The European molded fiber pulp packaging market is growing rapidly, of late, since it responds to consumer demand for ever more sustainable, biodegradable, recyclable, and natural packaging solutions for food and beverages, electronics, and healthcare, among others. The market is likely to grow at a CAGR of 3.8% during this period, reaching €4073.21 billion by 2035. Other growth drivers include increased EU rules on single-use plastics, improvements in molded fiber, and environmental sustainability of packaging made aware by most consumers.

Manufacturers are now emphasizing the development of innovative molded fiber packaging solutions, which include water-resistant and customizable designs, to substitute traditional plastic packaging. Partnerships with retail chains, QSRs, and packaging firms further accelerate the use of molded fiber pulp packaging in Europe.

| Attributes | Values |

| Projected Industry Size 2035 | € 4073.21 billion |

| Value-based CAGR (2025 to 2035) | 3.8% |

Explore FMI!

Book a free demo

Summary

This analysis points to the positioning of the major players in the industry of molded fiber pulp packaging. Huhtamaki Oyj is leading on innovative and sustainable molded fiber solutions. However, these are costly production lines. For Stora Enso, the biodegradable and renewable materials are high strength but lack the scalability in developing markets.

For Mondi Group, durable, customizable molded fiber packaging is available but has the disadvantage of competition from the low-cost solutions. This encompasses the opportunity in using sustainability trends, expansion of application areas for molded fiber packaging, fluctuating costs of raw materials, and evolving regulations as threats.

Huhtamaki Oyj

Huhtamaki demonstrates strengths in its advanced, recyclable molded fiber products. However, weaknesses include high production costs due to sophisticated manufacturing processes. Opportunities exist in expanding partnerships with European food service and retail companies. Threats arise from raw material price volatility and competition from emerging market players.

Stora Enso

Stora Enso is at the forefront of producing bio-based and biodegradable molded fiber packaging. However, the company lacks scale in expanding its operations in developing regions with rising demand. Opportunities are offered in expanding footprints in healthcare and electronics. Threats will be competition in conventional plastic packaging.

Mondi Group

Mondi Group specializes in durable and customizable molded fiber solutions. However, weaknesses include dependence on certain raw material suppliers. Opportunities exist in innovating with water-resistant molded fiber designs. Threats stem from regulatory changes and market competition from alternative materials.

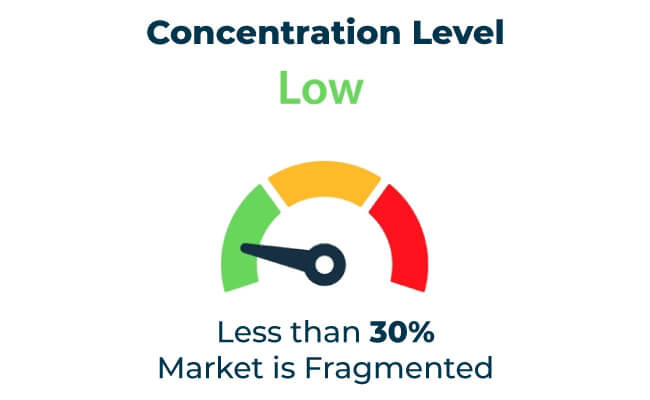

| Category | Market Share (%) |

|---|---|

| Top 3 Players (Huhtamaki Oyj, Stora Enso, Mondi Group) | 14% |

| Rest of Top 5 Players | 06% |

| Next 5 of Top 10 Players | 09% |

Type of Player & Industry Share

| Type of Player | Market Share (%) |

|---|---|

| Top 10 Players | 29% |

| Next 20 Players | 47% |

| Remaining Players | 24% |

Year-on-Year Leaders

The European Union has implemented stringent regulations to reduce single-use plastics and promote sustainable packaging. Policies like the EU Green Deal and the Single-Use Plastics Directive are driving innovation in molded fiber pulp packaging solutions.

Emerging markets in Asia-Pacific, the Middle East, and South America present significant growth potential for European manufacturers. Demand for sustainable and compliant molded fiber packaging is increasing globally to meet evolving consumer and regulatory expectations.

In-House vs. Contract Manufacturing

The molded fiber pulp packaging market in Europe is shaped by regional dynamics, with Western Europe leading in technological advancements and adoption due to stringent regulations. Central and Eastern Europe are emerging as key growth areas due to rising industrialization and consumer demand for sustainable packaging.

| Region | Western Europe |

| Market Share (%) | 50% |

| Key Drivers | Regulatory mandates and advanced technologies. |

| Region | Central Europe |

| Market Share (%) | 30% |

| Key Drivers | Industrial growth and increasing exports. |

| Region | Eastern Europe |

| Market Share (%) | 20% |

| Key Drivers | Expanding manufacturing sector. |

The European molded fiber pulp packaging market will expand through innovations in sustainable materials, advanced recycling methods, and partnerships with key industry stakeholders. Companies focusing on compliance, eco-friendliness, and cost-effective solutions will dominate this evolving market.

| Tier | Key Companies |

| Tier 1 | Huhtamaki Oyj, Stora Enso, Mondi Group |

| Tier 2 | DS Smith, Pactiv Evergreen Inc. |

| Tier 3 | Hartmann Group, Pro-Pac Packaging |

European molded fiber pulp packaging is likely to experience steady growth, fueled by the increasing demand for sustainability by consumers and strict regulations. Innovators who focus on compliance and sustainability will be leading this fast-moving market.

Key Definitions

Abbreviations

Research Methodology

This report is based on primary research, secondary data analysis, and market modeling. Insights were validated through industry expert consultations.

Market Definition

The molded fiber pulp packaging market in Europe includes recyclable, moisture-resistant, and customized packaging solutions for food, electronics, healthcare, and retail sectors.

Rising demand for sustainable and recyclable packaging solutions and stringent EU regulations.

The market is likely to grow at a CAGR of 3.8% during this period, reaching €4073.21 billion by 2035

Leading players include Huhtamaki Oyj, Stora Enso, and Mondi Group.

Key challenges include high production costs and regulatory complexities.

Opportunities lie in water-resistant coatings, advanced recycling technologies, and partnerships with FMCG brands.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.