The Europe Sports Nutrition market is set to grow from an estimated USD 7,231.3 million in 2025 to USD 14,634.4 million by 2035, with a compound annual growth rate (CAGR) of 7.3% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 7,231.3 million |

| Projected Europe Value (2035F) | USD 14,634.4 million |

| Value-based CAGR (2025 to 2035) | 7.3% |

The European sports nutrition market is witnessing a considerable growth rate which is the result of the rapid shift towards active lifestyles, increasing awareness of fitness nutrition, and the higher request for plant-based performance supplements.

Increasing numbers of consumers who participate in recreational sports, endurance training, and muscle-building exercises, have been the primary growth factor of the demand for high-quality, functional, and convenient nutrition products.

Consumers prefer more options such as dairy-free, soy-free, and allergen-free protein like pea protein, brown rice protein, and hemp-based protein powders. Moreover, sports nutrition is changing due to the increase of functional ingredients such as adaptogens, amino acids, probiotics, and electrolyte blends.

The market is also experiencing growth in sustainability, clean-label formulations, and new delivery formats like RTD drinks, protein bars, and plant-based protein powders. Also, the market saturation of traditional protein supplements has prompted the brands to expand their lines with items like pre-workout formulas, hydration boosters, and personalized nutrition strategies.

Explore FMI!

Book a free demo

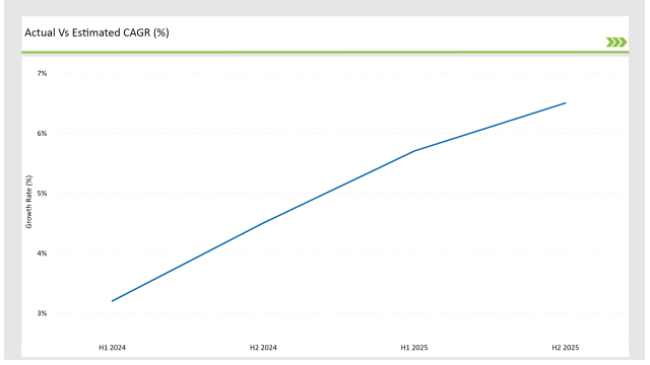

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Sports Nutrition market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 3.2% (2024 to 2034) |

| H2 2024 | 4.5% (2024 to 2034) |

| H1 2025 | 5.7% (2025 to 2035) |

| H2 2025 | 6.5% (2025 to 2035) |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Sports Nutrition market, the sector is predicted to grow at a CAGR of 3.2% during the first half of 2024, with an increase to 4.5% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 5.7% in H1 but is expected to rise to 6.5% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April-24 | MyProtein launched a pea and brown rice protein blend targeting endurance athletes. |

| March-24 | Glanbia Nutritionals expanded its RTD sports beverage range with enhanced rehydration formulas. |

| February-24 | Nestlé Health Science acquired a European plant-based sports supplement startup to strengthen its functional nutrition portfolio. |

| January-24 | Optimum Nutrition introduced a performance-focused recovery shake featuring probiotics and post-exercise adaptogens. |

Plant-Based Sports Nutrition: Clean-Label and Sustainable Protein Market Stealing the Show

The trend today is looking for protein from plant sources such as peas, hemp, and brown rice proteins which are non-dairy hypoallergenic, and easy to digest. Companies innovate by blending plant proteins that not only provide full amino acid profiles but also support effective muscle recovery and energy that lasts longer.

Brand sustainability is of course the main reason behind the movement on plant-based sports nutrition. The brands that utilize organic, regenerative agriculture, and carbon-neutral ingredient sourcing have a privileged position in the market.

Broadening of Hydration and Performance Enhancement Formulas for Endurance and Strength Athletes

Market demand for sports supplements goes beyond traditional protein supplementation. Rehydration and endurance-focused formulations have gained traction, particularly among runners, cyclists, and CrossFit athletes.

The electrolyte-enriched hydration powders market, alongside amino acid-added pre-workout drinks, and adaptogenic performance boosters, is booming because the research supports these for optimal performance in sports.

Companies like Glanbia, Isostar, and PowerBar target personalized hydration strategies by focusing on the individual’s sweat rates, electrolyte loss patterns, and endurance needs. For example, L-citrulline, beta-alanine, and nitric oxide boosters are now the functional ingredients in pre-workout and intra-workout formulas, so you will not only experience muscle endurance, and delayed fatigue but also improved oxygen transport.

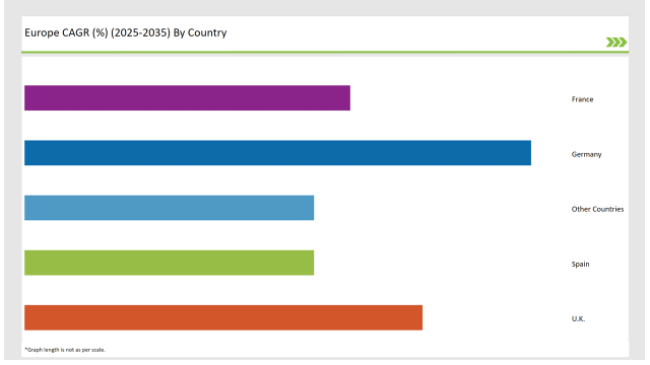

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 28% |

| Spain | 16% |

| UK | 22% |

| France | 18% |

| Other Countries | 16% |

The United Kingdom has grown to be a top competitor not only in demand but also in perceived functional and personalized sports nutrition; this was only made possible by the e-commerce boom, direct-to-consumer (DTC) system brands, and the high participation of a fitness-conscious population.

Personalized nutrition apps, AI supplement recommendations, and DNA-based sports nutrition plans have been resistant and a best-case scenario for consumer needs especially on fitness and supplementation.

By employing technology to make individualized macronutrient ratios, amine acid profiling, and goal-directed constitutions, leaders in the field such as Huel, MyProtein, and Bulk are assuring that even ordinary lifters and professional sportspeople use their products.

The push towards the vegan segment has also gained momentum from the green movement in the UK which has made vegan protein powders, energy bars, and hydration solutions highly sought-after among consumers.

Active product reformulations using pea, cannabis seed, and brown rice protein sources are the main direction taken by the firms that distribute plant-based products.

Italy has taken a forefront position in the field of recovery and endurance sports nutrition, thanks largely to the strong cycling, running, and endurance sports culture in the country. Both professional and amateur Italian athletes make use of scientifically proven recovery supplements, carbohydrate-electrolyte hydration blends, and collagen-enriched protein powders for muscle support, joint health, and long-term performance.

Marketers and fitness enthusiasts in Italy, such as EthicSport, Enervit, and NamedSport, are the ones who directly target the primary market by producing branched-chain amino acid (BCAA) intra-workout drinks, protein shakes designed for recovery, and nitric oxide boosters to improve circulation and oxygen transport.

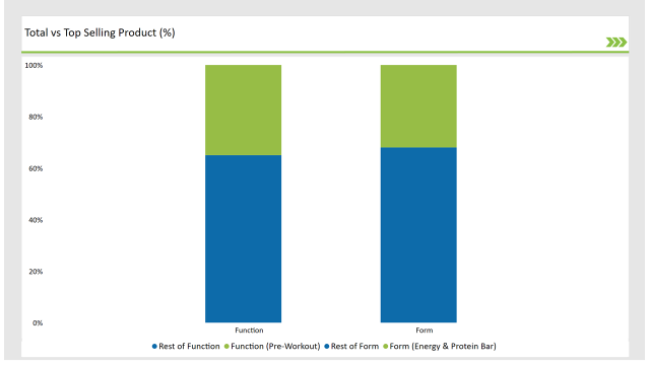

% share of Individual Categories Product Form and Function in 2025

| Main Segment | Market Share (%) |

|---|---|

| Form (Energy & Protein Bar) | 32% |

| Remaining segments | 68% |

On-the-go, performance-focused snack demands that drive innovation in high-protein, mostly fibre-rich, and plant-based protein bars. They are the breadwinners of the both pre- and post-workout nutrition domains.

Grenade, Clif Bar, and Barebells are some of the brands famous for the launch of low-sugar, keto-friendly, and high-protein bars that are aimed at athletes, gym-goers, and predominantly active consumers in search of fast, nutritious, and functional snacks.

Also, the trend of multi-layered, dessert-inspired protein bars that had been newly introduced has contributed to this genre. These bars are sold as a better flavor experience with no protein quality imperfections.

The addition of supermarket groups, fitness retail stores, and e-commerce sites that offer a broad selection of functional protein bars is also expected to increase the growth of the product as it is perceived as a convenient and performance-enhancing snack option.

| Main Segment | Market Share (%) |

|---|---|

| Function (Pre-Workout) | 35% |

| Remaining segments | 65% |

With more customers turning to high-intensity strength training, endurance running, and functional fitness programs, the sales of ergogenic pre-workout solutions have nearly taken off. Pre-workout products such as caffeine, L-citrulline, beta-alanine, and nitric oxide boosters often are the kick-starters for more focus, more endurance, and direct oxygen transport to muscles.

The best-known brands such as Optimum Nutrition, BSN, and Cellucor are broadening both their stimulant-based and non-stimulant pre-workout formulations, so the users are free to choose energy and endurance support depending on their individual goals in fitness.

These new fancy feature pre-workouts that come along with a clean label and botanical extracts as they seek to attract consumers who desire sustainability and absorb energy without side effects.

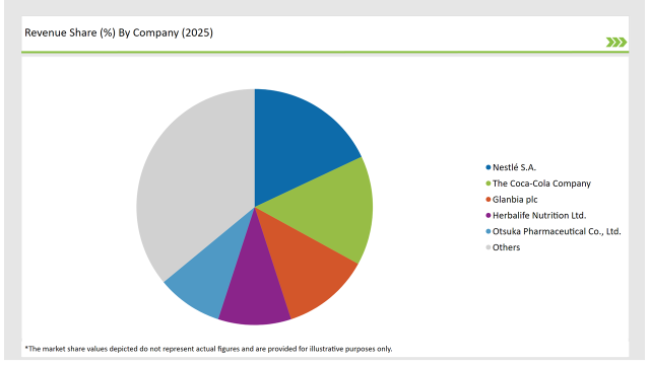

2025 Market share of Europe Sports Nutrition manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Nestlé S.A. | 18% |

| The Coca-Cola Company | 15% |

| Glanbia plc | 12% |

| Herbalife Nutrition Ltd. | 10% |

| Otsuka Pharmaceutical Co., Ltd. | 9% |

| Others | 36% |

Note: The above chart is indicative in nature

Gaining ground in Europe, sports nutrition is a sector that is highly competitive and involves a variety of players ranging from global multinational corporations right down to the newly launched direct-to-consumer brands, all of whom are vying for the favor of an ever-growing consumer base.

Acquiring brands like Glanbia, Nestlé Health Science, MyProtein, Optimum Nutrition, and Herbalife strategically through product diversification, and scientific collaborations display their dominance in the sector.

To this effect, these brands are pouring in resources into clinical research, sports science partnerships, and digital marketing strategies thus giving their brands a distinction as well as guaranteeing consumer trust in performance nutrition products.

Plant-based nutrition, functional adaptogens, and AI-optimized fitness supplements are marks of the market being revitalized, making companies continually and promptly their portfolios to offer the real next-generation sports nutrition solutions.

The Europe Sports Nutrition market is projected to grow at a CAGR of 7.3% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 14,634.4 million.

Key factors driving the Europe sports nutrition market include the increasing health consciousness among consumers and the growing popularity of fitness and wellness trends, leading to higher demand for protein supplements and functional foods. Additionally, the rise of e-commerce and innovative product offerings are enhancing accessibility and consumer engagement in the market.

Germany, France, Italy and UK are the key countries with high consumption rates in the European Sports Nutrition market.

Leading manufacturers include Nestlé S.A., The Coca-Cola Company, Glanbia plc, Herbalife Nutrition Ltd., and Otsuka Pharmaceutical Co., Ltd. known for their innovative and sustainable production techniques and a variety of product lines.

As per Ingredient Type, the industry has been categorized into Plant Based, and Animal Based.

As per Product Form, the industry has been categorized into Ready-to-drink, Energy & Protein Bar, Powder, and Tablets/Capsules.

As per Function, the industry has been categorized into Energizing Products, Rehydration, Pre-Workout, Recovery and Weight Management.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.