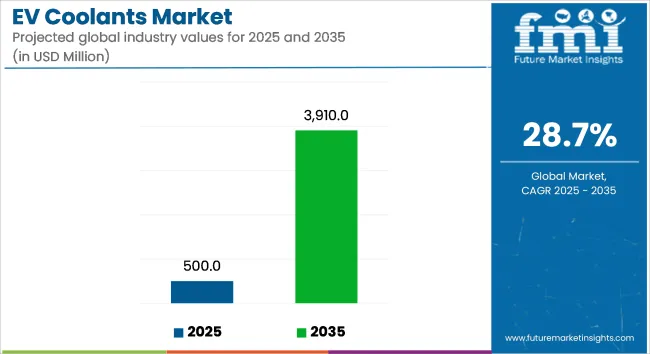

The global EV coolant market is estimated at USD 500 million in 2025, up from approximately USD 297.2 million in 2023, and is expected to grow to USD 3.9 billion by 2035, reflecting a CAGR of 28.7%. Growth is being supported by increased electric vehicle production, stricter safety standards for thermal systems, and substantial innovation in fluid formulations.

In October 2024, Prestone Products launched three EV-specific thermal management fluids. These included low-conductivity formulations that comply with China’s GB 29743.2 standard, using silicate inhibitor and phosphate-organic acid technologies. It was stated by Matt Kern, Senior Director of Global Sales at Prestone, that “Prestone’s thermal management fluids serve as an ally in combating corrosion and forming a protective barrier that shields these systems from the harmful effects of corrosion.” These products were designed to offer electrical safety and materials compatibility with aluminum heat exchangers and battery systems.

Evolution of EV cooling requirements has been noted in battery and powertrain subsystems. According to SAE, low-conductivity and corrosion-resistant fluids are required to suppress thermal runaway and protect high-voltage electronics in motor and battery packaging. These safeguards were shown to be essential for architectures using water-jacketed motor stators and fast-charging infrastructures.

Further insights were provided by Tom Corrigan, Director of EV Technology at Prestone. He explained that “low electrical conductivity is a must for thermal-management fluids which could potentially come in contact with high-voltage electronics.” This emphasis on dielectric performance and corrosion prevention was reflected in Prestone’s R&D roadmap.

Industry solutions have also begun integrating immersion cooling technologies. Advanced fluids engineered for both battery packs and power electronics were introduced by tier-one OEMs during 2024. These fluids were reported to support rapid thermal transients during fast-charge cycles, while maintaining temperature uniformity and minimizing energy losses.

Adoption of EV coolants has been supported by regulatory changes. China’s GB 29743.2 EV coolant conductivity regulation is expected to be enforced by mid-2026. This standard demands electrical conductivity below 100 µS/cm (rising to 300 µS/cm over time), which has driven global suppliers to adjust formulations accordingly.

Commercial use cases have emerged in 2024 fleet operations deploying medium- and heavy-duty EVs. Coolants meeting low-conductivity and corrosion specifications were being used to maintain battery pack lifespan in high-mileage usage.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 500 million |

| Industry Value (2035F) | USD 3.9 billion |

| CAGR (2025 to 2035) | 28.7% |

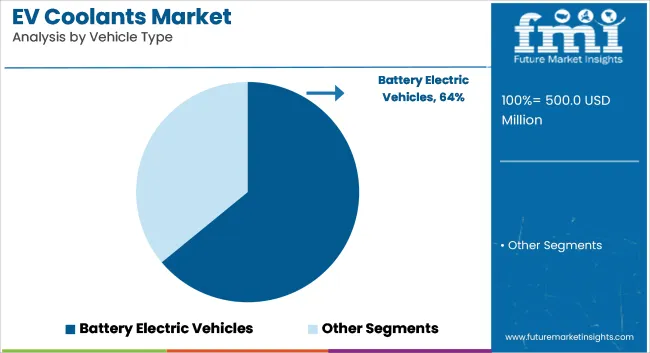

BEVs are estimated to account for approximately 64% of the global EV coolants market share in 2025 and are projected to grow at a CAGR of 28.1% through 2035. Their full reliance on electric drivetrains requires efficient thermal management systems to maintain optimal battery performance, inverter function, and onboard charger efficiency.

As battery capacities increase and fast-charging adoption expands, OEMs are prioritizing advanced coolant formulations that ensure stable thermal regulation under high-load conditions. BEVs from leading manufacturers such as Tesla, BYD, Hyundai, and Volkswagen rely on closed-loop coolant systems to extend battery life and ensure safety under diverse ambient temperatures.

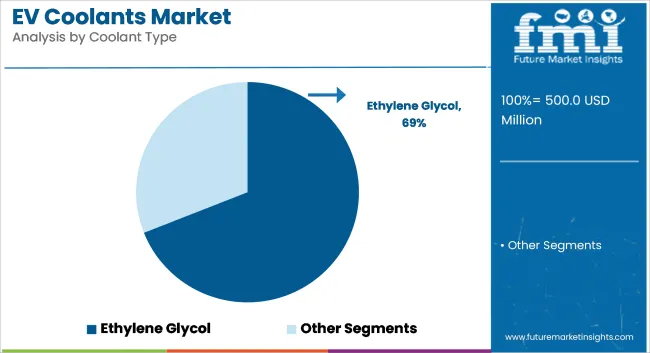

Ethylene glycol coolants are estimated to account for approximately 69% of the global EV coolants market share in 2025 and are forecast to grow at a CAGR of 27.6% through 2035. Their superior heat transfer properties, chemical stability, and compatibility with a range of thermal system components make them the preferred choice for EV battery packs and electronics cooling.

Used across BEVs, HEVs, and PHEVs, ethylene glycol blends are formulated with corrosion inhibitors and additives to ensure long-term system reliability. Manufacturers continue to refine formulations for low electrical conductivity, reduced evaporation loss, and freeze protection, reinforcing their role as the default coolant type in the growing EV ecosystem.

Manufacturers rate chemical stability as high, confirming that the coolant retains its properties at various operating conditions, but aftermarket suppliers and service centers allocate it a medium rating since its cost of performance lies in balance.

Aftermarket suppliers are on tight budgets, making cost efficiency a key factor; manufacturers and service centres rate it as medium. Manufacturers rank compatibility with EV systems as high, and other groups medium. Environmental impact and longevity are considered fairly important by all stakeholders, suggesting room for improvement in sustainability and durability.

The consequences of non-compliance can include safety risks, product recall and/or market bans-driving companies to modify formulations to adhere to region-specific requirements on a continual basis. The uncertainty with technology also brings risk; the established water-glycol coolants now compete with dielectric fluids in direct cooling systems.

If OEMs for the motors and batteries widely embraced immersion cooling, the traditional coolant suppliers might find demand dwindling.

The growth of the market is also further connected to how many EVs are adopted - even as demand elsewhere is growing, EVs utilize smaller coolant volumes than their internal combustion engine counterparts, meaning there is likely a limit to how much the general market might expand in the long run.

Worse yet, many coolants are formulated with specialty additives that are not produced at volume; coolant production is also dependent on petrochemical feedstocks, more than one of which is in short supply. Disruptions in raw materials availability, geopolitical instability, or logistics bottlenecks could generate shortages and price spikes.

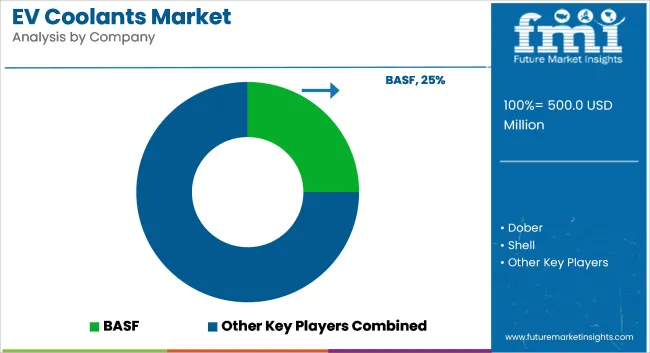

The chemical industry is dominated by a handful of giants such as BASF, Shell and Chevron, and smaller companies might find themselves bankrupt by price undercutting or locked out of lucrative OEM contracts. Further, untrue assertions about the product or inferior formulations pose a reputational risk, since any EV safety incident associated with the coolant could invoke scrutiny from regulators and damage to the brand.

The pricing in the EV coolant market is essentially bifurcated between standard water-glycol blends that are highly commoditized and cost-driven and premium dielectric coolants that command higher margins for their advanced performance benefits. For standard coolants, there is a strong price pressure, with suppliers competing on cost efficiency and bulk contracts to win OEM business.

In contrast, since high performance EVs and motorsports typically use dielectric coolants, these are value based commodities typically costing several times as much as basic formulations due to performance of heat dissipation and battery safety.

New entrants use penetration pricing to form ties with automakers, typically offering early bonuses or multi-year pricing guarantees to guarantee volume sales. Most supplier also take a tiered pricing approach, offering a basic glycol coolant for mass-market EVs and a high-end version for premium applications, enabling them to serve different buyer segments.

New pricing strategies could involve bundling coolant with maintenance and/or fleet management contracts or other forms of recurring revenue around scheduled replacements. The raw material costs, regulatory changes, competitive dynamics - all these external factors continue to influence the pricing trends, making it imperative for the suppliers to keep a tight balance between getting the cost recovery right and maintaining market competitiveness in their pricing strategies.

The USA. EV Coolants Market is expanding at a fast pace as the demand for electric vehicles (EVs) increases. With increased emphasis on sustainability and government incentives for EV purchases, the market for effective thermal management solutions is on the rise.

Large corporations such as Tesla, General Motors, and Ford are incorporating superior, non-conductive, dielectric coolants for boosting EV safety and performance while guaranteeing longevity in harsh weather conditions.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.3% |

The EV coolants market in the United Kingdom is expanding as the government pushes towards a zero-emission future. As the sales of internal combustion engine (ICE) vehicles are to be phased out by 2035, automakers and consumers alike are quickly switching to EVs, boosting demand for high-efficiency cooling technologies.

Government-backed programs, including the UK Battery Industrialization Centre (UKBIC), are driving innovation in battery thermal management, with a special focus on the contribution of future coolants to enhance battery safety and efficiency. The expanding second-hand EV market is also encouraging the development of long-term, maintenance-free coolants by manufacturers that maximize battery performance over the long term.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.6% |

The EV coolants market in the European Union is thriving due to strict environmental regulations and the continent's strong focus on sustainability. The European Green Deal is compelling vehicle manufacturers to use green thermal management solutions, thus spurring demand for biodegradable and recyclable coolants.

Germany, France, and the Netherlands are at the forefront, with significant investments in battery gigafactories and the development of next-generation cooling technologies that enhance efficiency and safety. Increasing volumes of high-performance EVs from BMW, Volkswagen, and Renault have created a demand for high-performance coolants that can facilitate rapid charging and intense operating conditions.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 8.1% |

The Japanese EV coolants market is growing substantially as a result of the country's dominance in innovating battery technology. As Japan is speeding toward carbon neutrality by 2050, the prospects of EVs with improved thermal management have been put in the limelight.

Japan's automakers, including Toyota, Honda, and Nissan, are at the forefront of using silicone-based and dielectric coolant technologies that maximize battery life and prevent overheating.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.9% |

South Korea’s EV coolants market is expanding at a phenomenal rate with government assistance, increased EV production, and technology advancements in battery cooling. Hyundai and Kia are among the top automobile makers that are spending heavily on solid-state battery technology, and the demand for future-generation coolants is increasing.

The South Korean government's Ministry of Trade, Industry, and Energy (MOTIE) has also invested money in the creation of advanced thermal management systems where EVs can operate at their optimum in extreme climatic conditions. Advanced AI-governed cooling systems are also being fitted into EVs to provide real-time thermal management for enhanced battery performance.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.4% |

The EV coolants market is becoming increasingly competitive as electric vehicles (EVs) gain mainstream adoption, driving demand for advanced thermal management solutions. Automakers as well as coolant manufacturers are keen on high-performance thermal fluids that optimize battery life, efficiency, and prevention of overheating.

The market is characterized by automotive fluid specialists, technology companies, and EV manufacturers that have invested in innovative cooling technologies for high performance and safety.

Leading in the sector is Castrol, BASF, Valvoline, Shell, and TotalEnergies, using proprietary thermal fluid formulations, strong OEM partnerships, and sustainability-focused R&D. These include emerging dielectric coolants, nanofluid technologies, and biobased thermal fluids, among innovations that are transforming the competitive landscape where players are inclined toward effective heat dissipation at a reduced environmental impact.

Concurrently, niche fluid technology companies and startups are entering the fray with immersion cooling and nonconductive cooling solutions for high-end EV applications. As battery technology becomes more advanced and regulations become stricter, the major players in this rapidly evolving market will also have a significant strategic advantage by investing in next-generation eco-friendly high-efficiency coolant solutions.

The EV coolants market serves Battery Electric Vehicles (BEVs), Hybrid Electric Vehicles (HEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and Fuel Cell Electric Vehicles (FCEVs), with BEVs driving the highest demand due to rapid electrification.

Coolants are used in electric passenger cars, electric commercial vehicles, electric two-wheelers, and others, with passenger cars dominating due to their increasing adoption.

The market includes ethylene glycol, polypropylene glycol, and other coolants, with ethylene glycol widely used for its superior thermal management properties.

The market spans North America, Latin America, Europe, East Asia, South Asia and the Pacific, and the Middle East and Africa (MEA), with Asia-Pacific leading due to the high production and sales of EVs.

A revenue of USD 500 million is expected to be generated from manufacturing EV coolants in 2025.

The market is predicted to reach a size of USD 3.9 billion by 2035, growing at a CAGR of 28.7% from 2025 to 2035.

Key manufacturers in the market include BASF, Dober, Shell, Total Energies, Valeo, Chevron, Exxon Mobil, Lukoil Petrons, Ashland Corporation, Sinclair Oil Corporation, and Blue Star Lubrication Technology.

North America and Europe are expected to be prominent hubs for EV coolant manufacturers, driven by the rapid adoption of electric vehicles and stringent thermal management regulations.

Water-glycol-based coolants are the most widely used product segment in the EV coolant market due to their superior thermal management properties and compatibility with EV battery systems.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Litre) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 4: Global Market Volume (Litre) Forecast by Vehicle Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Coolant Type, 2018 to 2033

Table 6: Global Market Volume (Litre) Forecast by Coolant Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 10: North America Market Volume (Litre) Forecast by Vehicle Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Coolant Type, 2018 to 2033

Table 12: North America Market Volume (Litre) Forecast by Coolant Type, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 16: Latin America Market Volume (Litre) Forecast by Vehicle Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Coolant Type, 2018 to 2033

Table 18: Latin America Market Volume (Litre) Forecast by Coolant Type, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 22: Europe Market Volume (Litre) Forecast by Vehicle Type, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Coolant Type, 2018 to 2033

Table 24: Europe Market Volume (Litre) Forecast by Coolant Type, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 28: Asia Pacific Market Volume (Litre) Forecast by Vehicle Type, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by Coolant Type, 2018 to 2033

Table 30: Asia Pacific Market Volume (Litre) Forecast by Coolant Type, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 34: MEA Market Volume (Litre) Forecast by Vehicle Type, 2018 to 2033

Table 35: MEA Market Value (US$ Million) Forecast by Coolant Type, 2018 to 2033

Table 36: MEA Market Volume (Litre) Forecast by Coolant Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Coolant Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Litre) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 9: Global Market Volume (Litre) Analysis by Vehicle Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Coolant Type, 2018 to 2033

Figure 13: Global Market Volume (Litre) Analysis by Coolant Type, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Coolant Type, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Coolant Type, 2023 to 2033

Figure 16: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Coolant Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Coolant Type, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 27: North America Market Volume (Litre) Analysis by Vehicle Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Coolant Type, 2018 to 2033

Figure 31: North America Market Volume (Litre) Analysis by Coolant Type, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Coolant Type, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Coolant Type, 2023 to 2033

Figure 34: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Coolant Type, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Coolant Type, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 45: Latin America Market Volume (Litre) Analysis by Vehicle Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Coolant Type, 2018 to 2033

Figure 49: Latin America Market Volume (Litre) Analysis by Coolant Type, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Coolant Type, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Coolant Type, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Coolant Type, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Coolant Type, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 63: Europe Market Volume (Litre) Analysis by Vehicle Type, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Coolant Type, 2018 to 2033

Figure 67: Europe Market Volume (Litre) Analysis by Coolant Type, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Coolant Type, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Coolant Type, 2023 to 2033

Figure 70: Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 71: Europe Market Attractiveness by Coolant Type, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by Coolant Type, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 81: Asia Pacific Market Volume (Litre) Analysis by Vehicle Type, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by Coolant Type, 2018 to 2033

Figure 85: Asia Pacific Market Volume (Litre) Analysis by Coolant Type, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Coolant Type, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Coolant Type, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by Coolant Type, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 92: MEA Market Value (US$ Million) by Coolant Type, 2023 to 2033

Figure 93: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 99: MEA Market Volume (Litre) Analysis by Vehicle Type, 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 102: MEA Market Value (US$ Million) Analysis by Coolant Type, 2018 to 2033

Figure 103: MEA Market Volume (Litre) Analysis by Coolant Type, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by Coolant Type, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by Coolant Type, 2023 to 2033

Figure 106: MEA Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 107: MEA Market Attractiveness by Coolant Type, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Evacuated Miniature Crystal Oscillator (EMXO) Market Forecast and Outlook 2025 to 2035

EV Charging Tester Market Size and Share Forecast Outlook 2025 to 2035

Evaporative Air Cooler Market Size and Share Forecast Outlook 2025 to 2035

EV Charging Cable Market Size and Share Forecast Outlook 2025 to 2035

EVOH Encapsulation Film Market Size and Share Forecast Outlook 2025 to 2035

eVTOL Charging Facilities Market Size and Share Forecast Outlook 2025 to 2035

Event Tourism Market Size and Share Forecast Outlook 2025 to 2035

EV Telematics Control Systems Market Size and Share Forecast Outlook 2025 to 2035

Evidence Collection Tubes Market Size and Share Forecast Outlook 2025 to 2035

EV Battery Recycling and Black Mass Processing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

EVA Coated Film Market Size and Share Forecast Outlook 2025 to 2035

EV Charging Management Software Platform Market Size and Share Forecast Outlook 2025 to 2035

EV EMC Battery Filter Market Size and Share Forecast Outlook 2025 to 2035

EV Traction Inverter Market Size and Share Forecast Outlook 2025 to 2035

EV Plant Construction Market Size and Share Forecast Outlook 2025 to 2035

EV Battery Heating System Market Size and Share Forecast Outlook 2025 to 2035

EV Charging Station Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Event Logistics Market Size and Share Forecast Outlook 2025 to 2035

Evaporated Filled Milk Market Size, Growth, and Forecast for 2025 to 2035

EV Lighting Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA