The Europe Probiotic Ingredients market is set to grow from an estimated USD 1,817.2 million in 2025 to USD 3,143.2 million by 2035, with a compound annual growth rate (CAGR) of 5.6% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 1,817.2 million |

| Projected Europe Value (2035F) | USD 3,143.2 million |

| Value-based CAGR (2025 to 2035) | 5.6% |

The European probiotic ingredients market is experiencing significant growth, primarily driven by growing awareness of gut health, immunity enhancement, and microbiome balance. Manufacturers are investing in scientifically validated probiotic strains for functional foods, dietary supplements, and probiotic-enhanced animal feed sectors to meet diverse consumer health needs.

The food & beverage segment continues to be the highest-consuming end-user of probiotic ingredients, which employ bacterial and yeast-based strains to augment the nutritional profile, digestive benefits, and functional properties of much of the product portfolio, such as dairy alternatives, fermented beverages, and probiotic-rich snacks.

These further fueled the adoption of high-performance probiotic ingredients across industries like food & beverages, animal nutrition, and cosmetics, where preventive healthcare, clean-label formulations, and personalized nutrition solutions are becoming increasingly important.

The food & beverage sector is still the largest end-user of probiotic ingredients that combine bacterial and yeast-based strains to enhance nutritional value, digestive effects, and functional properties for many products ranging from dairy alternatives and fermented beverages to probiotic-rich snacks.

There is a growth in plant-based and non-dairy probiotic formulations, thus increasing demand for vegan-friendly, allergen-free probiotic solutions that suit the changing tastes of health-conscious European consumers.

Explore FMI!

Book a free demo

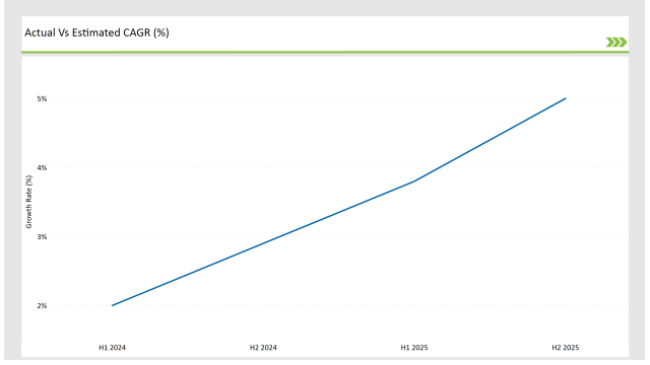

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Probiotic Ingredients market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 2.0% (2024 to 2034) |

| H2 2024 | 2.9% (2024 to 2034) |

| H1 2025 | 3.8% (2025 to 2035) |

| H2 2025 | 5.0% (2025 to 2035) |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Probiotic Ingredients market, the sector is predicted to grow at a CAGR of 2.0% during the first half of 2024, with an increase to 2.9% in the second half of the same year.

In 2025, the growth rate is anticipated to slightly decrease to 3.8% in H1 but is expected to rise to 5.0% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April-24 | Chr. Hansen introduced a novel probiotic strain for gut-brain axis support, targeting cognitive wellness and stress reduction. |

| March-24 | DuPont Nutrition expanded its yeast-based probiotic portfolio, focusing on immune-boosting formulations for dietary supplements. |

| February-24 | ADM acquired a probiotic fermentation facility in Europe to strengthen its regional production capabilities. |

| January-24 | Lallemand launched a heat-stable probiotic ingredient for fortified beverages and functional dairy applications. |

Rising Probiotic Ingredient Demand Based on Bacterial in Functional Foods and Supplements

The demand for bacterial-based probiotic ingredients includes the very high need for Lactobacillus, Bifidobacterium, and Streptococcus species in food, supplements, and animal nutrition. The scientifically validated strains of gut health, immune function, and metabolic wellness are rising trends, which encourages manufacturers to have multiple-strain formulations with diversified health benefits.

Consumer demand for probiotic-enriched functional foods, such as fermented dairy alternatives, probiotic yogurts, and digestive health beverages, increases the demand for high-stability, high-survivability bacterial strains.

Advanced techniques in bacterial fermentation from companies such as Chr. Hansen and Lallemand continue to invest in increasing the viability, efficacy, and interaction of their strains with the gut microbiome, thereby strengthening their grip on bacterial probiotic ingredients within Europe's rising functional nutrition market.

Increased Adoption of Yeast-Based Probiotics for Immune and Gut Health Applications

Out of a large share, Saccharomyces boulardii strains are gaining popularity for their gut-protective and immune-boosting abilities. Unlike other products of bacterial probiotics, yeast-based strains are still quite tolerant to antibiotics and the acidic environment of the stomach, making them a perfect solution for gut recovery, travel-friendly formulations, and post-antibiotic therapy.

The leading probiotic manufacturers are incorporating yeast-based strains into dietary supplements, functional beverages, and pet nutrition products, given their potential for supporting digestive balance, reducing gut inflammation, and preventing infections.

As consumer interest in gut-immune interactions grows, the market for yeast-derived probiotic ingredients is expected to continue expanding, especially in immune-targeted dietary supplements and microbiome-supportive formulations.

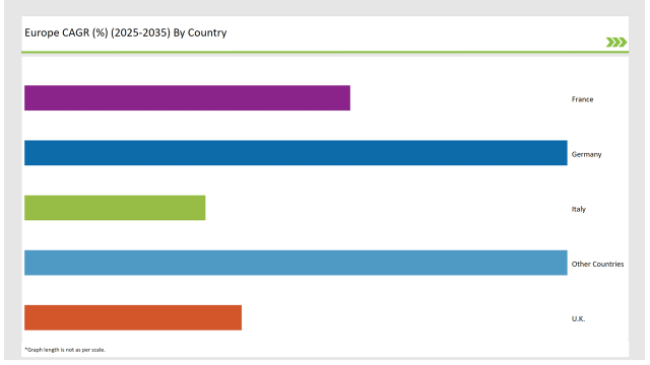

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 30% |

| Italy | 10% |

| UK | 12% |

| France | 18% |

| Other Countries | 30% |

Italian consumers are actively seeking gut-friendly dairy alternatives, high-protein yogurts, and digestive wellness solutions. Manufacturers, therefore, have started including bacterial probiotic strains- Lactobacillus and Bifidobacterium- in premium dairy products. Much more of the shift towards low-lactose and dairy-free probiotic drinks has further fueled the use of yeast-based probiotic ingredients in plant-based yogurt and kefir alternatives.

Italian beverage companies also add other products to their portfolios, including kombucha, probiotic-infused herbal teas, and functional soft drinks, to the growing health-conscious consumer base.

The collaboration of regional dairy cooperatives and suppliers of probiotic ingredients has also been further increased for research development of higher survivability bacterial strains with long shelf life and greater functionality in both dairy and beverage applications that have probiotics fortifications.

The Netherlands is positioned as the most prominent market for probiotic ingredients in animal feed. There is a very well-developed livestock sector focusing on the enhancement of feed efficiency, digestion, and immunity. Dutch farmers have started to adopt probiotic-enriched animal feed in the place of AGPs, enhancing gut health and disease resistance among poultry, swine, and dairy cattle.

With the increasing regulations in the EU on the use of antibiotics in animal feed, probiotic companies are developing particular bacterial strains that enhance nutrient uptake and stability in the guts of the animals.

Companies in the Netherlands are investing in heat-stable probiotic strains that survive better in pelleted and processed formulations of animal feed. Other developing demand areas are for probiotic yeast solutions for aquaculture feed, as it supports gut health and immune function in farmed fish and shrimp.

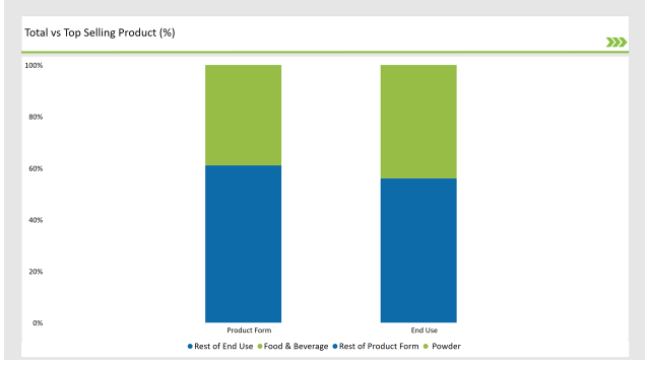

% share of Individual Categories Product Form and End-Use in 2025

| Main Segment | Market Share (%) |

|---|---|

| Product Form (Powder) | 39% |

| Remaining segments | 61% |

It is because of their superior shelf-life stability, along with ease of incorporation, makes it is a preferred option among the various food, supplement, and feed applications for manufacturers. Increasing demand for individualized probiotic blends has, in turn, created innovations in freeze-dried and spray-dried probiotic powders for high bacterial viability and strain-specific benefits.

It is widely employed in the production of functional foods and supplements of nutrient-enriched meal replacement, gut health protein powders, and fermented plant-based snacks. Increasing applications of powdered probiotics in infant nutrition also support the growth of the market as European parents seek clinically validated strains that support early-life gut health and immunity.

| Main Segment | Market Share (%) |

|---|---|

| End Use (Food & Beverage) | 44% |

| Remaining segments | 56% |

Consumers' preference for gut-friendly as well as immunity-reinforcing food products has motivated the innovation in probiotic-enriched dairy, functional drinks, and fortified snacks. Expanding dairy alternatives and plant-based nutrition are now witnessing manufacturers innovate with high-performance bacterial probiotic strains in fermented oat, almond, and coconut-based yogurts and beverages.

Another factor adding to the growth of the industry is the increasing probiotic-enriched sports nutrition and recovery beverages. European brands are now releasing kombucha, electrolyte-enforced probiotic waters, and post-exercise fermented drinks for digestive support and nutrient absorption for active consumers.

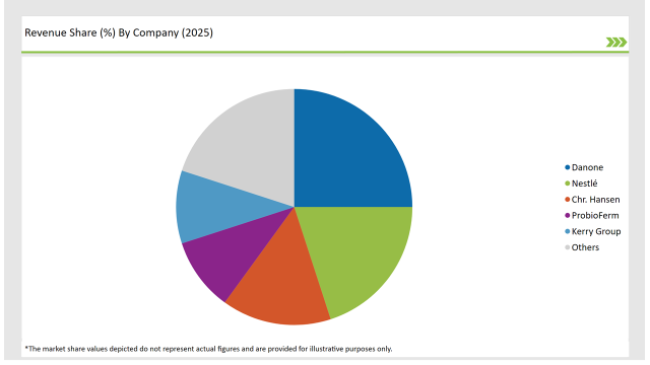

2025 Market share of Europe Probiotic Ingredients manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Danone | 25% |

| Nestlé | 20% |

| Chr. Hansen | 15% |

| ProbioFerm | 10% |

| Kerry Group | 10% |

| Others | 20% |

Note: The above chart is indicative in nature

The European probiotic ingredients market is competitive, with the manufacturers investing in research, advanced strain development, and targeted health applications. Chr. Hansen, DuPont, Lallemand, ADM, and Novozymes are the leading players concentrating on clinically validated probiotic formulations, microencapsulation technologies, and high-survivability bacterial strains.

Those companies expand their probiotic fermentation capabilities, ensuring regional supply stability and enhanced scalability for different food, supplement, and animal feed applications.

The rapidly advancing science in the field of gut microbiome has brought focus to precision probiotics and next-generation strain discovery, specific health conditions including metabolic disorders, cognitive function, and immune resilience. Direct-to-consumer (DTC) brands are also increasing market share through AI-driven microbiome analysis and customized probiotic subscription models.

The Europe Probiotic Ingredients market is projected to grow at a CAGR of 5.6% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 3,143.2 million.

Key factors driving the European probiotic ingredients market include the increasing consumer awareness of health benefits associated with probiotics, such as improved gut health and immune support. Additionally, the rising demand for functional foods and dietary supplements is fueling market growth as consumers seek natural and effective health solutions.

Germany, France, and UK are the key countries with high consumption rates in the European Probiotic Ingredients market.

Leading manufacturers include Danone, Nestlé, Chr. Hansen, ProbioFerm, and Kerry Group known for their innovative and sustainable production techniques and a variety of product lines.

As per Product Type, the industry has been categorized into Bacterial, and Yeast.

As per Product Form, the industry has been categorized into Powder, Granules, Capsules, Gel, and Others.

As per End Use, the industry has been categorized into Food & Beverage, Animal Feed, Dietary Supplement, and Cosmetics & Personal Care.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Comprehensive Analysis of Pet Dietary Supplement Market by Pet Type, by Product Type, By Application, and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.