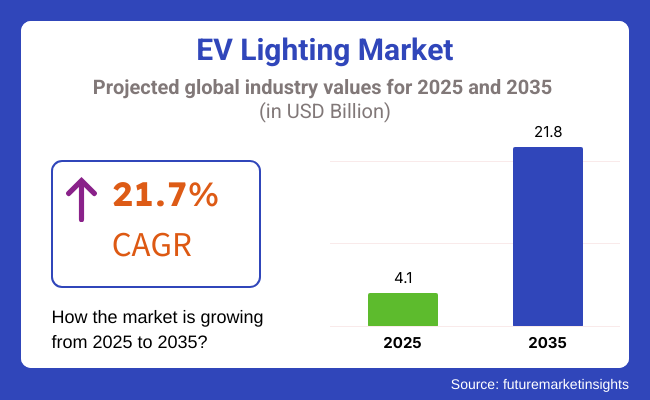

The EV lighting market is headed for significant growth with overall sales set to hit USD 4.1 billion in 2025 from USD 2.93 billion in 2023. It's set to grow to USD 21.8 billion by 2035, at a compound annual growth rate (CAGR) of 21.7%. Such a swift development is the result of the increasing demand for energy-saving appliances, the rise of the EV industry, and the evolution of lighting with LED and OLED becoming the main elements of light enhancements in vehicles.

Apart from the technical part, lighting visibility also serves a purpose in electric vehicles, and automakers include innovative types of lighting fixtures to build a brand identity, as well as achieve safety and efficiency. For instance, companies like Tesla and Audi are having moving matrix LED and laser headlights, respectively, to cut energy while having better visibility and thus safety.

Nevertheless, the market has some hurdles to cross despite the robust growth momentum. One such issue is cost sensitivity, especially in developing countries where premium OLED and LED are still costly. Manufacturers have to find a good equilibrium between the quality and the prices; hence, optimizing production costs is very important.

Additionally, EV interior lighting must be designed with energy efficiency in mind because excessive power draw can result in battery draining and affect vehicle mileage. Automotive manufacturers are more and more coming up with lighting products that have low energy consumption and high luminance in the form of BMW laser headlights which are able to provide bright light while consuming less power.

Besides, the market offers great opportunities through the introduction of new technologies. Examples are OLEDs, lasers, and adaptive lighting systems which are now the commonest in vehicles and are recognized to provide better safety, energy savings, and beauty. In addition, the marketing of intelligent lighting systems such as organic light-emitting diode (OLED), laser, and adaptive lighting, which are now becoming popular, is propelling the market even further.

Autonomous vehicles and connected cars that are joining forces more and more frequently will be widely characterized by these smart lighting and security features. As an example of this, Mercedes-Benz has applied a smart digital light in its electric vehicles that automatically adjusts the brightness of the lights based on the external conditions and even put signs on the street.

The road to innovation in the EV lighting industry will be carved by the quest for the balance between energy efficiency on the one hand and performance, aesthetics, and safety on the other hand. Thus, the technological leap will be lighting solutions that are equal to the new generation of electric vehicles.

Explore FMI!

Book a free demo

OEMs and customers also rate energy efficiency as important, as there is increasing emphasis on minimizing power consumption while providing bright, reliable lighting. OEMs score high on durability/impact resistance and must ensure that lighting components can endure being part of the end product; aftermarket suppliers and retailers rate that moderately.

Design innovation is of high importance to OEMs, suggesting that they are likely integrating advanced, flashy solutions into vehicles, but it ranks medium in importance for others groups. For aftermarket suppliers, cost/value is rated high and for retailers and consumers, moderately important. Regulatory compliance is crucial for OEMs, scoring highly, but not so much for retailers and consumers. Thus, the table shows the trade-off between performance, cost, and design factors which drive the EV lighting segment.

Between the years 2020 to 2024, there has been a rapid surge in the market concerning EV lighting systems as a result of advancements in LED, Laser and OLED technology coupled with the increasing acceptance of EVs. Automakers sought energy-efficient lighting systems for improved aesthetics, safety, and battery efficiencies within their vehicles.

Such include Adaptive LED headlamps, Laser headlights, and OLED taillights, and their superior brightness levels, extra-long life, and low power consumption offer new advantages over their predecessors. Energy-efficient lighting systems have proved to be instrumental in improving EV range and safety even as the manufacturers concentrate on the battery performance optimization.

From 2025 to 2035, automotive lighting will be transformed because of AI, IoT, as well as advanced materials into interactive adaptive devices. This type of lighting will be altered by AI for brightness, color, and direction based on driving conditions. Sensor-based systems would project warnings and lanes guidance on the road by means of an innovative projection.

OLED and micro-LED technology would present what can be described as ultra-thin flexible lighting designs that would now form an integral part of the outside appearance of EVs. The reduction of reliance on batteries in terms of efficiency will be made possible by innovations in solar and wireless lighting features supporting next-generation vehicle automation and smart mobility solutions.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Stricter safety standards for adaptive lighting, pedestrian visibility laws | AI-driven lighting compliance, communication-based illumination safety standards |

| Shift from halogen/HID to LED & laser lighting | AI-integrated adaptive lighting, OLED/micro-LED innovations, transparent lighting elements |

| Energy-efficient lighting for EVs, expansion of ADAS-compatible lighting | Smart lighting ecosystems for autonomous vehicles, interaction-based lighting for urban mobility |

| OTA-updatable lighting, digital light signatures | AI-powered road projections, gesture-responsive lighting controls |

| Development of energy-saving lighting systems | Wireless and solar-powered lighting, biodegradable and recyclable components |

| Limited analytics on light usage and efficiency | Cloud-based lighting control, AI-predictive maintenance for lighting performance |

| Semiconductor shortages affected availability of advanced lighting features | Scalable micro-LED manufacturing, 3D-printed modular lighting components |

| Rising EV adoption, demand for energy-efficient lighting | Autonomous mobility, smart city integration, cost-effective premium lighting solutions |

With over 78% penetration of LED technology, the EV lighting market is crucial for global supply chains but can be at risk given reliance on foreign products. Global chip shortages have hit LED drivers and components since they are related to chips, prompting price increases and delaying production.

Moreover, there are additional regulatory supply risks, including tariffs on Chinese imports of LEDs as well as logistical disruptions that suppliers now must navigate and mitigate for their production sustainability.

Suppliers who become obsolete through non-innovation will lose OEM contracts to competitive suppliers who can provide cost-effective and efficient solutions. As such, the market does become reliant on the rates of EV adoption, which can increase the risk of volatility; the demand for complex lighting solutions can be affected by economic downturns, changes in consumer preferences or shifts in vehicle design trends.

Regulatory risks also factor heavily into the equation, as inconsistency in safety standards between regions has a direct impact on product design and timelines for approval.

The sluggishness in the adoption of matrix LED technology in the USA, versus in Europe, shows how regulatory variation can curtail market potential. However, there are various solutions, such as OLED and fiber-optic lighting that pose threats of substitution to traditional LED modules, but LED technology will dominate the coming years.

They're having to be agile from a supplier perspective continue investing in R&D while keeping a lid on cost in a competitive environment.

Premium and Budget Price Segments in EV Lighting Market Moreover, high-end EVs utilize complex lighting schemes, including dynamic LED projector assist lights and ambient lighting effects, which adopt a value-based pricing strategy. These features still create room for improving safety, aesthetics, and personalization while allowing automakers to charge more for advanced lighting packages.

In contrast, budget EVs aim to maximize cost efficiency, utilizing basic LED modules with price points based on budget constraints for cost-effective assembly. Value-added pricing works for new technologies, like AI-controlled headlights and custom lighting animations, where consumers will accept a higher price if the added safety/luxury is perceived.

Bundling strategies are the norm, and with the trim packages already including all manner of premium features. It locks in better margins and fits automakers’ pricing strategies. New suppliers, especially from Asia, use penetration pricing to gain ground, upending longstanding Western manufacturers.

Factors affecting pricing include dropping LED component prices, consumer acceptance of paying for lighting improvements and sustainability issues. A standard LED price segment continues to drop but, amid pricing pressures, makers are using upsell opportunities via customizable lighting features to stay profitable.

| Country | CAGR (2025 to 2035) |

|---|---|

| The USA | 7.6% |

| The UK | 7.2% |

| EU | 7.8% |

| Japan | 7.5% |

| South Korea | 7.9% |

The USA market is also showing strong growth through increasing demand for electric vehicles (EVs), OLED and LED light technology, and government regulation of energy-efficient vehicle parts. Safety, car design, and energy efficiency are driving next-generation light solution growth demand among automobile manufacturers.

United States electric vehicle (EV) sales increased more than 40% in 2023, and growth is expected to continue, the USA Department of Energy's data show. Inflation Reduction Act (IRA) and other similar federal tax credits are driving demand and penetration.

Major automobile companies such as Tesla, Ford, and General Motors utilize high-intensity LED and adaptive light technology to enhance battery life and battery visibility. Tesla Matrix LED headlights of newer vehicles use smart high-beam control technology that reduces energy consumption. FMI predicts the USA market to mirror 7.6% CAGR during the research period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| EV Adoption Surge | Over 1.2 million EVs sold in 2023, supported by federal incentives. |

| Technological Advancements | Use of OLED, laser, and matrix LED lighting for improved energy efficiency. |

| Government Policies | IRA tax credits and USD 7.5 billion allocated for EV infrastructure. |

| Safety and Aesthetics Focus | Automakers integrating adaptive and ambient lighting to enhance visibility. |

The UK market is growing at a rate that grows with growing acceptance of EVs, greater energy regulation, and greater consumer demand for smart light technology. The government's move to phase out new petrol and diesel car sales by 2035 is taking EV production up, thus boosting demand for smart light technology.

Luxury vehicle companies such as Jaguar Land Rover and Bentley are investing in sophisticated lighting technology such as adaptive matrix LED technology for use in security and efficiency improvement in vehicles. Bentley Flying Spur's electronic lighting adapts brightness according to road conditions to enhance driving experience. The UK market is expected to see a 7.2% CAGR growth rate over the forecast period, says FMI.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| EV Growth | 370,000+ new EVs registered in 2023, up 18% YoY. |

| Strict Energy Regulations | Government mandates on carbon neutrality by 2050 driving LED/OLED adoption. |

| Premium Vehicle Market | High demand for luxury cars with customizable lighting systems. |

| Technological Advancements | Increased use of matrix LED and laser lighting for enhanced safety. |

The EU market is opening up with robust green regulation, technology innovation, and increasing EV sales attracting demand for affordable vehicle lights. France, Germany, and the Netherlands are at the forefront, with over 1 million new EVs registered in Germany alone in 2023.

EU Green Deal to reduce greenhouse gases by 55% by 2030 needs energy-efficient automotive lighting, and therefore the firms have adopted laser and OLED light technology. Volkswagen and BMW introduced OLED rear lights and adaptive laser headlights that reduce power consumption and enhance lighting.

Growth Factors in the EU

| Key Drivers | Details |

|---|---|

| Environmental Regulations | EU Green Deal targets 55% CO₂ reduction by 2030, promoting LED/OLED use. |

| EV Market Growth | Over 2.1 million EVs sold in 2023 across EU nations. |

| Technological Advancements | Volkswagen, BMW leading OLED and laser lighting innovation. |

| Cost-Efficiency Focus | High demand for energy-saving and long-lasting lighting systems. |

The Japanese market is expanding as the automobile sector increasingly uses the most recent high-efficiency light technologies to increase safety and save energy. Japan's vision of becoming carbon neutral by 2050 has been among the key drivers for the higher adoption of cutting-edge EV light solutions.

Toyota, Honda, and Nissan use adaptive lighting and OLED technology as a step to increase vision while conserving energy. Toyota bZ4X electric SUV has a high-end matrix LED system that minimizes glare and improves nighttime driving safety.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| National Carbon Neutral Plan | Commitment to net-zero emissions by 2050. |

| Smart Lighting Adoption | OLED, matrix LED, and adaptive lighting in mainstream EVs. |

| Growing EV Market | EV registrations up 25% YoY, increasing demand for efficient lighting. |

| Government Incentives | Subsidies and tax benefits for EV component manufacturers. |

South Korea paces high speed in the luxury vehicle lighting segment with EV manufacturing expansion, government initiatives, and widespread adoption of AI-based adaptive light technology. South Korea also targets 33% of new cars sold as electric vehicles by the year 2030, further propelling demand for energy-efficient light systems.

Automobile manufacturers like Hyundai and Kia are also introducing smart, AI-controlled lights that adapt based on weather and traffic. Hyundai Ioniq 6 has a smart pixel lighting system via an LED array for better appearance and efficiency.

Growth Factors in South Korea

| Key Drivers | Details |

|---|---|

| EV Industry Expansion | Targeting 33% of new vehicle sales as EVs by 2030. |

| Smart City Integration | Adoption of AI-powered adaptive lighting for urban mobility. |

| Government Support | Financial incentives for EV lighting tech R&D. |

| Technological Innovations | Hyundai’s Pixel LED lighting enhancing efficiency and safety. |

Both of which have their pros and cons, but halogens are by far the cheapest and most popular lighting solution on electric vehicles (EVs). They provide reasonably warm light output and are cost-effective to replace, so they’re favored in budget-friendly EVs and entry-level models. But halogen bulbs consume more energy and don’t last as long as newer technologies (about 1,000 hours, give or take).

Since EV efficiency relies on strictly de minimis power use, countless automakers are cutting halogen lighting in favor of more energy-efficient options.

But they outperform halogen bulbs in three ways: they produce more light, last 2,000 - 3,000 hours and sip less energy. These lights are white and bright, but also improve night visibility and safety.

However, HID tech has traditionally been a mid you can drool with a mind of a luxury EV type, like the i3 and Model S; it takes about three seconds to reach full lumens; creates heat; and is pricier than halogens-sort of an unnatural fit, which has led some carmakers to pursue even higher levels of efficiency with LED.

As a result the passenger cars segment holds major share in the overall EV lighting market on account of growing penetration of LED & HID lighting which automakers are introducing to enhance their safety, energy efficiency and aesthetics. Because it required very low power, having long life (upto 50,000 hours) and bright enough, LED lights particularly popular material to be used for premium and mid-range EV.

Adaptive LEDs already seem to be a part of cars such as the Tesla Model 3 and Audi e-tron, as does matrix LED with the primary goal of maximizing the path of the light, whilst minimizing energy use during the night. Autonomous driving will also manage the development of intelligent lamp systems, including dynamic headlight, ultrafast-laser objects, and more.

Electric commercial vehicles like trucks and delivery vans that operate for an average of 24 hours a day need a highly durable and power-efficient lighting solution. This segment is primarily characterized by increasing utilization of LED technology to minimize energy consumption while ensuring optimal brightness across the roads.

The European electric bus industry - vehicles from BYD and Mercedes-Benz - utilizes LED lighting throughout to lower maintenance costs while enhancing operator visibility. In this segment, the adoption of advanced EV lighting solutions has been driven by the creation of stringent regulatory guidelines pertaining to energy efficiency and road safety and rising incentives from the government to promote EV adoption of the fleet.

The advancements in LED, OLED, and adaptive lighting technologies have continuously transformed the global EV lighting market to enhance energy efficiency, safety, and beauty. As the market for electric vehicles (EVs) continues to grow, more of these intelligent lighting solutions as well as dynamic illumination will emerge, and many will adopt an AI-driven adaptive system to facilitate better visibility, conserve energy, and make the driver experience more enjoyable.

The tier-1 automotive lighting suppliers, technology developers and manufacturers of EVs are building a world filled with innovations in next-generation lighting and are shaping this market.

The leading players, including Hella, Valeo, Koito Manufacturing, Stanley Electric, and Marelli, are equipped with innovative and cutting-edge technologies with respect to LED and laser lighting systems, adaptive headlamps, and customizable interior ambient lighting. These companies are enhancing the competitive stand through their strong OEM collaborations, proprietary optical technology, and advanced digital lighting solutions.

On the other hand, new entrants and technology start-ups are crossing the limits in AI-enabled lighting controls, ultra-thin OLED panels, and matrix LED technology to meet the growing need for energy-efficient and intelligent lighting systems.

The all-dominating high-performance and innovative sustainable solutions in EV lighting will define the future leaders as automakers come to highlight the futuristic designs, compatibility with autonomous driving, and greener, energy-efficient components.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Osram Continental | 18-22% |

| HELLA GmbH & Co. KGaA | 15-20% |

| Koito Manufacturing Co., Ltd. | 12-16% |

| Valeo | 10-14% |

| Stanley Electric Co., Ltd. | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Osram Continental | Develops LED and laser-based product solutions, integrating intelligent adaptive control systems. |

| HELLA GmbH & Co. KGaA | Specializes in digital lighting solutions with advanced matrix LED and sensor-integrated lighting technologies. |

| Koito Manufacturing Co., Ltd. | Provides high-performance automotive lighting, focusing on adaptive driving beam (ADB) systems. |

| Valeo | Offers energy-efficient LED and OLED lighting, incorporating AI-driven lighting responses. |

| Stanley Electric Co., Ltd. | Focuses on innovative automotive lighting, including head-up displays and next-gen illumination techniques. |

Key Company Insights

Osram Continental (18-22%)

Osram Continental leads the sector with innovative LED and laser technologies designed for energy efficiency and superior visibility. Its smart lighting solutions enhance safety while optimizing power consumption for electric vehicles.

HELLA GmbH & Co. KGaA (15-20%)

HELLA is at the forefront of digital automotive lighting, offering advanced LED matrix solutions, sensor-based illumination, and adaptive headlight systems tailored for EVs.

Koito Manufacturing Co., Ltd. (12-16%)

Koito focuses on adaptive driving beam (ADB) technology, ensuring optimal road illumination while minimizing glare. The company pioneer's precision optics for enhanced night driving safety.

Valeo (10-14%)

Valeo integrates AI-powered lighting innovations, providing dynamic and energy-efficient OLED solutions that adjust based on driving conditions and ambient environments.

Stanley Electric Co., Ltd. (6-10%)

Stanley Electric develops next-generation automotive lighting, including advanced LED and projection-based illumination systems, enhancing the aesthetics and functionality of EVs.

A revenue of USD 4.1 billion is expected to be generated from manufacturing EV lighting in 2025.

The market is predicted to reach a size of USD 21.8 billion by 2035, growing at a CAGR of 21.7% from 2025 to 2035.

Key manufacturers in the market include Denso Corporation, Hella GmbH, Hyundai Mobis, Koito Manufacturing, Koninklijke Philips N.V., Osram GmbH, Robert Bosch GmbH, Stanley Electric Co., Valeo, and ZKW.

Asia-Pacific is expected to be a prominent hub for EV lighting manufacturers, driven by the rapid expansion of the electric vehicle industry and advancements in automotive lighting technology.

LED-based lighting solutions are the most widely used product segment in the EV lighting market due to their energy efficiency, durability, and superior illumination.

The EV lighting market includes halogen, xenon (HID), LED, and others, with LED leading due to its energy efficiency, durability, and superior illumination.

Lighting solutions are used in electric passenger cars, electric commercial vehicles, electric two-wheelers (E2W), and others, with passenger cars holding the largest share due to high production volumes.

EV lighting is distributed through original equipment manufacturers (OEMs), the aftermarket, and other channels, with OEMs driving demand due to factory-installed lighting systems.

The market spans North America, Latin America, Europe, East Asia, South Asia and Pacific, and the Middle East and Africa (MEA), with Asia-Pacific leading due to high EV adoption and strong automotive manufacturing.

Sales of Used Bikes through Bike Marketplaces Market- Growth & Demand 2025 to 2035

Truck Bedliners Market Outlook- Trends & Forecast 2025 to 2035

Start Stop System Market Growth – Trends & Forecast 2025 to 2035

Motorcycle Lead Acid Battery Market - Trends & Forecast 2025 to 2035

Automotive Door Guards Market - Market Outlook 2025 to 2035

Automotive Connecting Rod Bearing Market -Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.