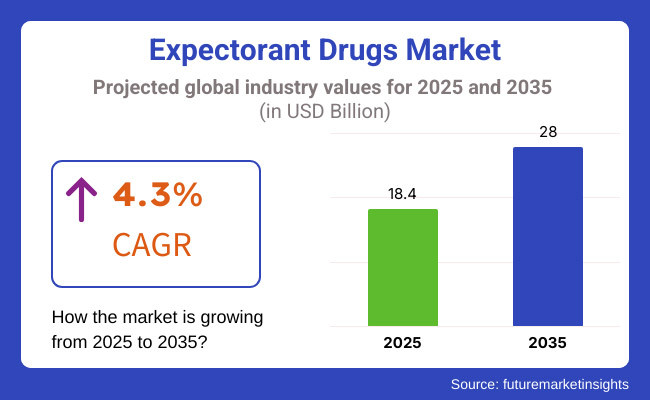

Global expectorant drugs sales are poised to experience significant growth over 2025 to 2035. The industry is valued at USD 18.4 billion in 2025 and is expected to reach USD 28.0 billion by 2035, growing at a CAGR of 4.3%. The leading factor shaping the industrial scenario of expectorant drugs is the rising awareness of respiratory health, especially after COVID-19 pandemic.

Governments across the globe are implementing healthcare initiatives to enhance the respiratory health and channelling favourable opportunities for pharmaceutical companies. Furthermore, the heightened expenditure on healthcare infrastructure has pushed the individuals to invest in medications that help them in improving their respiratory well-being.

Additionally, the rising rate of smoking in many regions is also another factor leading the demand for expectorant medicines, as smokers are at high risk of getting respiratory issues. As a result of these factors, the expectorant drugs industry will facilitate a robust growth, highlighting its importance in the pharmaceutical sector.

Explore FMI!

Book a free demo

The growth landscape of North America is accelerated by the increasing incidence of respiratory disorders, rising geriatric population and a dominant hold of many pharmaceutical businesses. Moreover, the rising awareness of the effects of air pollution and lung-related issues caused by smoking is facilitating the demand for expectorants.

The well-established healthcare system of the region and high accessible treatment options are further shaping the industry expansion. Additionally, increasing collaborations between research organizations and drug firms are spurring the manufacture of new drugs integrated with efficacy profiles and improved safety.

The expectorant drug industry of Europe is already well-flourished due to the rigid regulatory environment giving public safety and drug efficacy a top emphasis. The prominent leaders of European industry include Germany, France, and the UK with a strong presence in prescription-based and combination therapy.

The region’s increasing focus towards reducing the use of antibiotics is further accelerating the demand for expectorant medicines as a preferred choice for treating respiratory diseases. The growth in preventive healthcare programs and patient education initiatives is also expanding consumer demand for initial-stage respiratory therapies.

Due to the heightened urbanization, worsening air quality, and extensive expenditure on healthcare, the Asia-Pacific will remain the fastest expanding region of this industry. Countries including China, India, and Japan are observing increasing cases of respiratory-related diseases, accelerating the demand for both modern and traditional solutions. Furthermore, the rising establishments of retail pharmacy and trend of online drug purchase is also spurring the industrial growth.

Between 2020 and 2024, the expectorant drugs industry experienced a stable growth driven by the growing prevalence of respiratory concerns like chronic obstructive pulmonary disease (COPD), asthma, bronchitis, and flu. Increasing air pollution, rising smoking rate and the post-period of COVID-19 pandemic has further accelerated the demand for mucus-clearing medications. Additionally, continuous developments and improvisations in drug formulations such as extended-release and combination expectorants improved treatment effectiveness.

Progressing to 2025 to 2035, the industry will be shaped with the help of AI-powered drug discovery, personalized respiratory therapies, and green pharmaceutical manufacturing. However, governments will enforce stringent standards on expectorant products, prioritizing ingredient declaration and efficacy. Furthermore, efforts towards sustainability will promote the adoption of biodegradable packaging, green chemistry-based drug synthesis, and enhanced waste management in drug manufacturing.

A Comparative Analysis of Expectorant Drugs Industry (2020 to 2024 vs. 2025 to 2035)

| Category | Industry Evolution (2020 to 2024 vs. 2025 to 2035) |

|---|---|

| Regulatory Landscape |

|

| Technological Advancements |

|

| Consumer Demand |

|

| Sustainability |

|

| Supply Chain Dynamics |

|

| Key Drivers | Key Restraints |

|---|---|

| Rising Prevalence of Respiratory Diseases - Growing prevalence of diseases such as COPD, asthma, bronchitis, and seasonal flu are fueling the demand for expectorants drugs. | Stringent Regulatory Approvals - Guidelines imposed by regulatory authorities such as FDA, EMA can suppress drug approvals and lead to price negotiation delays. |

| Growing Consumer Awareness & OTC Medication Demand - The preference for self-medication and accessibility of over-the-counter expectorants is fuelling the sales. | Potential Side Effects - Few expectorants can come with side effects such as nausea, dizziness, or allergies, which could restrict consumer preference. |

| Advancements in Drug Formulations - Novel combination therapies, extended-release formulations, and artificial intelligence driven drug development activity improve drug efficacy and enable industrial growth. | Competition from Alternative Treatments - Herbal, homeopathic, and traditional medicine options challenge the viability of synthetic expectorants. |

| Rising Pollution Levels - An increase in air pollution and environmental causes leads to respiratory disorders which in turn increase the demand for expectorants. | High Cost of Prescription Drugs - The high price of certain prescription expectorants can hinder affordability and thereby limit accessibility, particularly in regions of the developing world. |

| Expansion of E-Commerce and Online Pharmacies - Digital health platforms and online pharmacies enable easy access to expectorant medications, helping industry penetration. | Supply Chain Disruptions - Reliance upon pivotal raw materials and geopolitical considerations can hamper access, resulting in drug shortages |

Impact Assessment of Key Drivers

| Key Drivers | Impact Level |

|---|---|

| Rising Prevalence of Respiratory Diseases: Increasing cases of COPD, asthma, bronchitis, and seasonal flu drive demand for expectorants. | High |

| Growing Consumer Awareness & OTC Medication Demand: Preference for self-medication and accessibility of expectorants boost industry growth. | High |

| Advancements in Drug Formulations: Combination therapies, extended-release formulations, and AI-powered drug development enhance efficacy. | Medium |

| Rising Pollution Levels: Increasing environmental pollution contributes to respiratory illnesses, creating sustained demand. | High |

| Expansion of E-Commerce and Online Pharmacies: Digital platforms provide easy access to expectorant medications, increasing industrial reach. | Medium |

Impact Assessment of Key Restraints

| Key Restraints | Impact Level |

|---|---|

| Stringent Regulatory Approvals: Strict guidelines from authorities delay new drug approvals and industry entry. | High |

| Potential Side Effects: Issues like nausea, dizziness, or allergic reactions may limit consumer adoption. | Medium |

| Competition from Alternative Treatments: Herbal and traditional medicines pose a challenge to synthetic expectorants. | Medium |

| High Cost of Prescription Drugs: Expensive formulations may reduce accessibility, particularly in developing regions. | High |

| Supply Chain Disruptions: Dependency on raw materials and geopolitical factors can lead to shortages, affecting availability. | Medium |

The expectorant drugs industry of United States is poised for a robust growth and will remain the key leader globally. The major factors driving the growth of this sector include the increasing awareness of over-the-counter (OTC) medications and high rate of respiratory diseases. In 2025, the industry is valued at USD 4.77 billion and is expected to reach USD 9.24 billion by 2035 at an expanding CAGR of 6.8%.

The rising number of people suffering from respiratory diseases like COPD and asthma continues to demand effective expectorant drugs. Food and Drug Administration (FDA) approvals of new expectorant forms are improving options for treatment, with pharmaceutical giants pumping in vast sums of money to develop better and friendlier forms of medicines.

The industrial landscape of expectorant drugs solutions of Germany is all geared up for a rapid growth, backed by the country’s well-developed healthcare infrastructure and a significant increase in aging population. In 2025, the expectorant drug industry is valued at USD 2.91 billion and by 2035 it will reach USD 4.53 billion, growing at a CAGR of 4.5%.

The growing prevalence of respiratory infections, particularly among the elderly, is fueling demand for effective expectorant drugs. Moreover, government programs related to respiratory health and the established presence of major pharmaceutical companies also contribute to the sector’s growth. Germany's established pharmaceutical companies guarantees reliable drug availability and innovation. Furthermore, public campaigns regarding respiratory health promote higher consumer use of expectorants. These factors cumulatively support the consistent growth of Germany's expectorant drugs industry during the forecast period.

India’s expectorant drugs industry is growing at a rapid pace, led by a high prevalence of respiratory disorders, increased expenditure of healthcare, and exposure to respiratory health awareness. In 2025, the Indian expectorant drug sector is valued at USD 3.25 billion, which is anticipated to reach USD 6.55 billion by the end of the forecast period 2035, expanding at a CAGR of 7.2%. India’s high level of pollution in urban areas and the growing smoking rate is giving birth to many respiratory disorders in individuals, eventually boosting the demand for expectorant drugs.

Increased health spending, driven by increasing disposable income, enables consumers to afford more for respiratory treatments. Government-funded healthcare programs driving infrastructure improvement and increased accessibility are other key drivers of market growth. Furthermore, countrywide public health campaigns to educate the populace about respiratory health drive the adoption of expectorant drugs, bolstering the growth during the forecast period.

China’s expectorant drugs industry is flourishing steadily driven by its population, increasing urbanization, and heightened cases of respiratory disorders. In 2025, the market is valued at USD 5.12 billion and by 2035 it is expected to reach USD 11.12 billion, growing at a CAGR of 8.1%.

China’s vast population significantly increases the demand for expectorant drugs. Due to the rapid urbanization, the problem of aggravated air pollution is contributing to the rise in respiratory disorders fuelling the demand for effective treatments.

The incorporation of traditional Chinese medicine combined with modern expectorant formulations attracts a wider consumer base, flourishing the industrial landscape. Further growth is supported by government healthcare reforms, designed to enhance access to medications. Strong domestic pharmaceutical companies also facilitate access to expectorant drugs sector in the region, thus contributing to the growth of expectorant drugs market in the Asia Pacific region in the coming forecast period.

Brazil’s expectorant drugs market is witnessing strong growth, driven by the high prevalence of respiratory illnesses, including chronic bronchitis, asthma, and flu-related conditions. The expectorant drug industry of Brazil is valued at USD 2.34 billion in 2025 and is anticipated to grow to USD 4.19 billion by the end of the forecast period 2035, growing at a CAGR of 6.0%.

Brazil's significant incidence of respiratory illnesses, such as asthma and chronic bronchitis, is a key growth driver for expectorant drugs. Increasing levels of air pollution in urban areas also add to lung-related diseases, which need effective treatments. The growth in retail pharmacy networks and online channels increases consumer availability of expectorant drugs. There is also an increasing demand for herbal-based products, addressing health-conscious consumers who prefer natural products.

In order to facilitate mucus production and make it easier for the respiratory system to discharge it, secretion boosters are essential. Because they can dissolve mucus, potassium iodide, potassium citrate, and sodium citrate are frequently employed in expectorant formulations.

Guaiphenesin's ability to effectively decongest the chest makes it one of the most often used expectorants, especially in over-the-counter medications. Another key component is ammonium chloride, which acts as an expectorant by promoting the secretion of mucus. With ongoing research improving their formulation for better patient response, other secretion promoters continue to support segment’s expansion.

Mucolytics break up thick and viscous mucus so that it can be more easily cleared from the airways. Bromhexine and ambroxol are commonly prescribed for their potent mucolytic activity and efficacy in treating conditions like chronic bronchitis. Acetylcysteine can decrease the viscosity of mucus and is frequently employed in more serious respiratory disorders. Carbocisteine is becoming increasingly popular because it exerts a two-way action by thinning the mucus as well as inhibiting airway inflammation. The growing need for mucolytics, especially in chronic respiratory disease treatment, continues to fuel growth across this segment, with pharmaceutical innovation enhancing drug formulations to improve efficacy.

Expectorant medicines are formulated in different forms to meet the different needs of the patients. Oral solid preparations such as powders, granules, tablets, capsules, and lozenges are still popular because they have a longer shelf life and are convenient for taking. Tablets and capsules are liked for their ease of measurement, whereas lozenges relieve the discomfort of throat-related symptoms.

Liquid oral preparations such as syrups, solutions, suspensions, and elixirs remain the clear leaders in the sector for expectorant drugs. Syrups, specifically, are most popular because of the pleasant taste and effective relief for respiratory congestion.

Suspensions and elixirs provide some other choice for patients who need different forms. Inhalants represent another very important segment of the sector, especially for patients with chronic respiratory conditions needing quicker relief by delivering the drug straight to the lungs. The growing usage of inhalant expectorants indicates the demand for stronger and quicker treatments is increasing.

The industry for expectorant drugs includes over-the-counter (OTC) as well as prescription drugs, catering to various needs of consumers. OTC expectorants are extremely popular because of the convenience of accessibility and availability at low costs, enabling consumers to treat mild respiratory problems without a prescription from a physician.

Guaiphenesin-containing OTC drugs continue to rule this segment because of their widespread reputation for being effective in dissolving mucus. Increased trends in self-medication also enhance demand for OTC expectorants, especially among those experiencing seasonal cold and flu.

Prescription expectorant medications are required for the treatment of more complex respiratory diseases that need professional medical care. Mucolytics like acetylcysteine and bromhexine are frequently prescribed for chronic respiratory diseases such as COPD and cystic fibrosis.

Doctors continue to prescribe expectorants in combination with other respiratory drugs to improve the effectiveness of treatment. Growing awareness about respiratory health and the availability of sophisticated prescription preparations drive the growth of this segment.

Expectorant medications are available through numerous channels to ensure universal access. Hospital pharmacies are still a mainstay of distribution, especially for prescription expectorants utilized in severe respiratory disease. These pharmacies guarantee that patients have professional advice regarding dosage and administration, thus ensuring effectiveness in treatment.

Retail outlets and drugstores still dominate the segment with ready availability of OTC as well as prescription expectorants. The public tends to seek the help of such stores for ready purchase, particularly during epidemic outbreaks. Increasing coverage of retail pharmacies in cities and rural locations is another contributing factor towards the growth of the industry.

Online pharmacies are gaining a notable traction as the increasing number of population prefers digital health solutions. The facility of home delivery, accessibility to vast array of expectorant medications, and budget friendly solutions make the online space appealing.

The industry for expectorant drugs is highly competitive, spurred by rising respiratory diseases, rising pollution, and consumer demand for over-the-counter (OTC) drugs. Businesses are investing in advanced technology formulations, combination therapy, and natural ingredient-based expectorants to maintain their position in the industry and stand out in the competition. The industry is dominated by many renowned established pharmaceutical companies and healthcare brands, each contributing to the evolving dynamics of respiratory health solutions.

The industry specializes in drugs that facilitate mucus clearance, which is a critical component of respiratory healthcare.

Growing respiratory diseases, advances in drug form, and increasing demand for over-the-counter medications drive industry growth.

North America, Europe, and Asia-Pacific lead, with emerging markets such as India and China experiencing high growth.

Breakthroughs are seen with extended-release drugs, combination regimens, and better drug-delivery systems to enhance effectiveness.

The Prurigo Nodularis (PN) Treatment Market is segmented by product, and end user from 2025 to 2035

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.