The global explosion proof equipment market grew at a moderate CAGR during the period of 2025 to 2035. It ensures personnel and asset safety while maintaining operational efficiency as the equipment is designed in such a way that there are no sparks and no ignition source in potentially flammable atmospheres - explosion is avoided.

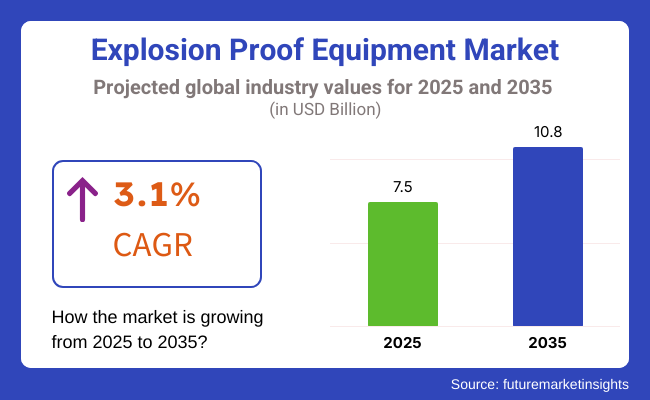

The explosion proof equipment market value in 2025 was around USD 7.5 Billion and estimated to hit USD 10.8 Billion until 2035. This is equivalent to a Compound Annual Growth Rate (CAGR) of 3.1% over the forecast period. With the growing industrialization around the world, the enforcement of strict safety regulations has led manufacturers to develop advanced explosion proof solutions that can ensure compliance with relevant regional and international directives like ATEX and IECEx certifications.

Introduction to explosion proof equipment Technological advancements in explosion proof equipment, such as smart monitoring systems for machinery, wireless communication, and ruggedized enclosures, are expected to boost the demand for explosion proof equipment in diverse industrial applications over the forecast period.

Light weight components like flame proof electric motors, explosion proof lights, flameproof switches and explosion proof sensors are finding wide acceptance in the manufacturing practices that would actually help to make sure if you're using the right components to meet the safety standards and a quality production process. As automation and the IIoT continue to rise, explosion proof equipment is becoming 'smart,' supporting real-time monitoring, and predictive maintenance for dangerous workspaces.

Explore FMI!

Book a free demo

North America remains a leading player in the explosion proof equipment space, with rooted industries, rigorous safety protocols, and constant government regulations fuelling market sales. Explosion proof equipment helps keep the extensive oil & gas, chemical, and mining industries in the United States and Canada running during safe operations.

To further comply with industry regulations, industries in North America are implementing advanced explosion proof technologies, including wireless communication devices and smart monitoring systems. In addition, this region records a strong aftermarket for explosion proof equipment as companies look to upgrade and replace legacy systems with reliable products.

Countries with established energy and chemical industries like Germany, The UK and Netherlands already demand high-quality explosion proof solutions to keep workers safe and meet EU standards.

One such sector is renewable energy projects from biofuel plants to hydrogen production facilities, where the use of explosion proof equipment is growing within the region. The analytics market growth is driven by an increasing demand for well-educated and skilled personnel and the combination of predictive and prescriptive analytics and machine learning capabilities.

Rapid industrialization and blowout in energy and chemical processing sectors in the Asia-Pacific region, coupled with growing awareness toward workplace safety standards in developing economies are the factors driving the growth of the global explosion-proof equipment market in the region.

East and Southeast Asian nations such as China, India, Japan etc. are spending their resources heavily to revise their industrial facilities and this is expected to boost the market demand for explosion proof equipment during the forecast period.

With stricter government regulations emerging throughout the Asia-Pacific region, industries within the region are increasingly relying on certified explosion proof solutions to maintain compliance with regulations and prevent disruptions to operations.

The rising trend for automation and digitalization, particularly in the Middle East and Africa due to its real time monitoring and predictive maintenance capabilities, has further aided the adoption of smart explosion proof equipment and supplemented the market growth.

Challenge

Stringent Safety Regulations and High Equipment Costs

The Explosion Proof Equipment Market is confronted with various difficulties imposed by stringent regulations on safety, along with high initial pioneering costs and constantly evolving standards prevailing within the industry. Industries like oil & gas, mining, chemicals, and manufacturing must have explosion proof equipment to protect against explosion hazards.

Yet meeting different safety standards around the world (from ATEX, IECEx, NFPA standards, etc.) make it harder to develop and get your products certified. Moreover, the high price of explosion-proof enclosures, sensors, and lighting systems deters the implementation of these safety solutions by small businesses.

The answer lies in cost-efficient production and prediction technology, the establishment of modular equipment designs, and the use of advanced materials that enable high durability without a significant impact on cost, as well as the improvement of production equipment performance. Standardizing safety certifications and improving interoperability of products will ease expansion into the market even further.

Opportunity

Increasing Demand for Hazardous Area Automation and Smart Safety Solutions

With the increased industry automation and demand for workplace protection and safety, the opportunities for Explosion Proof Equipment Market are immense. As industries increasingly implement automation in hazardous environments, the demand for an explosion proof control panels, sensors, and wireless monitoring systems rises.

Explosion-proof technologies are being revolutionized with the integration of AI-driven diagnostics, real-time hazard detection, and predictive maintenance. The continued evolution of intrinsically safe IoT devices and explosion-proof robotics increases operational efficiency in volatile environments.

Between 2020 and 2024 the explosion-proof equipment market grew from 2020 to 2024 due to increased industrial safety regulations, expansion in the hazardous operation of industries, and advances in protective enclosure. Mounting workplace safety mandates helped lead to increased demand for explosion-proof lighting, motors and surveillance systems.

But costs were high, certification requirements were cumbersome and supply chain constraints limited the expansion of the market. Driven by increasing demand from various industries, manufacturers concentrated on: rendering optimum material, designing lightweight explosion-proof products, and promoting automation compatibility.

AI-based risk assessment, and sustainable safety solutions by 2035. The fusion of digital twins, sensor fusion technology, and real-time explosion hazard analytics will allow industries to proactively mitigate risks. In the end, there will be a push for sustainable safety innovations with the adoption of explosion-proof renewable energy systems and battery storage solutions.

As autonomous operations expand into hazardous industries, such as oil and gas, teams will regularly use explosion-proof robotic systems, while AI-assisted monitoring will become normative safety measures. Now, those companies that lean towards Industry 4.0 safety protocols, invest in energy-efficient explosion-proof equipment, and build predictive hazard prevention technologies will kick-start the next phase of the evolutionary path for the market.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Strengthening of industrial safety regulations worldwide |

| Technological Advancements | Growth in explosion-proof enclosures and wiring systems |

| Industry Adoption | Increased use in oil & gas, chemicals, and manufacturing |

| Supply Chain and Sourcing | Dependence on specialized explosion-proof materials |

| Market Competition | Dominance of established industrial safety equipment manufacturers |

| Market Growth Drivers | Rising industrial automation and stringent workplace safety mandates |

| Sustainability and Energy Efficiency | Early development of energy-efficient explosion-proof systems |

| Integration of Smart Monitoring | Limited digitalization in explosion-proof equipment |

| Advancements in Explosion-Proof Robotics | Use of conventional protective enclosures and shielding |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of AI-driven safety compliance and automated regulatory monitoring. |

| Technological Advancements | Adoption of AI-based hazard detection, smart safety systems, and autonomous monitoring. |

| Industry Adoption | Expansion into renewable energy, autonomous mining, and space exploration safety. |

| Supply Chain and Sourcing | Localization of production, additive manufacturing for safety components, and sustainable materials adoption. |

| Market Competition | Rise of start-ups developing AI-driven, modular, and cost-effective explosion-proof solutions. |

| Market Growth Drivers | Increased adoption of real-time hazard monitoring, predictive maintenance, and intrinsically safe IoT devices. |

| Sustainability and Energy Efficiency | Full-scale transition to low-power, carbon-neutral safety equipment for hazardous environments. |

| Integration of Smart Monitoring | AI-driven predictive analytics, cloud-based hazard tracking, and automated failure detection. |

| Advancements in Explosion-Proof Robotics | Deployment of explosion-proof robotic systems for hazardous industry operations and maintenance tasks. |

The United States explosion-proof equipment market continues to develop gradually because stringent workplace safety policies, rising investments in oil and gas infrastructure, and increasing needs for explosion-proof lighting and communication devices. The Occupational Safety and Health Administration and National Electrical Code standards necessitate using explosion-proof enclosures and gear in hazardous industries.

The oil and gas sector, especially in eastern Texas, western North Dakota, and along the northern Gulf Coast, represents a major client of explosion-proof electric systems, management panels, and monitoring sensors. Additionally, growing financial commitment in chemical processing, pharmaceutical production, and food preparation plants are boosting demand for certified explosion-proof remedies.

With ongoing industrial safety improvements and rising requirements for hazardous area appliances, experts expect the USA explosion-proof equipment industry to develop progressively but steadily. Long-term projections anticipate that investments in worker protection and processing comforts will underpin needs for quality-controlled anti-spark solutions, helping this specialized market maintain slow and stable development over the upcoming decade.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.4% |

The United Kingdom's surge in intrinsically safe equipment continues due to vigorous ATEX standards, escalating needs for explosion-proof electrical systems, and burgeoning expenditures in automated manufacturing. Strictly, the UK Health and Safety Executive necessitates absolute adherence to hazardous area standards in oil refineries, chemical facilities, and industrial plants to shelter personnel.

The energy sector, including offshore oil and gas platforms situated in tempestuous North Sea waters, substantially utilizes hazardized lighting, motors, sensors and otherrated gear for volatile surroundings. Simultaneously, the proliferating emphasis on eco-friendly energy and hydrogen generation is propelling prerequisites for certified intrinsically safe instruments.

With resolute implementation of regulations and a proliferating demand for clever intrinsically safe remedies, it appears the UK explosion-proof equipment market is on track for steady increases in the ensuing years as industry digitizes and sustainable technology advances.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 2.9% |

The European Union explosion-proof equipment market has expanded steadily due to strict ATEX guidelines, rising investments in industrial safety solutions, and growing needs from petrochemical and pharmaceutical industries. Nations including Germany, France, and Italy have led adoption of contained explosion-proof enclosures, regulated systems, and monitored devices.

The EU's stringent workplace safety regulations as well as robust focus on environmental protection have motivated industries to embrace energy-efficient explosion-proof technologies and Internet of Things-integrated surveillance platforms which provide comprehensive oversight.

In addition, development in electric vehicle battery manufacturing and hydrogen fuel cell research have broadened the area for equipment intended for hazardous conditions.

As continuous funding supports automation and compliance within industry, the explosion-proof equipment market in the European Union is anticipated to develop consistently with promising opportunities emerging in innovative sectors and modernized operations across the region helping to strengthen international competitiveness.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.2% |

Japan's demand for intrinsically safe equipment has remarkably multiplied to fulfill escalating requirements crosswise various indispensable commercial sectors. The nation's exceptionally rigorous workplace safety rules necessitate utilizing electrically protected framework in combustible environments, particularly in chemical factories, nourishment industrial facilities, and pharmaceutical creators.

Core ventures like semiconductors and electronics depend vigorously on uniquely intended intrinsically safe cases for pristine work areas, constituting critical clients. Moreover, Japan's concentration on hydrogen vitality and fuel cells is cultivating interest for explosion-proof gas checking devices and observation frameworks.

As propelled explosion-proof innovations advance and necessities build for top-notch innately secure arrangements, the business appears situated for consistent development. Manufacturing plants will rely intensely upon cutting edge explosion-proof developments to work creation safely as yield spikes. An assorted exhibit of merchandise adjusted for particular mechanical applications ought to help support hearty market development in the coming years.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.0% |

The burgeoning South Korean explosion-proof equipment market has witnessed consistent progress, propelled by amplifying investments towards industrial safety as the expanding petrochemical and semiconductor sectors embrace intelligent hazardous area equipment alongside rising adoption. South Korea's Ministry of Employment and Labor (MOEL) rigorously enforces strict adherence to explosion-proof electrical systems through regulations in chemical plants, mining operations, and gas processing units.

Not only does the nation's blossoming semiconductor manufacturing industry, led by giants Samsung and SK Hynix, embrace explosion-proof enclosures and ventilation systems within cleanrooms but South Korea's investments in verdant hydrogen and next-generation rechargeable batteries also widen demands for gas detection solutions and explosion-proof monitoring systems to comply with safety standards.

Analysts anticipate the steady development of the South Korean explosion-proof equipment market will continue alongside ongoing enhancements in industrial automation and increasing focus on compliance.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.1% |

The explosion containment and explosion prevention/limiting energy segments hold the lion's share in the explosion-proof equipment market since industries are increasingly implementing sophisticated explosion protection technologies for workplace sustainability, compliance with strict hazardous environment regulations, and prevention of catastrophic accidents. Everything from oil & gas, mining, chemical processing, pharmaceuticals, power generation, explosion-proofing technologies are an integral part of the value chain used to reduce ignition risk, protect people and assets and enabling smoother industrial operations.

To control explosion risks, one of the most effective explosion-proof solutions you can find is explosion containment equipment, which is made of high-strength enclosures, reinforced casings, and specifically designed as enclosures to effectively contain internal explosions without external propagation. One of the advantages of explosion containment equipment over conventional safety fences is, no matter the explosion occurs inside the equipment, the pressure forces will destroy the containment equipment structure it never causes damage to the environment around.

The increased adoption of explosion containment solutions in underground mining to prevent an explosion, such as high-durability flameproof enclosures used for electrical equipment, has stimulated high demand in the market over the coming few years, ensuring their greater adoption during hazardous operations carried out in mines.

The emergence of AI-assisted explosion monitoring systems, which offer functionality such as per statement data up to October 2023 of pressure and temperature, and predictive maintenance with automated shut off capabilities, has only driven adoption further with an eye towards preemptive explosion prevention.

The design of composite materials and materials resistant to pressure and explosion-proof reinforced casings has scored on the growth of the market, as it makes the device more similar to the extreme conditions of operation.

Garnering a wider market expansion in industries handling flammable gases and combustible dusts, the development of modular explosion containment units, which feature modularized explosion-proof designs for high-risk industrial environments is likely to further broaden the outlook of the global explosion-proof equipment market.

While effective in protecting against extreme hazards, regulatory compliance, and operational reliability, explosion containment equipment presents stiff competition due to high production costs, lengthy installation process, and additional weight considerations for mobile applications. Nevertheless, innovative solutions like lightweight explosion-proof materials, AI-based risk detection systems with contingency plans, and advanced designs for smart containment systems address these challenges, enhancing cost effectiveness, adaptability, and long-term sustainability, ensuring a healthy explosion containment equipment market.

Explosion prevention equipment has seen robust market penetration, especially in chemical manufacturing, food processing, and power generation, with end users, recognizing the nature of explosion risks, increasingly adopting energy-limiting and ignition control mechanisms that prevent the formation of the explosion before it occurs. Explosion prevention solutions do not rely on containment of the explosion, but instead aim at eliminating one or more of the elements in the explosion triangle-fuel, oxygen, and ignition source-thereby addressing potential hazards before they are able to cause harm.

The increasing popularity of explosion prevention equipment as a critical component in preventing fires, explosions, and other hazardous events in gas handling and storage facilities, along with the demand for equipment with low-energy version ignition systems and intrinsically safe electrical components is pushing the industry towards next-generation explosion-proof designs to facilitate compliance with NFPA and OSHA safety standards. Research shows that the ignition won't be easier than 99% reduction in ignition systems; therefore, intrinsically safe systems provide more facilities in high-risk environments to reduce the risk of explosion.

Emphasizing dust explosion mitigation and specialty coverage, including electrostatic grounding and inert gas blanketing technologies, in pharmaceutical and food processing offerings has also driven increased market demand, extending and ensuring optimum use of explosion prevention solutions in at-risk industries.

Adoption has also been accelerated by the combination of automated explosion suppression systems with real-time gas leak detection and automated shutdown mechanisms, improving safety response times in hazardous conditions.

While energy-limiting circuit designs are being used commonly in the market, especially to provide low-voltage, spark-free electrical control systems for utility and equipment maintenance in hazardous area instrumentation, these designs are expected to optimize market growth by ensuring wider adoption in applications involving the processing of flammable liquids and gases.

The ramp up of explosion-proof LED lighting (with in-built sealed and reinforced lighting enclosure) for production sites classified as hazardous sites adopting explosion protection requirements assists in booming sales, as they bolster operations in explosion-prone industries.

While it does offer benefits in preventative explosion risk to mitigate the overall impact of an explosion, improved energy efficiency, and added operational safety, explosion prevention equipment is currently a substantial, high upfront cost investment that can be time-consuming to integrate into legacy systems. Yet, the range for explosion prevention solutions-high-risk industries- is only going to continue to enlarge with newly emergent innovation that drives effectiveness, adaptability, and cost where smart fire and gas detection, next-gen energy-limiting technologies, and AI powered explosion prevention analytics are concerned.

Two of the significant market drivers are the Class 1 and Class 2 flammable substances classes, as more industries use explosion-proof equipment to manage ignition risks associated with flammable gases, vapours, and dust, providing improved occupational safety and safety compliance.

Flammable combustibles (Class 1), including low molecular weight explosive gases and vapours (e.g., hydrogen, methane, propane, ethylene), are now considered as one of the principal risks in explosion prone industries and are thus detected with the use of explosion-proof electrical enclosures classification, intrinsic safe devices, and gas detectors. Class 1 hazards, due to the volatility of gaseous substances, are far more difficult to render safe than Class 2 hazards, meaning that they require the most specialized level of protection measures.

The growing demand for enhanced safety equipment in oil & gas refineries, including flameproof control panels and intrinsically safe instrumentation capable of handling explosive gas, has encouraged the uptake of next-generation explosion protection technologies, as refineries emphasize operational safety and compliance with environmental regulations. The figures above speak volumes about the significance of explosion-proof systems, which help reduce the chances of a fire or an explosion in a Class 1 environment by over 90% when implemented correctly and efficiently, enhancing workplace safety.

As more and more chemical manufacturers begin to integrate gas-tight enclosures and spark-free electrical systems into their processes, the demand for explosion-proof solutions has also driven down the cost and increased the market available for new technologies in this space further spurring on their acceptance in hazardous process environments.

The widespread adoption of AI-powered gas leak detection sensors (the type that included real time monitoring and auto-alert systems) has also sonically accelerated the transition towards better proactive safety in Class 1 hazardous areas.

Class 1 explosion-proof equipment generally offers advantageous solutions for high-risk gas management, compliance with regulatory standards, and protection against hazardous explosions; however, it entails high capital costs, complex certification processes, and strict installation requirements. But with new systems for smart gas detection, artificial intelligence-based prevention of explosions, and advanced gas-tight sealing technologies, effectiveness, sustainability, and affordability in Class 1 explosion-proof systems are set to drive continued market growth.

This has led to strong adoption of Class 2 flammable substances that are present in industries such as food processing, agriculture, mining and pharmaceuticals, such as combustible dust (coal dust, grain dust, drawer dust, powdered chemicals), as organizations are extensively working to minimize combustions, by implementing explosion-proof dust collection, grounding systems and ventilation solutions. Class 2 environments are different than Class 1 and must be in specially dust-proofed enclosures along with static discharge prevention to minimize the chance of ignition.

The increasing demand for dust collection systems in food and grain manufacturing is spurring manufacturers to integrate advanced explosion hazard mitigation technologies that have high-efficiency dust extraction and electrostatic grounding mechanisms, so as to prevent fires from combustible dust in agro-industries.

The booming of explosion-proof framework manufacturing and mining Crop production enhancing the market demand with spark-proof electrical systems and explosion-sealed stage conveyor intake assured the wider adoption in Class 2 esteemed workstations.

The adoption of AI empowered dust explosion monitoring involving real time particulate detection and automated shutdown controls is additionally driving demand and enabling better safety standards in dust prone manufacturing environments.

The explosion proof equipment market is growing at a rapid pace owing to increase in demand for safety solutions for hazardous area in the oil & gas, mining, chemicals, pharmaceuticals, and industrial manufacturing sectors. Enhanced Safety: Companies are researching and developing AI-enabled monitoring systems, intrinsically safe devices, and energy-efficient.

The global industrial safety equipment manufacturers in the explosion-proof market, specialized explosion-proof solution providers catering to the major industrial regions all across the globe, is expected to integrate technological improvements in the solution offerings such as the flameproof enclosures, explosion-proof lighting and gas detection systems. Explosion-proof enclosures that can help improve regulatory compliance and operational efficiency.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| ABB Ltd. | 15-20% |

| Eaton Corporation Plc | 12-16% |

| Siemens AG | 10-14% |

| Emerson Electric Co. | 8-12% |

| Rockwell Automation, Inc. | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| ABB Ltd. | Develops explosion-proof electrical enclosures, flameproof control systems, and hazardous area automation solutions. |

| Eaton Corporation Plc | Specializes in intrinsically safe devices, explosion-proof lighting, and hazardous location control equipment. |

| Siemens AG | Manufactures intelligent explosion-proof motor starters, AI-integrated process safety systems, and gas monitoring solutions. |

| Emerson Electric Co. | Provides certified explosion-proof instrumentation, industrial automation, and gas detection systems. |

| Rockwell Automation, Inc. | Offers hazardous area-rated PLCs, motor control centers, and intrinsically safe sensors for industrial safety. |

Key Company Insights

ABB Ltd. (15-20%)

It protects process equipment in various industries through its flameproof enclosures, smart motor control solutions, and hazardous area safety systems.

Eaton Corporation Plc (12-16%)

They provide the best solutions of industrial intrinsically safe.

Siemens AG (10-14%)

Siemens for example delivers AI-assisted explosion-proof industrial automation for increased safety and efficiency in explosion-prone facilities

Emerson Electric Co. (8-12%)

Emerson builds high-reliability, hazardous area gas monitoring systems with real-time analytics for explosion prevention.

Rockwell Automation, Inc. (5-9%)

Rockwell Automation develops smart, hazardous location-rated controllers and safety systems that satisfy international explosion-proof agency requirements.

Other Key Players (40-50% Combined)

Next-gen explosion protection technology, AI-driven safety monitoring, and its sustainable hazardous area solutions are provided by industrial safety and automation companies. These include:

The overall market size for Explosion Proof Equipment Market was USD 7.5 Billion In 2025.

The Explosion Proof Equipment Market expected to reach USD 10.8 Billion in 2035.

The demand for explosion-proof equipment will be driven by factors such as stringent safety regulations in hazardous industries, including oil and gas, chemicals, and mining. Increased industrial automation, rising concerns about worker safety, and growing investments in infrastructure in emerging economies will further boost market growth.

The top 5 countries which drives the development of Explosion Proof Equipment Market are USA, UK, Europe Union, Japan and South Korea.

Explosion Containment and Explosion Prevention Equipment Drive Market Growth to command significant share over the assessment period.

Power Generator for Military Market Growth – Trends & Forecast 2025 to 2035

Immersion Heater Market Growth - Trends & Forecast 2025 to 2035

Tire Curing Press Market Growth - Trends & Forecast 2025 to 2035

Turbidimeter Market Growth - Trends & Forecast 2025 to 2035

Marine Cranes Market Growth - Trends & Forecast 2025 to 2035

Industrial Exhaust System Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.