The Europe Pet Dietary Supplement market is set to grow from an estimated USD 1,304.5 million in 2025 to USD 2,431.3 million by 2035, with a compound annual growth rate (CAGR) of 5.1% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 1,304.5 million |

| Projected Europe Value (2035F) | USD 2,431.3 million |

| Value-based CAGR (2025 to 2035) | 5.1% |

Between 2020 and 2024, the pet dietary supplement market in Europe was mainly fueled by the increasing pet humanization trend, the rise of the pet health and wellness movement, and the development of veterinary nutrition. Packaged functional foods have become increasingly popular with pet owners to ensure their pets' normal joint movement, stomach health, weight management, and immune function are well taken care of.

The trend for prophylactic pet care has made pet dietary supplements a basic part of daily pet food, especially for geriatric pets, active breeds, and pets with some specific problems. The need for natural, organic, and vet-approved supplements has skyrocketed which in turn has brought about innovations in product development and the expansion of premium pet wellness brands.

Furthermore, the ecommerce boom and subscription pet nutrition business models had a significant impact on how customers buy and, in turn, add supplements to their pets' diets.

The pet dietary supplements also contain probiotics, omega fatty acids, and advanced glucosamine formulas which are the major market drivers. Companies are producing items that are palatable to pets and are scientifically proven to be effective for some specific health issues.

Explore FMI!

Book a free demo

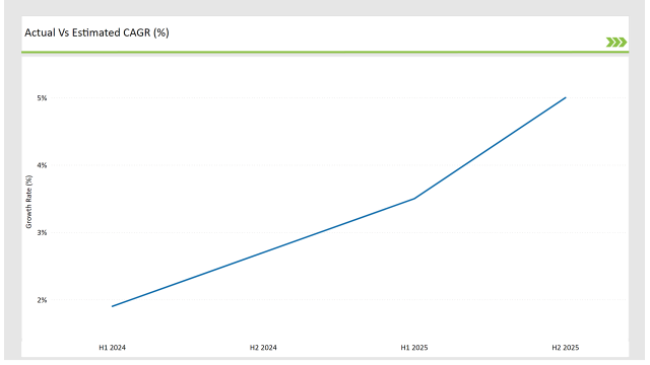

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Pet Dietary Supplement market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 1.9% (2024 to 2034) |

| H2 2024 | 2.7% (2024 to 2034) |

| H1 2025 | 3.5% (2025 to 2035) |

| H2 2025 | 5.0% (2025 to 2035) |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Pet Dietary Supplement market, the sector is predicted to grow at a CAGR of 1.9% during the first half of 2024, with an increase to 2.7% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 3.5% in H1 but is expected to rise to 5.0% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April-24 | Product Innovation - Zesty Paws launched a new range of probiotic-enriched functional treats for gut health and immunity. |

| March-24 | Retail Expansion - Purina introduced a premium veterinary-exclusive joint support supplement line across European pet clinics. |

| February-24 | Strategic Partnerships - Royal Canin partnered with European pet wellness brands to develop breed-specific dietary supplements. |

| January-24 | Technology Advancements - Mars Petcare integrated AI-driven pet health tracking technology to provide personalized supplement recommendations. |

The Rise of Probiotics and Gut Health Solutions for Pets in Pet Nutrition

The probiotic scarcity in gut health pet products within Europe and rising interest worldwide in probiotics gut health has quickly introduced probiotic-based pet dietary supplements. With oligosaccharide food, gas, and gut problems being more common in pets, probiotic products are getting more and more popular as pet owners are looking for preventive care mostly for them.

Purina, Zesty Paws, and Royal Canin are some of the brands that have come up with probiotics that are powerful and can handle most of the bad bacteria that are specific to the age and breed of the puppy. These formulas are intended not only to improve digestive balance and immunity issues but also to enhance the process of getting nutrients.

Additionally, using plant-based fermented probiotics, postbiotics, and prebiotics is being adopted in pet supplement development, thus ensuring the full spectrum of gut health. Moreover, veterinarian-promoted digestive health items are now adopted at a higher rate in pet clinics, specialty pet shops, and online sites which creates the driving power of the entire probiotics field.

Mobility Supplements for Aging Pets Witness Dramatic Growth

According to mainstream pet health and wellness concerns, the percentage of pets suffering from problems related to the joints is increasing due to the rise of their old pets, the growth of the rates of big breed dogs, and the high demand for glucosamine, chondroitin, and omega-3 fatty acid supplements across Europe. Pets, particularly dogs and cats, are being given support with joint formulations to help them with mobility, alleviate swelling, and renew the cartilage.

Some of the renowned companies that have entered the field include VetriScience, Nutramax, and YuMOVE by introducing a combination of three different joint solutions like glucosamine, MSM (methylsulfonylmethane), and green-lipped mussel extracts that provide complete mobility support.

In addition, CBD-infused pet dietary supplements for pain relief and anti-inflammatory effects are now catching more traction in places like Germany, France, and the UK as the laws of cannabis products for pets are more permissible.

Furthermore, improvements in liposomal and Nano-emulsion technologies are ensuring that glucosamine is absorbed and utilized more effectively by raising bioavailability thus helping in a faster action and long-term advantages of taking the product.

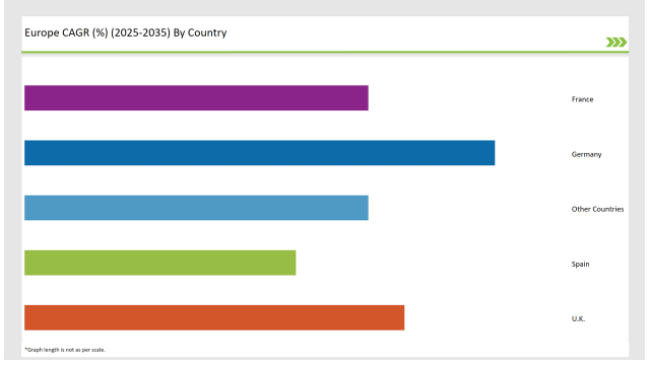

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 26% |

| Spain | 15% |

| UK | 21% |

| France | 19% |

| Other Countries | 19% |

In terms of the European market for pet dietary supplements, Germany leads the rest of the continent as it is driven by high pet ownership rates, strict veterinary health standards, and a growing consumer base that goes for premium pet nutrition.

The country is experiencing a noticeable trend of increasing breed-specific and age-specific dietary supplement requests, and brands are prioritizing the ones that provide tailor-made solutions for joint health, digestive support, and skin & coat wellness.

Brands like Royal Canin and Boehringer Ingelheim pursue scientific research and veterinary-approved pet supplement formulations that ensure higher bioavailability and benefits that are precise to the target. Moreover, the subscription-based business that is discovering a new market now is pet supplement subscriptions that offer monthly wellness kits based on veterinary prescriptions.

France has recorded enormous success in the premium pet supplement section, especially concerning specialized pet retailers and veterinary clinics. Pet owners in France are more likely to choose functional, human-grade supplements that are packed for long-term pet wellness and preventative health care.

Brands such as Virbac and Pro-Nutrition Flatazor are aiming to expand their premium supplement lines, with the new addition of omega-3 enriched skin and coat health formulas, weight management supplements, and holistic gut health solutions.

Furthermore, the concern for environmentalism and organic products has resulted in the establishment of the demand for the consumption of natural, plant-based pet supplements, which are free from artificial additives, fillers, and synthetic preservatives.

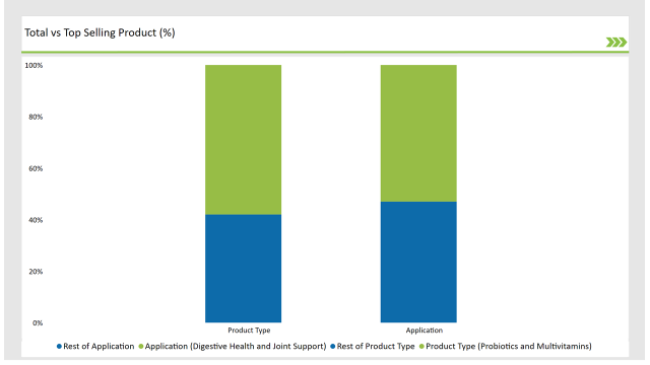

% share of Individual Categories Product Type and Application in 2025

| Main Segment | Market Share (%) |

|---|---|

| Product Type (Probiotics and Multivitamins) | 58% |

| Remaining segments | 42% |

The Probiotics and Multivitamins Market Witnessing a Significant Growth

The probiotics sector ranks as the most prominent in the European pet food supplement market. Since pet owners are becoming more aware of digestive health and immune system support, probiotics have gradually grown into the main part of functional pet nutrition.

Examples include Purina, Zesty Paws, and Royal Canin with multi-strain probiotic blends, assisting dogs, cats, and other pets to find gut microbiota balance, optimize nutrient absorption, and improve digestive efficiency. On top of this, sales of fermented probiotics and synbiotics, the latter combining prebiotics + probiotics, are increasingly sought as a means of preventive pet health care solutions.

The multivitamin segment is riding on the crest of the wave; as pet owners are looking for all-round solutions for their pet's health. Think of Nutramax and VetriScience who have recently introduced daily multivitamins that come with basically everything needed including vitamins, amino acids, and antioxidants that together help with immune function, brain development, and coat health.

The introduction of breed-specific and age-specific multivitamins has additionally been the primary driver of market expansion, enabling pet owners to obtain customized nutrition based on life and health conditions.

| Main Segment | Market Share (%) |

|---|---|

| Application (Digestive Health and Joint Support) | 53% |

| Remaining segments | 47% |

Stirring Demand for Digestive Health and Joint Support Supplements

The digestive health sector is the highest earner in the pet dietary supplement business, mainly because of the increase in the cases of food allergies, irritable bowel syndrome (IBS), and gut chrome issues in pets.

Veterinary professionals and pet wellness brands are increasingly recommending high-potency probiotic blends, fibre-based supplements, and digestive enzymes to improve nutrient absorption and gut health. Companies like Purina and Hill’s Pet Nutrition are directing their investments into gut-health-focused supplement lines, which include preventive and therapeutic digestive care solutions.

The joint health segment is one of the leading areas of application, especially for larger pets and elderly dogs who tend to have hip and joint issues. Supplements that contain glucosamine, chondroitin, MSM, and omega-3 fatty acids are common, with brands like YuMOVE and VetriScience launching joint support formulations that are substantiated with proven clinical efficacy.

2025 Market share of Europe Pet Dietary Supplement manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Nestlé Purina PetCare | 24% |

| Mars Petcare | 21% |

| Hill's Pet Nutrition | 17% |

| Bayer Animal Health | 10% |

| Vetoquinol S.A | 8% |

| Others | 20% |

Note: The above chart is indicative in nature

This industry is characterized by a mix of established multinational companies and emerging local players in terms of market concentration of the pet dietary supplement sector in Europe. Major companies include Nestlé Purina, Mars Petcare, and Hill's Pet Nutrition.

These companies command a large market share because they have a significant distribution network and brand recognition. These leading industries enjoy economies of scale and significant marketing budgets.

However, there is a niche brand of startups emerging, each focusing on one specific product: for example, organic, natural, and breed-specific supplements, which are coming to the fore given the surging demand in the market today for high-quality, tailored nutrition solutions for their pets. Accordingly, the fragmentation of the market is increasing by offering a more diverse range that caters to different pet health needs.

Furthermore, growing consciousness about pet health and well-being among European consumers is increasing competitiveness. The already vital regulatory frameworks, European Union feed legislation, play an even greater role in determining market scenarios.

In total, the market is still dominated by a few major players; however, the availability of many small businesses keeps this market dynamic and diverse for the European pet dietary supplement market.

The Europe Pet Dietary Supplement market is projected to grow at a CAGR of 5.1% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 2,431.3 million.

Key Key factors driving the Europe pet dietary supplement market include the increasing awareness among pet owners about the importance of pet health and wellness, leading to higher demand for nutritional supplements. Additionally, the growing trend of premiumization in pet products, with a focus on natural and organic ingredients, is further propelling market growth.

Germany, Italy, and UK are the key countries with high consumption rates in the European Pet Dietary Supplement market.

Leading manufacturers include Nestlé Purina PetCare, Mars Petcare, Hill's Pet Nutrition, Bayer Animal Health, and Vetoquinol S.A known for their innovative and sustainable production techniques and a variety of product lines.

As per Pet Type, the industry has been categorized into Cat, Dog, Birds, and Others.

As per Product Type, the industry has been categorized into Glucosamine, Probiotics, Multivitamins, Omega 3 fatty acids, and Others.

As per Application, the industry has been categorized into Joint Health, Digestive Health, Weight Management, Skin and Coat Health, Dental Care, and Others.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.