The global evaporative condensing units market is valued at USD 1.7 billion in 2025. As per FMI’s analysis, the evaporative condensing units market will grow at a CAGR of 6.1% and reach USD 3.1 billion by 2035.

Evaporative condensing units, or evaporative condensers as they are popularly known, are air-cooled heat exchangers that utilize evaporative cooling to transfer heat effectively. In 2024, the condensing unit industry experienced significant growth due to the increased need for energy-efficient cooling in various sectors. Advances in technology led to machines that worked better and were eco-friendlier, supporting global sustainability goals.

In 2025 and beyond, it is expected to flourish further. The focus of many companies now is to reduce carbon footprint and cut operational costs, driving investments in evaporative condensing units. Additionally, the rise of data centers and their demand for efficient cooling solutions presents new opportunities for growth in the industry.

| Metric | Value |

|---|---|

| Industry Value (2025E) | USD 1.7 billion |

| Industry Value (2035F) | USD 3.1 billion |

| CAGR (2025 to 2035) | 6.1% |

Explore FMI!

Book a free demo

The evaporative condensing units industry is undergoing rapid growth driven by the convergence of sustainability requirements, industrial growth, and ongoing pressure for efficiency of operations.

Growth in heat-sensitive applications in pharmaceuticals, cold chain logistics, and high-density data centers is transforming demand so that advanced, water-conserving systems are no longer optional but required.

While companies embracing intelligent automation and adaptive cooling technologies will benefit, companies that depend on traditional models risk obsolescence as regulations become stricter and energy-aware consumers expect greater efficiency.

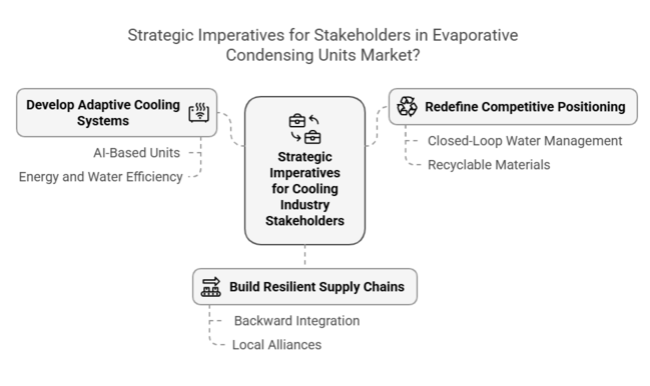

Develop Next-Generation Adaptive Cooling Systems

To remain at the forefront, manufacturers will need to transition towards AI-based evaporative condensing units that adapt automatically to changing environmental conditions, cutting energy and water usage. Investments in modular and scalable solutions will enable the provision of services to dynamic cooling-demand industries like data centers and bulk cold storage warehouses.

Redefine Competitive Positioning with Circular Economy Initiatives

Apart from compliance, companies need to embrace closed-loop water management, refrigerant recovery, and recyclable materials to meet the increasing demand for sustainable cooling. Companies that incorporate circular economy thinking into product design and lifecycle management will achieve long-term competitive superiority.

Build Resilient Supply Chains Through Vertical Integration

With raw material scarcity and geopolitical tensions affecting production costs, stakeholders must concentrate on backward integration, procuring major components like heat exchangers and corrosion-resistant alloys. Creating exclusive alliances with local distributors and service providers will also provide better control over pricing, availability, and customer retention.

| Risk | Probability & Impact |

|---|---|

| Sudden Technology Disruptions - Abrupt emergence of new alternative cooling methods, such as solid-state or magnetocaloric refrigeration, can suppress the demand for evaporative condensing units. | Medium Probability, High Impact |

| Fluctuating Water Regulations - Increasing global water conservation laws can impose use restrictions on evaporative cooling systems, impacting operational feasibility. | High Probability, High Impact |

| Market Consolidation & Pricing Pressure - Greater competition and more aggressive consolidation by HVAC giants might limit sector share for minor players, resulting in price wars and margin erosion. | Medium Probability, Medium Impact |

| Priority | Immediate Action |

|---|---|

| Next-Gen Product Development | Accelerate R&D on ultra-low water consumption devices and modular cooling technologies to future-proof the product portfolio. |

| Regulatory & Compliance Readiness | Work with policymakers and industry associations to shape future standards for refrigerants and energy efficiency. |

| Strategic Market Positioning | Strengthen partnerships with regional distributors and introduce customized financing models to promote faster adoption within emerging sectors. |

To stay ahead, companies must redefine their competitive edge by embedding predictive cooling intelligence, closed-loop water recycling, and next-gen refrigerants into their product roadmaps. The sector is shifting away from traditional measures of efficiency-purchasers today expect lifecycle cost optimization, real-time performance measurement, and regulatory resilience.

Organizations that accelerate AI-enabled diagnostics, negotiate sole-supply deals on hard-to-find materials, and take advantage of industrial decarbonization incentives will set the terms for the next phase of sector leadership.

Adaptation is no longer the top priority; the focus now is on preemptive disruption-transformation before policy changes and technology breakthroughs make old models irrelevant.

The application segment of the evaporative condensing industry will expand at a 6.0% CAGR from 2025 to 2035, with the refrigeration segment being the leader. Escalating demands for accurate temperature control and energy efficiency will fuel the growth.

Food processing, pharmaceuticals, and logistics industries will invest in the latest generation of refrigeration solutions to ensure compliance with stringent environmental regulations. The use of low-GWP refrigerants, hybrid cooling systems, and AI-powered automation will redefine the business.

Air conditioning use will witness major growth with commercial and industrial users looking for smart climate control systems. The transition to carbon neutrality and stricter energy efficiency requirements will drive up the use of smart evaporative cooling systems. Climate control by AI, demand-controlled cooling, and hybrid models will be on top, helping businesses lower costs while improving cooling efficiency.

Commercial use will lead the industry, expanding at a 6.2% CAGR from 2025 to 2035, as companies emphasize affordable, environmentally friendly cooling. Retail, hospitality, and office spaces at the large scale will more and more incorporate modular, high-efficiency cooling systems to meet energy codes and reduce operational costs.

The power industry will witness increasing demand for evaporative condensing units as energy companies increase cooling efficiency in thermal and renewable power plants. The chemical industry will increasingly adopt evaporative condensing units to meet stringent emission controls and enhance process efficiency. Cooling solutions featuring corrosion-resistant materials and automatic thermal monitoring will be in high demand. stability.

The United States will continue to see steady demand for evaporative condensing units under tight energy efficiency standards and the drive for environmentally friendly cooling systems. Rising adoption by data centers, grocery stores, and industrial buildings will spur growth. The transition to low-GWP refrigerants and the adoption of energy benchmarking policies will spur upgrades within the installed base of cooling equipment.

The commercial sector, especially retail and hospitality, will experience high adoption as companies target net-zero emissions. Sophisticated automation and IoT-centric performance optimization will become the norm across sectors, guaranteeing enhanced energy savings and environmental policy compliance. FMI projects that the CAGR for the United States will be 5.9% from 2025 to 2035.

India will see speedy growth in evaporative condensing unit uptake owing to rampant urbanization and infrastructure development. The food processing and pharma industries will lead substantial demand, as the need to sustain temperature-controlled spaces becomes paramount.

The growing number of international retail chain outlets and cold storage additions will also spur demand. Industrial usage, especially for steel and chemicals, will drive sector growth. Foreign direct investment in commercial real estate will further enhance deployment at shopping malls, hotels, and office space.

Natural refrigerants and solar-cooling units adoption will experience healthy growth, going hand-in-hand with India's green energy agenda. FMI forecasts that the CAGR of India will be 6.7% between 2025 and 2035.

China will become a leading force in the global industry for evaporative condensing units, with growth driven by fast industrialization and extensive manufacturing operations. China's ambitious energy efficiency policies and decarbonization efforts will make industries switch to high-efficiency cooling systems from traditional ones.

Growing investment in smart factories and automated warehouses will further propel demand for cutting-edge cooling technologies. The business sector, which includes hypermarkets and shopping malls, will use modular cooling systems to reduce operating costs.

The Chinese government tightening regulations on the environment, industries will further adopt low-emission refrigerant gases and transition to hybrid cooling technologies. FMI opines that China's CAGR will be 6.4% during 2025 to 2035.

The industry for evaporative condensing units in the United Kingdom will change at a fast pace with the country's policies of sustainability and carbon neutralization. The move towards net-zero emissions will compel companies to use innovative, energy-saving cooling technologies.

The quick growth in urban redevelopment activities will continue to drive demand for space-saving, high-performance cooling systems in commercial properties. The growing spotlight on vertical farming and controlled-environment agriculture will provide new drivers for evaporative cooling technologies. FMI projects that the United Kingdom CAGR to be 5.8% during the period from 2025 to 2035.

Germany's focus on industrial efficiency and environmental policies of green energy will propel consistent growth in the evaporative condensing unit industry. Germany's focus on lowering industrial emissions will cause widespread use of low-GWP refrigerants and water-saving cooling solutions.

The automotive and chemical manufacturing industries will be major adopters as industries upgrade their cooling systems to meet high environmental standards. The growth of green data centers will also drive industry growth further, with sectors utilizing AI-based cooling optimization.

Research-based innovation in clean refrigerants and energy-efficient cooling solutions will further boost industry competitiveness. FMI opines the CAGR for Germany between the years 2025 to 2035 at 6.0%.

South Korea's advanced manufacturing industry will be at the forefront of the growth of evaporative condensing unit uptake. Fast-paced digital transformation of manufacturing and logistics processes will raise the need for smart, energy-saving cooling technologies. Growing semiconductor and electronics production will push uptake in high-precision cooling applications to ensure operational reliability in sensitive production processes.

The retail food industry, and convenience store chains in specific, will replace cooling systems with energy-efficient and environment-friendly alternatives. AI and IoT integration in cooling systems will be extensively adopted, maximizing performance and reducing downtime. FMI forecasts that the CAGR of South Korea to be 6.1% during 2025 to 2035.

Japan will see lasting industry growth as businesses focus on automation and high-efficiency cooling solutions. The aging of commercial and industrial building infrastructure will lead to retrofitting with state-of-the-art evaporative condensing units. Japan's position as the robotics and AI-driven automation leader will enable smooth integration of smart cooling technology across all industries.

As the focus on energy saving grows, the government will enact policies requiring the use of sustainable cooling systems in manufacturing and logistics processes. Modular, space-efficient cooling solutions will be extensively invested in by companies, making them adaptable to Japan's compact city infrastructure. According to FMI, Japan's CAGR will be 5.9% from 2025 through 2035.

France's evaporative condensing unit industry will grow as companies synchronize with the nation's aggressive decarbonization agenda. Regulations issued by the government that encourage energy efficiency will drive the shift to hybrid cooling technology in all sectors.

Food and beverage processing will be a significant growth driver, with high-efficiency cooling systems taking center stage to ensure stringent hygiene and temperature control requirements. With the emphasis on sustainability in the country, manufacturers will design next-generation cooling systems with green refrigerants and water-saving systems. FMI opines that the CAGR of France will be 5.7% during 2025 to 2035.

Italy's industry will experience continued growth, with backing from the increasing use of energy-efficient condensing units in industrial and commercial applications. Sustainable manufacturing and smart logistics centers will fuel the demand for intelligent condensing units. The hospitality industry, including high-end hotels and resorts, will focus on evaporative condensing units that support Italy's green tourism program.

Italy's focus on lowering water usage will also fuel the shift toward advanced cooling systems with effective water management. As digital monitoring solutions are increasingly integrated into industries, real-time performance optimization will be a major differentiator. FMI projects that the CAGR of Italy will be 5.8% between 2025 and 2035.

Australia and New Zealand will witness rising demand for evaporative condensing units due to their focus on green cooling technology. The commercial real estate industry will drive widespread adoption as firms strive towards net-zero emissions. The mining and resource extraction industries will invest in advanced cooling technology to ensure energy efficiency in distant operations.

Agricultural applications, particularly in greenhouse farming, will be more significant as climatic conditions require controlled cooling systems. FMI opines the CAGR of Australia & New Zealand to be 5.9% between 2025 and 2035.

(Surveyed Q4 2024, n=500 stakeholder participants evenly distributed across manufacturers, distributors, industrial end-users, and commercial facility operators in the USA, Western Europe, China, Japan, and India)

Regional Variance:

High Variation in Adoption:

ROI Considerations:

69% of USA stakeholders found IoT-based automation to be "worth the investment," while only 34% in Japan immediately recognized value.

Consensus:

Stainless Steel & Aluminium Alloys: Preferred by 63% of stakeholders for corrosion resistance and toughness.

Regional Variance:

Shared Challenges:

86% listed rising costs of raw materials and supply chain disruptions as a top concern.

Regional Differences:

Manufacturers:

Distributors:

End-Users (Industrial & Commercial):

Alignment:

72% of global manufacturers intend to invest in intelligent energy-efficient cooling systems.

Divergence:

High Consensus: Energy efficiency, sustainability compliance, and cost issues are global concerns.

Key Variances:

Strategic Insight:

Regional adaptation-automated excellence in the USA, sustainable design in Europe, value-based models in China and India-will determine industry success.

| Country | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States | The DOE Energy Conservation Standards and EPA SNAP policies require high-efficiency and low-GWP refrigerants. ASHRAE 90.1 standards and AHRI certification for performance verification are required by companies. |

| India | The Bureau of Energy Efficiency (BEE) encourages minimum energy efficiency standards. Commercial HVAC systems manufacturers have to comply with ISO 16358-1 and ISI certification. |

| China | The China Energy Label (CEL) program has stringent energy efficiency compliance. GB/T 25127 performance and safety certification is required by companies. |

| United Kingdom | The Ecodesign Directive under the UK Energy-related Products (ErP) Regulation requires low carbon emissions. CE and UKCA marking is required for sales. |

| Germany | The Federal Immission Control Act (BImSchG) and DIN 8975 certification necessitate low-emission cooling technologies. The EnEV standards govern efficiency requirements. |

| South Korea | The Korean Energy Efficiency Labeling Program establishes compulsory efficiency standards. The products are required to meet KS C 9306 certification of performance and environmental safety. |

| Japan | The METI Top Runner Program fosters efficiency development. JIS certification is required by companies to ensure compliance with energy-saving requirements. |

| France | The RT2020 Building Regulation imposes commercial cooling energy efficiency. NF Certification is required to be obtained by manufacturers to comply with local sustainability targets. |

| Italy | Italian Legislative Decree 192/2005 is harmonized with EU Ecodesign directives, necessitating CE marking and UNI EN 378 certification for environmental and safety standards. |

| Australia-New Zealand | MEPS (Minimum Energy Performance Standards) program governs cooling efficiency. GEMS certification compliance is mandatory for all commercial units. |

The industry of evaporative condensing units is moderately consolidated, with leading players holding on to maximum shares and emerging regional players further facilitating competition. Top companies are emphasizing competitive prices, technological advancements, strategic alliances, and international expansion to solidify their industry stance.

During 2024, major developments in the industry facilitated and defined sector growth. For instance, in March, Aircoil Company (BAC) introduced a fresh series of eco-friendly evaporative condensing units that limit water and energy usage, and also meet the international standards of sustaniabilty.

Furthermore, Evapco Inc. disclosed that it has closed an acquisition deal with a European HVAC manufacturer in June, expanding its company image in the European industry and diversifying its product line.

Baltimore Aircoil Company (BAC) - ~25-30%

Evapco - ~20-25%

SPX Cooling Technologies (Marley) - ~15-20%

Johnson Controls (York) - ~10-15%

Airedale International - ~5-10%

Colmac Coil - ~5-8%

Growing energy efficiency needs for cooling solutions, regulatory changes supporting green refrigerants, and technology developments in heat exchange systems are driving the growth of the industry.

Stringent emissions standards and energy efficiency regulations are making manufacturers think outside the box in terms of using sustainable materials and advanced cooling technologies.

Trade barriers, local certification requirements, and significant initial investment in manufacturing eco-friendly units are some of the big issues.

Industries such as data centers, cold storage, and food processing are increasingly investing in these systems in order to optimize efficiency and attain sustainability goals.

Companies are differentiating themselves through mergers and acquisitions, strategic alliances, and R&D on high-efficiency, low-maintenance cooling solutions.

Refrigeration, Air Conditioning

Commercial, Power, Chemical

North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific East Asia Middle East and Africa

Electric Winch Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Commercial RAC PD Compressor Market Growth - Trends & Forecast 2025 to 2035

Electric & Hydraulic Wellhead Drives for Onshore Application Market Insights - Demand, Size & Industry Trends 2025 to 2035

Echo Sounders Market Insights - Demand, Size & Industry Trends 2025 to 2035

Industrial Motors Market Insights - Growth & Demand 2025 to 2035

Electric Hedge Trimmer Market Insights Demand, Size & Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.