The Europe Plant-Based Pet Food market is set to grow from an estimated USD 7,748.7 million in 2025 to USD 15,174.6 million by 2035, with a compound annual growth rate (CAGR) of 7.0% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 7,748.7 million |

| Projected Europe Value (2035F) | USD 15,174.6 million |

| Value-based CAGR (2025 to 2035) | 7.0% |

The European plant-based pet food market is predicted to have a strong growth rate between 2025 and 2035, which will be mainly caused by the increased trends of pet humanization, ethical consumerism, and the rise of sustainability and animal welfare concerns. Due to people's quest for cruelty-free, allergen-free, and environmentally sustainable ways to feed their pets, the increased demand for high-protein, plant-based, and nutritionally balanced pet food has been huge.

Plant-based pet food is the latest science-based development that complements the specific needs of the pet to its optimal level. This is because the companies are creating high-protein, grain-free, and omega-rich formulations for carnivorous birds, dogs, cats, and other pets.

In addition to these points, the progress made in the field of plant protein extraction and the development of fermentation-based pet food production has led to improvements in the palatability, digestibility, and nutrient profile of these diets.

The market further flourishes due to the increasing number of pet adoptions, a rise in per capita income and more money spent on pet nutrition, and the growing distribution, offline and online, through different retailers. The trend of probiotic-enriched, essential amino acid, and vitamin solid foods is fast becoming common for European pet owners, helping further the industry's growth.

Explore FMI!

Book a free demo

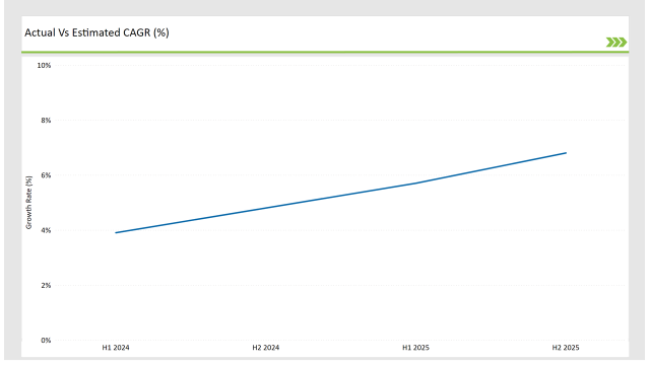

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Plant-Based Pet Food market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 3.9% (2024 to 2034) |

| H2 2024 | 4.8% (2024 to 2034) |

| H1 2025 | 5.7% (2025 to 2035) |

| H2 2025 | 6.8% (2025 to 2035) |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Plant-Based Pet Food market, the sector is predicted to grow at a CAGR of 3.9% during the first half of 2024, with an increase to 4.8% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 5.7% in H1 but is expected to rise to 6.8% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April-24 | Product Launch - Nestlé Purina introduced a vegan kibble for cats and dogs, fortified with taurine and amino acids. |

| March-24 | Retail Expansion - Wild Earth, a leading plant-based pet food brand, expanded its presence in European pet specialty stores. |

| February-24 | Strategic Partnerships - Petaluma partnered with organic ingredient suppliers in Germany to develop high-quality plant-based wet food. |

| January-24 | Sustainability Initiatives - Omni Pet Food launched eco-friendly, recyclable packaging for its plant-based pet food range. |

Increasing Demand for Sustainable and Ethical Pet Nutrition

The rise in the adoption of vegetarian pet foods has been the result of increased demand for environmentally reasonable pet food. It has been observed that along with the increase in the number of pet owners going flexitarian and vegan, the decrease in the ecological footprint is the reason for many of the pets eating alternative protein diets.

Tested by such firms as Wild Earth and Omni Pet Food that turn to fermentation-based protein, algae-derived omega-3s, and high-protein legume-based formulations to guarantee balanced nutrition for pets. The move towards ethical, cruelty-free, and clean-label pet food products also plays a big role in the increase in the market.

Also, government-sponsored programs for sustainability or ecological, green consumer conduct are the ones that accelerate the demand for these kinds of stores. European pet owners even have a taste for non-GMO, soy-free, and hypoallergenic diets for their pets which mark the transition to functional science-backed nutritional products.

Technological Advancements Increasing Nutritional Content in Plant-Based Pet Food

The concern of nutritional sufficiency for plant-based pet diets is addressed by the manufacturers who utilize biotechnological advancements in fermentation-derived proteins, bioengineered amino acids, and novel plant-based taurine formulations. For instance, firms like Nestlé Purina and Petaluma incorporate pea protein, lentil flour, and yeast-derived vitamins to make sure that the plant-based pet food is digestible, palatable, and contains a complete nutritional balance.

The use of freeze-drying and extrusion processing techniques is also part of the plan to sustain nutrient integrity while at the same time increasing the stability. To tackle this issue, the inclusion of functional additives such as prebiotics and gut-friendly fibres is modifying plant-based pet diets in favour of digestive health.

The newly introduced technology in the form of precision fermentation and cellular agriculture has resulted in companies producing bio-identical proteins that imitate traditional meat-derived nutrients allowing plant-based pet food to be a suitable, ethical, and nutritionally viable choice for European pet owners.

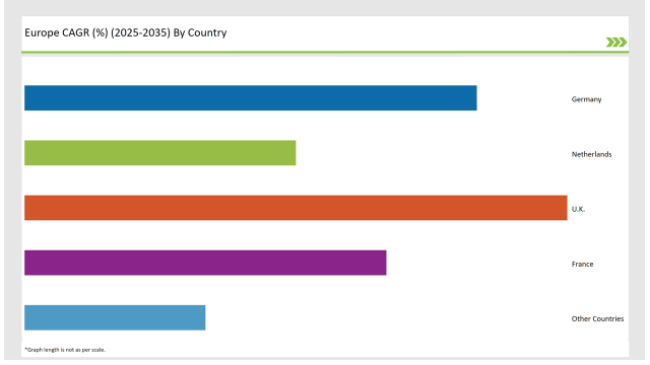

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 25% |

| Netherlands | 15% |

| UK | 30% |

| France | 20% |

| Other Countries | 10% |

Germany is one of the leading countries in the market for plant-based pet food in Europe, mainly because of the pre-eminence that sustainability, ethical consumerism, and organic pet nutrition have in the country. The country also has lots of people who own pets who claim to be vegetarian or vegan; therefore, this has been on the rise lately to seek meat-free as well as eco-friendly pet foods.

Two brands that have succeeded in finding more space in German pet specialty stores and organic markets are Wild Earth and Omni Pet Food. Moreover, transparency, ingredient traceability, and eco-friendly packaging are the priorities of Germany's pet food regulatory regime, which ultimately leads to the development of the market. The great demand for functional pet food enriched with essential amino acids, probiotics, and vitamin-enriched plant proteins has also been a key driver behind the growth of the sector.

France has become a hotspot for the plant-based pet food market which is mainly powered by the premiumization of pet diets and the increasing number of owners who are opting for holistic, organic pet nutrition. The French pet food industry is targeting high-end, natural, and clean-label ingredients, which drives the demand for high-protein plant-based formulas.

Frontline companies Petaluma and Nestlé Purina have introduced special plant-based pet food products that include pea protein, lentils, algae-based DHA, and bioactive prebiotics that support gut health and immunity. The strict regulations on clean-label formulations, organic sourcing, and the addition of functional food ingredients solidify France's position as a premium market for plant-based pet food solutions.

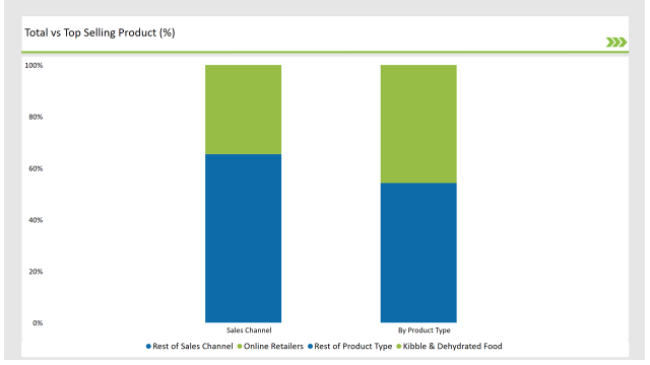

% share of Individual Categories Product Type and Sales Channel in 2025

| Main Segment | Market Share (%) |

|---|---|

| Product Type (Kibble & Dehydrated Food) | 45.8% |

| Remaining segments | 54.2% |

The Leading Innovation of Kibble & Dehydrated Food in Plant-Based Pet Nutrition

Kibble/dry pet food comprises the largest share of the plant-based pet food market and is primarily targeted to the masses following the affordable, long shelf life, and convenience factors. Brands like Nestlé Purina and Wild Earth are engaged in the production of high-protein, grain-free kibble formulations with the addition of pea protein, chickpeas, lentils, and algae-based DHA for optimal amino acid profiles and gut health support.

The new technology in the extrusion process of cold-pressed is enabling manufacturers to improve kibble’s nutrient retention and digestibility, which is a concern about the nutritional adequacy of plant-based pet diets.

Pet food in the form of dehydrated food has more demand as futuristic pet owners want diets with fewer substances and fresh and nutrient-dense meals. Unlike regular kibble, dehydrated food retains the natural fibre and micronutrients of plant-based ingredients, hence making it the most suitable digestible and appetizing option for health-conscious pet owners.

Companies like Petaluma and Omni Pet Food are the ones at the forefront, launching low-heat processed, organic, and functional plant-based dehydrated formulas for senior pets, pets with digestive sensitivities, and high-energy breeds.

| Main Segment | Market Share (%) |

|---|---|

| Sales Channel (Online Retailers) | 34.6% |

| Remaining segments | 65.4% |

The Change in Pet Food Retailing is Caused by the Expansion of Online Retailers

Store-based retailing is at the top because plant-based pet food is sold in pet specialty stores, supermarkets, and veterinary clinics. The main point of sales channels for plant-based pet food are pet stores, supermarkets, and vet clinics. The biggest chunk of the market is covered by offline retailers which include pet specialty stores, supermarkets, and veterinary clinics primarily selling plant-based pet food.

Usually, people opt for in-store shopping since independent pet nutritionists help them decide about the right feeding plan, analyse the formulations, and choose trustworthy brands. The premier pet food brands Wild Earth and Nestlé Purina have reached several major European pet retailers by having their plant-based options sold in these places close to the general public.

Conversely, the climbing trend of personalized subscription meal plans, direct-to-consumer (DTC) pet food brands, and e-commerce platforms has online sales the most attractive choice. Omni Pet Food and Petaluma are among the new brands that are implementing the use of AI technology in pet food, along with auto-replenishment sales and loyalty programs, thus attracting digital-native pet parents.

On top of that, the unveiling of specialty vegan pet food on third-party platforms such as Amazon, Zooplus, and Pets at Home, should make the premium plant-based pet food market grow tremendously among European citizens.

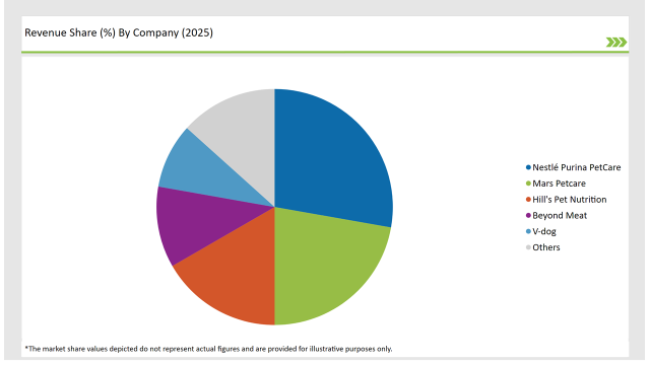

2025 Market share of Europe Plant-Based Pet Food manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Nestlé Purina PetCare | 25% |

| Mars Petcare | 20% |

| Hill's Pet Nutrition | 15% |

| Beyond Meat | 10% |

| V-dog | 8% |

| Others | 12% |

Note: The above chart is indicative in nature

The Europe plant-based pet food market is concentrated representing leading players like Nestlé Purina, Wild Earth, Petaluma, and Omni Pet Food who carry product innovation forward, hit the retail circuit, and the sustainability initiatives.

These firms are pros at fitting plant compositions with huge amounts of protein, and jack in fermented proteins, and microalgae, plus probiotics, fibre blends, and bioengineered taurine as functional ingredients to make sure plant-feeding pets get a full range of nutrients.

New emerging companies are successful in taking advantage of the particular shopper's needs, but at the same time, they provide the client with customized menu plans, veterinarian-validated diets, and nuts and bolts for your pet. V-Dog and The Pack are the firms that are entering organic, GMO-free, and grain-free product segments, which are being made for pets with certain dietary intolerances.

Being sustainable and using raw materials from ethical sources matter in market competition; meanwhile, some brands will pay attention to carbon-negative pet food production, recycling packaging materials, and growing with nature.

As regulations change, pet food producers that are open about the product's composition, send it to veterinarians for research, and prove in the science that organic herbs are beneficial, will be far ahead of the competition in Europe.

The Europe Plant-Based Pet Food market is projected to grow at a CAGR of 7.0% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 15,174.6 million.

Key factors driving the European plant-based pet food market include the increasing consumer demand for sustainable and healthy pet food options that align with ethical and environmental concerns. Additionally, the growing awareness of the health benefits of plant-based diets for pets is fueling market growth as pet owners seek alternatives to traditional meat-based products.

Germany, France, and UK are the key countries with high consumption rates in the European Plant-Based Pet Food market.

Leading manufacturers include Nestlé Purina PetCare, Mars Petcare, Hill's Pet Nutrition, Beyond Meat, and V-dog known for their innovative and sustainable production techniques and a variety of product lines.

As per Product Type, the industry has been categorized into Kibble/Dry, Dehydrated Food, Treats and Chews, Freeze-Dried Raw, Wet Food, and Frozen.

As per Pet Type, the industry has been categorized into Cat, Dog, Birds, and Others.

As per Sales Channel, the industry has been categorized into Store-based Retailing, and Online Retailers.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

Japan Avocado Oil Market Analysis - Size, Share & Trends 2025 to 2035

Korea Avocado Oil Market Analysis - Size, Share & Trends 2025 to 2035

Korea Texturized Vegetable Protein Market Analysis – Size, Share & Trends 2025 to 2035

Japan Texturized Vegetable Protein Market Analysis - Size, Share & Trends 2025 to 2035

Western Europe Texturized Vegetable Protein Market Analysis - Size, Share & Trends 2025 to 2035

Korea Customized Premix Market Analysis – Size, Share & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.