The Europe Potato Flakes market is set to grow from an estimated USD 1,099.5 million in 2025 to USD 1,757.1 million by 2035, with a compound annual growth rate (CAGR) of 4.8% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 1,099.5 million |

| Projected Europe Value (2035F) | USD 1,757.1 million |

| Value-based CAGR (2025 to 2035) | 4.8% |

The Europe potato flakes market is expected to grow strongly between 2025 and 2035 due to changing consumer preferences for convenient, long-lasting, and versatile food products. Potato flakes are easy to use and have a longer shelf life, which makes them popular in both the food service industry and household applications.

There is an emerging interest in the consumption of processed potato products, especially flaked potato and their derivatives, as they are primary ingredients in ready-to-eat meals, soups, snacks, and bakery products. Another growing trend includes an inclination towards plant-based, and gluten-free diets thus intake of potato flakes as a functional ingredient in alternative food products is rising.

The market is supported further by improvements in potato processing technology, wherein there is minimal nutrient loss and an improvement in quality. Key players are also putting efforts into enlarging their capacity for production while diversifying product lines to better serve the rising demand for clean-label, non-GMO, and organic potato flakes.

Explore FMI!

Book a free demo

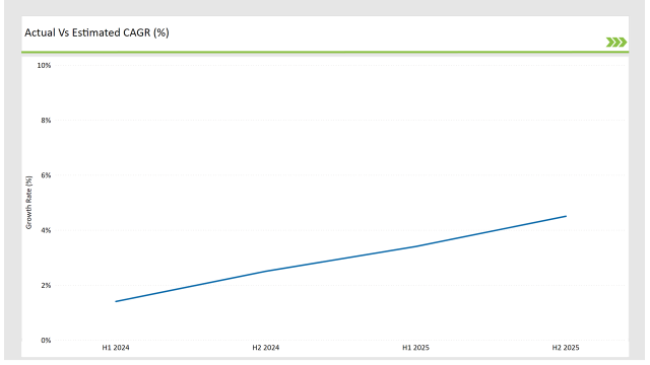

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Potato Flakes market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 1.4% (2024 to 2034) |

| H2 2024 | 2.5% (2024 to 2034) |

| H1 2025 | 3.4% (2025 to 2035) |

| H2 2025 | 4.5% (2025 to 2035) |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Potato Flakes market, the sector is predicted to grow at a CAGR of 1.4% during the first half of 2024, with an increase to 2.5% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 3.4% in H1 but is expected to rise to 4.5% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 24 - March | Expansion of Production Facilities- Lamb Weston expanded its potato flakes manufacturing plant in the Netherlands to meet growing demand across Europe. |

| 15 - February | New Product Launch- McCain Foods launched a new line of flavored potato flakes aimed at the convenience food sector, targeting busy consumers. |

| 13 - January | Strategic Partnership- A partnership was formed between a leading potato supplier and a food service company to enhance the distribution of potato flakes in Europe. |

Convenience Foods Witness Growth in the European Potato Flakes Market

There has been an increasing consumption of potato flakes mainly attributed to the trend in Europe concerning consumers' growing affinity towards convenience foods. Potato flakes have become integral parts of a majority of instant ready-to-eat meals, soups, and snacks because they can be easily used as they provide an extended shelf life. The food service industry, in general, and quick-service restaurants (QSRs), in particular, are major consumers of potato flakes.

These are an essential component of mashed potatoes, coatings, and fillings. Their wide use as thickening agents in soups and gravies has further increased their popularity. With growth in dual-income families and hectic schedules, the easy-to-cook demand is increasing with a preference for potato flakes.

With this scenario, the manufacturers are gaining an advantage through innovative new products, like flavoured potato flakes and fortified versions, to accommodate varied consumer needs.

Innovation in Clean-Label and Organic Potato Flakes

Clean-label and organic food products have considerably impacted the potato flakes market in Europe. Consumers are opting for less processed and natural ingredients, and the manufacturers are thus developing potato flakes to meet the same requirements.

Organic potato flakes without synthetic additives and pesticides have received substantial attention in countries such as Germany, France, and the Netherlands, where the consumption of organic food is rapidly increasing.

Organic alternatives aside, clean-label solutions now are the focus of manufacturers with the removal of artificial preservatives and fortification with vitamins and minerals to enhance potato flakes' nutritional profile. Another boost for this trend is in the better processing technologies- vacuum-dried and drum-dried-that would retain the flavour and nutrient profile of potatoes.

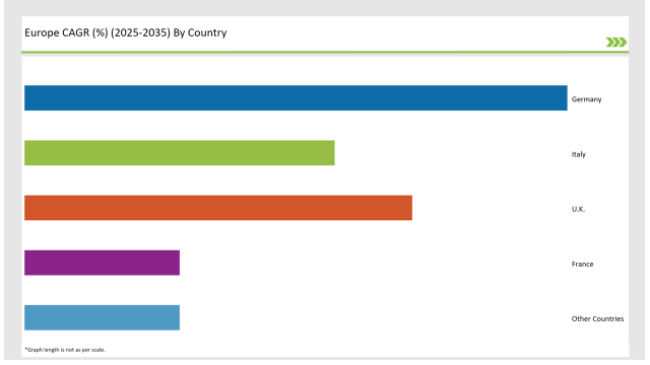

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 30% |

| Italy | 12% |

| UK | 22% |

| France | 16% |

| Other Countries | 20% |

Potato flakes have emerged as a leading market in Europe, but the market preference for organic and gluten-free potato flakes has grown stronger in Germany.

Germany's health-conscious consumers are increasingly seeking to include potato flakes in their diet as a convenient and nutritious food ingredient. Germany is using advanced processing technologies to ensure the production of high-quality potato flakes that conform to strict standards of organic certification among leading players.

Germany's well-established food processing sector also propels the market for potato flakes. Potato flakes are being introduced in a large number of ready-to-eat and convenience food items such as instant soups, mashed potatoes, and snacks. Government support for organic farming and the adoption of green food production systems complement the market trend for the environmentally friendly product of potato flakes.

The United Kingdom presents a dynamic potato flakes market focusing on innovation and sustainability. Demand has increased lately because of a rapid rise in demand for ready-to-eat foods and plant-based food products as essential ingredients for preparing vegan and vegetarian recipes.

Several manufacturers are continuously introducing new, flavoured, and fortified potato flake products to meet changing tastes and fulfil diet requirements. Retailers in the UK are taking advantage of the meal kit and pre-packaged solutions trend where potato flakes are used as a convenient and versatile ingredient.

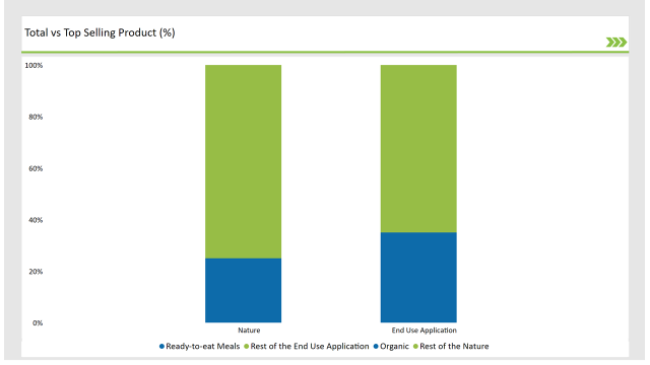

% share of Individual Categories Nature and End-Use Application in 2025

| Main Segment | Market Share (%) |

|---|---|

| Nature (Organic) | 25% |

| Remaining segments | 75% |

Low Moisture Organic Potato Flakes Become the Trend of Europe

Due to a higher shelf life and versatility, low-moisture potato flakes are being very widely consumed throughout Europe. This flake variety is often used by the food processing industry for making instant mashed potatoes, soups, and other readymade food items, due to the lower moisture levels that keep these products stored longer and ready to reconstitute at ease, as preferred both by consumers and producers alike.

Germany and France are experiencing high demand for low-moisture organic potato flakes, which is driven by the increasing demand for convenience foods and industrial applications.

Organic potato flakes have experienced a rapid growth in demand in Europe, driven by consumer demand for clean-label and sustainably sourced products. Products that are free of synthetic pesticides and additives, organic potato flakes are very popular in the markets of Netherlands and Scandinavia. These flakes are being used in super-premium food products, including baby food, gluten-free baked goods, and plant-based snacks.

| Main Segment | Market Share (%) |

|---|---|

| End Use Application (Ready-to-eat Meals) | 35% |

| Remaining segments | 65% |

Food & Beverages and Animal feed industry is driving the demand

The potato flakes application is primarily food and beverages as ready-to-eat-meals in Europe. Potato flakes have a huge demand in making soups, sauces, snack items, and bakery products.

In addition to that, they are gaining prominence with the surge in demand for plant-based and gluten-free foods and products, including vegan recipes and alternative meat products. The leading manufacturers are looking for innovative formulations such as flavoured potato flakes to cater to the diverse tastes of consumers and drive growth in this segment.

Potato flakes are a cost-efficient and nutritious element in animal feeds, providing nutrients and energy. The use of potato flake in different regions has rapidly picked up in places where agricultural sectors are highly operating, such as Eastern Europe, which increasingly uses potato by-products for production in feedstock.

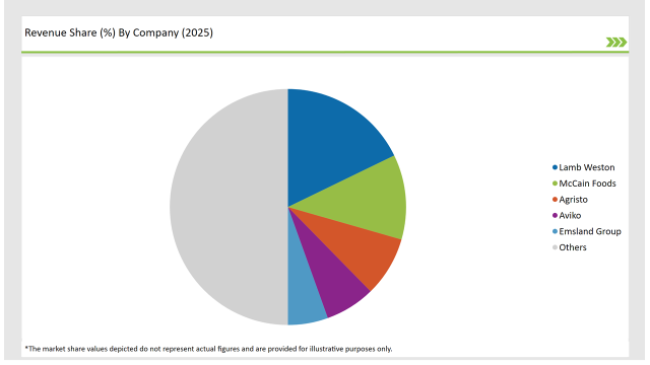

2025 Market share of Europe Potato Flakes manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Lamb Weston | 26% |

| McCain Foods | 17% |

| Agristo | 12% |

| Aviko | 10% |

| Emsland Group | 8% |

| Others | 73% |

Note: The above chart is indicative in nature

The potato flakes market in Europe shows a moderate level of consolidation, with the top players being Lamb Weston, Aviko, and McCain Foods, who hold a large part of shares in the market.

They are the companies using the most advanced production facilities and distribution networks in order to cover the growing demand in the industry. Their success has been built on the implementation of various strategic measures, like expanding capacity, innovating the product, and being sustainable, so they become stronger in this way.

Also, the regional companies earn a notable part of the market cover by catering to niche markets and supplying unique products made by local sources. For instance, Eastern European manufacturers mainly supply industrial-grade low-cost potato flakes for industrial purposes. Local manufacturers in Western Europe, focus on premium and organic versions of the product.

The Europe Potato Flakes market is projected to grow at a CAGR of 4.8% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 1,757.1 million.

Key factors driving the European potato flakes market include the increasing demand for convenient and ready-to-use food products, as well as the growing popularity of plant-based diets and clean label ingredients. Additionally, the rise in food service and snack food sectors further fuels the market growth for potato flakes.

Germany, France, and UK are the key countries with high consumption rates in the European Potato Flakes market.

Leading manufacturers include Lamb Weston, McCain Foods, Agristo, Aviko, Emsland Group, and Simplot known for their innovative and sustainable production techniques and a variety of product lines.

As per Form Type, the industry has been categorized into Standard Flakes, Mashed Potato Pellets, Powder/Granules, and Specialty Flakes.

As per End Use Application, the industry has been categorized into Snack Foods, Ready Meals, Food Service, Bakery, Soups & Sauces, and Others.

As per Distribution Channel, the industry has been categorized into B2B/Industrial, Wholesale, Retail, and Online.

As per Nature, the industry has been categorized into Conventional, and Organic.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

Fish Waste Management Market Analysis by Source and End Use Industry Through 2035

Kelp Protein Market Analysis by Form and End Use Through 2035

Fish Soup Market Analysis by Form, Format, Packaging and Sales Channel Through 2035

Fish Silage Market Analysis by Fish, Fish Type, Application and Form Through 2035

Fish Roe Enzymes and Extracts Market Analysis by Type, Source and Application Through 2035

Edible Seaweed Market Analysis by Product Type, End Use Application, Extraction Method and Form Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.