The Europe Postbiotic Pet Food market is set to grow from an estimated USD 251.0 million in 2025 to USD 383.1 million by 2035, with a compound annual growth rate (CAGR) of 4.3% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 251.0 million |

| Projected Europe Value (2035F) | USD 383.1 million |

| Value-based CAGR (2025 to 2035) | 4.3% |

The European market for postbiotic pet food has been rapidly increasing in the past few years and reflects a more general trend within the pet care industry: emphasizing improved pet health through functional ingredients.

Postbiotics are products or metabolic by-products from bacteria that are derived from probiotics, and it is these postbiotics that are being acknowledged because of their potential to promote pet health without using live microorganisms.

The demand for postbiotic pet foods increases with growing pet health issues in the form of digestive problems, immune support, skin disorders, and joint issues, which the owners try to manage through nutritional means.

Another reason to use postbiotics over traditional additives is the preference for natural, clean-label ingredients. The major players in the market include Nestlé Purina Petcare, Mars Petcare, and Hill's Pet Nutrition, who are integrating postbiotics into their existing product lines as part of their strategy to remain competitive.

These companies usually also achieve strategic direction through effective marketing and not just through product innovation in terms of promising scientific benefits regarding postbiotics, satisfying the pet owners about the efficacy of the ingredients.

Explore FMI!

Book a free demo

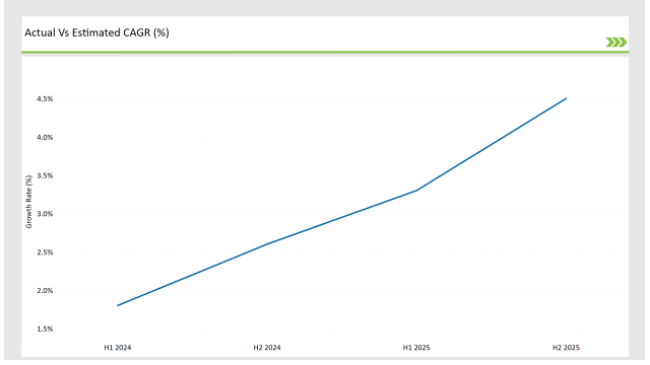

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Postbiotic Pet Food market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 1.8% |

| H2 (2024 to 2034) | 2.6% |

| H1 (2025 to 2035) | 3.3% |

| H2 (2025 to 2035) | 4.5% |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Postbiotic Pet Food market, the sector is predicted to grow at a CAGR of 1.8% during the first half of 2024, with an increase to 2.6% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 3.3% in H1 but is expected to rise to 4.5% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April 2024 | Product Launch: Nestlé Purina launched a new range of postbiotic-enriched pet food to support digestive health in cats and dogs, claiming improved gut health and immune support. |

| March 2024 | Partnership Announcement: Mars Petcare entered into a partnership with a leading postbiotic manufacturer to develop joint health formulations for senior pets. |

| February 2024 | Research Publication: Hill’s Pet Nutrition published a research paper demonstrating the positive effects of postbiotics on skin and coat health in dogs, marking a significant breakthrough for skin-health-focused pet foods. |

Postbiotics in Aging Animals for Better Cognitive Health

The European pet population is aging, and there is increasing concern about the cognitive decline in senior pets, especially dogs and cats. This has further increased the demand for functional pet foods that help support cognitive health. Postbiotics, which support gut health and overall immune function, are now being integrated into pet food formulations specifically designed for aging pets.

It therefore has been established that an individual's gut health has a direct relationship with the condition of their brain. This is emerging as a focus area for pet food makers. Short-chain fatty acids and other metabolic by-products, which are known as postbiotics, have demonstrated neuroprotection effects that may delay or even halt cognitive decline in pets.

In this regard, several pet food manufacturers are producing dry and wet formulas with the incorporation of postbiotics. Such products claim to enhance memory, cognitive activity, and brain function in geriatric animals. This tendency is especially more prominent in European countries where pet owners are ready to pay more to make their pets healthy and extend their lifespan for more years.

Rising Immune Support Solutions through Postbiotics

The incorporation of postbiotics into cognitive health formulations is a significant innovation in the pet food industry, and as awareness of this connection between gut and brain health grows, more companies are likely to explore similar formulations.

Pets with sensitive immune systems must be kept at the highest possible immune levels. Recent studies have evidenced that postbiotics can balance the immune response by stimulating some beneficial immune cells to be developed as well as enhancing general immunological responses.

This has brought more pet foods with postbiotics that facilitate immune system benefits. In Europe, where pet health is a paramount concern, in markets like the UK, Germany, and France, there has been a great demand for postbiotics-containing foods.

Famous brands like Mars Petcare and Nestlé Purina have been leading the charge in that, offering postbiotics in their products for dogs and cats with immunodeficiency diseases. The types of postbiotics compositions are designed to improve gut microbiota, which has a direct association with the immune system.

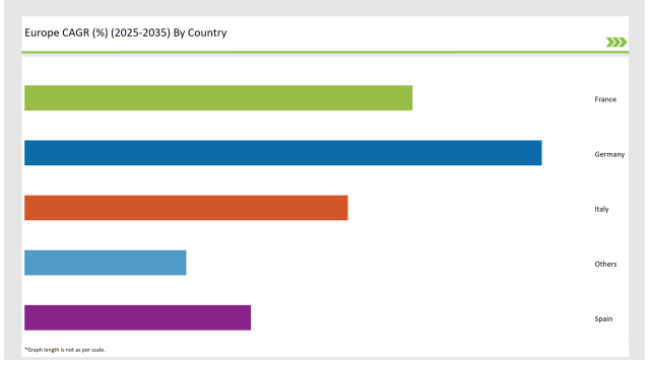

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 32% |

| France | 24% |

| Italy | 20% |

| Spain | 14% |

| Others | 10% |

The United Kingdom is leading the postbiotic pet food market with a remarkable growth rate across Europe due to the high level of pet ownership and growing consumer demand for health-focused products.

British pet owners show strong interest in the wellness of their pets and therefore, functional pet diets are regarded as a trend that gives health some beneficial effects. Postbiotic items have found their path in this area as they can provide digestive, immune, and even brain support in older animals.

Organizations such as Nestlé Purina and Mars Petcare have undertaken important actions in postbiotic-maintained developments as a result of consumers choosing products with functional ingredients in pet food.

Furthermore, with the commensurate rise of risks concerning antibiotic resistance and the awareness of the benefits of natural, non-living ingredients, postbiotics are positioned as an attractive alternative probiotic option.

The UK has also been associated with a regulatory transparency approach which means that companies manufacturing pet food have to show the efficacy of postbiotics by clinical trials and studies.

Germany has been another active nation in the postbiotic pet food sector expansion in Europe, along with the emphasis placed on innovation and high-quality standards. As one of the major markets for pet food in Europe, Germany is a perfect place for the launch of post-bio products. According to the observations, stand-alone postbiotics that target intestinal polyps, allergies, and arthritis have all been recognized among the most appropriate functional foods.

The market for pet foods that help with digestive health, immune function, and arthritis has been growing the fastest, and postbiotics have been highlighted as the beneficial ingredient to use. The German pet food industry has witnessed the launch of many new products carrying the postbiotics health claim, manifesting the developments in the area of joint health and digestive health primarily.

Apart from that, German people are generally open to products that have innovative features related to the health of pets. Thus, postbiotics are more often recognized as a necessity in premium pet food lines.

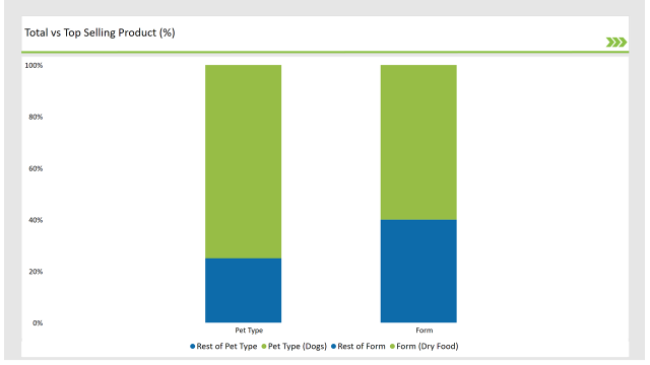

% share of Individual Categories Form and Pet Type in 2025

| Main Segment | Market Share (%) |

|---|---|

| Form (Dry Food) | 60% |

| Remaining segments | 40% |

Dry food is the most developed category in the European pet food market. The primary cause of this surge is the convenience and long storage ability of the dry food that is favoured by supporters of the popular choice among pet owners.

The cost of dry food is also the most acceptable in the market compared to wet one, which is a reason why many consumers buy this product. Moreover, the progress of formulation has allowed for the creation of quality dry food that caters to distinct dietary requirements, such as grain-free, high-protein, and life-stage-specific nutrition.

The growing interest of pet owners in their pets' health and nutrition has built a desire for premium dry food products that offer balanced nutrition and enhance their overall well-being. On top of that, the convenience trend in pet care, which involves easy storage and portion control, has a positive impact on the demand for dry food.

| Main Segment | Market Share (%) |

|---|---|

| Pet Type (Dogs) | 75% |

| Remaining segments | 25% |

The explosion of the segment is a consequence of the rising number of dog owners and the dog humanization trend. Therefore, pet owners are opting to buy food that is of high quality and which fulfils all the necessary nutritional requirements for their pets.

The increase in demand for dog food formulas that are special, for example, grain-free, high-protein, and breed-specific, goes in line with the desire of pet owners to feed their dogs the way nature intended.

Plus, the rise of premium and organic food products is positively impacting the sector's growth, as people try to use natural sources and respect nature. The very fact that consumers can purchase in varied product forms, such as dry food, wet food, and treats, makes the dog food offerings even more attractive.

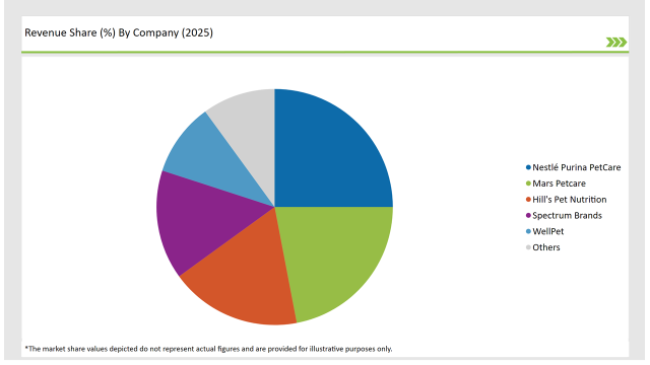

2025 Market share of Europe Postbiotic Pet Food manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Nestlé Purina PetCare | 25% |

| Mars Petcare | 22% |

| Hill's Pet Nutrition | 18% |

| Spectrum Brands | 15% |

| WellPet | 10% |

| Others | 10% |

Note: The above chart is indicative in nature

The European postbiotic pet food market is a mixture of global leaders, regional players, and local players. Tier 1 companies make up most of the market with a wide distribution of products having postbiotics.

Leaders of the industry like Nestlé Purina, Mars Petcare, and Hill's Pet Nutrition make heavy investments in research and development to bring forward innovative formulations, that integrate postbiotics into their recipes. They have global distribution networks and excellent brand recognition to continue to compete.

Tier 2 companies consist of Royal Canin and Orijen with niche products related to specific health concerns, which may be joints or digestive issues. In all cases, companies target a narrow regional market where they can take advantage of high specialization through experience in a related pet health area.

Some examples of Tier 3 companies are local German brands and independent pet food producers who together with postbiotics from regional suppliers. Although the companies are marginally smaller than others, they still represent the diversity of the European postbiotic sector by manufacturing products that meet specific demand from consumers.

The Europe Postbiotic Pet Food market is projected to grow at a CAGR of 4.3% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 383.1 million.

Key factors driving the postbiotic pet food market in Europe include the increasing awareness of pet health and wellness, leading to a demand for functional ingredients that support digestive health and overall well-being. Additionally, the trend towards natural and clean label products is encouraging pet owners to seek out high-quality, scientifically formulated pet foods that incorporate postbiotics.

Germany, France, Italy and UK are the key countries with high consumption rates in the European Postbiotic Pet Food market.

Leading manufacturers include Nestlé Purina PetCare, Mars Petcare, Hill's Pet Nutrition, Spectrum Brands, and WellPet known for their innovative and sustainable production techniques and a variety of product lines.

As per Pet Type, the industry has been categorized into Dogs, Cats, and Other Pets.

As per Form, the industry has been categorized into Dry Food, Wet Food, and Treats & Supplements.

As per Distribution Channel, the industry has been categorized into Pet Specialty Stores, Online Retail, Veterinary Clinics, and Supermarkets/Hypermarkets.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.