The Europe Sourdough market is set to grow from an estimated USD 52.9 million in 2025 to USD 92.5 million by 2035, with a compound annual growth rate (CAGR) of 5.8% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 52.9 million |

| Projected Europe Value (2035F) | USD 92.5 million |

| Value-based CAGR (2025 to 2035) | 5.8% |

The European sourdough market has grown spectacularly over the last few years, fuelled by the consumer's trend towards healthier, minimally processed foods and an increased interest in artisanal and traditional baking methods.

A naturally leavened bread that has been increasingly gaining popularity, sourdough is perceived as having better health benefits than traditional yeasted bread: lower glycemic index, higher digestibility, and more complex flavour. It has a wide range of sourdough types that include traditional, whole grain, rye, white, and multigrain, which respond to the changes in consumer preference across Europe.

The growth in the sourdough market is also driven by the rising interest of consumers to have organic and clean-label food products, as well as sustainably sourced ones with quality ingredients. The European sourdough market is represented by both large multinational food manufacturers, such as Grupo Bimbo and Aryzta, and smaller regional artisan bakeries.

These companies use a range of strategies to adapt to the growing demand for premium, health-conscious baked goods, including launching new product lines; offering gluten-free or vegan products; and wide distribution networks that include health food stores and online channels.

Explore FMI!

Book a free demo

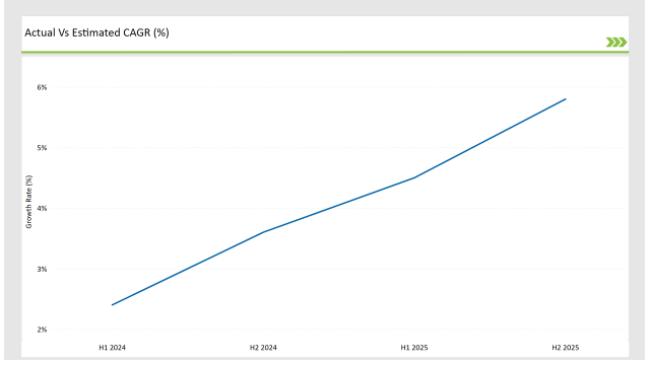

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Sourdough market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 2.4% (2024 to 2034) |

| H2 2024 | 3.6% (2024 to 2034) |

| H1 2025 | 4.5% (2025 to 2035) |

| H2 2025 | 5.8% (2025 to 2035) |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Sourdough market, the sector is predicted to grow at a CAGR of 2.4% during the first half of 2024, with an increase to 3.6% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 4.5% in H1 but is expected to rise to 5.8% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April-2024 | New Product Launch: Traditional sourdough bread with added fiber and probiotics enters the European market to cater to the growing demand for gut-health promoting products. |

| March-2024 | Expansion of Distribution: Major sourdough brands expand their presence in online grocery stores, making it easier for consumers to access fresh, artisanal sourdough products. |

| February-2024 | Sustainability Initiative: A leading European sourdough manufacturer introduces eco-friendly packaging made from 100% biodegradable materials to reduce environmental impact. |

Sourdough as a Natural and Health-Conscious Bread Option

Over the past few years, there has been a growing interest amongst European consumers in natural, artisanal bread products that have both flavour and health benefits. It is no surprise that sourdough, a product using natural fermentation with wild yeast and lactic acid bacteria, has gained popularity mainly because of its potential digestive benefits and clean-label status.

Unlike commercial yeast-leavened bread, sourdough is much easier to digest. Long fermentations can be used to break down gluten within the dough for some individuals suffering from gluten intolerance.

European consumers, in a bid to better their health conditions, have learned of these attributes and have welcomed sourdough into many family kitchens and in trendy restaurants serving healthy foods.

As more and more people are becoming interested in gut-friendly products, sourdough bread is composed of probiotics that support the gut microbiome, thereby adding to the huge demand for sourdough bread and its related products like pizza dough, crackers, and pita bread.

Innovation in sourdough flavours and product offerings.

Dramatic innovation is taking place in the European sourdough market regarding taste profiles and product varieties. Manufacturers and artisan bakeries have been developing new means of differentiating their sourdough offerings.

Traditional sourdough is no longer what it used to be; its variants, once limited to the more basic white and whole wheat variety, now abound with exciting new flavours and textures.

Rye and multigrain sourdoughs are gaining popularity in Germany and other Scandinavian countries wherein the appetite for dark, hearty breads are prevalent. Whole grain sourdough, with higher fiber and nutritional values compared with its counterparts, is trending because consumers are more conscious of how healthy their diets should become.

There are also new product formats such as sourdough crackers, buns, and pizza dough, exploiting the growth in snack food and convenience food. In this respect, sourdough pizza dough has gained popularity among European consumers looking for a healthy alternative to traditional pizza bases, with its natural fermentation process giving it a unique texture and flavour.

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 24% |

| Italy | 18% |

| Spain | 14% |

| France | 32% |

| Other Countries | 12% |

One of the highest compound annual growth rates in sourdough consumption across Europe has been recorded in the United Kingdom during the last couple of years. It is on the back of the increasing awareness among consumers toward healthier eating and a growing desire for artisanal products. Sourdough bread demand has soared in Britain as a whole and among urbanites seeking healthier and less processed versions of traditional bread.

This can be attributed to the general trend towards functional foods and beverages, items that offer benefits beyond mere nutritional value. Since consumers have begun to become aware of the health benefits associated with naturally fermented food for the digestive and immune systems, sourdough bread has been positioned as healthier because of its probiotic content and lower glycemic index than regular bread.

The UK also has a strong food experimentation culture; it will inject sourdough into so many food categories, like pizza dough, biscuits, and even cakes, enabling it to reach an extremely diverse group of consumers.

Germany is yet another European nation where sourdough is going through a significant growth phase; the culture of bread consumption goes way back. Bread is widely appreciated in the German market and sourdough is a mainstay of its traditional bread making.

Recently, sourdough has become very popular as an upscale, healthy product both in urban and rural areas. German demand for whole-grain and rye sourdough has rapidly increased, however, as Germany's consumers generally seek healthier products that fit a healthy lifestyle better.

Furthermore, the trend is also being facilitated by the rapid growth in consumer demand for naturally and organically produced foods since consumers are highly concerned with fewer additives and the use of more tradition-based production.

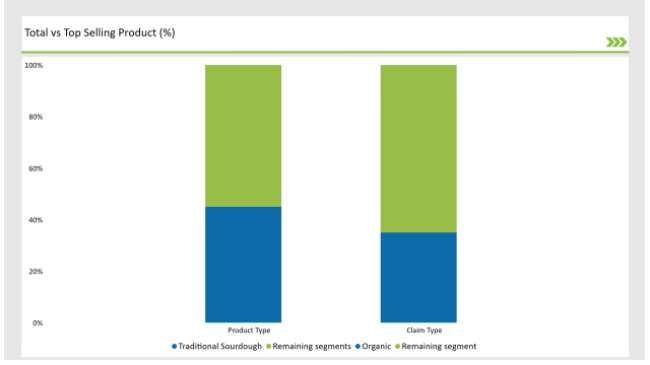

% share of Individual Categories Product Type and Claim Type in 2025

| Main Segment | Market Share (%) |

|---|---|

| Product Type (Traditional Sourdough) | 45% |

| Remaining segments | 55% |

The sourdough segment of the traditional style permeated the European sourdough market due to its sense of authenticity and the health benefits available. As customers grow increasingly interested in the more recent concepts of natural and growth foods, rather than opting for sourdough, consumers are more likely to be attracted to beer because of its unique flavor and the secondary advantages of fermentation.

It has been this trend that makes consumers hold health as very valuable and take caution about food eaten that made demand for the traditional sourdough increase more. It is frequently referred to as being bread of the healthier sort; because this comes out with fewer indexed foods relative to commercially mass-produced products.

In addition to the benefits of probiotics, becoming popular is a trend of clean-label items such as traditional sourdough ones made from organic and local ingredients. The sector which is about production of sourdough is expected to develop continuously as the bakeries and manufacturers adopt traditional techniques and increase the quality of sourdough to prove their worth.

| Main Segment | Market Share (%) |

|---|---|

| Claim Type (Organic) | 35% |

| Remaining segments | 65% |

Organic claims are the most extraordinary growth sector in the sourdough market in Europe, indicating that the aged shift in consumers toward cleaner and fresher foods has taken place. Currently with the leap of one inclusion and the fear of pesticides and fertilizers being removed, the demand for sourdough products came out gluten-free, organic, fair trade which is feasible among the organically produced ones.

This is the most common trend noticed, mostly among health-conscious individuals who pay much attention to the meals they are eating, and some of them are willing to pay more for organic products.

Organic sourdough besides the fermentation process, traditional value gives the product which is transparently produced food. The result is that more bakeries and food manufacturers will be offering a range of organic sourdough.

2025 Market share of Europe Sourdough manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Baker's Delight | 22% |

| Sourdough Co. | 18% |

| La Boulangerie | 15% |

| Artisan Bread Company | 12% |

| Dough & Co. | 10% |

| Others | 23% |

Note: The above chart is indicative in nature

The Europe sourdough market is divided across a chain of players operating at various levels of the supply chain. The Tier 1 players consist of the multinational corporations Bimbo and Aryzta-and are market-dominating players with large production and widespread distribution networks.

Sourdough is sold in massive quantities by these players, either to retailers or food service providers. They focus on the expanding demand for sourdough bread, be it traditional or convenient: frozen sourdough bread and pre-made pizza dough.

Tier 2 companies are local artisanal bakeries and medium-sized producers who target consumers seeking premium, niche sourdough products. Quality ingredient focus, organic sourcing, and often smaller batches are focal points for these companies. They will have sourdough in a variety of forms, from whole grain, multigrain, rye, and gluten-free versions, and can be sold through specialized food retailers and the local markets.

Tier 3 companies are small regional players who could operate in local or limited markets, including unique or homemade sourdough products. These companies rely highly on customer loyalty and a good local presence; they offer creative variations of sourdough bread and related products to meet their specific customer needs.

The Europe Sourdough market is projected to grow at a CAGR of 5.8% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 92.5 million.

Key factors driving the Europe sourdough market include the increasing consumer demand for artisanal and healthier bread options, as well as the growing trend towards clean label products made with natural ingredients. Additionally, the rise in home baking and interest in traditional baking methods are further fueling the popularity of sourdough.

Germany, France, and Italy are the key countries with high consumption rates in the Europe Sourdough market.

Leading manufacturers include Baker's Delight, Sourdough Co., La Boulangerie, Artisan Bread Company, and Dough & Co. known for their innovative and sustainable production techniques and a variety of product lines.

As per Product Type, the industry has been categorized into Traditional Sourdough, Flavoured Sourdough, Specialty Sourdough, and Convenience Sourdough.

As per Claim Type, the industry has been categorized into Organic, Non-GMO, Gluten-Free, High Fibre, and Others.

As per Packaging Type, the industry has been categorized into Retail Packaging, Bulk Packaging, Frozen Packaging, and Others.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.