The Europe Starch Derivatives market is set to grow from an estimated USD 8,097.6 million in 2025 to USD 12,684.1 million by 2035, with a compound annual growth rate (CAGR) of 4.6% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 8,097.6 million |

| Projected Europe Value (2035F) | USD 12,684.1 million |

| Value-based CAGR (2025 to 2035) | 4.6% |

The European starch derivatives market has moved progressively from 2020 to 2024 based on increasing demand from consumers and industries, which cut across a vast industry. The starch derivatives represent the processed starch in different uses with superior functional benefits.

From traditional raw starches from corn, potato, and wheat to wide derivatives with use found in food and beverages, pharmaceuticals, chemicals, and personal care products, the market for these derivatives will only continue growing. Players are spread widely, with everything from giant international manufacturers to smaller niche regional companies, which form the diversity of the European starch derivative market.

Thickeners, stabilizers, sweeteners, and texturizers are the forms that are applied widely to achieve high quality and functionality in these products. The development of starch derivatives in Europe is the result of the growing request for food and beverage processing, which will bring to focus modern starches as low-cost, functional ingredients.

Explore FMI!

Book a free demo

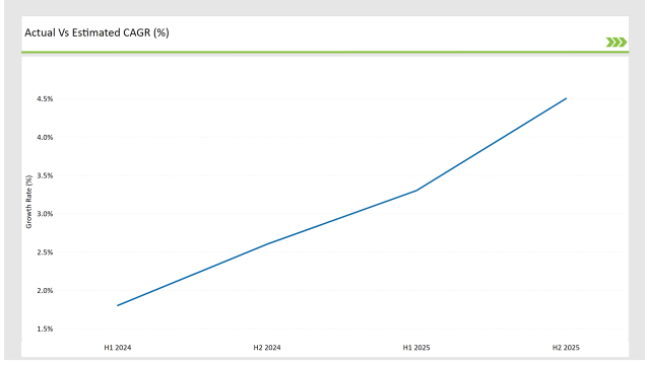

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Starch Derivatives market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 1.8% (2024 to 2034) |

| H2 2024 | 2.6% (2024 to 2034) |

| H1 2025 | 3.3% (2025 to 2035) |

| H2 2025 | 4.5% (2025 to 2035) |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Starch Derivatives market, the sector is predicted to grow at a CAGR of 1.8% during the first half of 2024, with an increase to 2.6% in the second half of the same year.

In 2025, the growth rate is anticipated to slightly decrease to 3.3% in H1 but is expected to rise to 4.5% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April 2024 | Sustainable Sourcing Expansion - Cargill introduced a new range of sustainably sourced starch derivatives derived from non-GMO corn, furthering their commitment to reducing their carbon footprint. |

| March 2024 | Technological Innovation in Food Applications - Ingredion launched a new line of tapioca-based modified starch derivatives that provide enhanced texture and longer shelf-life in gluten-free bakery products. |

| February 2024 | Product Expansion for Pharmaceutical Industry - Archer Daniels Midland (ADM) expanded its product offerings with a novel resistant starch derivative aimed at the pharmaceutical industry, focusing on drug delivery systems and dietary supplements. |

Latest developments in modified starch derivatives for clean-label foods

As European consumers became more health conscious, demand for clean-label products-free of artificial ingredients, preservatives, and complex additives-has surged.

According to this need, the starch derivative market has been through a host of innovations. One such advancement in this context is the replacement of synthetic stabilizers and food texturizers with starch derivatives as natural ones, thus outshining their counterparts like gums and artificial emulsifiers.

Modified starches derived from corn, potatoes, and tapioca are particularly popular for their ability to enhance food texture, viscosity, and mouthfeel without compromising the purity of the ingredients.

For instance, maltodextrin and cyclodextrin are starch-derived compounds used within beverages and dairy products to contribute to texture modifications and longer storage periods without the use of preservatives or artificial sugars.

Companies like Ingredion and Cargill are leading transformation, with the former offering clean-label starch derivative solutions and, through research and development, enhancing functionalities of these products to provide strong performance in wide applications.

Growth of starch derivatives in pharmaceutical applications

The pharmaceutical industries are the other significant source of growth in the starch derivatives market in Europe. The demand has been heavily driven by pharmaceuticals and drug delivery systems, as well as dietary supplements.

The starch derivatives are applied primarily in the formulation of both solid and liquid dosage forms, predominantly as excipients in tablet and capsule formulations, where they play a key role in the dissolution and bioavailability of drugs. Modified starches, such as pregelatinized starch, that are processed for improved solubility are essential in the delivery of APIs effectively.

It is the future trend of personalized medicine and nutraceuticals that is rapidly increasing the demand for starch derivatives with targeted functionality that can be tailored for drug delivery systems. The increased demand for highly efficient and precise delivery systems for drugs will result in the increasing application of starch derivatives in controlled-release systems as well as high-dose drug formulations.

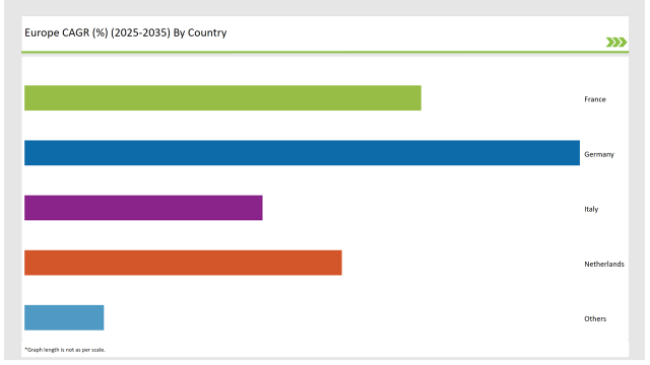

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 35% |

| France | 25% |

| Netherlands | 20% |

| Italy | 15% |

| Others | 5% |

Starch derivatives in Europe are dominated by Germany, which is also growing rapidly in the future. Major factors driving growth in Germany are its focus on sustainability, food processing industry, and strong pharmaceutical industry, apart from its trend towards innovation. The country has an important position for both the chemical and food industries as a source of new starch-based ingredients.

German manufacturers have experienced consumers shifting towards products of plant-based and gluten-free origin. There are highly used starch derivatives such as tapioca and corn starch for improving food and beverage-based products. In the country, pharmaceutical also shows significant demand for starch derivatives including drug delivery systems and nutraceuticals.

Another significant participant in the European starch derivatives market has emerged in France and is gaining more focus on functional food ingredients. Being one of the considerable countries with a large food and beverage sector, France is witnessing increasing demand for healthier food products, from which resistant starch emerges as a quite popular functional ingredient gaining resonance with health benefits ranging from gut to immune health.

Now, French consumers are becoming more health-conscious and hence require low-calorie, high-fibre food. This has triggered the rising demand for starch derivatives supporting nutritional goals. The French government is also supporting organic farming and there is an increasing trend of traceability in food. Organic starch derivatives from sources such as corn and wheat have witnessed a surge in demand.

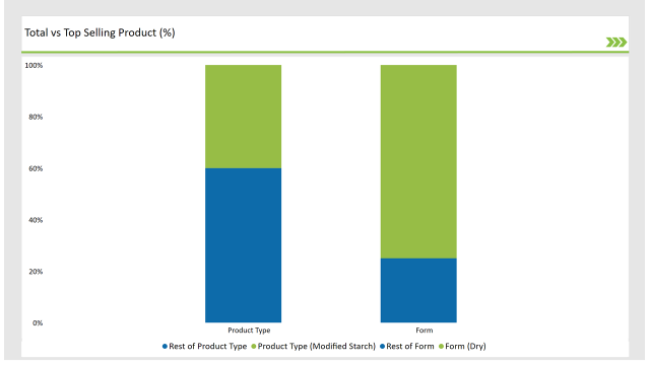

% share of Individual Categories Product Type and Form in 2025

| Main Segment | Market Share (%) |

|---|---|

| Product Type (Modified Starch) | 40% |

| Remaining segments | 60% |

Growth is driven mainly by increased demand for functional ingredients in different industries, including food and beverages, pharmaceuticals, and personal care.

Modified starches have higher strengths in thickening, gelling, and stabilization properties, hence being very significant in the preparation of a whole line of products. The applications of modified starches in food production are becoming more popular owing to their improved texture, enhanced shelf life, and mouthfeel properties of prepared foods.

Clean-label trends are also gaining popularity these days as consumers demand products that contain natural and recognizable ingredients. The growth path of the segment will continue as manufacturers are constantly developing new modified starch formulations to address the specific requirements of various applications.

| Main Segment | Market Share (%) |

|---|---|

| Form (Dry) | 75% |

| Remaining segments | 25% |

The dry form holds the most significant position in the European market of starch derivatives. Because of the advantages of dry starch, it also has a very diversified application scope, besides being very convenient.

Dry starch is commonly used in food preparation for sauce thickening and soups as well as in gravies and is frequently included in baked foods for texture, among other attributes, and in retention of moisture. Dry starch is also less bulky and easily handled; consequently, most companies prefer dry starch, making the whole process almost efficient.

The rising tide of clean-label products is another emerging trend that will drive up demand for dry starches. Dry starch would be perceived as more natural than a liquid counterpart. The dry version is highly favoured in other applications such as adhesives, textiles, and paper goods, where their functional properties will be essential.

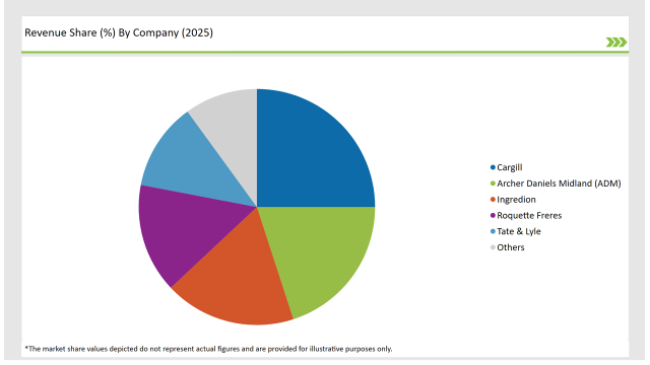

2025 Market share of Europe Starch Derivatives manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Cargill | 25% |

| Archer Daniels Midland (ADM) | 20% |

| Ingredion | 18% |

| Roquette Freres | 15% |

| Tate & Lyle | 12% |

| Others | 10% |

Note: The above chart is indicative in nature

The European starch derivatives market can be segmented into Tier 1, Tier 2, and Tier 3 companies. Tier 1 companies include the top companies that operate with large geographic scales and strong global presence with good market shares. They dominate and have an intensive research presence over innovative starch derivatives and trendsetters in the business.

Some of the major players in the market are Cargill, ADM, and Ingredion, which have a very large portfolio of starch derivatives catering to food, pharmaceutical, and industrial applications. They have set up production facilities in Europe and are constantly innovating to respond to changing consumer needs.

Tier 2 companies, Roquette and Südstärke, are mostly regional in orientation and offer custom starch derivatives specifically for niche applications. They best understand the regional markets and their consumers' requirements, which helps them to prepare products that answer the needs of their customers better than any other type.

Tier 3 company, the small regional player looking to acquire a business in a location that has the most specialized products, generally localized to areas. These companies should not have a level of R&D facilities compared to the big beasts but still are very important since they provide focused solutions for various industries, mainly organic and non-GMOs.

The Europe Starch Derivatives market is projected to grow at a CAGR of 4.6% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 12,684.1 million.

Key factors driving the starch derivatives market in Europe include the increasing demand for clean label and natural ingredients in food and beverage products, as well as the growing applications of starch derivatives in various industries such as pharmaceuticals, cosmetics, and textiles. Additionally, the trend towards healthier eating and the need for functional ingredients are further propelling market growth.

Germany, France, and Netehrlands are the key countries with high consumption rates in the European Starch Derivatives market.

Leading manufacturers include Cargill, Archer Daniels Midland (ADM), Ingredion, Roquette Freres, and Tate & Lyle known for their innovative and sustainable production techniques and a variety of product lines.

As per Product Type, the industry has been categorized into Modified Starch, Sweeteners, Native Starch, and Cationic Starch.

As per Source Type, the industry has been categorized into Corn, Potato, Wheat, and Cassava.

As per Application, the industry has been categorized into Food & Beverages, Paper & Paperboard, Feed Industry, Pharmaceuticals, and Textiles.

As per Form Type, the industry has been categorized into Dry, and Liquid.

As per Functionality, the industry has been categorized into Thickening, Stabilizing, and Binding, Emulsifying.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Comprehensive Analysis of Pet Dietary Supplement Market by Pet Type, by Product Type, By Application, and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.