The Europe Prenatal Vitamin Supplement market is set to grow from an estimated USD 179.6 million in 2025 to USD 420.8 million by 2035, with a compound annual growth rate (CAGR) of 8.9% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 179.6 million |

| Projected Europe Value (2035F) | USD 420.8 million |

| Value-based CAGR (2025 to 2035) | 8.9% |

Europe's prenatal vitamins sector is likely to see impressive progress from the year 2025 to 2035, stemming from the ever-growing knowledge of maternal health, birth rates of certain European nations, and the shift in consumer preferences to high-quality prenatal nutrition.

The rise of scientific prenatal vitamins encapsulated with the popular essential micronutrients such as folic acid, iron, DHA, calcium, and vitamin D is not only the available option but also the driving force behind the expansion of the sector.

This development is changing the landscape of prenatal nutrition across Europe as more people ask for different forms of supplements that are both practical and bioavailable, such as gummies, liquid, and powder formulations.

Increased focus on marketing products that are organic label and vegan quality has been fuelled by the pressure of the stricter nutritional standards and labelling regulations by the European Union. This means that manufacturers make these products for people who are extra careful with their health and the environment.

Promising technologies for nutrient encapsulation are being developed and thus, the bioavailability of the essential vitamins of pregnancy is increased. The above-mentioned interventions ensure better nutrient absorption and mother's compliance.

Explore FMI!

Book a free demo

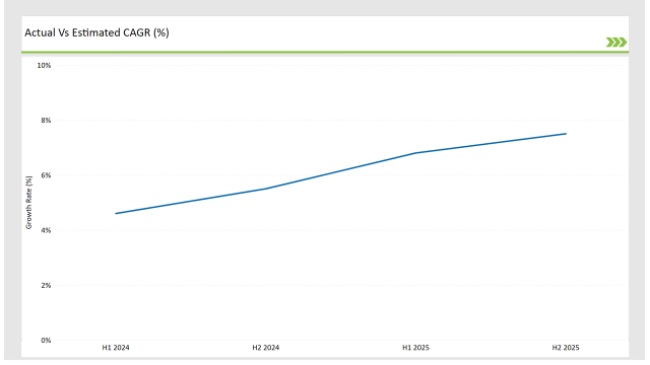

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Prenatal Vitamin Supplement market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 4.6% (2024 to 2034) |

| H2 2024 | 5.5% (2024 to 2034) |

| H1 2025 | 6.8% (2025 to 2035) |

| H2 2025 | 7.5% (2025 to 2035) |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Prenatal Vitamin Supplement market, the sector is predicted to grow at a CAGR of 4.6% during the first half of 2024, with an increase to 5.5% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 6.8% in H1 but is expected to rise to 7.5% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April-24 | Product Innovation - Bayer launched a vegan prenatal gummy supplement in Europe with plant-based DHA and folic acid. |

| March-24 | Strategic Partnerships - Nestlé Health Science collaborated with European healthcare providers to develop customized prenatal vitamin plans. |

| February-24 | Expansion of Retail Presence - Vitabiotics expanded its prenatal supplement portfolio in hypermarkets and pharmacies across France and Germany. |

| January-24 | Technological Advancements - Abbott introduced a microencapsulation technology to improve the stability and absorption of key prenatal vitamins. |

Personalized Prenatal Nutrition and Functional Supplements gaining high ground

Personalized prenatal vitamin supplements have turned into a centrepiece of the European prenatal market, as pregnant women now desire to have vitamin formulas that are customized to their particular needs, including nutritional deficiencies, lifestyle, and medical conditions.

The two companies Nestlé Health Science and Abbott that are dominant in this area are putting money into a new technology that engages the use of AI-powered nutrient profiling and genetic testing code which will help healthcare practitioners customize the prenatal supplement formula for particular pregnancies.

Simultaneously, the functional prenatal supplements traced with collagen, probiotics, and omega-3 fatty acids are gaining market share in Europe. These new formulas contribute to increased foetal development, immune support for the mother, and better gut health.

The primal brands that lead here are Vitabiotics and Bayer which are bringing prenatal vitamin blends on the market that address typical pregnancy issues, such as reducing nausea, providing energy, and enhancing foetal cognition.

Breakthroughs in Retail Expansion and Direct-to-Consumer E-Commerce

The distribution network of prenatal vitamin supplements in Europe is going through a tumultuous change, with e-commerce and direct-to-consumer brands being the strongest shift.

The new child mothers in the online retail platforms that are reshaping consumer buying behaviour are allowing them to browse through every category they want, prenatal supplements, in particular, to draw a comparison of formulations and to select freely subscription subscription-based plans.

Some of the largest supplement companies like as Vitabiotics, Nestlé, and Bayer are now propping up their retail places in drug stores, pharmacies, and specialized health shops abroad, in particular. Hypermarkets and supermarkets are the majority of sales channels, but they are now closely followed by online sales. It is, however, online sales that are registering a faster growth rate due to digital health consultations, subscription-based prenatal, and door-to-door supplement deliveries.

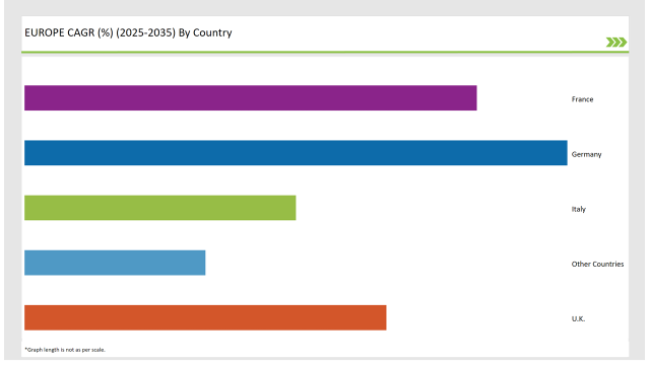

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 30% |

| Italy | 15% |

| UK | 20% |

| France | 25% |

| Other Countries | 10% |

Germany is a fast-growing European market for prenatal vitamin supplements primarily due to excellent maternal healthcare knowledge, government-assisted nutrition and pregnancy programs, and a fully developed pharmaceutical chain of distribution.

The country has strict regulations around nutritional supplements which have forced producers to emphasize pharmacy-grade prenatal vitamin supplements that correspond to the stipulations of the EFSA European Food Safety Authority.

The prescription-based prenatal supplements are a part of the acne care scheme in the German pharmaceutical industry and the retail drugstores and the hospital stocks are where the majority of supplements are being distributed.

Well-known brands such as Vitabiotics and Nestlé Health Science are diversifying their product lines by entering physical retail and online marketplaces, with 30% sold by drugstores and pharmacies. German consumers are opting for more vegan, allergen-free, and sustainable formulations in the clean-label and organic prenatal supplements.

France is witnessing a significant rise in the demand for high-quality prenatal vitamin supplements, which are largely bioavailable, all-natural, and premium product-oriented. The figure of women being pregnant and being health conscious is the main reason for such demand as they choose to take pharmaceutical-grade and scientific studies-based formulations.

Pharmacies and special drugstores in France are essential distribution channels of prenatal supplements; hypermarkets and supermarkets the OTC prenatal vitamins sales. According to a trend, French patients prefer gummies and liquids formulation, which urged Bayer and Abbott to launch higher absorption prenatal vitamin blends, helpful for mothers carrying babies and showing digestive issues or difficulty in the swallowing hard capsules.

The demand for customized prenatal supplement offerings is growing in France, with an increasing number of health start-ups and providers of maternity care offering digitalized subscription-based personalized vitamin programs.

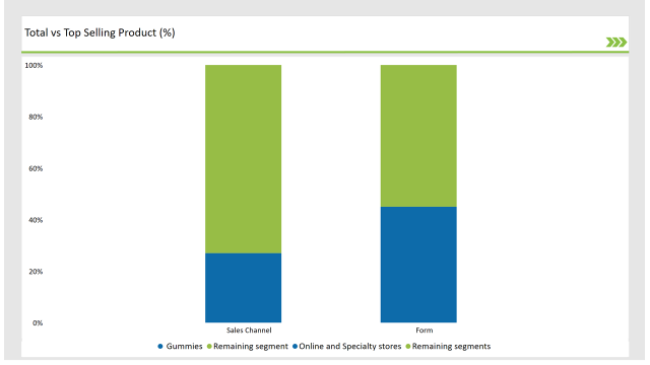

% share of Individual Categories Form and Sales Channel in 2025

| Main Segment | Market Share (%) |

|---|---|

| Form (Gummies) | 45% |

| Remaining segments | 55% |

In the prenatal vitamin nutritional market in Europe, capsules and tablets are still the number one form due to their high nutrient density, longer shelf life, and medical professionals' recommendations. Most pharmaceutical companies have Bayer and Vitabiotics in the lead with clinically validated prenatal vitamin formulations in tablet and capsule form.

Gummies are, on the other hand, in the beam of the fast-growing section, led by people's desire for tasty, chewable, and easy gradatory with friendly tastes. A plurality of future mothers has to deal with morning sickness and a reluctance to swallow pills which makes gummy VR a better option.

All-time top brands like Abbott and Nestlé Health Science are launching sugar-free, gelatine-free prenatal gummies with improved bioavailability aimed at health-conscious and vegan shoppers. Beyond that, there are probiotics, collagen, and omega-3s, which have been added to the gummies proving to be a risk of additional maternal health benefits.

| Main Segment | Market Share (%) |

|---|---|

| Sales Channel (Online and Specialty stores) | 27% |

| Remaining segments | 73% |

Hypermarkets and supermarkets stand out as the most popular and well-used channels for the sale of prenatal vitamin supplements throughout Europe thanks to the great accessibility, lower prices, and the schemes of buying more and saving.

Most of the expecting mothers trust the retail pharmacy with their over-the-counter (OTC) prenatal vitamins, which they usually purchase on the go from different brands such as Carrefour, Tesco, and Aldi that have expanded their sections with both a main line and a new, organic product line.

Drug stores and pharmacies are also a common sale cohort, especially since most prenatal vitamins are placebos or suggested by healthcare professionals. Generally, pharmacists help mothers-to-be with the purchase of medical prenatal supplements, particularly women who struggle with getting enough specialized nutrition due to risky pregnancies. Pfizer and Vitabiotics are among the brands that are increasingly eyeing pharmacies to promote their products and get legit endorsements.

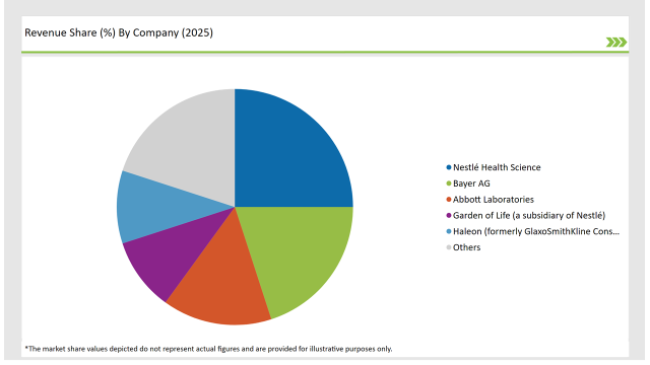

2025 Market share of Europe Prenatal Vitamin Supplement manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Nestlé Health Science | 25% |

| Bayer AG | 20% |

| Abbott Laboratories | 15% |

| Garden of Life (a subsidiary of Nestlé) | 10% |

| Haleon (formerly GlaxoSmithKline Consumer Healthcare) | 10% |

| Others | 20% |

Note: The above chart is indicative in nature

The European prenatal vitamin supplements market has a medium level of monopoly with the top players being Bayer, Vitabiotics, Nestlé Health Science, Abbott, and Pfizer. These firms continue to invest heavily in the development of targeted nutritional prenatal options, the enhancements of bioavailability, and new strategic retail outlets for the service of the changing requirements of pregnant women all over Europe.

The advent of new companies and the introduction of specialized brands have brought about changes in the market through the use of direct-to-consumer(DTC) personalized prenatal vitamins that target specific maternal health conditions like gestational diabetes, nausea management, and high-risk pregnancy support.

Other companies have integrated the use of AI-powered nutrient recommendations along with subscription-based supplement programs that redound to the demand for personalized prenatal care in Europe.

As the healthcare systems of European countries focus more on mothers' nutrition training and clinical supplementation, the market is bailed out with new product types, increased rivalry, and better ties among supplement brands, medical professionals, and retail pharmacies.

The Europe Prenatal Vitamin Supplement market is projected to grow at a CAGR of 8.9% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 420.8 million.

Key factors driving the prenatal vitamin supplements market include the increasing awareness of maternal health and nutrition among expectant mothers, as well as the rising prevalence of pregnancy-related complications that necessitate nutritional support. Additionally, the growing trend of preventive healthcare and the influence of healthcare professionals in recommending supplements further boost market demand.

Germany, and France, are the key countries with high consumption rates in the European Prenatal Vitamin Supplement market.

Leading manufacturers include Nestlé Health Science, Bayer AG, Abbott Laboratories, Garden of Life (a subsidiary of Nestlé), and Haleon (formerly GlaxoSmithKline Consumer Healthcare) known for their innovative and sustainable production techniques and a variety of product lines.

As per Form Type, the industry has been categorized into Capsule/Tablets, Gummies, Powders, Liquids, and Others.

As per Sales Channel, the industry has been categorized into Online, Drug Stores and Pharmacies, Hospital & Clinics, Hypermarkets/Supermarkets, Convenience Stores, Health and, wellness Stores, Specialty Stores, and Departmental Stores.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Vegan DHA Market Outlook - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.