The Europe Microbial Seed Treatment Market is set to grow from an estimated USD 384.9 million in 2025 to USD 1,117.9 million by 2035, with a compound annual growth rate (CAGR) of 11.3% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 384.9 million |

| Projected Europe Value (2035F) | USD 1,117.9 million |

| Value-based CAGR (2025 to 2035) | 11.3% |

The Europe Microbial Seed Treatment Market is expected to see substantial growth from 2025 to 2035 driven by rising agricultural sustainability issues and the transition to biological alternatives.

Farmers throughout the area are utilizing microbial seed treatments to boost crop resilience, increase yield, and reduce reliance on chemical-based fertilizers. Due to strict European Union regulations promoting bio-based agricultural methods, the microbial seed treatment market is poised for swift growth.

The rising demand for enhanced food production and the preservation of soil health is propelling the market, especially in key agricultural countries like Germany, France, Italy, and the UK Furthermore, the growth of the market is supported by developments in microbial technologies, boosted R&D investments, and strategic partnerships between biotech firms and agricultural businesses.

The introduction of new microbial strains that improve nutrient uptake, root growth, and disease resistance makes microbial seed treatments a revolutionary method for contemporary European agriculture.

Explore FMI!

Book a free demo

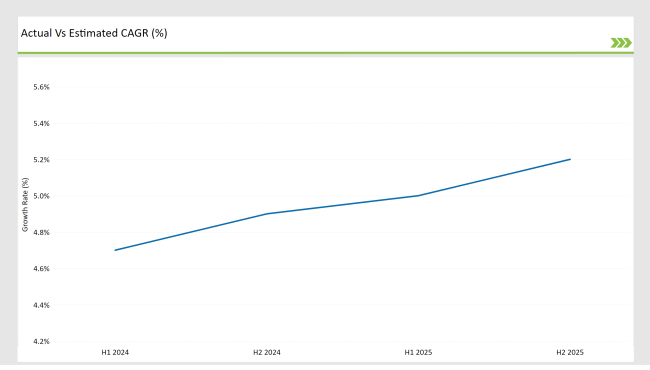

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Microbial Seed Treatment Market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

For the Microbial Seed Treatment Market, the sector is predicted to grow at a CAGR of 4.7% during the first half of 2024, with an increase to 4.9% in the second half of the same year. In 2025, the growth rate is anticipated to slightly increase to 5.0% in H1 and is expected to rise further to 5.2% in H2.

This pattern reveals an increase of 30 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 30 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 24- January | Product Launch : BASF introduced a groundbreaking biofungicide seed treatment specifically engineered for wheat and barley crops in the United Kingdom. The innovative product, developed after three years of extensive field trials . |

| 24- March | Expansion : Bayer AG significantly expanded its microbial research facility in Munich, Germany, with a 153 million USD investment to accelerate biological seed treatment development. The expanded center features state-of-the-art laboratories and research capabilities . |

| 24 -July | Collaboration: Corteva Agriscience and Syngenta formed a strategic partnership to jointly develop advanced microbial seed treatment solutions. The five-year collaboration combines Corteva's expertise in seed technology with Syngenta's biological research capabilities . |

| 24- October | Acquisition: Novozymes completed the acquisition of BioTech Innovations GmbH, a leading German biotech startup specializing in microbial seed treatments. |

Adoption of Bio-Based Agricultural Practices in Response to EU Sustainability Policies

The European microbial seed treatment market is undergoing strong expansion fueled by the combination of regulatory demands and sustainability needs. The EU's strict rules regarding synthetic agrochemicals, especially through the European Green Deal and Farm to Fork Strategy, have prompted a notable change in farming methods. This regulatory structure seeks to cut chemical pesticide usage by 50% by 2030, generating a significant market chance for biological substitutes.

Market trends indicate a growing uptake of microbial seed treatments, as farmers are more frequently acknowledging their advantages in environmental compliance and enhancing agricultural productivity.

These therapies, which include helpful bacteria and fungi, are showing remarkable outcomes in increasing nutrient absorption efficiency, enhancing stress resilience, and naturally elevating crop production. Top agricultural technology firms are reacting by broadening their bio-based product ranges and increasing their research funding.

The market is additionally bolstered by rising consumer interest in sustainably sourced food and expanding carbon credit possibilities for regenerative agricultural methods. Incentives from EU member countries, such as subsidies and grants for bio-based agricultural inputs, are boosting market entry.

This shift is especially notable in major agricultural areas such as France, Germany, and Spain, where early implementers are experiencing successful use of microbial solutions for different crop varieties.

Advancements in Microbial Strains and Seed Coating Technologies

Improvements in microbial strains and seed coating techniques are greatly impacting the European microbial seed treatment market by boosting agricultural productivity and sustainability. Cutting-edge microbial strains, comprising both genetically altered and naturally found beneficial microbes, enhance nutrient absorption, disease tolerance, and overall crop endurance.

Simultaneously, cutting-edge seed coating methods allow for the efficient application of these microbes straight onto seeds, safeguarding them during germination and promoting ideal establishment in the soil.

This comprehensive strategy corresponds with the growing need for eco-friendly farming methods and regulatory demands, fueling investment in microbial seed treatments as a practical substitute for chemical pesticides and fertilizers, ultimately transforming agricultural practices throughout Europe.

The following table shows the estimated growth rates of the top fourmarkets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The government of the United Kingdom has distinctly prioritized investment in R&D across multiple sectors, especially in biotechnology, renewable energy, and advanced manufacturing, driven by the relentless goal of enhancing the nation's competitiveness in the global market while addressing pressing issues like climate change and health.

Incentives such as tax breaks, subsidies, and initiatives like the R&D Tax Credit Scheme have facilitated financing for technology start-ups and enabled companies, irrespective of their size, to obtain advanced manufacturing equipment, as seen with certain firms.

Collaborations among educational institutions, corporations, and the government have fostered a strong innovation ecosystem where UK universities and research organizations spearhead the creation of new technologies that are subsequently commercialized through government-backed initiatives.

The collaboration between R&D and governmental backing through taxes and revenues greatly contributes to the economy while also promoting the UK's advancement as a center for technological expertise and a leader in sustainable development.

Germany has seen a growing demand for sustainable agricultural products. Certainly, the nation is experiencing this demand driven by recent regulatory shifts and the strong commitment of the German populace to embrace sustainable agriculture.

The German government has enforced strict regulations aimed at reducing agriculture's footprint: limits on pesticide use; encouragement of organic farming; and incentives for adopting sustainable practices along with various other measures. These regulatory changes are accompanied by rising consumer awareness and a heightened preference for sustainably produced food.

Also, the Federal Initiative for Organic Agriculture and Alternative Sustainable Agriculture Practices has offered funding to farmers during their shift to organic farming. Furthermore, the rapid implementation of sustainable practices in Germany is largely a result of the goals established by the European Union's Green Deal.

This has led to a significant demand for organic and local products, creating fresh opportunities for farmers and businesses. Ultimately, regulatory backing, consumer demand, and various government efforts have positioned this nation as a leader in sustainable agriculture by fostering advancements and creativity in the field.

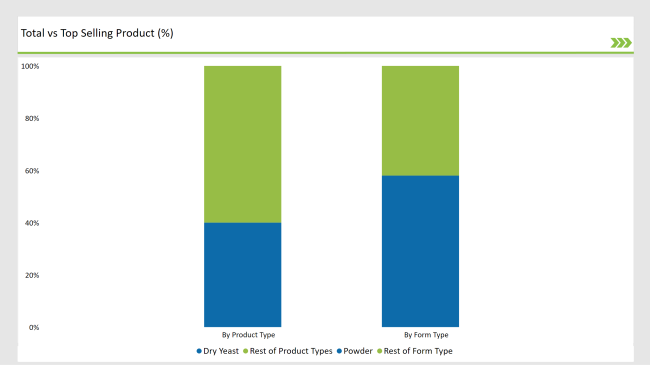

% share of Individual categories by Product Type and Applications in 2025

Bacterial Leading Microbe Type Adoption Due to Higher Effectiveness

Microbials used for bacterial-based seed treatment are gaining increasing traction in the European market due to their exceptional multifunctionality, strong compatibility with agricultural systems, and demonstrated effectiveness in enhancing crop efficiencies.

Bacterial groups such as Bacillus, Pseudomonas, and Rhizobium are favored for their prompt attachment to seeds and roots for symbiotic interactions with plants: Their functions include enhancing nutrient availability like nitrogen fixation and phosphate solubilization; exhibiting antibiotic properties against soil-borne pathogens; and inducing systemic resistance in plants against biotic stressors. Besides their capacity to appear and reappear in various soils, they also demonstrate sufficient resilience to shifting climates.

Regulatory structures in Europe aim to support the shift towards bacteria-based solutions. Similar to the EU Farm to Fork Strategy and prohibitions on synthetic agrochemicals, these trade strategies promote the change.

What bacteria possess compared to fungal biocontrol agents is typically a quicker competitive capacity for inhabiting areas and a significantly wider range of effectiveness, making them more dependable in IPM systems.

Row Crops Driving Market Expansion in Agricultural Heartlands

Row crops such as maize, wheat, soybeans, and oilseed rape are the primary contributors to the microbial seed treatment market in Europe, particularly in nations like France, Germany, and certain areas of Eastern Europe. These crops occupy vast regions and support the foundation of local food supply and economy, resulting in a strong need for technologies that can enhance their productivity.

Microbial seed treatments offer a viable option to enhance germination rates, seedling strength, and stress resilience in row crops cultivated in monoculture systems prone to pest invasions, nutrient depletion, or both: the expense is expected to be less than that of alternative methods

In the core regions of Europe, sustainable intensification aligns with microbial solutions that decrease dependency on synthetic fertilizers and pesticides. For instance, introducing bacteria to maize seedlings enhances nitrogen-use efficiency, which has both economic and environmental implications concerning nitrate-leaching.

Additionally, in cereal crops, the use of microbes will help diminish early-season diseases like Fusarium or Pythium, which are triggered by climate-related changes. Additionally, considering that the Common Agricultural Policy (CAP) compensates farmers for implementing practices that enhance their environmental performance, it offered even greater motivation for farmers to adopt microbial solutions.

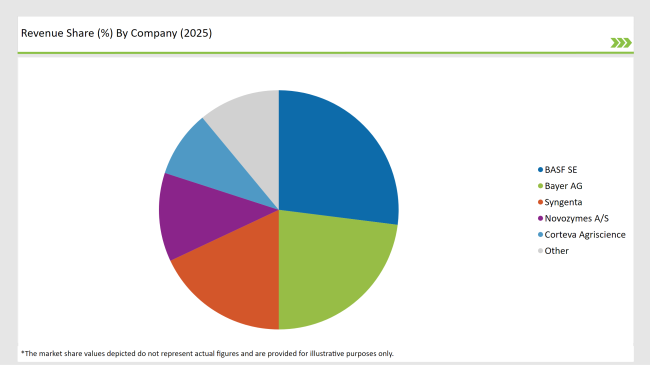

2025 Market share of Microbial Seed Treatment Manufacturers

The European market for microbial seed treatment is moderately concentrated, featuring significant players like BASF SE, Bayer AG, Syngenta, Novozymes A/S, and Corteva Agriscience, which hold substantial market shares. These companies maintain their influence over market operations through extensive distribution networks, strong research expertise, and strategic partnerships.

Local and regional players are also making headway by focusing on niche markets and offering innovative, sustainable solutions. Major players are concentrating on expanding their production capacities to capture the growing demand for effective microbial seed treatments.

Research and development efforts are being prioritized to enhance product functionality and effectiveness. Regional players are increasingly adopting strategies that include the production of organic and non-GMO treatments to meet specific consumer needs, reflecting the dynamic evolution of the European microbial seed treatment market.

The Europe Microbial Seed Treatment Market is projected to grow at a CAGR of 11.3% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 1,117.9 million.

Key factors driving the European Microbial Seed Treatment Market include increasing health consciousness and demand for natural alternatives, alongside regulatory changes and consumer preferences for low-calorie options. Additionally, trends in the food and beverage industry and sustainability concerns are influencing market dynamics.

Germany, the UK, and France, are key countries with high consumption rates in the European microbial seed market.

Leading manufacturers include BASF SE, Bayer AG, Syngenta,Novozymes A/S and Corteva Agriscience, known for their innovative and sustainable production techniques and a variety of product lines.

As per Microbe Type, the industry has been categorized into Bacterials, Fungals and Others.

As per Crop Type, the industry has been categorized into Row Crop, Cereals & Grains, Fruits & Vegetables and Oil Seeds.

As per Functionality, the industry has been categorized into Seed Protection, Seed Enhancement, and Bio-fertilizers.

As per Form, the industry has been categorized into Liquid, and Powder/Granules.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.