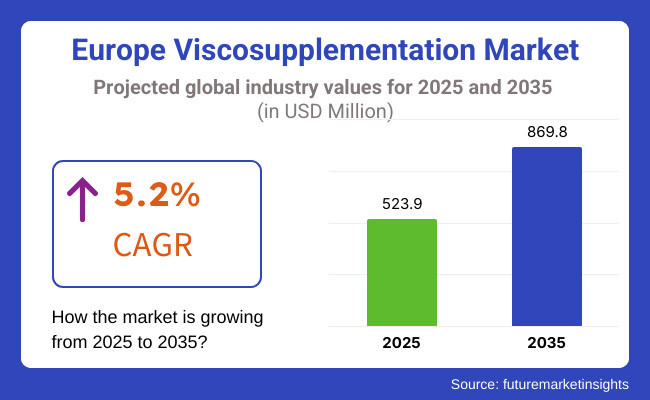

The Europe viscosupplementation market is expected to be reach USD 523.9 million in 2025 and is likely to expand up to approximately USD 869.8 million by the end of 2035. The sales are believed to rise with a CAGR of 5.2% during the period of 2025 to 2035.

The European market for viscosupplementation is expected to grow substantially with increases in osteoarthritis incidents and the popularity of minimally invasive procedures among patients. Formulations of better hyaluronic acid such as cross-linking and multiple injection therapies will improve treatment effects and patient health. Reimbursement policies in key European countries and regulatory initiatives will fuel industry growth.

Rising population age and demand for less invasive procedures also will increase demand. This biologics manufacturers are launching next-generation viscosupplements with increased viscosity and longer duration of action. Market players are increasingly entering into strategic partnerships to drive product development and establish a stronger market presence.

Pricing pressures and competition from other forms of therapy could, however, temper market growth. In spite of these threats, technological progress and extended distribution networks will mold a dynamic and competitive viscosupplementation market in Europe in the next decade.

Explore FMI!

Book a free demo

The German viscosupplementation market is transitioning from traditional hyaluronic acid injections to biomechanical innovations and regenerative medicine strategies. Newly developed cross-linked hyaluronic acid formulations that are not only better but also last much longer are now available because of the research and development in this respect. This provides a possibility to decrease the frequency of injections.

Moreover, manufacturers are working on bioengineered viscosupplement that incorporate hyaluronic acid and growth factors in order to stimulate cartilage regeneration and thus making a more profound impact on osteoarthritis. Unlike the other European markets, Germany has witnessed a dual trend in the health care sector.

The shift towards outpatient viscosupplementation procedures in ambulatory surgery centres (ASCs), which has the dual effect of lowering the hospital burden and patient alluring demand for private pay-treatments is advocating the need for reimbursement constraints, which in turn is making the long-lasting quality formulations push into the self-paying path. Key Players include TRB Chemedica, Anika Therapeutics and others remain as a key contributor to the expansion of the market.

The UK viscosupplementation sector is shifting structurally with various influences such as the changing healthcare policies, the evolving reimbursement frameworks and the rising demand for cost-effective osteoarthritis management. As the NHS has more budget restrictions, viscosupplementation is being increasingly seen as a private-pay treatment which is why premium single-injections are being pushed into self-funded care models.

This shift has inspired market participants to launch subscription-based viscosupplementation services that will give patients regular injections at flexible payment plans. A second trend that stands out is the increasing reach of sports medicine and performance-driven joint care.

The demand for injections of the new type of high-molecular-weight hyaluronic acid that is used for the effectiveness of the duct is raised by professional sportsmen and people who do active sports. Moreover, the opportunity of the UK. to emerge as a global research platform for bioactive viscosupplements is being explored by Ferring Pharmaceuticals and Seikagaku Corporation which look into peptide-enhanced formulations that would probably stimulate the repair of cartilage.

In the future, the market will be formed with the dynamics of precision medicine, as digital health tools will assist in customizing viscosupplementation treatments to the particular patient profile.

The viscosupplementation sector in France is undergoing transformation with a strong focus on early osteoarthritis intervention and synergy with regenerative medicine. France stands out among its European counterparts, as one of the most developed healthcare systems in which reimbursement of viscosupplement system under its public healthcare that is resistant to the changes ensuring the consistent market demand.

Yet, the manufacturers face adversities from the pricing regulations and the issue of generic infiltration which pushes them to go further than just offering nonsurgical hyaluronic acid injections. The predominant pulsation in the French market is the increased use of dual-action viscosupplement that pre-eminently encapsulate hyaluronic acid and anti-inflammatory chemical agents, such as corticosteroids in a bid to achieve a more effective analgesic impact and to the same extent cartilage-saving.

Moreover, the country is coming forth as an academic venue for the counter-current of next-generation viscosupplements, in which primary institutions like INSERM are on a quest for stem cell-source and nanotechnology-based injections which contribute to joint regeneration positively.

With AI implementation, France is at the forefront of using patient profiling which enables the rheumatologists to design the suitable viscosupplementation scheme through predictive analytics. There will be a considerable effect toward the main trend of precision osteoarthritis treatment, which continues to prioritize research toward the application of choice viscosupplementation methods in the upcoming decade.

Challenges

Pricing Pressures and Intense Competition Challenge Market Growth

The European viscosupplementation market is facing growth challenges due to strict reimbursement policies, pricing pressures and competition from alternative therapies. The national healthcare systems in Germany and the UK maintains that only cost-effective solutions can be reimbursed and thus advanced viscosupplements are unable to get the reimbursement approval.

The developments in knee replacement surgeries and the introduction of new biologics give potential alternatives, which in turn slows down the adoption of viscosupplement. Medical practitioners have second thoughts due to the suspicions of efficacy and the need for multiple injections.

The delay in the approval process by regulatory bodies occurs through the enforcement of strict requirements on newly developed formulations. Furthermore, the lack of standardized treatment guidelines throughout Europe leads to inconsistencies, which in turn, hinder the establishment of viscosupplementation as a primary approach for osteoarthritis management.

Opportunities

Hybrid Viscosupplements with Regenerative Agents Unlock New Growth Potential

Medical devices manufacturers have the opportunity to gain benefits through the use of next-generation hybrid viscosupplements that work both with hyaluronic acid and regenerative agents. These compounds accelerate cartilage replenishment while delivering lubrication to the joint and thus interact with the very cause of osteoarthritis instead of simply masking it.

The increasing preference for biologics and regenerative medicine powers up the manufacturers to push off high-priced and high-efficacy viscosupplements that have demand from both patients and healthcare providers. The introduction of digital health solutions and remote monitoring, could also help to optimize the treatment outcomes. These innovations make a positive impact on patient compliance, lift up physician confidence and also start the broader use of viscosupplement in the course of time in the field of osteoarthritis.

Between 2020 and 2024, the viscosupplementation market in Europe witnessed important transformations brought by the factors such as the aged population and the increase in osteoarthritis cases that raised the demand for the alternative of surgery for pain management in joints. The healthcare providers went from multi-injection to single-injection viscosupplements, leading to the overall improvement of client compliance and reduction of clinic visits.

The regulatory boards came up with the approval of new formulations; and, on the other side, the reimbursement policies in France and Germany, which were in favor of adoption, while the NHS budget constraints in the UK sent more clients to self-pay options. The manufacturers, on the other hand, presented cross-linked and prolonged-release hyaluronic acid formulations to treat efficacy. Still, price-setting pressures and competing alternatives such as biologics with knee replacements were the reasons for the market's stunted growth.

In the coming future between, 2025 to 2035, creative medication combined with digital interlocking will remodel the whole industry. Manufacturers will innovate the fill finished products that have both hyaluronic acid and with plate-rich plasma (PRP). These products will not only lubricate, but also regenerate cartilage.

Practitioners will apply AI-based patient profiling and precision medicine techniques to create personalized viscosupplementation schedules, which will lead to better treatment outcomes. As the cost burden rises, manufacturers shall introduce cheap but long-term viscosupplements to establish their accessibility.

The new biotech companies shall disrupt the market on the other hand by bioengineered solutions that will outperform the formulators and will guarantee better joint protection and tissue healing. Minimally invasive treatments for controlling pain will reach many people so that viscosupplementation can still be seen as a preferable treatment as compared to surgery. These innovations will lead to the steady development of the market and changing the way of treating osteoarthritis during the next decade in Europe.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Focus on efficacy and safety of hyaluronic acid-containing products, with regulatory agencies speeding up approvals of novel viscosupplementation procedures. |

| Technological Advancements | Adoption of minimally invasive injection techniques and development of single-injection products to enhance patient compliance. |

| Consumer Demand | Greater patient education resulting in increased demand for non-surgical and minimally invasive osteoarthritis treatment alternatives |

| Market Growth Drivers | Increased incidence of osteoarthritis because of the growing population of the elderly, combined with the development in medical technology allowing improved management of joint ailments. |

| Sustainability | Early initiatives toward creating environmentally friendly manufacturing processes and minimizing the environmental footprint of medical devices |

| Supply Chain Dynamics | Dependence on well-established distribution channels with a view to securing the availability of viscosupplementation therapy in large healthcare facilities. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Introduction of extensive guidelines for customized viscosupplementation regimens and state-of-the-art delivery systems to provide standardized treatment protocols throughout Europe. |

| Technological Advancements | Integration of advanced imaging modalities and AI-driven tools to optimize injection accuracy and treatment outcomes, along with the development of next-generation hyaluronic acid formulations. |

| Consumer Demand | Increase in the popularity of customized and home-based viscosupplementation treatments, with patients demanding therapies that cater to their individual health profiles and lifestyle choices. |

| Market Growth Drivers | Increased healthcare infrastructure across emerging markets in Europe, heightened investment into research and development of new viscosupplementation treatment options, and strategic partnerships among pharmaceutical firms and medical care providers. |

| Sustainability | Full-scale implementation of sustainable practices, such as green manufacturing technologies, use of biodegradable materials in product packaging, and application of energy-efficient processes across the supply chain. |

| Supply Chain Dynamics | Supply chain optimization through digital technology, improving transparency and efficiency and secure timely delivery of customized viscosupplementation products to varied healthcare facilities, including far-flung and underserved areas. |

To conclude, the viscosupplementation market of Europe is set for continuous growth by virtue of technology advances, personalized treatment options, and enlargement of advanced healthcare services to the general public. The need for adaptability to regulatory changes and persistent investment in research and development to cover the variable demands of patients across the region are the key factors for the industry stakeholders.

Market Outlook

The Germany viscosupplementation market will be on its path of growth as healthcare centers will start non-surgical osteoarthritis treatments and the manufacturers will launch brilliant cross-linked hyaluronic acid types. Researchers will be working on regenerative therapies while clinicians will be applying AI-driven patient profiling to make treatments more effective. In-patient staging highlights outpatient procedures, and self-pay options that brunt of patients, are the driving forces for market shaping

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.3% |

Market Outlook

Hybrid therapies that integrate hyaluronic acid with regenerative agents to achieve better treatment results will be incorporated by French clinicians. Bioengineering solutions will be created by scientists whereas the expansion of outpatient procedures will be achieved by hospitals and private clinics. The adoption of AI-driven diagnostics and personalized treatment protocols by healthcare providers will be the main factors leading to the market growth even in the face of pricing pressures and the shifting of reimbursement policies

Market Growth Factors

The Accumulating Osteoarthritis Cases: An increasing number of people suffering from osteoarthritis is a leading factor driving the demand for viscosupplementation.

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| France | 5.4% |

Market Outlook

There is a growing viscosupplementation adoption among UK clinicians amid increasing private sector demand for osteoarthritis treatments not requiring surgery, manufacturers are introducing single-injection, high-end offerings to respond to the emerging self-pay due to NHS spending cuts, healthcare practitioners are applying artificial intelligence-driven diagnosis and distant monitoring to boost precision in treatments. Private outpatient units and clinics, despite the limits on reimbursements, are driving market growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.2% |

Market Outlook

Viscosupplementation Market in Italy is shifting towards high-end products as patients have increasingly opting for non-surgical treatments for osteoarthritis. Clinicians primary strategies remain the use of single-injections and regenerative therapies as they help in the improvement of the patient compliance and outcomes.

Overall, the private hospitals are complementing self-pay treatment options with the reimbursement problems explored. While on the other hand, there is much innovation on biologic-enhanced viscosupplements. Outpatient clinics and digital health solutions are bringing patients closer to the healthcare services and thereby making a considerable positive impact on the market.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Italy | 5.8% |

Market Outlook

Spain's viscosupplementation sector is expanding as physicians embrace non-surgical osteoarthritis interventions to treat an aging population. Producers are introducing innovative single-injection and cross-linked hyaluronic acid products to improve treatment effectiveness. Private payers are increasing private pay choices as reimbursement issues restrict adoption in public healthcare.

Research organizations are developing regenerative viscosupplements, combining growth factors and biologics to optimize joint protection. Telemedicine sites and outpatient facilities are expanding viscosupplementation access, guaranteeing wider market penetration. In spite of cost constraints and competition from other forms of therapy, patient need and technological innovations are supporting market growth

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Spain | 6.2% |

Single Injection Viscosupplementation: Single-Injection Viscosupplementation Transforming Osteoarthritis Care in Europe

The Single-Injection viscosupplementation is fast becoming a popular choice among patients in the European market. They want it because this therapy is easy to do, it burdens you less, and it is the least invasive. These injections are characterized by the use of very high molecular weight hyaluronic acid (HA) where the effect creates joint mobility and comfort of the osteoarthritis (OA) patients in the shortest time.

The factor causing the biggest increase in the single-injection demand is the growing elderly demographic and the simultaneous growth in knee osteoarthritis and outpatient procedures. The market is mostly Western Europe, with Germany, France, and the United Kingdom, which are pioneering single-injection use, mainly due to favorable reimbursement policies and a strong orthopedic system. Eastern Europe, meanwhile, is experiencing an increase in demand for the product because of the higher awareness and more availability of advanced treatments.

Among other things, single-injection biosensors with AI for knee imaging will be the future trend for the personal viscosupplementation dispensing, and the bioengineered HA formulations will be the extended joint protection. The innovative working of combining HA with techniques like PRP (platelet-rich plasma) will become the next stage of developing regenerative medicine.

Three Injection Viscosupplementation: Three-Injection Therapy Gains Popularity in Moderate Osteoarthritis Management

The Three-Injection viscosupplementation continues to be a highly recommended treatment protocol proportioning a balanced act of benefit and patient compliance. This type of approach not only gives patients a longer relief from symptoms compared to single injection but also is considered the first choice of orthopedic specialists for moderate cases of osteoarthritis.

The preference for short-term solutions for joint pain is increasing, and their use is broadening in treating sports injuries, while patients now consider HA therapy as a substitute for surgery, which are the factors that have created the demand. The most advanced economies in the management of OA-inflicted countries are the West and North Europe, which have a secure healthcare-funded system to support their initiatives, while the South and the East parts of Europe are growing steadily due to the increasing number of orthopedic clinics.

Upcoming developments are likely to include next-generationHA injections with increased bioavailability, AI-driven predictive models for patient response assessment, as well as newHA-collagen hybrid formulations for the protection of the joint.

Hospitals: Hospitals Dominate Europe’s Viscosupplementation Market as Primary OA Treatment Centers

The largest market portion in viscosupplementation in Europe is held by Hospitals as they are the essential centres for osteoarthritis diagnosis and treatment. These locations handle advanced OA cases, post-traumatic joint conditions, and the patients who need to follow multimodal pain management strategies in which the use of viscosupplementation becomes a part of the orthopaedic treatment plan.

The rise in knee replacement surgeries, hospital-based preference for the adoption of non-surgical ways of treating OA illnesses, and public healthcare centres are increasingly choosing viscosupplementation as the first-line therapy which is convincing factors for people to use it.

Germany, France and the UK dominate the sector in hospital-based viscosupplementation procedures. The popular developments will be robotic-assisted HA injection guidance, AI-powered hospital pain management platforms, plus the combined application of viscosupplementation alongside individual rehabilitation programs.

Orthopaedic Clinics: Orthopaedic Clinics Offer Faster, Cost-Effective, and Personalized Joint Care

Viscosupplementation becomes a main avenue for the orthopaedic clinics, due to the outpatient-based increase of OA treatment and the demand for joint care. Aside from being the fastest patient delivery clinic and disposing of less expensive viscosupplementation options, these clinics also provide a good emotional response through personalized treatment especially to active older adults and sports injuries.

Minimal invasive surgery is being adopted, possibilities of outpatient surgeries not involving hospitals are preferred, and the connection between the clinics and the sports rehabilitation centres is improving, which is the reason for market extension. Increasing private health networks spur the growth of orthopaedic clinic, while the Western Europe region is still the capital of regional HA placed therapies.

The Europe viscosupplementation market is intense and competitive, basically due to the raised osteoarthritis cases, the soaring need for non-invasive pain control techniques, and the progress in the hyaluronic acid-related therapy.

The enterprises are backing innovations such as multi-injection and single-injection formulations, biocompatible gels, and long-lasting viscosupplements to keep ahead of the competition. The market is influenced by some leading pharmaceutical companies, biotechnology firms, and orthopaedic solution suppliers, where all of them take their part in the constant development of the viscosupplementation treatment options in Europe.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Sanofi | 22-26% |

| Anika Therapeutics | 18-22% |

| Bioventus | 10-14% |

| Fidia Farmaceutici | 8-12% |

| Seikagaku Corporation | 5-9% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Sanofi | Market leader offering Synvisc and Synvisc-One, known for long-lasting relief in osteoarthritis treatment. |

| Anika Therapeutics | Develops advanced hyaluronic acid-based viscosupplements such as Orthovisc and Monovisc. |

| Bioventus | Specializes in multi-injection and single-injection viscosupplementation therapies, including Durolane. |

| Fidia Farmaceutici | Offers a range of HA-based injections for osteoarthritis, including Hymovis and Hyalgan. |

| Seikagaku Corporation | Develops innovative joint health solutions, including hyaluronic acid-based viscoelastic supplements. |

Key Company Insights

Sanofi (22-26%)

A dominant player in the viscosupplementation market, Sanofi’s Synvisc products are widely used for long-term osteoarthritis pain relief.

Anika Therapeutics (18-22%)

A leader in hyaluronic acid-based orthopedic treatments, Anika provides high-quality, minimally invasive viscosupplements.

Bioventus (10-14%)

A key provider of osteoarthritis management solutions, Bioventus focuses on injectable therapies for joint lubrication and pain reduction.

Fidia Farmaceutici (8-12%)

A specialist in HA-based treatments, Fidia Farmaceutici delivers innovative and effective viscosupplementation solutions.

Seikagaku Corporation (5-9%)

Known for its expertise in glycoscience research, Seikagaku develops high-quality hyaluronic acid therapies for joint care.

Other Key Players (25-35% Combined)

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

The Europe Viscosupplementation industry is projected to witness CAGR of 5.2% between 2025 and 2035.

The Europe Viscosupplementation industry stood at USD 497.6 million in 2024.

The Europe Viscosupplementation industry is anticipated to reach USD 869.8 million by 2035 end.

China is expected to show a CAGR of 5.4% in the assessment period.

The key players operating in the Europe Viscosupplementation industry are Sanofi, Anika Therapeutics, Bioventus, Fidia Farmaceutici, Seikagaku Corporation Zimmer Biomet, Meda Pharma (Mylan), OrthogenRx, LG Chem and others

Single Injection Viscosupplementation, Three Injection Viscosupplementation, Five Injection Viscosupplementation, Next Generation (Steroid Combination)

High Molecular Weight, Medium Molecular Weight, Low Molecular Weight

Hospitals, Ambulatory Surgical Centers and Specialty Clinics

The Prurigo Nodularis (PN) Treatment Market is segmented by product, and end user from 2025 to 2035

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.