The global event management software market is set to reach USD 82.3 billion, a significant increase from the 2025 valuation of USD 17 billion. The CAGR is estimated to be around 17.1%. As more and more organizations adopt digital solutions for event planning and staging, the demand for sophisticated event management software continues to grow at a remarkable speed.

Event management software is a computer program used to simplify event planning, organization and staging. These solutions come in cloud and on-premise software formats that allow for core capabilities like registration/ticketing, venue management, marketing automation and attendee interaction.

These tools are used by businesses, governments and non-profits in order to make logistics more efficient, do real-time monitoring of the event, and raise their ROI. As more and more people turn their attention to hybrid and virtual events, Event Management platforms are incorporating artificial intelligence (AI), data analytics, and automation to give better service. As digitalization shapes the future of events, software companies are always coming up to meet new customer demands with scalable, ready-to-use solutions.

It develops in a number of factors that are driving upward the Event management software industry. The rapid rise of frictionless event experiences, automation (or 'real-time marketing'), and data-driven decision-making have forced many organizations into investing in AI-driven event management tools. Companies rely on cloud-based platforms for seamless cooperation, remote access and real-time data tracking.

Furthermore, the surge in hybrid and virtual events has also boosted demand for solutions that can do everything from live broadcasting to audience engagement, remote networking and more. Analytics-based insights are becoming a priority for companies. These insights are used to measure the level of attendee engagement, optimize events, and improve marketing results. The rise of digital payment networks and block chain ticketing helps also to protect security and operational efficiency in business areas.

While growing rapidly, the event management software industry faces problems such as cybersecurity threats, data privacy and demanding implementation costs Enterprises dealing with large-scale events must comply with stringent data protection regulations in order to keep the information of attendees secure.

Integrating event management software with existing enterprise systems can present a technical challenge for some businesses. Competition among the providers of software is fierce, so they must continue to innovate and differentiate their products if they want to hang on to customers.

New trends and technological advances may give the industry a welcome boost. AI-powered chat bots and virtual agents enhance the interaction between attendees, delivering automatic service information in response to customer requests with targeted recommendations.

Event planners can use predictive analytics to view historical data traces for clues about how prospective audience members will behave this year. Block chain technology makes event ticketing more secure, reduces fraud and brings transparency to the event. As businesses come to regard digital solutions for events as essential, the event management software market will take shape with new technologies that improve efficiency and change worldwide events at every level.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 17 billion |

| Industry Size (2035E) | USD 82.3 billion |

| CAGR (2025 to 2035) | 17.1% |

Explore FMI!

Book a free demo

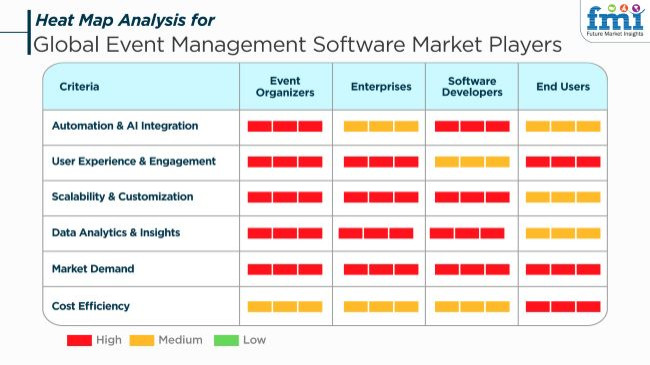

The rapid expansion of the industry is mainly due to the digitalization of events, hybrid event formats, and the data-driven insights need of the companies. Event organizers value automation by featuring AI, easy registration systems, and real-time engagement tools at the top of their priority list to provide a comfortable and enjoyable attendee experience. The features of event ROI measurement, lead generation, and easy integrability with CRM tools bound them.

The software vendors are leading the way to develop cloud-based, AI, and mobile-focused solutions for event management appropriate to virtual as well as live events. End users' demands include the simplicity of use, individualization of the event, and networking without problems. Criteria for the main buyers' decision include the ability to scale operations, access on multiple devices, AI analytical features, integration options, and affordability. The increase of automation and engagement tools in corporate conferences, expos, and virtual summits makes the event management software industry expand extensively in the near future.

Event Management Software Market Contract Analysis:

| Company | Development Details |

|---|---|

| Cvent | Launched an AI-powered event planning tool to enhance attendee engagement and streamline event management processes. |

| Eventbrite | Partnered with a major virtual reality platform to offer immersive event experiences, expanding their digital event offerings. |

| Bizzabo | Acquired a leading event marketing firm to integrate advanced marketing automation features into their platform. |

In 2024, the industry witnessed significant advancements, with companies like Cvent introducing AI-driven tools to enhance event planning and attendee engagement. Eventbrite expanded its digital footprint by partnering with virtual reality platforms, offering immersive event experiences. Bizzabo's acquisition of an event marketing firm underscores the trend of integrating marketing automation to provide comprehensive event solutions.

Between 2020 and 2024, the industry enjoyed steady growth as businesses, organizations, and event planners turned to the digitally-paved route of their tool to structure event planning, registration, and engagement. Cloud-based platforms with AI-assisted attendee analytics, automated scheduling, and real-time audience interaction have seen acceptance at a much faster rate following the emergence of the pandemic, and the establishment of virtual and hybrid events. Significant integration with CRM- and marketing-automation solutions created a fertile ground for deeper personalization and data-driven decisions around events. But apprehension regarding cybersecurity, integrations' complexities, and lack of being able to replicate the in-person networking experience discouraged a seamless adoption from legacy to newer solutions.

From 2025 to 2035, the event management software space will transform with immersive technologies, AI event matching, and blockchain ticketing solutions. Virtual reality and augmented reality will imaginatively design interactive and immersive digital event spaces for virtual participants and networking through real interaction. AI-driven automation will provide participant engagement through sentiment analysis in real-time and dynamic content distribution. With sustainability on the agenda, event planners will adopt carbon footprint-tracking tools and digital twin simulation to minimize the environmental impact of their events while ensuring flawless delivery.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Data privacy regulations shaped attendee data collection and accessibility compliance. | AI-driven compliance tools ensure cybersecurity and regulatory adherence for virtual and hybrid events. |

| Virtual and hybrid event platforms grew post-pandemic, improving engagement through AI matchmaking. | AR and metaverse events enhance attendee interaction with AI-driven personalization. |

| Cloud-based event management software gained traction for scalability and accessibility. | Blockchain-powered event platforms ensure security and transparency. |

| Enterprises prioritized hybrid events for broader reach, with automation and customization as key differentiators. | AI-driven event planning simplifies logistics and enhances personalized experiences. |

| Digital event solutions reduced paper use and carbon footprints. | AI-optimized carbon-neutral event planning minimizes environmental impact. |

| Rising cyber threats led to secure registration and payment systems. | AI-driven encryption and quantum-safe security protect global event data. |

| Hybrid event strategies addressed cancellations and technical failures. | AI-powered predictive analysis reduces event risks, with autonomous backup systems ensuring seamless execution. |

| Digital events, remote participation, and AI engagement tools became essential. | Metaverse-driven immersive events and AI-powered networking reshape attendee experiences. |

The industry is prone to several risks such as data security, technological obstacles, industry competition, and economic downturns.

Regulatory compliance is not uniform globally; that is, it has an impact on how event software providers find it necessary to collect, store, and process the customer's information. The companies are obliged to comply with privacy, accessibility, financial regulatory laws so that they avert penalties.

Disruptive technologies such as AI, VR, and blockchain have been moving the industry in a different direction. Companies that do not adopt automation, AI-based data insights, and hybrid event formats are flirting with extinction. Deploying cloud-based, scalable, and AI-enabled event technology guarantees a competitive edge in the long haul.

Industry competition is very fierce as a result of the presence of firms such as Cvent, Eventbrite, and Bizzabo which command the bandwagon. The primary way to gain additional industry share is differentiation through personalization, user experience, and demand-driven solutions.

The impact of economic downturns on the corporate sector can sometimes be seen in the events' budgets. During periods of financial hardships, flexible pricing strategies, cost-effective solutions, and freemium models are the tools to sustain the demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 16.2% |

| Germany | 15.4% |

| UK | 16.7% |

| China | 17.6% |

| India | 18.3% |

The USA has a tight hold on the industry due to its well-developed digital infrastructure and corporate event culture. Large corporations, SMEs, and non-profit organizations gladly spend money on event technology to automate planning, attendance, and insights. Organizations are increasingly embracing AI-powered automation, hybrid event solutions, and real-time data insights to streamline operations and engage the audience more effectively. Industry growth is fueled by the dominance of large software vendors and ongoing technological advancements.

The integration of event management software with CRM and marketing automation tools makes efficiency even greater. Virtual and hybrid events continue to grow, causing the industry to transform by offering scalable solutions to different business needs. FMI is of the opinion that the American industry is going to experience a 16.2% CAGR throughout the research.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| High Digital Connectivity | Enables efficient event management through cloud platforms and AI technology for the American economy. |

| Strong Corporate Event Culture | Large businesses, SMEs, and charities spend on event technology for more participant interaction, easier planning, and greater maximum analysis. |

| Increased Demand for Virtual and Hybrid Events | Early integration into event software enables companies to achieve the greatest audience reach, integrating real-time data with automated processes for delivering improved experiences. |

| Availability of Key Industry Players | The USA has key event management software players that offer innovation through the development of new products and strategic acquisition of companies. |

| Increased Use of AI and Automation | Artificial intelligence-based solutions maximize efficiency, delivering personalized experiences and minimizing event processes. |

China's event management software industry continues to expand with digitalization, transforming the way business is done. Companies increasingly adopt complex platforms to stage spectacular conferences, business summits, and exhibitions. Mobile-enabled solutions, artificial intelligence-powered automation, and real-time analytics radically boost event planning productivity.

Organizations use virtual and hybrid event formats to bridge global bases, maximizing reach and interaction. Government programs for smart cities and the digital economy enable local and international suppliers with AI-driven, scalable solutions to gain momentum. Economic development and technological advancement continue to drive China forward. FMI is of the opinion that China's industry will grow at 17.6% CAGR during the forecast period.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Rapid Digitalization | China’s industry expands as businesses embrace technology for large events, corporate events, and exhibitions. |

| Government-Sponsored Initiatives | Smart city initiatives and digital economy initiatives enhance the use of software. |

| Increased Mobile Penetration | Mobile event solutions continue to be popular, with functional features and real-time interaction. |

| AI-Powered Event Automation | Companies utilize AI-powered solutions to automate event processes and maximize audience interactions. |

| Competitive Market Environment | Local and international vendors introduce scalable, customized, and AI-powered solutions. |

India's industry is growing rapidly with increasing digital adoption across industries. Mobile phone and cloud technology penetration stimulates the need for economical and scalable solutions. Organizers prefer virtual and hybrid model events to make them easy to organize and accessible for a large group of targets.

Digital development initiatives by the public sector and startup ecosystems create opportunities for wider utilization of software. AI-powered automation, network usefulness, and inspection are propulsive forces to ease event planning operations and their organization. The affordability of software products because of the cost-effectiveness of solutions makes event management technology reachable to mid-size organizations. Thus, India stands as the leading emerging industry for the industry. FMI has confidence that the Indian industry will register an 18.3% CAGR through the forecast period.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Growing SME Segment | Mid-sized and small business organizations embrace budget-friendly event software platforms. |

| Boosted Digital Uptake | Increased use of cloud and mobile-friendly platforms supports business growth. |

| Virtual and Hybrid Events Growth | Organizations depend on hybrid models to encourage more flexibility and participation. |

| Government Incentives for Digitalization | The use of software grows through digitalization and startup business development strategies. |

| More AI Adoption in Event Organization | AI-powered automation, network software, and analytics enhance events. |

Germany’s industry expands as businesses use technology to organize events. Corporate event culture dominates in the nation, guaranteeing that demand for AI-driven platforms, cloud-driven platforms, and data analytics will be in place. Virtual and hybrid model events get traction as companies look for efficient means to optimize audience interaction.

Companies choose secure and compliant software options that support EU data protection standards. Increased consciousness of conferences, trade shows, and corporate forums further fuels the expansion of the industry.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| Strong Corporate Event Market | Germany’s corporate landscape fosters the necessity for effective event management solutions. |

| Technological Innovation | Sophisticated analysis, AI-powered automation, and seamless integrations make event planning more effective. |

| Hybrid and Virtual Event Adoption | Organizations leverage technology to ensure maximum event reach and engagement. |

| Data Security and Compliance Focus | Organizations focus on secure event management solutions against EU regulations. |

| Emerging MICE Industry | Conferences, exhibitions, and corporate events are fueling greater software needs. |

The UK industry is experiencing constant growth, and firms are adopting digital media to spearhead event planning and staging. Firms focus on hybrid and virtual event platforms to increase coverage and engagement among the audience. AI-based analytics and automation requirements also increase, ensuring maximum efficiency across different roles of event management.

Firms require cloud-based scalable solutions to address other events. Marketing and CRM integration with unified software enhances maximum decision-making capabilities, enhancing vertical take-up even further.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Maturing Business Climate | The UK boasts a matured event management sector, leading to steady software demand. |

| Hybrid and Virtual Event Focus | Quests leverage computer technology to enrich event experiences. |

| High AI and Data Analytics Penetration | Artificial intelligence-driven tools simplify planning, participant interaction, and event production. |

| Increasing Demand for Scalable Solutions | Companies require scalable, cloud-based platforms to host diverse event types. |

| Seamless Integration with Marketing and CRM Tools | Easy software integration improves efficiency and data-driven decision-making. |

| Enterprise Size | Share (2025) |

|---|---|

| Large Enterprises | 61.3% |

The industry segments are SMEs (small and medium enterprises) and large enterprises, both of which contributeto growth.

Small& medium enterprises (SMEs)

SMEs are adopting on-demand SaaS advancements. Cloud-based alternatives such as Eventbrite, Whova, and Hopin present low-cost event registration, ticketing, and marketing solutions that save this event spend by 30%.Cvent Event data: The worldwide growth of virtual andhybrid events powered by digital transformation continues to gain momentum. The cost of these technologies and the lack ofvirtual IT skill sets in-house limit wider adoption.

Large Enterprises

As this isthe biggest driver of the majority of EMS revenue anyway, the big players are not REM driving but rather TRANSFORMING with AI-laden insights, live audience interaction, enterprise-level integrations, and whatnot. More than 65% of Fortune 500 companies rely on Cvent, Bizzabo,and RainFocus, among similar services, to run corporate events like conferences around the globe (Grand View Research, 2024).

Advanced EMSsolutions can help increase attendee participation, secure event delivery by 40%, and reduce manual planning tasks by 50%. The rise of stringent compliance requirements of GDPR and CCPA is also driving the need for secure, data-centric EMS solutions.

While large businesses own a majorpiece of the revenue share with advanced features and enterprise-level event management needs, SMEs drive EMS growth through the adoption of cloud-based solutions.

| Deployment | CAGR (2025 to 2035) |

|---|---|

| Cloud-Based | 17.8% |

There is an increasing demand for scalable and cost-effective solutions, and the cloud-basedevent management software segment will dominate the market and account for 17.8% of the market share by 2025. Since these are modern applications and do not require any hardware overheads, organizations are replacing their existing on-premise applications with the most in-demand cloud-basedapps.

They enjoy continuous upgrades and always available quality access. Cloud solutions help plan remote collaboration, hybrid and virtual events, third-party integrations and others, which is why enterprises prefer their choice forbetter attendee engagement. Industry leaders like Ungerboeck, EventMobi, and Hopin are leveraging AI analytics, automation, and multi-platform availabilityto facilitate the planning and execution of events.

On the other hand, the on-premise event management software segment holds a 9.6% industry share in 2025 dueto increasing data security, regulatory compliance, and control over full IT infrastructure for industries. On-premise solutions are the preferred choice for enterprises that conduct large-scale events or work with sensitive attendee data, as this allows them to mitigate cyber security risks and operateindependently.

On-premise deployment offers more controlby removing the dependency on an external provider, which is typically seen in a cloud-based solution, which also makes high levels of event-specific customization likely. on-premises solutions are available from companies such as Momentus Technologies, Eventzilla, andMeeting Evolution, which are specifically aimed at enterprises, government agencies, and large event organizers.

The industry is highly competitive, driven by increasing demand for automation, real-time analytics, and hybrid event solutions. The business is adopting a highly scalable AI-centric environment to drive attendee engagement and optimize event ROI while streamlining operations.

Key players like Cvent, Eventbrite, and Bizzabo possess extensive event-planning solutions for enterprises and multinational corporations to use. Whova, EventMobi, and vFairs, on the other hand, focus mainly on hybrid, virtual event management and boast enhanced features for attendee engagement and data analytics tools. New entrants such as Eventzilla, Aventri, and Sched, however, are focusing on designing economical and customizable solutions for small to medium-sized events.

The industry now sees a paradigm shift with AI-based automation, cloud event management, and seamless integration with other CRM and marketing platforms. These days, most companies are adopting real-time analytics, personalization tools, and networking enhancements as a competitive differentiator for their services.

Restructuring of the competitive landscape through strategic partnership and acquisition strategy and technological advancement has seen many firms expanding their global reach, making their software more relevant to modernized customer demands.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Cvent | 20-25% |

| Bizzabo | 15-20% |

| Eventbrite | 10-15% |

| Aventri | 8-12% |

| Hopin | 5-10% |

| RainFocus | 4-8% |

| Other Companies (combined) | 30-38% |

| Company Name | Key Offerings/Activities |

|---|---|

| Cvent | Integrated event management platform with AI analytics as well as automation. |

| Bizzabo | Virtual and hybrid event cloud experience platform. |

| Eventbrite | Event ticketing and marketing automation on the web for event planners. |

| Aventri | Full-service event management solutions with engagement tools for attendees. |

| Hopin | Interactive video conferencing and networking virtual event platform. |

| RainFocus | Event personalization powered by AI and centralized event data management. |

Key Company Insights

Cvent (20-25%)

Cvent tops the event management software industry with its strong event planning, AI-based analytics, and automation features, providing an integrated experience for event planners.

Bizzabo (15-20%)

Bizzabo's cloud-based event experience solutions provide comprehensive support for hybrid and virtual event production at advanced levels of engagement.

Eventbrite (10-15%)

Eventbrite has built an online ticketing and marketing automation platform, allowing organizers to maximize attendance and revenue for their events.

Aventri (8-12%)

Aventri provides end-to-end event management solutions, together with integrated attendee engagement and data-informed insights.

Hopin (5-10%)

Hopin is a foremost virtual event platform, offering great networking, live streaming, and interactive engagement features.

RainFocus (4-8%)

RainFocus provides AI-powered personalization for events, centralized event data management, and attendee analytics with true depth.

Other Key Players (30-38% Combined)

The industry is slated to reach USD 17 billion in 2025.

The industry is predicted to reach a size of USD 82.3 billion by 2035.

India, slated to grow at 18.3% CAGR during the forecast period, is poised for the fastest growth.

Cvent Inc., InEvent, Inc., Ungerboeck, Eventzilla, Certain, Inc., Eventbrite, Arlo, XING Events, Eventsforce, Aventri Inc., and Hubilo Technologies Inc. are the key players in the industry.

On premise solutions is being widely used.

By deployment, the industry is segmented into clouds and on-premises.

By enterprise size, the industry is segmented into small & medium enterprises (SMEs) and large enterprises.

By end user, the industry is segmented into event management companies, travel & hospitality companies, corporates, government, academic institutions, and others.

By region, the industry is segmented into North America, Latin America, Asia Pacific, the Middle East & Africa (MEA), and Europe.

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Mobility as a Service Market - Demand & Growth Forecast 2025 to 2035

Infrared Sensors Market Analysis – Growth & Trends 2025 to 2035

Laser Marking Market Insights - Growth & Forecast 2025 to 2035

Laser Hair Removal Devices Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.