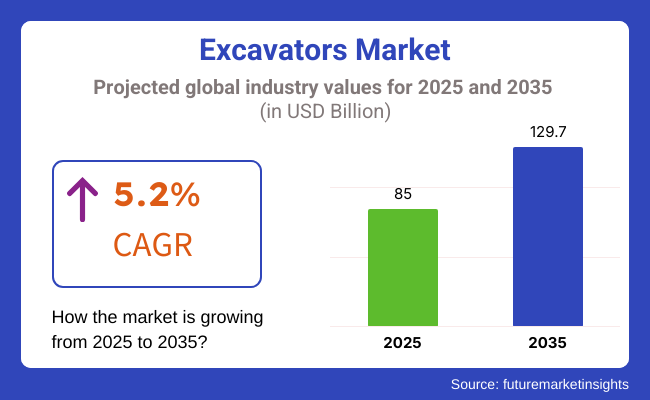

As per the FMI study, global marketing will hit the mark of USD 85 billion by the year 2025. Furthermore, the market will touch the figure of almost USD 129.7 billion in 2035, which represents a compound annual growth rate (CAGR) of 5.2% during the forecasting period.

Steady expansion is mainly attributed to the fact that there is a high demand for advanced machinery, technical improvements, and the launching of numerous infrastructure and construction projects globally. The excavator market is on the rise due to the unbroken cementing infrastructure, the expanding construction, and the need for heavy-duty tools in the agriculture, mining, and urban sectors.

The market grows primarily on the base of constant carriages of excavators to introduce modern technology, the trend of increasing urbanization, and the preference for eco-friendly, fuel-efficient equipment. The poor initialization of burglars' rates is a major factor for concern particularly for small enterprises and freelancers.

Moreover, these machines call for substantial financial input, which might hinder them from being laid in all fields regardless of the long terms of adoption benefits they assure. Over and above that, maintenance and repair costs can become critical, notably where the service stations are far away in remote or rural areas.

Technological barriers dampen the pace too; the combining of features like telematics, GPS, and automation in the excavator can cost a lot. A big number of small or medium setups may not manage adapting these technologies unlike their bigger peers are not due to finances but the unavailability of trained manpower. Despite these inhibitors, the demand for market growth has been effectively gravitational.

A growing concern for sustainability and green construction offers another door to development. Businesses are taking on importance in the race for setting up environmental standards and green building codes by renting out electric and fuel-efficient excavators. The Asia-Pacific and African markets are particularly appealing due to their fast planting of urban areas and construction of infrastructure in the regions, which leads to a high demand for construction equipment.

The rental market move-up also ventures in a big way, as it offers contractors flexibility, minor capital outlay, and the use of the latest excavator models without taking them into ownership. The combined impact of these factors on the excavator market is the happy sales and the rise in demand from end-users.

During 2020 to 2024, the market for excavators grew as cities developed, and automation started to be integrated. Governments started demanding stimulus packages, and manufacturers were attracted towards electric and hybrid models as rules for emission were strict. Caterpillar, Komatsu, and Volvo launched battery-electric excavators to reduce carbon footprints and costs.

Artificial intelligence, telematics, and GPS automation enhanced efficiency and safety, and remote-operated machines were popular. Rental business companies adopted smart excavators for efficient and affordable operations. But COVID-19 disrupted supply and labor, temporarily slowing the growth. Digital procurement and fleet management streamlined operations in 2024, increasing market resilience.

Between 2025 and 2035, the industry will change through automation, AI, and sustainability. Autonomous AI-powered excavators, predictive maintenance, and digital twins will increase productivity. Zero-emission operation will become possible through hydrogen fuel cells and solid-state batteries.

AR-based training will speed up learning by operators, and 3D printing and modular equipment will facilitate higher customization and repair. Renting will be the way of the future, with intelligent platforms making it easy to access equipment instantly. ECO-friendly AI-based equipment will set the construction agenda by 2035.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Emission regulations drive hybrid/electric adoption | Strict zero-emission mandates, hydrogen-powered machinery |

| AI-powered machine control, telematics adoption | Full automation, digital twins, AR-based training |

| Construction, mining, infrastructure projects | Smart urbanization, AI-driven construction sites |

| Remote-controlled, semi-autonomous machines | Fully autonomous fleet management, robotic precision |

| Expansion of electric models, biofuel integration | Circular economy adoption, sustainable material sourcing |

| GPS automation, basic fleet monitoring | AI-driven predictive maintenance, real-time troubleshooting |

| Supply chain disruptions, raw material price fluctuations | Scalable local manufacturing, 3D printing for spare parts |

| Infrastructure expansion, urbanization trends | Digital construction ecosystems, real-time connectivity |

Raw material cost has a significant impact on the excavator market (Steel can take up 40% of an excavator’s total cost). Prices are directly affected by the ups and downs in steel, aluminum and rare-earth metals.

Supply chain disruptions are still a problem. The lead times for engines and electronics, hydraulic components, etc. are being affected by semiconductor shortages, and increasing freight prices. OEMs have begun to prioritize localization strategies, meaning sourcing critical components closer to manufacturing hubs so as not to rely upon global shipping.

Caterpillar and Komatsu, for instance, are expanding regional supply chains in India and Southeast Asia to reduce logistics risks.

The suppliers are also consolidating, with hydraulic systems dominated by Bosch Rexroth, Eaton and Kawasaki and engines dominated by Cummins, Isuzu and Yanmar. Suppliers of track and attachments (Berco and Bridgestone) are entering into long-term contracts with OEMs. Pursuing a route of vertical integration and diversification of the supply base will provide opportunities for cost savings and supply security through new supplier strategic partnerships.

| Aspect | Details |

|---|---|

| Emerging Chinese & Indian OEMs | SANY leads with 15% global excavator market share (2023), surpassing Caterpillar in China. LiuGong, Zoomlion, Tata Hitachi, and Kobelco are expanding exports. |

| Disruption in the Excavator Market | Chinese OEMs offer 20–30% lower-cost excavators than Caterpillar and Komatsu. India's Tata Hitachi and JCB focus on price-sensitive markets with locally produced models. |

| Threat to Premium Brands | Caterpillar's global excavator sales declined 5% in 2023 as Chinese brands gained share. Komatsu faces pressure in Southeast Asia, where SANY and XCMG grew sales by 25%. |

| Global Market Expansion | SANY exported 20,000+ excavators in 2023, targeting Africa, Latin America, and the Middle East. Indian brands benefit from 'Make in India' incentives, reducing import costs and improving price competitiveness. |

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 7.9% |

| UK | 7.5% |

| European Union | 8.2% |

| Japan | 7.8% |

| South Korea | 8.4% |

The USA Market is experiencing steady growth and increasing demand for construction, infrastructure development, and mining operation. With the vision of public infrastructure development offered by the United States government, these machines are working on enormous applications of mega projects such as highway construction, commercial offices, and city development.

One of the strongest drivers of growth in the market is the Infrastructure Investment and Jobs Act, which invests in transportation infrastructure, bridges, and clean energy programs. Electric and hybrid growth is also a growth driver that is reshaping the industry mix as companies invest in low-carbon, low-emission, and energy-efficient technology due to stringent environmental regulations.

Growth Factors in USA

| Key Factors | Details |

|---|---|

| Infrastructure Investment | Government-backed projects for roads, bridges, and public transport. |

| Rising Demand for Autonomous Excavators | Adoption of AI-driven and remotely operated construction equipment. |

| Growth in Renewable Energy Projects | Excavator demand in solar and wind farm |

| Expansion in Mining Sector | Increased excavation for lithium and rare earth minerals. |

United Kingdom Market is increasing since the nation highly values refurbishment of infrastructure, urban development, and green building practices. Housing and transport projects supported by the government are creating demand, especially for smaller and electric models, which are optimal for city usage.

The UK Construction Strategy 2025 is poised to become more productive and lower emissions, and promote electric and hybrid such equipment usage. Furthermore, telematics innovation, remote diagnostics, and partially autonomous controls are making it more efficient, fuel-efficient, and safer on-site.

Industry giants like JCB, Hitachi, and Volvo Construction Equipment are leading the way in this revolution, using machine-learning-based excavation machines and real-time data monitoring to optimize processes.

Growth Factors in UK

| Key Factors | Details |

|---|---|

| Smart City & Urban Redevelopment | Demand for compact and electric excavators in urban areas. |

| Net-Zero Emission Targets | Push for electric and hybrid excavators to reduce environmental impact. |

| Increased Investment in Underground Transport | Growth in tunneling projects for metro and rail expansions. |

| Post-Brexit Construction Boom | New infrastructure spending driving excavator demand. |

The European Union Market is transforming with emission controls, urbanization, and green infrastructure investment. The European Green Deal is forcing manufacturers to offer low-carbon versions of excavators, which are driving demand for hydrogen and electric excavators.

This is succeeded by the Netherlands, France, and Germany as pioneers as stand-alone and AI-powered with machine vision, remote operation, and real-time geofencing to ensure optimal site efficiency and reduced labor cost. Excessive use of railway construction and energy-saving construction is also generating huge demand for high-performance and multi-purpose equipment.

The industry majors such as Hyundai Construction Equipment, Liebherr, and Doosan are investing in battery-electric powertrain, hydraulic efficiency, and modular design for excavators to keep up with the pace of evolving industry demands.

Growth Factors in European Union

| Key Factors | Details |

|---|---|

| EU Green Deal Regulations | Strict emission norms boosting electric and hybrid excavator adoption. |

| Expansion of High-Speed Rail & Road Networks | Large-scale transportation projects increasing demand. |

| Growth in Renewable Energy Infrastructure | Excavators used in wind farm and energy storage developments. |

| Strong Leasing & Rental Market | Increasing preference for renting excavators over direct ownership. |

Japan Market widens with the propulsion of technological developments, construction automation, and government infrastructure development. Highly efficient, compact, and AI-driven exits are in demand with Japan's emphasis on disaster-resilient infrastructure and urban resilience.

Japanese companies like Komatsu, Hitachi Construction Machinery, and Kubota are dominating the market in complete electric and half-autonomous, and lower carbon footprint with improved working productivity. Robotic excavation is also being pushed more with high precision and fewer manpower requirements.

As the urban cities in Japan require powerful and heavy-duty machinery, the firms are manufacturing powerful mini excavators with digital real-time interfaces to deliver utmost productivity in limited space.

Growth Factors in Japan

| Key Factors | Details |

|---|---|

| Earthquake-Resistant Infrastructure | High demand for advanced excavation equipment in seismic zones. |

| Development of Smart Construction Technology | Integration of IoT and AI-driven excavators. |

| Aging Workforce & Automation | Growing shift towards autonomous and remote-controlled excavators. |

| Compact Excavator Demand | Preference for mini-excavators due to dense urban construction. |

The South Korean Market is growing exponentially via smart city urbanization, mega-infrastructure expansion, and use of state-of-the-art construction automation. South Korea's urban renewal and green energy policies from the government are driving demand for next-generation. Ministry of Land, Infrastructure, and Transport (MOLIT) also promotes the use of AI-based construction equipment so that machines can be operated with precision, reduced fuel, and emission. Remote control and autonomous excavation equipment is being utilized to introduce safety and efficiency advantage to construction sites.

Industry pioneers Doosan Infracore, Hyundai Construction Equipment, and Hanwha Engineering are sweeping the market using computerized excavating equipment, ultra-skinny structures, and hydrogen equipment specifically tailored to South Korean urban developments.

Growth Factors in South Korea

| Key Factors | Details |

|---|---|

| High-Tech Excavator Manufacturing | Hyundai Construction Equipment & Doosan leading global exports. |

| Increased Demand for Smart & Autonomous Excavators | AI-powered and electric models gaining traction. |

| Expansion of Renewable Energy & Infrastructure | Government push for solar and wind power projects. |

| Growth in High-Rise & Underground Construction | Demand for advanced excavation equipment in densely populated cities. |

Crawler excavators are by far the most popular segment in the excavator market due to their greater stability, horsepower, and performance capabilities for heavy-duty applications such as construction, mining, and highway projects. Telematics and AI-driven automation systems are also being integrated into next-generation crawler excavators, allowing for heavy machines to be monitored remotely in real time for performance, fuel efficiency and diagnostics, as well.

But the method still faces challenges including high upfront costs, issues regarding transportation, and maintenance needs. These are some of the problems manufacturers are solving by deploying modular undercarriages, hybrid powertrains, machine-learning systems so efficiency and robustness improve.

Due to these reasons, wheeled excavators have become a popular choice for urban and highway construction projects. Crawlers come with the disadvantage of cumbersome movement speed, whereas theirs is an easy tack that allows for quickly relocating from one job site to another, minimizing downtime. Manufacturers including Liebherr, Hitachi and Doosan are enhancing wheeled excavators with advanced control systems, fuel-efficient technologies and higher lift capacities.

Joystick-controlled booms and electric powertrains are raising operator productivity and energy efficiency even higher. Although applications may be limited off-road and stability can be a consideration, improvement in hydraulic systems, the durability of tires, and overall machine performance continues to promote their use in flexible, high-performance construction works.

Industries are on the lookout for the reduction of emissions while favouring environmental sustainability, and shifting towards hybrid and electric excavators is a high priority. Compared to conventional diesel-powered excavators, electric and hybrid excavators consume less fuel, are quieter, and emit nothing.

With the introduction of lithium-ion batteries, regenerative braking systems, and smart energy management technologies, innovators like Volvo CE, Hyundai and Takeuchi have paved the way for hybrid and electric excavators. These industrial machines give comparable performance to traditional models, without the carbon footprint.

Sustainable excavators offering zero emissions and low-nuisance are being bolstered by improvements in energy density, fast-charging capabilities, and advancements in drivetrain configurations, withstanding challenges that include limited operating range, prohibitive battery costs, and a need to develop an appropriate charging infrastructure.

Since they are heavily used for construction purposes and in remote areas without charging capabilities, ICE (internal combustion engine) excavators will remain a dominant segment in the construction equipment market, despite the rising trend toward hybrid and electric models.

The high-performance ICE excavators are known for their stability and durability, high power ratings, and long service times without refueling, making them an essential tool for large-scale projects like mining, complex road building, and infrastructure projects.

On the other hand, equipment giants such as Caterpillar, Komatsu and Hitachi are constantly innovating their ICE excavators by developing advanced fuel-efficient engines, better hydraulics, and smart control systems to improve performance while further reducing fuel consumption and emissions. Automated idle management, telematics integration, and operator enhancement controls are some of the features boosting efficiency and productivity.

Tightening emissions regulations, rising fuel costs and growing environmental concerns present challenges for ICE excavators. Advances in low-emission diesel engines, alternative fuels such as biodiesel, and hybrid-assist internal combustion engine (ICE) systems are working to tackle these difficulties. Although electric and hybrid models are being brought onto the market, ICE excavators should not be expected to fall too much out of favour in the marketplace, particularly in those regions of the world where access to green energy-related infrastructure is limited.

The market is growing at a rapid rate spurred by construction, mining, and infrastructure industries driving demand for advanced digging and earth-moving equipment. Fuel efficiency, automation, and electric machinery are the areas where companies are focusing to reduce carbon footprint and increase operational efficiency.

Urbanization and government expenditure on smart cities are propelling growth in intelligent control systems, telematics, and hybrid technology in products. It is controlled by experienced heavy equipment operators, technology firms, and component makers creating future-generation excavation equipment.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Caterpillar Inc. | 20-25% |

| Komatsu Ltd. | 15-20% |

| Volvo Construction Equipment | 12-16% |

| Hitachi Construction Machinery | 10-14% |

| Liebherr Group | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Caterpillar Inc. | Develops fuel-efficient and electric drives with smart telematics to track in real-time. |

| Komatsu Ltd. | Excels in autonomous and hybrid digging technology for increased productivity. |

| Volvo Construction Equipment | Innovates in electric and hybrid with AI-driven efficiency features. |

| Hitachi Construction Machinery | Provides high-performance hydraulic and electric with accurate control. |

| Liebherr Group | Specialist in big-scale with high-tech load-sensing hydraulic systems. |

Key Company Insights

Caterpillar Inc. (20-25%)

Caterpillar leads the industry with cutting-edge, energy-efficient models that integrate advanced telematics for predictive maintenance and real-time performance tracking.

Komatsu Ltd. (15-20%)

Komatsu pioneer’s hybrid and autonomous excavation technology, optimizing fuel consumption and reducing emissions while enhancing digging precision.

Volvo Construction Equipment (12-16%)

Volvo is at the forefront of electrification, offering a range of electric and hybrid machines designed to improve efficiency while minimizing environmental impact.

Hitachi Construction Machinery (10-14%)

Hitachi delivers high-performance machines with advanced hydraulic and electronic controls that enhance operator efficiency and accuracy on-site.

Liebherr Group (6-10%)

Liebherr focuses on powerful, heavy-duty excavators, integrating state-of-the-art hydraulic systems and load-adaptive technology for superior performance in tough environments.

Other Key Players (30-40% Combined)

Several other companies are contributing to the excavator’s market by introducing AI-powered automation, telematics integration, and alternative fuel technologies.

In terms of vehicle weight, the market is categorized into three segments: diggers weighing less than 10 tons, those ranging from 11 to 45 tons, and those exceeding 46 tons.

The segmentation by engine capacity includes diggers with up to 250 HP, as well as those with an engine capacity ranging from 250 to 500 HP.

Based on type, the market is divided into wheeled excavators and crawler excavators.

The drive type segmentation consists of electric-powered excavators and those driven by internal combustion engines (ICE).

Geographically, the market is analyzed across five key regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The overall market size for the industry is estimated to be USD 85 billion in 2025.

The excavators industry is expected to reach USD 129.7 billion in 2035.

The demand will grow due to increasing infrastructure development, rising demand for construction equipment, and advancements in hydraulic and electric excavators.

The top 5 countries driving the excavators market are the USA, China, Germany, Japan, and India.

Mini and hydraulic excavators are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Vehicle Weight, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Vehicle Weight, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Engine Capacity, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Engine Capacity, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Drive Type, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Drive Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Vehicle Weight, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Vehicle Weight, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Engine Capacity, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Engine Capacity, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Drive Type, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Drive Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Vehicle Weight, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Vehicle Weight, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Engine Capacity, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Engine Capacity, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Drive Type, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Drive Type, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Vehicle Weight, 2018 to 2033

Table 34: Europe Market Volume (Units) Forecast by Vehicle Weight, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Engine Capacity, 2018 to 2033

Table 36: Europe Market Volume (Units) Forecast by Engine Capacity, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Drive Type, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by Drive Type, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Vehicle Weight, 2018 to 2033

Table 44: Asia Pacific Market Volume (Units) Forecast by Vehicle Weight, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Engine Capacity, 2018 to 2033

Table 46: Asia Pacific Market Volume (Units) Forecast by Engine Capacity, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 48: Asia Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Drive Type, 2018 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by Drive Type, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Vehicle Weight, 2018 to 2033

Table 54: MEA Market Volume (Units) Forecast by Vehicle Weight, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Engine Capacity, 2018 to 2033

Table 56: MEA Market Volume (Units) Forecast by Engine Capacity, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 58: MEA Market Volume (Units) Forecast by Type, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Drive Type, 2018 to 2033

Table 60: MEA Market Volume (Units) Forecast by Drive Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Vehicle Weight, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Engine Capacity, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Drive Type, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Vehicle Weight, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Vehicle Weight, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Vehicle Weight, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Vehicle Weight, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Engine Capacity, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Engine Capacity, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Engine Capacity, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Engine Capacity, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Drive Type, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Drive Type, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Drive Type, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Drive Type, 2023 to 2033

Figure 26: Global Market Attractiveness by Vehicle Weight, 2023 to 2033

Figure 27: Global Market Attractiveness by Engine Capacity, 2023 to 2033

Figure 28: Global Market Attractiveness by Type, 2023 to 2033

Figure 29: Global Market Attractiveness by Drive Type, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Vehicle Weight, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Engine Capacity, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Drive Type, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Vehicle Weight, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Vehicle Weight, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Vehicle Weight, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Vehicle Weight, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Engine Capacity, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Engine Capacity, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Engine Capacity, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Engine Capacity, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Drive Type, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Drive Type, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Drive Type, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Drive Type, 2023 to 2033

Figure 56: North America Market Attractiveness by Vehicle Weight, 2023 to 2033

Figure 57: North America Market Attractiveness by Engine Capacity, 2023 to 2033

Figure 58: North America Market Attractiveness by Type, 2023 to 2033

Figure 59: North America Market Attractiveness by Drive Type, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Vehicle Weight, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Engine Capacity, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Drive Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Vehicle Weight, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Vehicle Weight, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Vehicle Weight, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Weight, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Engine Capacity, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Engine Capacity, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Engine Capacity, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Engine Capacity, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Drive Type, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Drive Type, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Drive Type, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Drive Type, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Vehicle Weight, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Engine Capacity, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Drive Type, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Vehicle Weight, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Engine Capacity, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Drive Type, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Vehicle Weight, 2018 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Vehicle Weight, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Vehicle Weight, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Vehicle Weight, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Engine Capacity, 2018 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Engine Capacity, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Engine Capacity, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Engine Capacity, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 109: Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Drive Type, 2018 to 2033

Figure 113: Europe Market Volume (Units) Analysis by Drive Type, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Drive Type, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Drive Type, 2023 to 2033

Figure 116: Europe Market Attractiveness by Vehicle Weight, 2023 to 2033

Figure 117: Europe Market Attractiveness by Engine Capacity, 2023 to 2033

Figure 118: Europe Market Attractiveness by Type, 2023 to 2033

Figure 119: Europe Market Attractiveness by Drive Type, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Vehicle Weight, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Engine Capacity, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by Drive Type, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Vehicle Weight, 2018 to 2033

Figure 131: Asia Pacific Market Volume (Units) Analysis by Vehicle Weight, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Vehicle Weight, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Vehicle Weight, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Engine Capacity, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Units) Analysis by Engine Capacity, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Engine Capacity, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Engine Capacity, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Drive Type, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Units) Analysis by Drive Type, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Drive Type, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Drive Type, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Vehicle Weight, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Engine Capacity, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Type, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Drive Type, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Vehicle Weight, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Engine Capacity, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by Drive Type, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Vehicle Weight, 2018 to 2033

Figure 161: MEA Market Volume (Units) Analysis by Vehicle Weight, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Vehicle Weight, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Vehicle Weight, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Engine Capacity, 2018 to 2033

Figure 165: MEA Market Volume (Units) Analysis by Engine Capacity, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Engine Capacity, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Engine Capacity, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 169: MEA Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by Drive Type, 2018 to 2033

Figure 173: MEA Market Volume (Units) Analysis by Drive Type, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by Drive Type, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Drive Type, 2023 to 2033

Figure 176: MEA Market Attractiveness by Vehicle Weight, 2023 to 2033

Figure 177: MEA Market Attractiveness by Engine Capacity, 2023 to 2033

Figure 178: MEA Market Attractiveness by Type, 2023 to 2033

Figure 179: MEA Market Attractiveness by Drive Type, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA