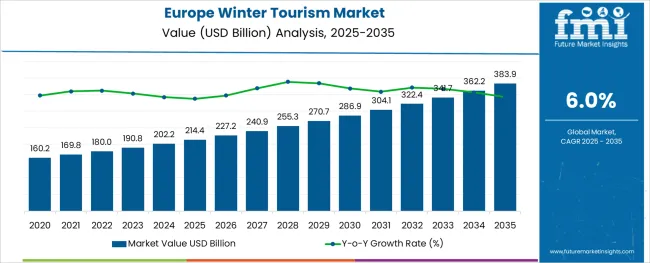

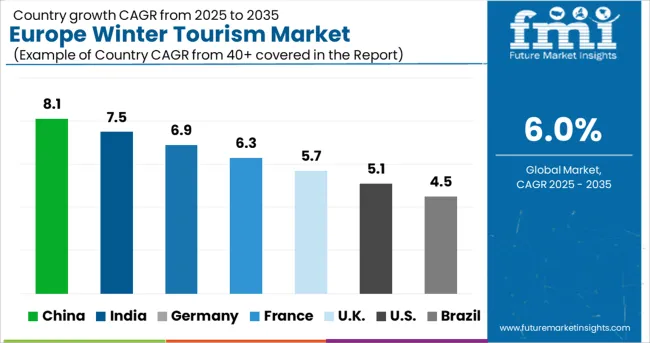

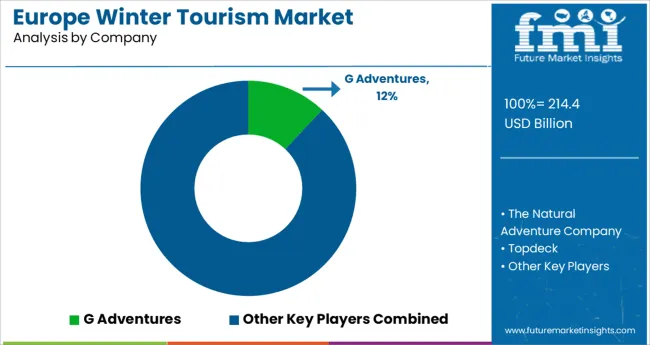

The Europe Winter Tourism Market is estimated to be valued at USD 214.4 billion in 2025 and is projected to reach USD 383.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

The Europe winter tourism market is experiencing robust growth, supported by a combination of infrastructure modernization in alpine destinations, increased participation in snow sports, and enhanced digital booking experiences. Changing consumer preferences toward experience-centric travel, especially among younger demographics, are accelerating demand for tailored winter vacation packages. Governments and tourism boards across the region are investing in year-round accessibility, climate-resilient resort infrastructure, and eco-tourism programs to ensure sustainability and long-term viability of winter tourism.

Furthermore, the widespread adoption of mobile-first platforms and dynamic pricing tools has enhanced transparency and convenience in travel planning, boosting booking volumes. Visa relaxations, improved air connectivity, and strategic destination branding are also contributing to the influx of international tourists during the peak winter season

As climate variability continues to influence snowfall patterns, innovation in artificial snow-making and diversified winter offerings-such as wellness tourism and local cultural events-are expected to sustain growth across segments.

The market is segmented by Tourism Type, Booking Channel, Tourist Type, and Age Group and region. By Tourism Type, the market is divided into Skiing, Hiking, Mountain Climbing, Trails Travel, Religious Travel, and Christmas Travel. In terms of Booking Channel, the market is classified into Online Booking, Phone Booking, and In Person Booking.

Based on Tourist Type, the market is segmented into International and Domestic. By Age Group, the market is divided into 26-35 Years, 15-25 Years, 36-45 Years, 46-55 Years, and 66-75 Years. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

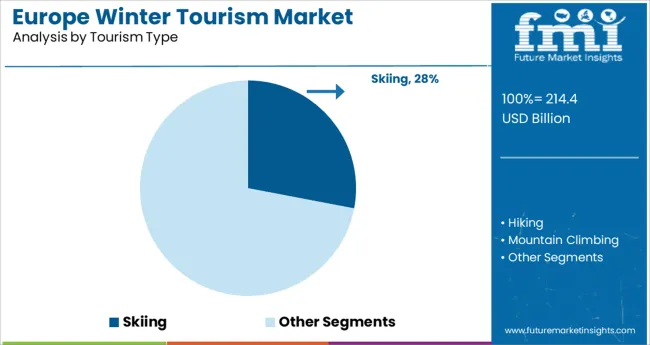

Skiing is projected to account for 28.0% of the total revenue share in the Europe winter tourism market by 2025, making it the leading tourism type segment. This dominance is being attributed to the widespread appeal of alpine sports, well-established ski resorts across regions such as the Alps and Scandinavia, and rising interest in physical outdoor recreation among tourists.

The segment benefits from extensive infrastructure, including ski lifts, slope grooming technologies, and dedicated training facilities, which enhance the safety and accessibility of skiing for both novices and seasoned travelers

Moreover, the contribution of skiing to local economies through ancillary services such as equipment rentals, ski schools, and après-ski amenities continues to strengthen its commercial viability. As family and group travel trends expand, skiing destinations are increasingly incorporating inclusive packages and diversified slope activities, reinforcing the position of skiing as a core winter tourism product in Europe.

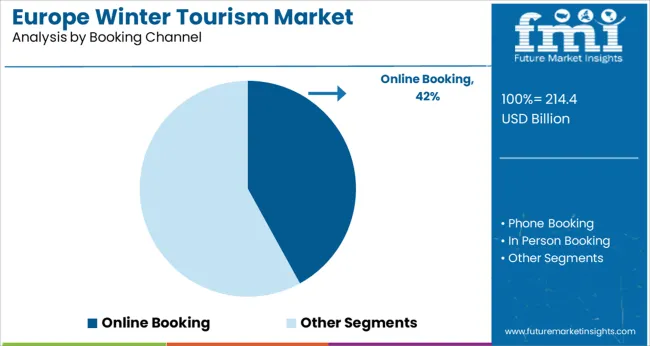

Online booking is expected to represent 42.0% of total bookings in the Europe winter tourism market by 2025, emerging as the leading channel. This growth is being driven by increased reliance on digital platforms, mobile apps, and third-party aggregators that offer real-time availability, dynamic pricing, and bundled packages tailored to individual preferences.

Online platforms have enhanced consumer confidence through transparent reviews, flexible cancellation policies, and multi-currency support, making cross-border travel planning more accessible. The rise of digital-native travelers and last-minute travel habits is also encouraging tourism operators to prioritize mobile optimization and AI-driven personalization. Additionally, the integration of loyalty programs, social media promotions, and influencer marketing into online booking ecosystems is expanding customer engagement.

As consumers seek seamless, contactless experiences post-pandemic, the shift toward online travel services is expected to further accelerate, consolidating its dominance in the winter tourism value chain.

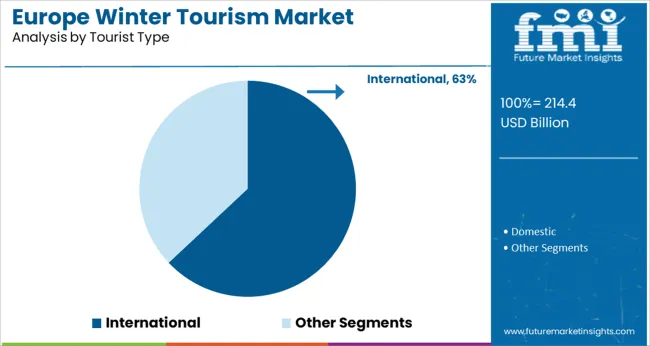

International tourists are projected to comprise 63.0% of the total traveler base in the Europe winter tourism market by 2025, positioning them as the dominant tourist type. This leadership is being driven by Europe’s global reputation as a winter destination, supported by iconic alpine resorts, diverse terrain, and a strong cultural and heritage backdrop. The expansion of low-cost carriers, cross-border rail infrastructure, and digital visa facilitation has significantly reduced travel barriers for tourists from Asia, the Americas, and the Middle East.

High-income travelers from these regions increasingly view European winter holidays as aspirational, prompting repeat visitation and premium package purchases. Furthermore, international tourist expenditure contributes significantly to local economies, boosting demand for multilingual guides, globally accepted payment systems, and tailored service offerings.

The continued marketing of Europe’s winter destinations through international campaigns and participation in global travel fairs has also reinforced the continent’s standing as a top-tier winter holiday destination.

There are many different countries in Europe, each of which has its own significance and may be historical or heritage related. Switzerland, Austria, France, Iceland, Sweden, etc. countries are popular destinations for tourists from all over the world as they have so many places to visit and check out. Tourists come to Europe to experience the lifestyle in cities, enjoy the cuisines, explore nature, and visit historical and famous places.

Millions of people visit these cities each year, eager to return to visit these countries and experience the many facets of these countries: With famous sites such as the Eiffel Tower, the Colosseum, Stonehenge, the city of Athens, Prague Castle, and the canals of Venice. Travelers to Europe are international and even come from Europe itself.

Competition among enterprises in the tourism sector in European nations has shown to be a motivation to spur ongoing progress. Entrepreneurs in the tourist sector are vying to surpass other enterprises, and many of them are doing so effectively by looking for lower-cost alternatives, improving quality, and learning new ways to boost production.

It has been demonstrated that competition among tourism-related businesses in European countries serves as a driving force for forward movement. Tourism-related business owners compete with one another, and many of them succeed in doing so by identifying more affordable alternatives, raising standards, and discovering innovative ways to increase output.

European Travelling Commission (ETC) is responsible for the promotion of European countries as key destinations for tourism. ETC also provides member businesses services, which boosts productivity and competitiveness.

There are multiple initiatives taken by the commission, including the promotion of tours by media, tie-ups with businesses, and establishing direct Business to consumer relations. The Nordic countries are filled with mountains, glaciers, and beaches, which are the main attraction for tourists loving ecological tourism.

These scenarios and landscapes surely are unique experiences for travelers. Also, tourism companies are arranging activities such as skiing, ice skating, and off-road cycling, which will attract an adventure-loving group of tourists.

Tourism has a positive impact on the economy of multiple countries worldwide and Nordic Countries are observing a boost in tourism. This brings unexplored challenges and opportunities as well. Tourism was one of the important agendas of the Nordic Council of Ministers in the last few years.

Tourism is a complex sector, affecting multiple parts of the economy, making it difficult to identify and coordinate common goals. At the same time, tourism has the potential to contribute to economic growth, social inclusion, and environmental awareness.

Tourism in the Nordics is a dedicated Nordic Innovation initiative aimed at fostering Nordic cooperation on innovation in the tourism industry and contributing to a more environmentally, socially, and economically sustainable region.

It focuses on developing new sustainable business models and innovative digital solutions. It has funded projects such as Mobile positioning data for tourism statistics, sustainable tourism in Nordic Harbor Towns, and Nordic Travel Tech Network.

For the promotion and development of Mountain tourism in European countries, UWNTO and the Ministry of Tourism of Andorra are organizing World Congress on Snow and Mountain Tourism. Mountain tourism is tourism that takes place in a defined and limited geographical space, such as a hill or mountain, with specific landscapes, topography, climate, biodiversity (fauna and plants), and characteristics and attributes unique to the local community.

It is a type of activity. Wide range of outdoor recreation and sports activities. The recent congress meeting discussed many factors of mountain tourism development. Topics such as innovation in mountain tourism, sustainable mountain tourism, digital transformation of tourism and its future, etc. were discussed by representatives from a number of European Countries, like Italy, the United Kingdom, France, and Greece.

Wild Sweden is an organization, that works mainly on sustainable wild tours and helps in rural development. It is a member of three regional tourism boards and the Swedish Ecotourism Society. The company is working with local guesthouses and small-scale, family-owned businesses.

They use local transportation such as buses and trains as their tour transportation and fixed partners which serve authentic food, which is also locally produced. This is leading to local business growth and economic boost. Wild Sweden is also planning on offering long-term tour packages, instead of short ones, so that tourists can experience the wilderness up close, rather than just getting a glimpse of nature.

The top players in European tours are offering a number of tours, which are customized according to the preference of tourists. Many tours and travel companies are offering adventure tours, safaris, and cruises in winter, along with visits to the highlights in European countries.

For instance:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Million for Value |

| Key Region Covered | Europe |

| Key Countries Covered | United Kingdom, Switzerland, Austria, Norway, Spain, Netherlands, Sweden, and Greece. |

| Key Segments Covered | Tourism Type, Booking Channel, Tourist Type, Tour Type, Age Group, and Region. |

| Key Companies Profiled | Topdeck; The Natural Adventure Company; G Adventures; Intrepid; GJ Travel; Shamrocker Adventures; Exodus Travel; On Go tours; Tauck; Expat Explore Travel; Thomas Cook Travels; Trafalgar; Wingbuddy; Euroventures |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global europe winter tourism market is estimated to be valued at USD 214.4 USD billion in 2025.

It is projected to reach USD 383.9 USD billion by 2035.

The market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types are skiing, hiking, mountain climbing, trails travel, religious travel and christmas travel.

online booking segment is expected to dominate with a 42.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Europe's Golden Generation Travel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA