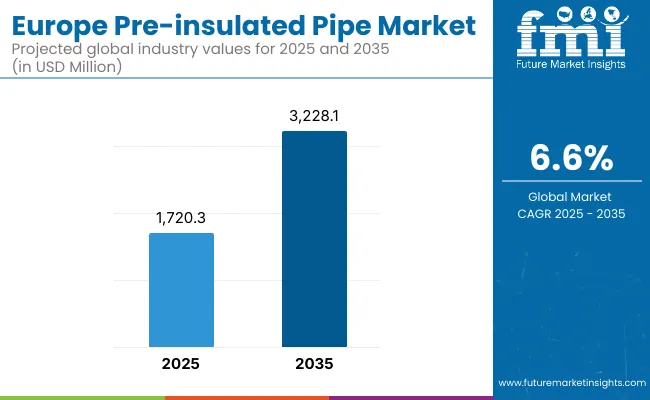

The European pre-insulated pipe market is expected to register steady growth, supported by rise in investments in district heating, industrial thermal transport, and sustainable building systems. These pipes have heating foam and protective jackets, reducing thermal loss and increasing energy efficiency for long-distance fluid transport networks. The market is expected to reach USD 3,228.1 million by 2035 from USD 1,720.3 million in 2025, growing at a CAGR of 6.6% during the forecast period.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 1,720.3 million |

| Market Value (2035F) | USD 3,228.1 million |

| CAGR (2025 to 2035) | 6.6% |

As Europe shifts to greener infrastructure and climate-resilient heating solutions, pre-insulated pipes are becoming the cornerstone of district heating and cooling systems. These systems are popular for being durable, low maintenance and energy-saving. In Northern and Central Europe in particular, nations are targeting old pipelines for replacement with new lines that are modern and highly insulated. Use of pre-insulated pipe is also increasing in oil & gas, chemical processing, food manufacturing, and marine applications where controlled fluid temperature is important.

Advanced polyurethane and polyisocyanurate foam technologies are being developed by the manufacturers to improve thermal resistance, fire protection, and moisture barrier performance. Public infrastructure projects are increasingly integrating leak detection sensors and smart monitoring systems within pipe networks. The move to decarbonized heating and less carbon emissions is also fuelling innovation in recyclable and bio-based insulation systems aimed at circular economy models.

Beyond this, pre-insulated pipe networks deliver long-term energy savings and carbon footprint reductions. We expect demand to be strong across new build, infrastructure retrofits, and renewable energy projects, most notably in relation to geothermal and biomass based heating systems.

Northern Europe already has an extensive district heating network, creating a mature, high-demand market for pre-insulated pipes. For instance, countries such as Sweden, Finland and Denmark are shifting into fourth-generation low-temperature heating networks with high-performance, thermally efficient pipe systems. The region focuses on corrosion resistance, leak detection technology and modular joint systems to address harsh winter conditions and extensive pipe runs in urban and rural environments.

Western Europe is ahead again due to their powerful regulatory benevolence toward energy efficiency and decarbonisation. Germany, France and Benelux are replacing old thermal infrastructure with modern high-insulation piping for district heat, cooling and industrial steam transport. Western Europe, for instance, has additionally invested heavily in innovation, such as recyclable insulation materials, pre-assembled pipe sections, and smart monitoring to prevent thermal loss.

The increasing demand for pre-insulated pipes across HVAC systems for buildings and renewable energy projects as well as agriculture-based heating applications in Southern Europe is a potential driving factor for the growth of the market. Countries such as Italy, Spain and Portugal are investing in biomass and solar-thermal integrated networks, where thermal efficiency and negligible maintenance are paramount. We’re seeing adoption grow in middle-market towns and eco-tourism projects, and more interest in modular, flexible pipe systems that can help implement decentralized energy grids.

Eastern Europe is updating much of its infrastructure, particularly the legacy district heating systems from the Soviet era. Countries like Poland, Romania and the Czech Republic are installing new polyurethane-insulated systems, abandoning older and less energy-efficient steel pipelines. The EU funds projects to modernise the region's infrastructure and reflects the growing need for cost-efficient solutions in the piping industry, combining heat retention and endurance.

Challenges

High Installation Costs and Complex Retrofitting

The initial cost of pre-insulated pipe systems (including the trenching, jointing, and insulation logistics) can be quite high, particularly for retrofits. Retrofitting urban heating systems is usually a challenge from technical perspective (e.g., physical route constraints, limited space, regulations). Likewise, lengthy procurement cycles and stringent certification requirements that are hallmarks of public infrastructure projects can significantly slow relative deployment timelines.

Opportunities

Green Heating Mandates and Technological Upgrades

Europe’s target for carbon neutrality is triggering solid prospects for pre-insulated pipe systems within both heating and cooling industries. Renewable-integrated pipe systems (which would be connected to biomass, solar thermal, or geothermal sources) are also catching on, as fossil-fuel-based heating is phased out. The demand for flexibility in the form of joint systems, corrosion-resistant jackets, and IoT-based thermal monitoring systems is on the rise. Modular, plug-and-play pipe sections are gaining ground, too, as a way to expedite installation and reduce service interruptions.

The European pre-insulated pipe market had a total revenue impact from 2020 to 2024, as well as during the period from 2020 to 2024, decreased by pandemic recovery funding, EU climate investments, and other factors that spurred demand for energy-efficient municipal heating. In smart cities, pilot projects incorporated sensor-embedded pipelines and hybrid insulation materials. The primary focus was on combating energy poverty, with incentives linked to urban retrofitting in low-income neighbourhoods.

From 2025 to 2035, the market will transition to next-gen pipe systems that target circularity and low-temp fluid transport. Integrated thermal sensors, remote asset monitoring and real-time energy analytics will be standard features of largescale installations. District cooling and co-gen networks will become more relevant in the high-density urban areas. In addition, industry attention will shift from public infrastructure to include high-efficiency, thermally managed industrial fluid distribution and cold chain logistics.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Technology Focus | PUR-foam insulation and steel/polymer jackets |

| Demographic Penetration | Municipal and industrial retrofits |

| Treatment Settings | Centralized district heating and industry |

| Geographical Growth | Germany, Nordics, Poland |

| Application Preference | Heating and industrial steam |

| Cost Dynamics | CapEx -intensive projects, subsidy-backed |

| Consumer Behaviour | Driven by regulatory compliance |

| Service Model Evolution | Product and engineering contracts |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Technology Focus | Bio-based foam, leak detection sensors, and smart pipe coatings |

| Demographic Penetration | New smart city grids, mixed-use building heating systems |

| Treatment Settings | Decentralized, hybrid heating and integrated HVAC systems |

| Geographical Growth | France, Southern Europe, and Eastern EU expansion zones |

| Application Preference | District cooling, geothermal, and low-temp energy transport |

| Cost Dynamics | Leaner installation models with lifecycle cost focus |

| Consumer Behaviour | Demand for energy efficiency, emissions tracking, and smart data |

| Service Model Evolution | EPC + data integration, predictive maintenance partnerships |

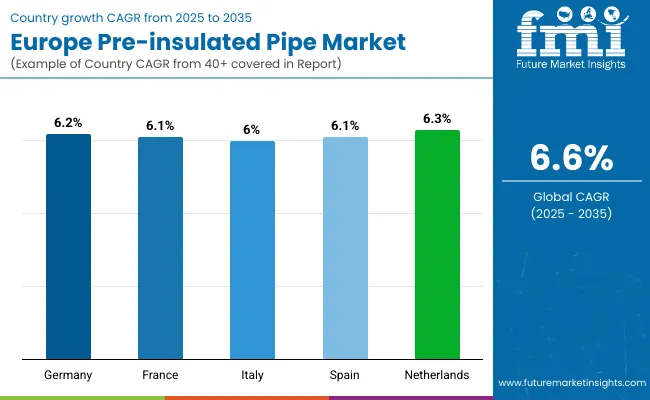

Germany is the dominant player in the Europe pre-insulated pipe market, bolstered by extensive district heating networks and challenging energy efficiency regulations. Retrofitting of older thermal grids and the growth of zero-energy buildings in the country is creating demand for pipes insulated with polyurethane and mineral wool. On the other hand, industrial users prefer thicker insulation variants for process heating and chilled water applications, as it assures minimum thermal loss.

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.2% |

The push towards decarbonisation in France governing the heating systems in buildings translated to greater investments in pre-insulated pipelines especially in urban renovation projects. In underground hot water and gas distribution, polyethylene and elastomeric foam insulated pipes are now being used. France will focus on phasing out fossil heating, which is expected accelerate deployment in new and replacement installations.

| Country | CAGR (2025 to 2035) |

|---|---|

| France | 6.1% |

Growing investments in green building projects and energy-resilient infrastructure in Italy are further bolstering the demand growth for lightweight, corrosion-resistant pipe insulation. Most prefer phenolic foam and polypropylene variants because they perform well in high-humidity zones. In Europe, particularly in Italy, manufacturers are responding with customized thickness options for insulation to serve the varied needs of residential, commercial, and municipal needs.

| Country | CAGR (2025 to 2035) |

|---|---|

| Italy | 6.0% |

The increased pressure for Spain to save energy in public and commercial structures is encouraging the use of pre-insulated piping for HVAC for district cooling. In coastal cities, elastomeric foam and glass wool are used in all-projects because they do not corrode in saline environment. The market is also being driven by government subsidies for schools, hospitals, and social housing to improve efficiency in heating.

| Country | CAGR (2025 to 2035) |

|---|---|

| Spain | 6.1% |

Portugal is also slowly ramping up deployment of pre-insulated piping for geothermal and biomass-based heating networks. Aerogel and Mineral wool insulation is gaining a demand for high-performance energy projects. Urban heat loop installations in dense urban areas such as Amsterdam and Rotterdam have employed thinner insulation (0.5 to 1 inch), in order to reduce trench sizes as much as performance allows.

| Country | CAGR (2025 to 2035) |

|---|---|

| Netherlands | 6.3% |

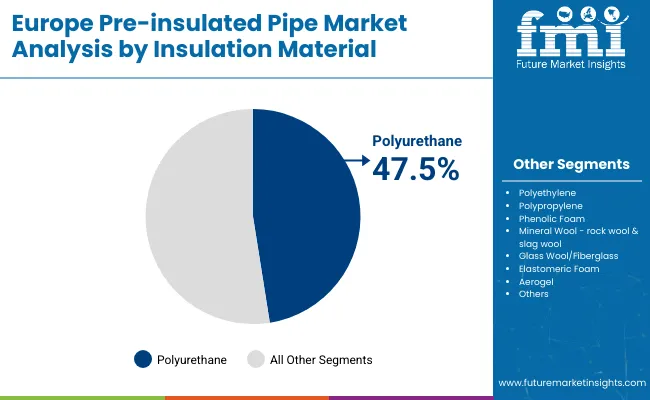

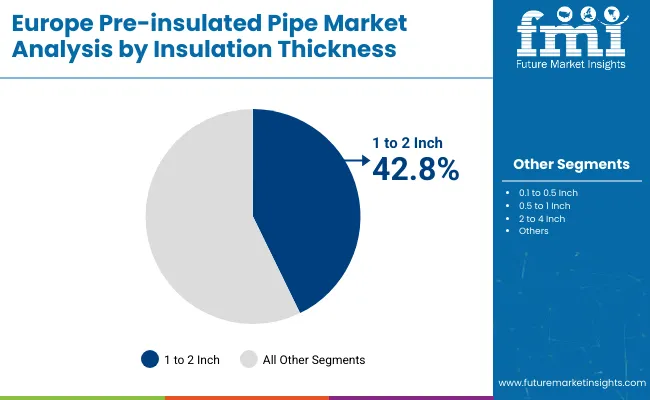

It breaks down the Europe pre-insulated pipe market into following segments - insulation material: polyethylene, polypropylene, polyurethane, phenolic foam, mineral wool (rock wool & slag wool), glass wool/fiberglass, elastomeric foam, aerogel, others insulation thickness - 0.1 to 0.5 Inch, 0.5 to 1 Inch, 1 to 2 Inch, 2 to 4 Inch Of these, polyurethane is still the preeminent material, given its unrivalled thermal conductivity and mechanical strength across use cases.

| Insulation Material Segment | Market Share (2025) |

|---|---|

| Polyurethane | 47.5% |

Polyurethane is expected to lead with a 47.5% share in 2025. Polyurethane foam is the most-used material for hot water and steam systems, they are the most heat-insulated, and they have a long operational life because of underground conditions. Its ability to be used with steel and plastic pipe systems makes it even more attractive to energy, utility, and industrial customers.

| Insulation Thickness Segment | Market Share (2025) |

|---|---|

| 1 to 2 Inch | 42.8% |

In 2025, insulation thickness of 1 to 2 inches will represent 42.8% of the market. This range is best suited for general-purpose applications such as building heating, chilled water transport, and integration of renewable energy systems. It will give best thermal resistance while having reasonable installation size and costs.

Facade systems to maintain insulation integrity and thermal performance offer significant thermal efficiency on the surface and are the key to being sustainable in commercial buildings, driving demand in the MMS market in Europe. Companies are launching corrosion-resistant outer casings, hybrid insulation materials, and intuitive monitoring interfaces for temperature and leakage control.

Tailor-made insulation solutions for municipal grids, renewable heating solutions, and industrial processes enable vendors to address rising energy transition targets. EN 253 and Euro class product certifications are still fundamental for marketability.

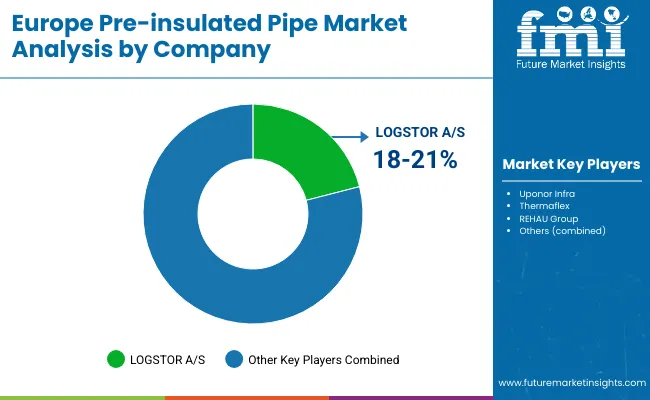

Market Share Analysis by Key Players

| Company Name | Estimated Market Share (%) |

|---|---|

| LOGSTOR A/S | 18-21% |

| Uponor Infra | 14-17% |

| Thermaflex | 12-15% |

| REHAU Group | 10-13% |

| Others | 34-38% |

| Company Name | Key Offerings/Activities |

|---|---|

| LOGSTOR A/S | In 2025 , launched Flextra Link ™, a smart-insulated district heating pipe with integrated temperature monitoring. |

| Uponor Infra | In 2024 , introduced Ecoflex VIP, combining vacuum insulation panels with flexible casing for zero-energy buildings. |

| Thermaflex | In 2025 , expanded its Flexalen range with bio-based foam and HDPE casing optimized for geothermal systems. |

| REHAU Group | In 2024 , enhanced RAUVITHERM series with anti-UV outer jackets and advanced heat loss prevention layers. |

Key Market Insights

LOGSTOR A/S (18-21%)

LOGSTOR leads with pre-insulated pipe systems engineered for performance and longevity in European thermal networks. Its innovations in leak detection and digital monitoring make it the go-to partner for smart heating infrastructure across Northern and Central Europe.

Uponor Infra (14-17%)

Uponor Infra is well-known for modular pipe solutions designed for flexibility, ease of installation, and sustainability. Its Ecoflex product line is favored in new-build residential complexes and community heating systems.

Thermaflex (12-15%)

Thermaflex emphasizes eco-design, offering recyclable insulation with high-performance thermal retention. Its pre-insulated pipes are widely used in decentralized energy systems and biomass-powered heating grids across the EU.

REHAU Group (10-13%)

REHAU provides advanced polymer-based solutions combining thermal durability with mechanical strength. Its focus on energy efficiency and seamless integration in HVAC systems strengthens its position in retrofit and green building projects.

Other Key Players (34-38% Combined)

The market size in 2025 was USD 1,720.3 million.

It is projected to reach USD 3,228.1 million by 2035.

The rise in investments in district heating, industrial thermal transport, and sustainable building systems will drive the demand for the pre-insulated pipe market in Europe.

The top contributors contributing to the pre-insulated pipe market in Europe are Germany, Sweden, France, Denmark, and Netherlands.

The Polyurethane segment is anticipated to dominate the pre-insulated pipe market in Europe.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Europe's Golden Generation Travel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA