize processing time.

The extraction kits market in Europe is at high pace due to the regulatory bodies that uphold rigorous standards of quality and reliability for diagnosis, forensic sciences, and pharmaceutical applications. The countries of Germany, France, and the UK are swiftly implementing automated extraction technologies in order to ameliorate the workflows in molecular diagnosis. Government-funded project researches Genomics, Proteomics, and Infectious Disease Detection, contributing to market growth.

The demand for extraction kits is being further driven with rising antimicrobial resistance research and continued expansion of biobanking activities. Economic uncertainties and compliance costs are, however, proving to be hindrances to scaling for small biotech firms. Sustainability is a key focus among consumers in Europe; hence, laboratories are looking for eco-friendly reagents and consumables for extraction.

Asia-Pacific can be seen as exhibiting the fastest growth of all markets as biopharmaceutical companies intensify their research, governments invest in diagnostic infrastructure, and the healthcare systems attempt to deal with rising infectious disease cases.

In China, India, and Japan, nucleic acid extraction kits are being rapidly incorporated into genetic testing, cancer research, and molecular diagnostics. With the increase in diagnostic laboratories, government-backed biotech initiatives, and clinical research activity, the markets are growing.

Manufacturers in Asia-Pacific rely on the low-cost production capacity to make the region a key supply of extraction kits globally. High-throughput laboratories are increasingly moving toward automated extraction platforms for greater efficiency, lower errors, and support of large-scale infectious disease testing along with precision medicine applications.

Challenges

Lack of Highly Skilled and Experienced Professional Pose a Challenge to the Market

Many governments want to promote the development of a mainstream biotech industry, to mirror the global model, but progress has been slow. In order to develop the economy and advance, different regions require skilled professionals. Many companies have reported a sizable gap between skilled professionals and the current workforce.

The shortage of experienced individuals has hampered growth of the market in most emerging countries. Improper knowledge flow, low salary scales, challenging roles, and inadequate laboratory training are some of the main factors contributing to the lack of skilled professionals.

Opportunities

Increased Adoption of Next-generation Sequencing (NGS)-based Diagnostics Opens up the Market Opportunity

Increased demand for fast and scalable molecular diagnostic solutions is fuelling innovation in automated extraction kits. Improved microfluidic technologies are allowing miniaturized and portable extraction solutions to extend their applications to decentralized diagnostic platforms.

The growth of liquid biopsy applications, with high-sensitivity extraction of circulating nucleic acids, offers profitable opportunities for industry players. More interconnections among biotech companies, research institutions, and healthcare organizations are driving the creation of next-generation extraction kits with greater sensitivity and specificity.

High-throughput and robotic sample preparation platforms are transforming efficiency in research and diagnostic laboratories. Industry players are aggressively incorporating sophisticated algorithms to maximise extraction procedures, eliminate human error, and improve accuracy in nucleic acid and protein extraction. These advances are simplifying workflows, raising sample throughput, and increasing lab productivity as a whole.

Researchers are propelling the demand for high-purity nucleic acid and protein extraction with precision medicine and single-cell analysis gaining traction. Laboratories now use sophisticated extraction kits that can handle low-input samples with minimal damage, and thus are critical instruments in oncology, rare disease research, and targeted therapy discovery.

Regulatory bodies such as the FDA, EMA, and WHO are implementing tighter regulations to validate the consistency and accuracy of extraction kits employed in clinical diagnostics. Businesses today adhere to strict validation procedures to meet these requirements, ensuring quality assurance and uniformity in diagnostic use. Moreover, new policies promoting local biotech production in different regions are changing market strategies and enhancing regional manufacturing capacity.

Laboratories are turning green, and companies are stepping up to create sustainable kits for extraction with biodegradable reagents and lower plastic content. Companies are placing investment in green chemistry methods to produce non-toxic extraction buffers for safeguarding global sustainability efforts to reduce harmful waste in research labs and clinical settings.

Historically, the market saw significant growth largely driven by advancements in molecular diagnostics technologies, growing research and development activity, and growing infectious disease spreading. Diagnostic laboratories and centers were increasingly using extraction kits to carry out molecular diagnostic tests, specifically infectious disease diagnosis and genetic analysis.

The growth in biopharmaceutical and biotech company research created a need for effective nucleic acid and protein extraction solutions. Researchers were also working on precision medicine and targeted therapies, generating a need for quality extraction kits to facilitate genomic and proteomic studies. Research laboratories are also embracing automation and high-throughput extraction platforms to enhance workflows and efficiencies.

The rising interest in personalized medicine is fueling the demand for extraction kits with particular research and diagnostic uses, hence growing the specificity of genomic research. The emerging markets are also being tapped by players, which means improved healthcare infrastructure and research investments, hence new sources of growth.

Producers are making sustainability their top concern through the creation of green packaging, non-toxic reagents, and environmentally friendly extraction technologies, in the spirit of global environmental campaigns. Altered market scenarios also are prompting producers to invest in technology innovations, regulatory affairs compliance, and strategic collaborations, keeping pace with the fast-growing demand for high-performance extraction kits for research and clinical uses.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with safety and efficacy regulations for clinical and research applications. |

| Technological Advancements | Development of user-friendly kits with improved sensitivity for molecular diagnostics. |

| Consumer Demand | Increased use of extraction kits in infectious disease detection and genetic testing. |

| Market Growth Drivers | Expansion of biotechnology and pharmaceutical research, along with increased demand for molecular diagnostics. |

| Sustainability | Initial adoption of eco-friendly packaging and reduced reagent waste. |

| Supply Chain Dynamics | Growth in e-commerce platforms for lab supply distribution. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter guidelines for automation validation and quality control in high-throughput extraction systems. |

| Technological Advancements | AI-driven automation in extraction processes to optimize workflow efficiency. |

| Consumer Demand | Growing demand for customized extraction solutions for personalized medicine and precision diagnostics. |

| Market Growth Drivers | Expansion into emerging markets and continuous product innovation for next-generation genomic and proteomic applications. |

| Sustainability | Industry-wide implementation of biodegradable materials and non-toxic reagent formulations. |

| Supply Chain Dynamics | Digital supply chain integration for real-time inventory management and direct-to-consumer sales. |

Market Outlook

The USA extraction kits market is developing at a high pace due to an increased use of molecular diagnostics and genomic studies by healthcare professionals and researchers. A high incidence of infectious outbreaks and chronic diseases has increased demand for sample preparation for diagnostics as well as drug discovery.

The well-developed research infrastructure and large investments in biotechnology and life sciences further augment market demand, making the USA a market leader in global extraction kits.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.1% |

Market Outlook

Germany's market for extraction kits expands as its top-notch research equipment and keen interest in precision medicine drive demand. Pharmaceutical and biotechnology firms rely more on precise extraction kits in drug discovery and molecular diagnostics.

Stringent government regulations and nationwide priority on precision and quality back this growth market. Researchers, too, stretch applications to include genomics and proteomics, further consolidating Germany's leading position in the market.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.0% |

Market Outlook

The extraction kits market in China is booming, mainly because of the operational increase in biotechnology and healthcare infrastructure spending by both the private sector and the government. Infectious diseases and chronic diseases are on the rise; hence, these lower-cost diagnostic solutions are under demand.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 13.0% |

Market Outlook

India's market for extraction kits is expanding because healthcare providers and researchers are responding to the increasing infectious disease burden and emphasis on molecular diagnostics. Growing diagnostic laboratories, expanded access to healthcare, and the strong pharma industry are promoting demand for inexpensive and scalable extraction systems. Government efforts to spur research and encourage local production contribute further to the size of the market.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 8.5% |

Market Outlook

The extraction kits market of Brazil is observing gradual growth with the nation attempting to tackle growing instances of contagious illnesses such as Zika and dengue. Involvements made by governments for public health facilities and advancement of biotechnology-based research activities are boosting demands for effective diagnostics devices.

Advances made in health infrastructures as well as heightening awareness concerning molecular diagnostics are compelling adoption even within clinical as well as research realms.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 4.4% |

DNA Extraction Kits Drive Market Growth with Rising Demand for Non-Invasive Diagnostics

There has been a constant boom in the market for cell-free DNA (cfDNA) extraction kits, gradually gaining attention from researchers and clinical professionals that utilize them in liquid biopsy, non-invasive prenatal testing (NIPT), and cancer diagnosis-as these kits provide fragmented DNA recovered from blood plasma, urine, and other body fluids to allow for early disease detection and in-time tracking of tumor growth.

Increased demand for non-invasive diagnostic solutions, advancement in precision medicine adoption, and fast-growing numbers of professional and non-professional standards related to early cancer detection fuel this market demand.

The USA and Europe lead the implementation of cfDNA extraction kits among researchers and medical professionals because of widespread funding of molecular diagnostics, along with liquid-biopsy-based cancer-screening approvals. Yet, the accelerated spread of cfDNA extraction kits to the Asia-Pacific market is because clinical research in personalized medicine has sped up across the region.

Viral RNA Extraction Kits Surge Amid Growing Need for Rapid and Accurate Pathogen Detection

There was a greater need for viral RNA extraction kits globally as laboratories began to react to worldwide pandemics, including COVID-19. Fast and reliable detection of viral RNA became essential elements in the control of any outbreak and carrying out epidemiological surveys.

These kits have since been used in PCR-based pathogen detection; virology research and vaccine production in research and diagnostic laboratories. The growing incidence of viral diseases, the need to have accurate diagnostic equipment, and the rising government programs aimed at enhancing readiness against pandemics are the main drivers stimulating growth in the market.

North America and Europe are the topmost continents that depend on viral RNA extraction kits, courtesy of both extensive infectious disease research programs and a well-developed molecular diagnostics infrastructure. Asia Pacific is, however, quickly closing the gap in that aspect due to increased investments in healthcare and improved pandemic response measures.

Disease Diagnosis Dominates the Extraction Kits Market with Expanding Molecular Diagnostic Applications

As nucleic-acid-based diagnostics are used at large scale for detection of infection, testing of genetic disorder, and diagnosis of chronic disease by clinical laboratories, hospitals, and other diagnostic centers, diagnosis of disease prevails over the extraction kits in the market.

PCR, next-generation sequencing, and microarray-based assays are carried out at large scales by healthcare providers with DNA and RNA extraction kits. Rising incidence of infectious diseases, greater genetic tests on account of increased demand, and ongoing technological progress in molecular diagnostics drive the market.

North America and Europe dominate in this market as the region has widely embraced nucleic acid-based disease diagnosis. In contrast, the Asia-Pacific market is working to significantly enhance the country's healthcare system through the renewal of most infrastructural developments with government support for genetic screening programs.

Cancer Research Fuels Extraction Kits Demand Through Advancements in Precision Oncology and Genomic Studies

Cancer research keeps on fueling demand in the market of extraction kits because nucleic acids are employed for tumor profiling, biomarker identification, and patient-specific therapeutic approaches in oncology. DNA and RNA extraction kits are easily utilized by research centers and laboratories in liquid biopsies processes, circulating tumor DNA (ctDNA) analysis, transcriptomic analyses-from which far greater insights in cancer development and response to treatment can be obtained.

The precision oncology emphasis, enhanced investments in cancer genomics, and expanding next-generation sequencing usage in tumor profiling drive market expansion. The North American market is the leader in cancer research applications backed by heavy investment in molecular oncology R&D while the Asia-Pacific region is experiencing considerable growth due to increased cancer incidence and changing genomic research programs.

The extraction kits market is highly competitive, driven by increasing demand for DNA, RNA, and protein extraction in research, diagnostics, and biopharmaceutical applications. The market is shaped by well-established biotechnology firms, diagnostic companies, and emerging molecular research suppliers, each contributing to the evolving landscape of extraction solutions

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Qiagen | 6.1% |

| Thermo Fisher Scientific | 16.4% |

| Promega Corporation | 3.6% |

| Takara Bio Inc. | 2.4% |

| Bioneer Corporation | 2.3% |

| Other Companies (combined) | 69.2% |

| Company Name | Qiagen |

|---|---|

| Year | 2025 |

| Key Developments/Activities | Market leader offering DNA, RNA, and protein extraction kits for clinical and research applications, including automation-compatible solutions. |

| Company Name | Thermo Fisher Scientific |

|---|---|

| Year | 2024 |

| Key Developments/Activities | Provides a comprehensive portfolio of nucleic acid extraction kits, reagents, and instruments for high-throughput workflows. |

| Company Name | Promega Corporation |

|---|---|

| Year | 2024 |

| Key Developments/Activities | Specializes in high-efficiency DNA and RNA extraction kits, widely used in molecular biology and forensic applications. |

| Company Name | Takara Bio Inc. |

|---|---|

| Year | 2024 |

| Key Developments/Activities | Develops innovative and cost-effective extraction kits, emphasizing purity and ease of use for academic and clinical research. |

| Company Name | Bioneer Corporation |

|---|---|

| Year | 2025 |

| Key Developments/Activities | Offers high-quality extraction solutions with enzymatic processing for superior nucleic acid recovery. |

Key Company Insights

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

The overall market size for extraction kits market was USD 2,314.0 million in 2025.

The Extraction Kits Market is expected to reach USD 4,725.1 million in 2035.

Growing demand for personalized medicine is boosting the use of extraction kits in companion diagnostic assays for targeted therapies.

The top key players that drives the development of extraction kits market are Qiagen, Thermo Fisher Scientific, Promega Corporation, Takara Bio Inc., and Bioneer Corporation

DNA extraction Kits in product type of extraction kits market is expected to command significant share over the assessment period.

DNA extraction Kits, RNA Extraction Kits, Total nueclic acid (RNA +DNA)

Disease Diagnosis, Drug Discovery, Cancer Research, cDNA Library and Others

Hospitals, Academic & Research Institutes, Pharmacuetical & Biotechnology Companies, Clinical Research Organizations, Diagnostic Laboratories, Forensic Labs

North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, Middle East & Africa

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Cardiovascular Diagnostics Market Report- Trends & Innovations 2025 to 2035

Venous Ulcer Treatment Market Overview - Growth, Trends & Forecast 2025 to 2035

Leukocyte Adhesion Deficiency Management Market - Innovations & Treatment Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.