The Europe Plant Based Preservatives market is set to grow from an estimated USD 1,256.6 million in 2025 to USD 2,670.5 million by 2035, with a compound annual growth rate (CAGR) of 7.8% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 1,256.6 million |

| Projected Europe Value (2035F) | USD 2,670.5 million |

| Value-based CAGR (2025 to 2035) | 7.8% |

The growth is seen to rise in the European market of plant-based preservatives between 2020 and 2024 through consumer demands toward natural, ecological, non-toxic means toward the increase in shelf life among various products: food and beverage, cosmetic and pharmaceutical products, among others.

Plant-based preservatives derive their source from natural plant material wherein essential oils and plant extracts with herbal extracts as well as spices are said to contain some chemical compounds, providing antimicrobial activity, antioxidation, and anti-fungistatic actions. Such preservatives provide alternatives to synthetic chemicals, making them appealing to consumers seeking healthier and more sustainable options.

Increasing consumption of plant-based food products, awareness of the health benefits of natural ingredients, and concerns over the adverse environmental impact of synthetic preservatives are driving up demand for natural preservatives in Europe.

In this scenario, companies are now focusing on improving their product portfolio and enhancing performance through innovative formulation and technology for natural preservatives.

The key players in this industry are BASF SE, Firmenich SA, and Symrise AG, which also heavily invest in research and development for new, plant-based preservatives to be incorporated with high regulatory levels but meet the increasing demand for clean-label products.

Explore FMI!

Book a free demo

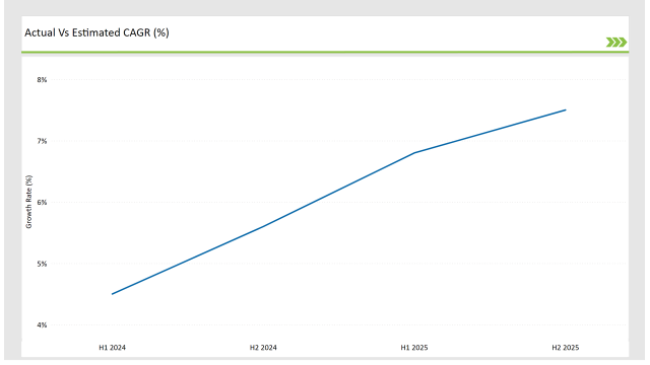

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Plant Based Preservatives market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 4.5% (2024 to 2034) |

| H2 2024 | 5.6% (2024 to 2034) |

| H1 2025 | 6.8% (2025 to 2035) |

| H2 2025 | 7.5% (2025 to 2035) |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Plant Based Preservatives market, the sector is predicted to grow at a CAGR of 4.5% during the first half of 2024, with an increase to 5.6% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 6.8% in H1 but is expected to rise to 7.5% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April-2024 | New Product Launches: Several companies introduced new plant-based preservatives sourced from rare herbs, aiming to cater to both food and cosmetic industries. |

| March-2024 | Strategic Partnership: BASF SE partnered with a major European retailer to enhance the availability of its plant-based preservatives in the mainstream food market. |

| February-2024 | Market Expansion: Firmenich SA expanded its product line to include plant-based preservatives for the pharmaceutical sector, focusing on non-toxic solutions for drug formulations. |

Huge demand for non-food applications by plant-based preservatives.

Plant-based preservatives are rapidly growing from within the confines of traditional food and beverages and moving toward strong expansion in cosmetic and personal care applications. A move to cleaner products and products containing fewer or no synthetic chemicals also encourages consumption; as such, plant-derived preservatives also have increased demand.

To this response, leading corporations have come up with a preservative-based formula of natural products with upgraded antimicrobial as well as anti-oxidative capabilities for extended shelf lives for cosmetics so that the resultant final product shall retain efficacy as well as its safety throughout its period.

Other herbal extracts that are becoming more popular in cosmetic formulations include tea tree oil and chamomile, which inhibit bacterial growth while providing natural skin benefits. The plant-based alternatives have emerged as the new replacements for synthetic preservatives, such as parabens, which have come under growing consumer and regulatory criticism.

The increasing interest of consumers in using natural ingredients and sustainable practices further compels the companies to consider new plant sources and develop unique preservation methods ensuring the quality of the products with minimal impact on the environment.

Innovation in plant-based preservatives for agriculture.

Another area of innovation in the plant-based preservatives market in Europe is the use of these natural alternatives in agriculture. As the agricultural sector faces increasing pressure to adopt sustainable practices and reduce the use of synthetic chemicals, plant-based preservatives are emerging as a viable solution to protect crops from pests and diseases while reducing the environmental footprint of traditional pesticides.

Essential oils derived from plants such as neem, eucalyptus, and citronella are gaining traction as natural insecticides and fungicides, offering an eco-friendly alternative to synthetic chemical agents.

These plant-based solutions not only protect crops but also promote soil health, as they are biodegradable and do not harm beneficial insects or microorganisms in the soil.

Consumer demand for organic, pesticide-free products is also stimulating the uptake of plant-based preservatives by the agricultural industry. Farmers are looking for efficient ways of crop health management that are sustainable, and plant-based preservatives happen to be a non-toxic natural way of controlling pests and diseases.

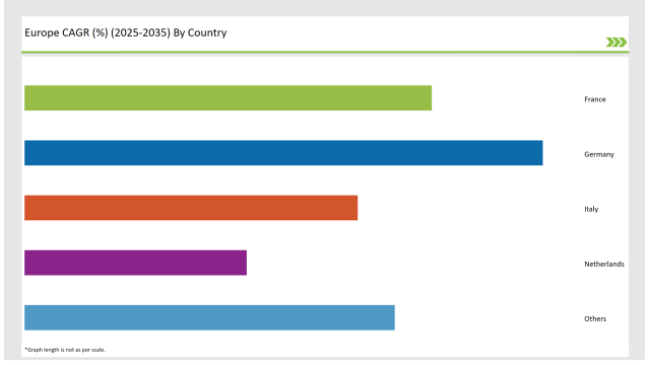

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 28% |

| France | 22% |

| Italy | 18% |

| Netherlands | 12% |

| Others | 20% |

Germany is among the leading nations of the European regions in adopting plant-based preservatives, mainly in the food and beverage sectors. As consumers demand such products and regulators incline more toward natural additives than synthesized ones, the country has witnessed a strong shift toward natural ingredients.

With a strong concern over health issues and a general liking for clean labels, consumers in Germany are keenly interested in the idea of using essential oils and plant extracts to replace chemical-based preservatives. Thus, large to small food firms are very prompt in adopting the newest plant-based preservatives to fulfill the demand for organic and natural food products in Germany.

France has proved one of the strongest-growing markets of plant-based preservatives in Europe, majorly within the food and beverage segment. Natural, organic product growth trends were prevalent in France demand has transformed, wherein it shifts more and more toward natural, organic items as an alternative that indicates personal care regarding health and environment-friendly concerns.

This is the reason why there is also an increasing demand for foodstuff with plant preservatives from essential oils, plant extracts, and spices. The highly qualified French consumers within the urban population, are aware of the good things of having clean-label foods and also willing to pay an extra pound for products minus synthetic additives.

Additionally, some of the prominent companies in the plant-based preservatives market have their headquarters in France, including Naturex (a subsidiary of Givaudan) and Laboratories Photosynthesis, which are researching innovative plant-based solutions to serve the food industry.

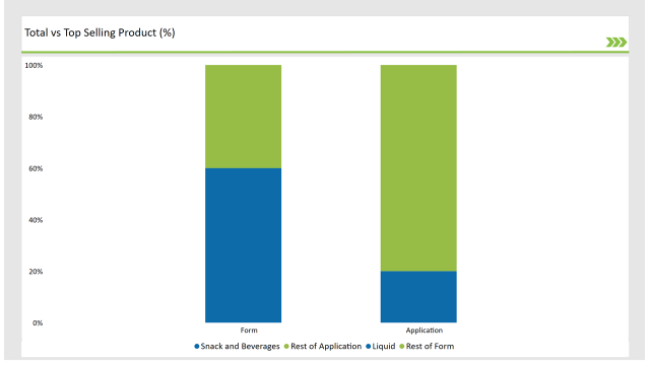

% share of Individual Categories Application and Form in 2025

| Main Segment | Market Share (%) |

|---|---|

| Application (Snack and Beverages) | 20% |

| Remaining segments | 80% |

Snack and Beverages Segment Dominates the Market

Due to the large food and beverage segment, plant-based preservatives in the Europe region hold a very high share. In turn, these factors ensure that food producers opt for alternatives to synthetic preservatives in preference to plant-based preservatives on more health-conscious customers demanding clean, more natural products.

There are plant-based preservatives containing rosemary extract, oregano oil, and cinnamon oil. These have lately become the most embraced because they have natural antimicrobial and antioxidant properties. They extend the shelf life of food products without compromising their quality or safety.

European Union's strict regulation on food additives, especially synthetic ones, has further fuelled its march towards the use of plant-based preservatives in the food and beverage industry. Consumers increasingly seek to have fewer artificial ingredients with every passing year; in the coming years, therefore, demand for plant-based preservatives will soar in the food and beverage sector.

| Main Segment | Market Share (%) |

|---|---|

| Form (Liquid) | 60% |

| Remaining segments | 40% |

Liquid Form Type Dominates the European Plant-Based Preservatives Market

The growth is primarily due to consumer preference for natural and organic products, which are perceived as being more effective and easier to use in a wide range of food formulations with liquid preservatives. The liquid preservative flexibility is easy to integrate into the most diverse applications that may include beverage, sauce, and dressing manufacturing. This gives manufacturers a further reason to be attracted to products in this category.

Advances in extraction and formulation technologies improve the performance and stability of plant-based preservatives in liquid form. In addition, consumer concern for their health and consequent demand for cleaner labels creates an opportunity for food manufacturers, as preservation efficiency without synthetic additives is provided in liquid form. Even regulatory preferences for natural ingredients push this direction, encouraging the development and investment in liquid plant-based preservatives.

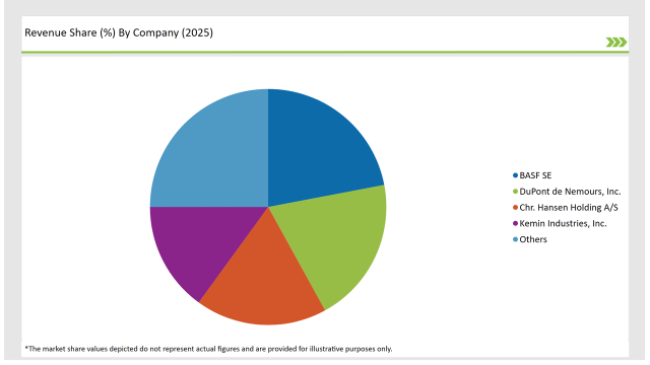

2025 Market share of Europe Plant Based Preservatives manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| BASF SE | 22% |

| DuPont de Nemours, Inc. | 20% |

| Chr. Hansen Holding A/S | 18% |

| Kemin Industries, Inc. | 15% |

| Cargill, Incorporated | 10% |

| Others | 15% |

Note: The above chart is indicative in nature

European plant-based preservatives are tiered in nature. Tier 1 companies are those dominating the global landscape, characterized by their resource availability and technological competency to develop and scale up plant-based preservative solutions across several industries. Leaders in this regard of innovation and product development include BASF SE, Symrise AG, and Firmenich SA, driving expansion in markets.

Advantages accrued through huge research and development networks with already established distribution channels help them to supply all types of applications, ranging from food and beverages to cosmetics and pharmaceuticals.

At the regional level, Tier 2 companies such as Laboratoires Phytosynthese and Naturex, which is currently a division of Givaudan are well-placed to fulfill the specific markets with specialized plant-based preservative solutions. These companies focus on niche applications and closely collaborate with clients to discover solutions that precisely match the specific needs of each client.

Generally, Tier 3 companies are small and highly localized, focusing mostly on either a specific area or application in this instance, a novel, plant-based preservative from indigenous plants.

The Europe Plant Based Preservatives market is projected to grow at a CAGR of 7.8% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 2,670.5 million.

Key factors driving the European plant-based preservatives market include the increasing consumer demand for natural and clean-label products, as well as growing awareness of health and sustainability issues, prompting food manufacturers to adopt plant-based solutions. Additionally, regulatory support for natural ingredients and innovations in food technology further enhance market growth.

Germany, France, and UK are the key countries with high consumption rates in the European Plant Based Preservatives market.

Leading manufacturers include BASF SE, DuPont de Nemours, Inc., Chr. Hansen Holding A/S, Kemin Industries, Inc., and Cargill, Incorporated known for their innovative and sustainable production techniques and a variety of product lines.

As per Source Type, the industry has been categorized into Herbs & Spices, Plant Extracts, Fruits & Vegetables, and Essential Oils.

As per Form Type, the industry has been categorized into Liquid, Powder, Others.

As per Application, the industry has been categorized into Bakery & Confectionery, Dairy & Frozen Products, Snacks & Beverages, Meat & Poultry, Sauces & Dressings.

As per Functionality, the industry has been categorized into Antimicrobial, Antioxidant, Anti-enzymatic, Others.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

Fish Waste Management Market Analysis by Source and End Use Industry Through 2035

Kelp Protein Market Analysis by Form and End Use Through 2035

Fish Soup Market Analysis by Form, Format, Packaging and Sales Channel Through 2035

Fish Silage Market Analysis by Fish, Fish Type, Application and Form Through 2035

Fish Roe Enzymes and Extracts Market Analysis by Type, Source and Application Through 2035

Edible Seaweed Market Analysis by Product Type, End Use Application, Extraction Method and Form Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.