The Europe Mezcal market is set to grow from an estimated USD 185.7 million in 2025 to USD 331.4 million by 2035, with a compound annual growth rate (CAGR) of 6.0% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 185.7 million |

| Projected Europe Value (2035F) | USD 331.4 million |

| Value-based CAGR (2025 to 2035) | 6.0% |

Europe is experiencing a strong inflow of demand for mezcal, the driver of which is the reshaping of consumer preferences to premium craft spirits and artisanal alcoholic beverages.

Accompanied by European consumers becoming more adventurous in their drinking habits, there is interest in such spirits that are made by traditional processes and in small quantities as mezcal, which offer a distinct smoky flavour and cultural tradition. The increasing popularity of agave-based spirits is largely driven by the increased global cocktail culture, with mezcal being one of the main ingredients in high-end mixology.

One key reason for the boosting of the European mezcal market is that high-quality mezcal brands are now more widely available across both on-trade and off-trade channels. Bars, upscale restaurants, and cocktail lounges are not only adding more and more mezcal-based cocktails to their menus but this also has a positive impact on the customers' attention.

Explore FMI!

Book a free demo

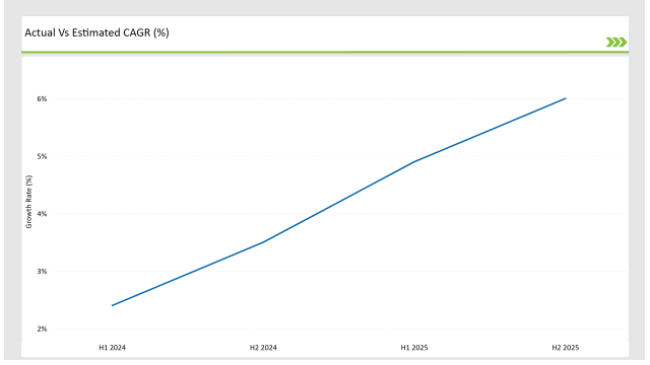

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Mezcal market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 2.4% (2024 to 2034) |

| H2 2024 | 3.5% (2024 to 2034) |

| H1 2025 | 4.9% (2025 to 2035) |

| H2 2025 | 6.0% (2025 to 2035) |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Mezcal market, the sector is predicted to grow at a CAGR of 2.4% during the first half of 2024, with an increase to 3.5% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 4.9% in H1 but is expected to rise to 6.0% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April-2024 | Pernod Ricard expanded its mezcal portfolio by acquiring a majority stake in a premium artisanal mezcal brand. |

| March-2024 | Diageo launched a new ultra-premium mezcal line in Europe targeting high-end cocktail bars and luxury spirits retailers. |

| February-2024 | Bacardi partnered with a Mexican distillery to introduce an exclusive limited-edition mezcal collection in European markets. |

| January-2024 | Online spirits retailer Master of Malt reported a 35% increase in mezcal sales across its European platform. |

The Ever-Increasing Acceptance of Mezcal Thematic for Drinks and Spirits Made by Consumers' Quest for Premium and Artisanal Spirits

The European market has expressed its definitive preference for premium spirits, and mezcal’s artisanal and handcrafted nature is a perfect companion to the trend. Unlike mass-produced spirits, mezcal’s traditional production methods, which involve pit roasting agave and natural fermentation, give consumers a real experience of his/her cultural heritage and the art of brewmaster skills.

The rise of high-end bars and speakeasies in Europe has contributed to the insertion of mezcal into the market, as bartenders look for unique and complex flavors to craft classical cocktails.

In addition to that, the mezcal manufacturers and the European mixologist's collaborations have brought the cocktail menus of improvisation to life with mezcal as a base in the new drinks.

Bartenders are continuously revealing the diverging taste of mezcal and combining it with herbal and citrus elements thus making their signature drinks that are attractive to modern clients. The advent of experiential marketing including mezcal evening cocktail workshops, pop-up brand mixology events, and storytelling that promote storytelling promotions contributed to mezcal's status rise from a niche spirit to a sought-after premium beverage in the European market backdrop.

Booming Market Growth thanks to Expanded Distribution Networks and Retail Availability

The distribution sector of mezcal in Europe is currently in a pronounced transition, with more retailers, specialty liquor stores, and e-commerce platforms featuring a broad spectrum of mezcal. On-trade channels, such as bars, nightclubs, and restaurants, have been the leading distribution segment.

The joint venture between the spirit distributors in Europe and the mezcal producers in Mexico drawing closer to one another has led to the inclusion of additional brands along with their prices dropping through competition. The off-trade channels mainly consist of supermarkets, liquor stores, and online merchants as the purchasing trend is shifting to at-home buying. The expansion of direct-to-consumer online sales and subscription services that give access to exclusive mezcal selections has also made the distribution highly effective.

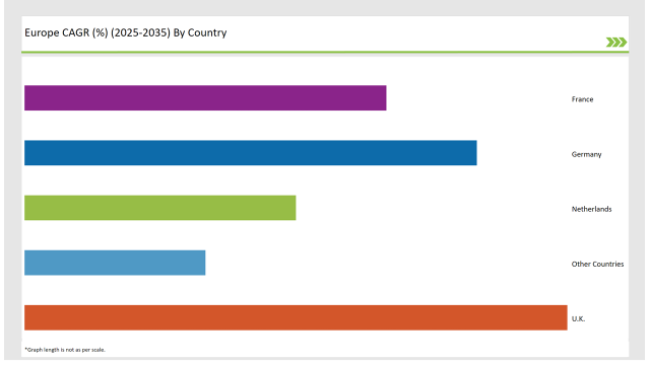

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 25% |

| Netherlands | 15% |

| UK | 30% |

| France | 20% |

| Other Countries | 10% |

France, which is commonly linked to wine and cognac drinking, has found a new section where mezcal is taking its place due to the increasing demand for craft drinks. French consumers are changing their perception of mezcal from simple distillation to a more complex one, with the BCN cities like Paris, Lyon, and Marseille having seen a growth in mescal bars and cocktail venues that accept bartenders experimenting with mescal-based cocktails, offering them to both advanced and starter drinkers.

An off-trade sector that makes specialty liquor stores and online retailers a go-to source of a full range of mezcal beers is also taking off in France. The companies are distributing mezcal brands through liquor stores and online shops, in collaboration with Mexican distilleries. Furthermore, tourism and gastronomy have been major players in alcohol trends in France, and the inclusion of mezcal in gothic restaurant menus and luxury hospitality places is likely to ignite its further spread.

Spain's traditional and cultural bond with Latin America, as it has been for centuries, makes it feasible for mezcal to develop in Europe. Given the impressive market for tequila, especially, the Spanish palate is turning to mezcal - diversely different agave-based alcoholic beverages stand out from the traditional high alcohol and sweet types with more complicated flavors. In metropolises such as Madrid, Barcelona, and Seville, the places where mezcal is typically found are high-class drinking establishments, and places to hang out where harpists fulminate with smoky mezcal drinks in the presence of the audacious consumer.

Through hotels and restaurants, Spain's hospitality industry made it to rise of the mezcal liquor. The rise in mezcal consumption has also been a result of Latin American restaurants that serve and pair mezcal with iconic Spanish tapas, thus reaching a new food audience.

The off-trade is also expanding as supermarkets and liquor stores are adding more mezcal brands to their list of products to meet the demand. Besides, the festivals and cultural events that present Latin American heritage are the platforms for the mezcal brands to showcase their products, which again strengthens Spain's position as a main market in Europe for mezcal.

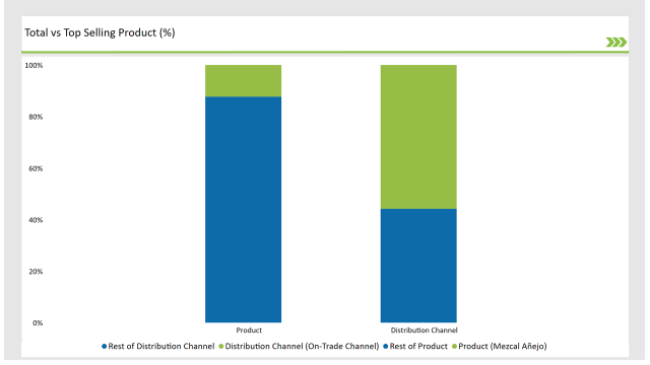

% share of Individual Categories Product and Distribution Channel in 2025

| Main Segment | Market Share (%) |

|---|---|

| Product (Mezcal Añejo) | 12.3% |

| Remaining segments | 87.7% |

Mezcal Añejo Gains Tendances Among Connoisseurs and Aged Spirit Enthusiasts

Mezcal Añejo, which enjoys the favor of Spanish consumers, is a top choice, which should be found in the collection of any self-respecting aged spirits enthusiast. The dark, tropical notes of caramel, oak, and spice bring it closer to the direction of whiskey, brandy, and rum drinkers, who in their turn, look for agave spirits with a touch of elegance. Aged mezcal collectors have also assumed this popularity because it is so rare and stands the test of time besides its intricate process and aging.

The best mezcal brands are taking on this current tide by launching limited edition aged versions, which in turn emphasizes the artistic nature of the production of barrel aging and terroir-driven flavors.

The UK, Germany, and France are the top markets that are experiencing a boom in the demand for high-end Mezcal Añejo, especially in luxury bars, private clubs, and specialized liquor retailers. The category is projected to advance due to the increased number of customers looking for unique, aged mezcal that provides them with a sipping experience that is above the ordinary.

| Main Segment | Market Share (%) |

|---|---|

| Distribution Channel (On-Trade Channel) | 55.8% |

| Remaining segments | 44.2% |

Cocktail Enthusiasm Driving Mezcal On-Trade Sales Hitting the Top

The on-trade channel serves as the major distribution way for mezcal in Europe. The cocktail culture is growing in Europe, thus, bartenders and mixologists enlist mezcal in their cocktails that are creative and high-end, and that makes them attractive to public drinkers who are looking for an adventure.

The use of different drink recipes, such as the ones with smoky tequila or the old-fashioned style, which is mixed with mezcal, makes the drink a central choice for nearly all cocktail ingredients. Bars, lounges, and nightclubs are teaming up with controlled mezcal brands that are the main source of learning skills, as they carry out tasting and workshop events, to improve the on-trade sales.

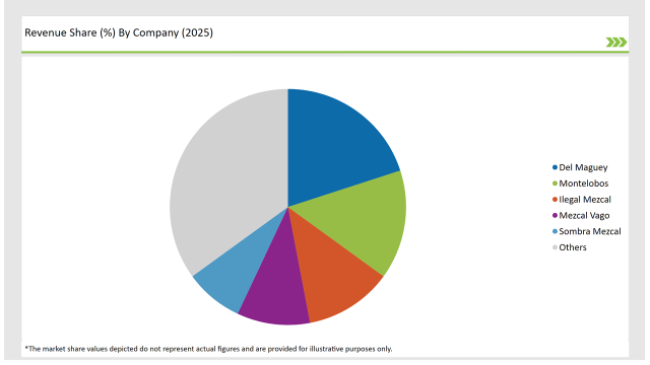

2025 Market share of Europe Mezcal manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Del Maguey | 20% |

| Montelobos | 15% |

| Ilegal Mezcal | 12% |

| Mezcal Vago | 10% |

| Sombra Mezcal | 8% |

| Others | 35% |

Note: The above chart is indicative in nature

The European mezcal market presents a blend of conglomerate spirits corporations and independent distillers, where heightened competition and strategic acquisitions have seen recent shifts in market trends. As major players, Diageo, Pernod Ricard, and Bacardi have broadened their category of mezcal by purchasing stakes in brands of premium mezcal filling their pockets with more agave spirits market share.

They use the majority of the available distribution networks and expand the mezcal to the European countries that were not targeted or were difficult to enter before, thus improving accessibility. Through this, the independent artisans, on the contrary, try to define themselves according to their philosophy of production.

For instance, brands like Mezcal Amores, Montelobos, and Del Maguey are on the list of brands that smokers have developed a strong relationship with through their uncompromised principles of quality and true craftsmanship.

The competition in the European mezcal market is even ultra-boosted by the rare agave varieties Tobaziche, Tepeztate, and Arroqueño, which are planted and processed by those small niche players that target connoisseurs with their exclusive and unique tasting mezcal.

The Europe Mezcal market is projected to grow at a CAGR of 6.0% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 331.4 million.

Key factors driving the Europe mezcal market include the growing consumer interest in premium and artisanal spirits, which has led to increased demand for authentic and high-quality mezcal products. Additionally, the rising trend of cocktail culture and the exploration of diverse flavours among consumers are further fuelling the market's growth.

Germany, France, and UK are the key countries with high consumption rates in the European Mezcal market.

Leading manufacturers include Del Maguey, Montelobos, Ilegal Mezcal, Mezcal Vago, and Sombra Mezcal known for their innovative and sustainable production techniques and a variety of product lines.

As per Product, the industry has been categorized into Mezcal Joven, Mezcal Reposado, Mezcal Anejo, Mezcal Vidrio, and Others.

As per Source, the industry has been categorized into Espadin, Tobala, Tobaziche, Tepeztate, Arroqueno, and Others.

As per Concentration, the industry has been categorized into 100% Agave Mezcal, and Blends.

As per Distribution Channel, the industry has been categorized into On-Trade Channel, and Off-Trade Channel.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

A detailed analysis of the Australia Licorice Root industry and growth outlook covering form, and application segment

UK Licorice Root Industry Analysis from 2025 to 2035

USA Licorice Root Industry Analysis from 2025 to 2035

USA Lactase Industry Analysis from 2025 to 2035

USA Snack Pellets Industry Analysis from 2025 to 2035

USA Monoprotein Industry Analysis from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.