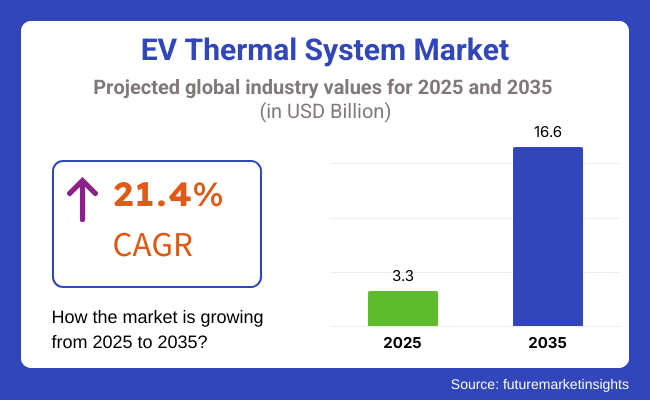

As per FMI analysis the market is projected to reach USD 3.3 billion in 2025 and expand to approximately USD 16.6 billion by 2035, reflecting a compound annual growth rate (CAGR) of 21.4% over the forecast period.

The electric vehicle thermal systems market is experiencing remarkable growth at an annual growth rate (CAGR) of 21.4%, which is a clear indicator of the thermal system industry expansion driven primarily by technological innovation, widespread adoption of EVs and the ever-increasing demand for advanced thermal management solutions in electric vehicles.

More specifically, electric vehicle thermal systems market is witnessing a quick rise, attributed to the rising number of EVs, the improvements in thermal management technologies, and the demand for an effective thermal load management solution for electric vehicle batteries and powertrains.

On the one hand, thermal systems are crucial in the maintenance of ideal operating temperatures for motors, batteries, and electrical components, while on the other hand, the performance, safety, and battery life of those components are directly related to the thermal systems controlling the component surface temperature. The elevated demand for items is affected by the advanced technology of electric vehicle powertrains, the increasing number of electric vehicles on the road, and the demand for better thermal management systems.

As buyers look for EVs with greater driving ranges and decreased charging times, the demand for thermal systems that ensure the least possible energy consumption apart from maximizing reliability, safety, and efficiency is on the rise. This segment has a critical position in the transition movement towards electric mobility on a worldwide scale. Achieving the challenge of ensuring battery thermal management systems possess the required higher energy density and longer range is one of the leading concerns in this sector.

Customers put a priority on battery performance and increase the required driving range, hence manufacturers have to come up with ideas that boost energy efficiency while guaranteeing safety at the same time. The most advanced thermal systems are still expensive, and this is the main issue, especially in developing markets and for low-cost EVs.

Manufacturers ought to navigate the thin line between quality and cost to meet the demand of price-sensitive customers particularly as electric car uptake intensifies. The auto industry globally is not left out of the liquid supply chain interruptions that involve semiconductors, which materially affect the thermal management systems' production.

Adequate assurance of quality raw materials and parts is fundamental to effective thermal solution manufacturers. As electric mobility spreads across the globe, the opportunities for businesses to generate more products related to the thermal systems involved in EV powertrains, batteries, and HVAC applications is easily inferred on as they venture into new thermal solutions that match the needs of the evolving EV sector.

Breakthroughs in thermal management technology, such as innovation in active cooling, cost-effective air conditioning, and advanced battery thermal management, give a strong base for expansion of the market. The companies engaged in R&D to develop inexpensive and power-saving products are likely to grasp their fair share of newly appearing prospects at this juncture.

Countries around the globe are putting the regulations on emissions as well as the investments to promote clean technologies which are surging the demand for electric cars and green thermal management technologies thus creating a place for thermal system manufacturers which are able to provide environmentally friendly, energy-efficient products.

The growing production of electric vehicles by car manufacturers is another aspect through which they can benefit as partnerships with OEM suppliers become increasingly important. Vehicle makers are looking for thermal management solutions which apart from being effective integrate with the style of the next generation electric vehicles and of future battery technologies.

From 2020 to 2024, the EV thermal system market grew at a rapid rate as companies invested in battery cooling, performance, and passenger comfort. The high-capacity lithium-ion batteries required efficient thermal management, driving a shift from air-cooled to liquid-cooled systems for optimal temperature management. Heat pump technology replaced energy-consuming resistive heating, offering greater range and efficiency.

Sustainability goals pushed manufacturers towards low-GWP refrigerants, phase-change materials, and eco-friendly cooling technologies. But high costs and semiconductor shortages delayed mass adoption. By 2024, supply chain efficiencies and economies of scale brought advanced thermal solutions into greater availability and reduced price points.

Between 2025 and 2035, predictive cooling, immersion cooling, and AI-powered waste heat recovery will bring change in the EV thermal systems. Smart sensors will optimize real-time temperature control, and dielectric immersion cooling will optimize battery efficiency and lifespan. Bio-based coolants and closed-loop thermal management will reduce environmental impact. Digital twins will optimize system design and fleet management. Next-generation thermal solutions will make electric trucks and solid-state batteries a reality, and EVs will reach greater efficiency, range, and sustainability.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Regulatory Landscape: Stricter energy efficiency standards, eco-friendly refrigerants | Sustainable closed-loop thermal systems, AI-driven efficiency mandates |

| Technological Advancements: Adoption of heat pumps, liquid-cooled battery packs | Immersion cooling, waste heat recovery, AI-optimized thermal management |

| Industry Applications: Enhanced battery cooling for high-capacity EVs | Thermal management for solid-state batteries and long-haul electric trucks |

| Adoption of Smart Equipment: Telematics-based temperature monitoring | Digital twin simulations for real-time predictive maintenance |

| Sustainability & Cost Efficiency: Low-GWP refrigerants, improved energy efficiency | Bio-based coolants, graphene-based heat spreaders, recycled cooling fluids |

| Data Analytics & Predictive Modelling: Limited predictive maintenance capabilities | AI-powered real-time thermal analytics, dynamic cooling adaptation |

| Production & Supply Chain Dynamics: Semiconductor shortages, high-cost thermal solutions | Cost-effective thermal materials, widespread adoption of scalable cooling technologies |

| Market Growth Drivers: EV adoption, demand for efficient battery cooling | Expansion of commercial EVs, rapid adoption of solid-state battery technology |

With ever tighter environmental regulations of the kind typically imposed by governments and other regulatory types, suppliers are now being forced to up their game in developing low-impact, high-efficiency solutions for EV thermal management systems. One particularly significant change on the not too distant horizon is a phase out of HFC refrigerants due to their higher global warming potential (GWP).

The EU’s F-Gas Regulation and the USA’s AIM Act are phasing out HFCs like R-134a and R-1234yf, compelling the industry to migrate to low-GWP substitutes, like carbon dioxide-based (R-744) and hydrofluoroolefin (HFO) refrigerants. Suppliers must undergo these changes, or risk losing market access through non-compliance.

Advances in thermal management technology are also driven by new energy efficiency targets. Regulatory frameworks are coming into play in Europe, China, and North America that demands stricter vehicle efficiency in turnover targets, meaning optimizing heat pumps and liquid cooling are essential to expanding EV range in severe climates.

Automakers are investing heavily into smart thermal controls, variable-speed compressors and phase-change materials to meet these efficiency regulations.

| Category | Details |

|---|---|

| Cost-per-kW of Cooling Efficiency | EV A/C compressors: USD 70 per kW; PTC heaters: USD 75 per kW. Heat pumps add 30–50% to costs but save 150–450% in battery range. Costs are dropping due to economies of scale, especially in China. |

| Tesla's Sourcing Strategy | Tesla develops thermal systems in-house, sourcing only specific parts like compressors. Focuses on integration over cost savings, limiting Tier-1 supplier involvement. |

| Ford's Sourcing Strategy | Ford is giving global sourcing to Tier-1 providers, however they are relocating to vapor-injection heat pumps. Long-term contracts; used to control costs, leading to supplier chances for innovation |

| BYD's Sourcing Strategy | BYD is quite vertically integrated, thus few opportunities exist with full-system suppliers. Keeps the average cost low by outsourcing parts to local partners |

| Volkswagen's Sourcing Strategy | VW will pivot from total outsourcing to internal design, yet will still depend on manufacturers. The integrated approach is the future of both VW and its suppliers, who must adapt or be replaced. |

| Long-Term Contracts & Supplier Opportunities | OEM suppliers’ contracts are generally 5-8 years. Engagement in early development of EV platform is what matters the most. On one hand, insourcing trend seen in Tesla, VW, BYD challenges traditional external suppliers with the differentiation via technology, process, and efficiency. |

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 8.4% |

| UK | 7.9% |

| European Union | 8.2% |

| Japan | 7.8% |

| South Korea | 8.1% |

United States EV Thermal System Market is growing at record rates as a result of driving faster towards electric transport. Need for energy-saving thermal management solutions in electric vehicles (EVs) is necessitated by strengthening governmental support, advance in battery technologies, and increasing charging facility rollout.

One of the drivers of the industry is the Inflation Reduction Act, encouraging cleaner transportation with tax credits to EV purchasers and pressuring automakers to design new thermal solutions. Second, the urgency to roll out fast-charging networks has stimulated interest in the next generation of thermal solutions to further improve battery life and performance.

Major vehicle manufacturers such as Tesla, Ford, and General Motors are utilizing sophisticated thermal management technologies such as liquid cooling, phase-change materials, and artificial intelligence-based heat management to obtain maximum performance and battery protection.

Growth Factors in the USA

| Key Factors | Details |

|---|---|

| Rising EV Adoption | Increasing sales of EVs driving demand for efficient thermal management systems. |

| Battery Performance Enhancement | Focus on thermal systems that improve battery efficiency and longevity. |

| Expansion of Fast Charging Infrastructure | Need for advanced cooling technologies to support high-speed charging. |

| Strong R&D in Heat Management | Innovations in phase-change materials and liquid cooling solutions. |

The UK EV Thermal System Market is expanding at a wonderful pace, as the government is trying to phase out internal combustion engine (ICE) vehicles by 2035. The energy-efficient demand for electric vehicles has fueled investments in waste heat recovery, electric vehicle climate control solutions, and battery cooling.

UK Road to Zero Strategy and Zero Emission Vehicle (ZEV) Mandate are forcing the manufacturers to enhance thermal efficiency, keeping EV batteries intact through various climates. Growth of commercial fleet and electric bus is also generating demand for packaged heating and cooling systems to achieve peak operating efficiency.

Automobile manufacturers like Jaguar Land Rover, Arrival, and Bentley are using heat pump technology combined with intelligent cooling circuits to achieve the highest possible battery life without compromising comfort.

Growth Factors in the UK

| Key Factors | Details |

|---|---|

| 2030 ICE Ban | Strict regulations pushing automakers to develop efficient EV thermal solutions. |

| Growth in Luxury & Performance EVs | Demand for advanced HVAC and battery cooling in high-end electric vehicles. |

| Investment in Lightweight Materials | Use of graphene-based cooling solutions to improve energy efficiency. |

| Harsh Weather Adaptation | Development of advanced heating systems for cold-weather EV performance. |

European Union Thermal System is expanding in response to ambitious carbon neutrality goals, increased EV penetration, and enormous R&D initiatives in efficient vehicle components for automobiles. The European Green Deal is compelling car makers to use effective cooling solutions with even lower power consumption while hitting ambitious EU emission goals.

Germany, France, and the Netherlands are leading battery cooling fluids, solid-state battery thermal management, and AI thermal management. Mass roll-out of rapid EV charging stations has raised stakes for future-proof thermal management systems.

Industry giants Volkswagen, BMW, and Renault are working on thermally dynamic cooling modules so that EVs can operate under cold or hot conditions with maximum efficiency.

Growth Factors in European Union

| Key Factors | Details |

|---|---|

| Stringent Emission Norms | EU Green Deal mandates better thermal efficiency in EVs. |

| Expansion of Gigafactories | Growth in regional battery production requiring high-performance cooling solutions. |

| Innovations in Heat Pump Technology | Increased adoption of energy-efficient heat pumps for EVs. |

| Growing EV Market Share | Rising demand for advanced climate control in electric vehicles. |

The Japanese Electric Vehicle Thermal System Market is expanding with focus on battery technology, energy efficiency, and green mobility in Japan. Due to the intention of the country to be carbon neutral by 2050, the need for advanced thermal management in EV efficiency is paramount.

Japanese auto players like Toyota, Honda, and Nissan are spearheading the technology revolution in solid-state battery technology with high-performance thermal management systems with battery stability.

Japan's cutting-edge miniaturization and lightweight thermal management system developments are leading global energy-efficient thermal management best practices.

Japan is determined to build autonomous thermal solutions with highest heat dissipation capability with long-term reliability with the launch of battery-swapping EVs.

Growth Factors in Japan

| Key Factors | Details |

|---|---|

| Focus on Energy-Efficient HVAC Systems | Development of ultra-low energy heating and cooling technologies. |

| Government Incentives for EVs | Support for innovations in thermal management for improved battery life. |

| Advanced Battery Cooling Solutions | Leading automakers investing in cutting-edge battery thermal systems. |

| Lightweight & Compact Design | Research into miniaturized thermal systems for better EV efficiency. |

South Korea EV Thermal System Market is on the rise with firm backing from the government regulations, growing volume of EVs production, and technology development of next-gen battery coolants. The Hyundai-initiated and Kia-sponsored transition towards promoting the use of the next generation of electric vehicles is driving the consumption of advanced thermal management systems on a massive priority.

The Ministry of Trade, Industry, and Energy (MOTIE) is investing significantly in phase-change materials, artificial intelligence cooling technology, and thermoelectric battery management systems in its efforts to provide optimal EV performance. South Korean wireless EV charging infrastructure is also being constructed with emphasis on liquid-cooled battery packs for secure charging.

Major players such as Hyundai Mobis and Hanon Systems are investing in smart battery thermal management to provide long-term performance during harsh weather conditions

Growth Factors in South Korea

| Key Factors | Details |

|---|---|

| Leadership in Battery Manufacturing | Integration of next-gen cooling tech by LG Energy Solution and Samsung SDI. |

| R&D in Phase-Change Materials | Innovations in thermal materials for better heat dissipation. |

| Demand for High-Performance EVs | Hyundai and Kia focusing on sportier electric models with advanced cooling. |

| Fast Charging Optimization | Development of thermal systems that prevent overheating during rapid charging. |

Power electronics are essential for EV performance, and control the flow of energy between the speed device, the engine, and the energy output techniques. With high-voltage components such as onboard chargers and inverters becoming the standard, efficient cooling solutions are vital to reliability and performance.

Liquid cooling systems are becoming more preferable for high-power electronics as they have better heat dissipation and less potential to overheat. And Bosch and Valeo are working on new liquid-cooled inverters and semiconductors that feature increased thermal conductivity and energy efficiency.

Although the technology is leading the way in terms of liquid cooling, the high production cost and packaging difficulties present barriers. In addition, the continued adoption of silicon carbide (SiC) and gallium nitride (GaN) semiconductors will enable enhanced heat management and greater feasibility of compact, high-performance cooler solutions.

Fluid transport systems circulate cooling fluids to manage temperatures in an EV's battery, motor, power electronics and other critical components, which is an essential part of EV thermal management. This highly efficient system is necessary for optimal operating conditions, reliability and heat management in high-performance EVs.When considering heat transfer, the majority of the most widespread fluid transport systems are liquid-based fluids.

From fluid transport components, such as pumps, hoses, and valves, Dana Incorporated and Hanon Systems are developing compact, lightweight, and highly efficient components. These systems are engineered to cope with the high thermal loads of modern EVs but remain low energy consumers.

Battery electric vehicles (BEVs) depend on thermal management systems to maintain optimal flow of energy between the battery pack, motor and the various components of the drivetrain systems as well as to preserve the battery pack's longevity and safety.

The BEVs run solely on high capacity battery systems, making sure that effective cooling solutions are in place, critical to reliability, performance, and safe operation. Hence, liquid cooling systems are being used more often than others in case of BEV batteries due to the stability of operational temperature which withstands heavy charging and discharging loads.

These systems efficiently dissipate heat while preventing overheating and thermal runaway. The development of batteries as SAMSUNG, LG & other companies like Tesla, BYD, CATL are working on liquid-cooled battery packs with significantly improved thermal conductivity

Hybrid electric vehicles (HEVs) depends on thermal management systems to maintain temperatures balanced in both its internal combustion engine (ICE) and electric component systems including the battery, motor, and power electronics.

Due to the dual powertrain architecture of HEVs, efficient cooling solutions play a critical role in the seamless transfer of energy, performance, and endurance of the system during its operation. This occurs in HEVs equipped with liquid cooling systems for the battery in addition to the power electronics, as it maintains heat regulation when switching energy loads between the ICE and the electric motor.

These are essential in avoiding overheating, enhancing energy efficiency, and the regenerative braking system. Leading automakers like Toyota, Honda, and Ford are adopting sophisticated hybrid designs that use a liquid-cooled battery pack for better thermal efficiency and fuel economy.

Electric vehicle thermal systems are expanding at a very fast pace with electric cars gaining popularity by the day, and therefore efficient thermal management systems are required. Although battery performance and lifespan always take precedence, companies are shifting their attention to premium cooling and heating technology in order to optimize energy efficiency. Use of heat pumps, liquid cooling, and phase-change materials is offering better thermal stability, sustaining excellent vehicle performance and safety. Established automotive component manufacturers, tech players, and start-ups are taking the market by storm by investing in next-generation electronic vehicle thermal management systems.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Denso Corporation | 18-22% |

| Valeo | 15-20% |

| MAHLE GmbH | 12-16% |

| Hanon Systems | 10-14% |

| BorgWarner Inc. | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Denso Corporation | Develops high-efficiency heat pump systems and battery cooling technologies for EVs. |

| Valeo | Specializes in next-generation liquid cooling and phase-change materials to optimize battery life. |

| MAHLE GmbH | Provides advanced HVAC solutions and battery thermal management systems. |

| Hanon Systems | Focuses on integrated thermal control solutions, including refrigerant-based cooling systems. |

| BorgWarner Inc. | Innovates in e-thermal systems, offering intelligent thermal control for EV drivetrains. |

Key Company Insights

Denso Corporation (18-22%)

Denso is the market leader in thermal vehicle system supply to electronics with state-of-the-art liquid cooling and heat pump technology providing industry-leading battery and passenger compartment temperature management.

Valeo (15-20%)

Valeo is a pioneer in thermal management technology with highly efficient cooling systems that increase EV range and battery life through smart heat-dissipation strategies.

MAHLE GmbH (12-16%)

MAHLE stands out in energy-efficient and sustainable thermal management solutions with innovative products for enhancing electric vehicle performance by minimizing power consumption.

Hanon Systems (10-14%)

Hanon Systems paces the trend for end-to-end thermal management by refrigerant-based and hybrid cooling techniques to optimize EV battery performance.

BorgWarner Inc. (6-10%)

BorgWarner paces better e-thermal solutions with accurate electric drivetrain temperature control to provide longevity and efficiency.

Other Notable Players (30-40% Combined)

They are winning market share in the expanding thermal systems market for electric vehicles through technological advancements in cooling and energy-efficient thermal management.

This segment includes Heating Ventilation and Air Conditioning (HVAC), Power Train Cooling, Fluid Transport, and Others.

This segment encompasses Battery Electric Vehicle (BEV), Hybrid Electric Vehicle (HEV), Plug-in Hybrid Electric Vehicle (PHEV), and Fuel Cell Electric Vehicle (FCEV).

This segment covers Engine Cooling, Air Conditioning, Heated Steering, Waste Heat Recovery, Transmission System, Heated or Ventilated Seats, and Others.

This segment consists of North America, Latin America, Europe, East Asia, South Asia and Pacific, and The Middle East and Africa (MEA).

The overall market size is anticipated to be USD 3.3 Billion in 2025.

The electronic vehicle thermal system market is expected to reach USD 16.6 Billion in 2035.

The demand will grow due to rising adoption of electric vehicles, the need for efficient battery cooling systems, and advancements in thermal management solutions.

The top 5 countries driving the electronic vehicle thermal system market are China, the USA, Germany, Japan, and South Korea.

Battery thermal management systems and HVAC solutions for electric vehicles are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by System Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by System Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by System Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by System Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by System Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by System Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by System Type, 2018 to 2033

Table 34: Europe Market Volume (Units) Forecast by System Type, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 36: Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by System Type, 2018 to 2033

Table 44: Asia Pacific Market Volume (Units) Forecast by System Type, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 46: Asia Pacific Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Asia Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by System Type, 2018 to 2033

Table 54: MEA Market Volume (Units) Forecast by System Type, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 56: MEA Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 58: MEA Market Volume (Units) Forecast by Application, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: MEA Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by System Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by System Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by System Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by System Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by System Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by System Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Application, 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by System Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by System Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by System Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by System Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by System Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by System Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Application, 2023 to 2033

Figure 59: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by System Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by System Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by System Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by System Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by System Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by System Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by System Type, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by System Type, 2018 to 2033

Figure 101: Europe Market Volume (Units) Analysis by System Type, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by System Type, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by System Type, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 109: Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 113: Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Europe Market Attractiveness by System Type, 2023 to 2033

Figure 117: Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 118: Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by System Type, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by System Type, 2018 to 2033

Figure 131: Asia Pacific Market Volume (Units) Analysis by System Type, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by System Type, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by System Type, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by System Type, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by System Type, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by System Type, 2018 to 2033

Figure 161: MEA Market Volume (Units) Analysis by System Type, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by System Type, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by System Type, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 165: MEA Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 169: MEA Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 173: MEA Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: MEA Market Attractiveness by System Type, 2023 to 2033

Figure 177: MEA Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 178: MEA Market Attractiveness by Application, 2023 to 2033

Figure 179: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

EV Transmission System Market Size and Share Forecast Outlook 2025 to 2035

Thermal Cleaning System Market Growth - Trends & Forecast 2025 to 2035

Thermal Profiling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

EV Battery Heating System Market Size and Share Forecast Outlook 2025 to 2035

EV Telematics Control Systems Market Size and Share Forecast Outlook 2025 to 2035

Thermal-Wet Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Embolic Prevention Systems Market

Closed System Transfer Devices Market Insights – Industry Trends & Forecast 2024-2034

Revolutionary Moisture Locking Systems Market Size and Share Forecast Outlook 2025 to 2035

Thermal Management Materials for EV Batteries Market Size and Share Forecast Outlook 2025 to 2035

Smart Elevator Automation System Market Growth - Trends & Forecast 2024 to 2034

Industrial Vacuum Evaporation Systems Market Analysis - Size & Industry Trends 2025 to 2035

Driveline Control Systems and Devices Market Size and Share Forecast Outlook 2025 to 2035

Q-Commerce Last-Mile Thermal Packs & Reverse Logistics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Next-Generation Intrusion Prevention System (NGIPS) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Automotive Thermal System Market Analysis by Application, Vehicle Type, Propulsion Type, Component, and Region Through 2035

EV Charger Tester Market Size and Share Forecast Outlook 2025 to 2035

Thermal Interface Material Market Size and Share Forecast Outlook 2025 to 2035

Thermal Management Market Forecast and Outlook 2025 to 2035

EV Charger Converter Module Market Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA