The world executive education program market is evolving rapidly as working professionals seek constant learning opportunities in order to advance their leadership abilities, adapt themselves to technological transformations, and outshine others amidst dynamic business arenas. Institutions are now integrating digital learning, AI-powered personalized modules, and immersive real-world applications to meet the needs of mid-level and senior executives.

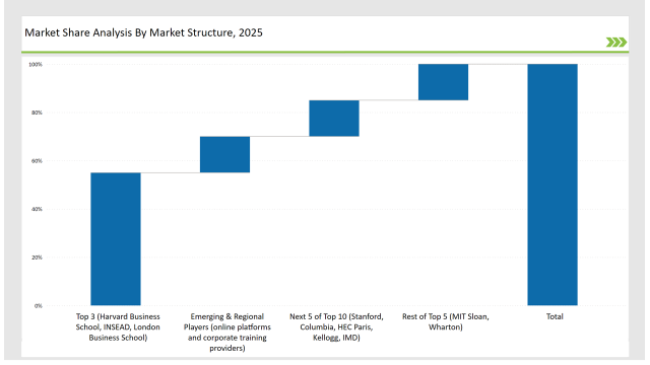

The market is dominated by leading institutions such as Harvard Business School, INSEAD, and London Business School, which have prestigious programs, industry partnerships, and global recognition, collectively holding 55% of the market share. Regional universities and niche executive training providers make up 30%, and emerging digital platforms that provide AI-driven, flexible, and customized learning experiences constitute the remaining 15%.

Explore FMI!

Book a free demo

| Market Segment | Industry Share (%) |

|---|---|

| Top 3 (Harvard Business School, INSEAD, London Business School) | 55% |

| Rest of Top 5 (MIT Sloan, Wharton) | 15% |

| Next 5 of Top 10 (Stanford, Columbia, HEC Paris, Kellogg, IMD) | 15% |

| Emerging & Regional Players (online platforms and corporate training providers) | 15% |

The executive education program market in 2025 is moderately concentrated, with top business schools and corporate training providers holding 40% to 60% of market share. Institutions like Harvard Business School, INSEAD, and Wharton dominate, while online platforms and specialized training providers add competition. The rise of digital learning and corporate upskilling programs fuels market expansion and diversification.

Executive education programs are offered through multiple channels. University-based programs and business schools account for 50% of the market, as professionals seek globally recognized credentials. Online learning platforms contribute 35%, fueled by demand for flexible, self-paced education. Corporate-sponsored programs make up 10%, as companies invest in leadership development for their employees. Direct-to-professional executive coaching and consulting firms represent 5%, targeting high-level executives seeking personalized mentorship.

The executive education market is categorized into leadership programs, financial management courses, digital transformation programs, and industry-specific executive training. The leadership programs command the largest portion at 45% of the market, dealing with strategic decisions and managerial performance. Financial management courses make up 25% of the share, which are concerned with the finance of corporations and investment decisions. Digital transformation programs constitute 20%, readying executives on AI, data analytics, and other technological improvements. Industry-specific executive training stands at 10%, focusing on professionals in health, energy, and technology fields.

The executive education program market has undergone significant changes during 2024, shaped by innovations in digital learning, collaboration with industries, and customized training for executives. Key players in the list include:

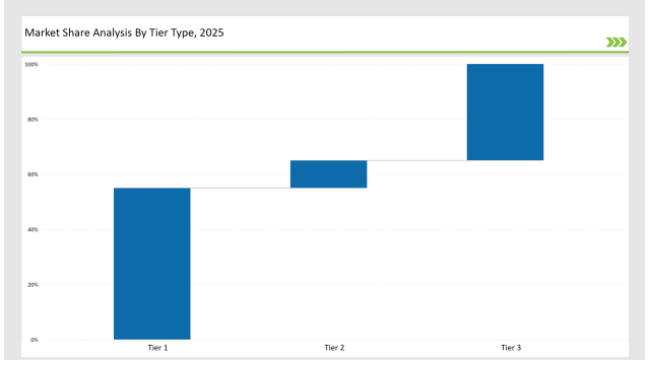

| Tier Type | Tier 1 |

|---|---|

| Example of Key Players | Harvard Business School, INSEAD, London Business School |

| Market share % | 55% |

| Tier Type | Tier 2 |

|---|---|

| Example of Key Players | MIT Sloan, Wharton |

| Market share % | 10% |

| Tier Type | Tier 3 |

|---|---|

| Example of Key Players | Regional business schools, online learning startups |

| Market share % | 35% |

| Institution | Key Focus Areas |

|---|---|

| Harvard Business School | AI-driven executive education & business simulations |

| INSEAD | Blended learning & digital leadership programs |

| London Business School | Executive finance & strategic management courses |

| MIT Sloan | AI, blockchain & data-driven decision-making for executives |

| Wharton | Corporate-sponsored & customized leadership training |

| Emerging Platforms | Flexible, cost-effective, online executive education |

Continuous growth in the market for executive education programs is seen, driven by AI-powered learning experiences, increasing remote education, and corporate investments in leadership development. Institutions will integrate data-driven decision-making, immersive learning technologies, and real-world business challenges into executive courses. Strategic collaborations with Fortune 500 companies, startups, and global business leaders will further shape the market. As the demand for executive upskilling accelerates, the focus will remain on flexibility, customization, and technological innovation to meet evolving professional learning needs.

Harvard Business School, INSEAD, and London Business School collectively hold 55% of the market share.

Online learning, Regional business schools contributes 35% of global sales, offering flexible and cost-effective executive education solutions.

AI-driven executive education and digital transformation programs are among the fastest-growing segments.

Regional business schools focus on affordability, local market relevance, and customized executive leadership programs.

AI-driven learning, hybrid education models, and corporate-sponsored leadership programs are driving market growth.

Eyewear Market Analysis by Product Type, End Use, Sales Channel, Material Type, and Region

Perfume Market Analysis by Product Type, Nature, End-use, Sales Channel, and Region through 2035

BRICS Disposable Hygiene Products Market Analysis by Age Group, Product, Packaging, and Country through 2035

Air Freshener Market Analysis by Product Type, Application Type, Sales Channel, Fragrance Type, and Region from 2025 to 2035

Washing Machine Market Analysis by Various Materials, Thickness Capacity Type Through 2035

Luxury Handbag Market Analysis by Product Type, Material Type, and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.