The Europe lactic Acid market is set to grow from an estimated USD 3,921.0 million in 2025 to USD 5,373.0 million by 2035, with a compound annual growth rate (CAGR) of 3.2% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 3,921.0 million |

| Projected Europe Value (2035F) | USD 5,373.0 million |

| Value-based CAGR (2025 to 2035) | 3.2% |

The European lactic acid market is undergoing strong growth, fueled by a blend of environmental awareness, regulatory backing, and various industrial uses. This extensive growth path is supported by rising demand in various sectors, especially in food & beverages, pharmaceuticals, biodegradable plastics, and personal care sectors.

The market's development is greatly affected by the European Union's strong environmental regulations and sustainability efforts, which actively encourage the shift from traditional petroleum products to bio-based options.

In the food and beverage industry, the adaptability of lactic acid as a natural preservative, acidulant, and flavoring agent has resulted in its extensive use. The increasing consumer demand for clean-label items and functional foods has notably enhanced its use in fermented dairy goods, meat preservation, and probiotic formulations.

The increase in health-aware consumers looking for low-calorie options has further boosted market expansion, as lactic acid is essential in creating healthier food choices for issues such as obesity and diabetes.

The biodegradable plastics sector signifies a notably vibrant growth area, with polylactic acid (PLA) becoming a prominent sustainable substitute for traditional plastics. This expansion is heavily backed by EU directives designed to decrease plastic waste and encourage circular economy concepts.

The pharmaceutical and personal care industries have notably embraced lactic acid, leveraging its characteristics as a pH regulator, skin revitalizing agent, and natural antimicrobial substance.

Explore FMI!

Book a free demo

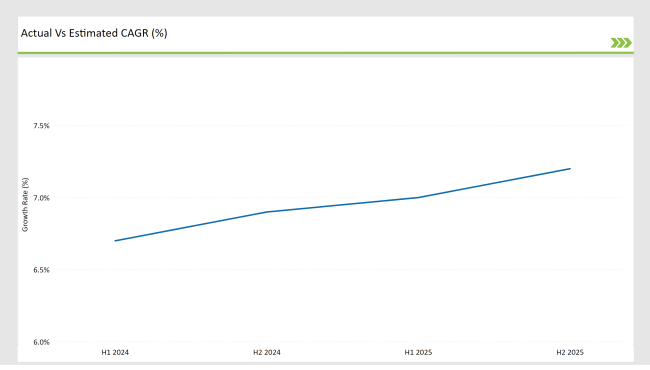

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Lactic Acid market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the European Lactic Acid market, the sector is predicted to grow at a CAGR of 7.1% during the first half of 2024, with an increase to 7.3% in the second half of the same year. In 2025, the growth rate is anticipated to slightly increase to 7.6% in H1 and is expected to rise further to 7.7% in H2.

This pattern reveals an increase of 50 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 40 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 24- March | Expans ion of Manufacturing Facilities: Corbion NV Invested USD 48 million in expanding lactic acid production capacity at their Netherlands facility, increasing output by 25% to meet growing European demand . |

| 24-April | Partnership - BASF SE Collaborated with European biotech startups to develop novel lactic acid derivatives for sustainable cosmetic applications. |

| 24-July | Technology - Thyssenkrupp AG Launched innovative fermentation technology for cost-effective lactic acid production at an industrial scale . |

| 24-June | Market Expansion - Henan Jindan Lactic Acid is an Established European distribution network for specialized lactic acid products targeting food and beverage industries. |

Growing Adoption of Biodegradable and Bio-Based Plastics

The expanding lactic acid market in Europe is primarily driven by the increasing production and use of biodegradable and bio-based plastics. This is being significantly influenced by the pent-up demand resulting from strict European Union rules regarding single-use plastics and sustainability efforts.

Leading manufacturers are increasing the output of polylactic acid (PLA), a biodegradable polymer made from lactic acid, in response to rising demand from the packaging and consumer products industries. Simultaneously, the EU Circular Economy Action Plan and its objective to address plastic waste have bolstered the promotion of bio-based alternatives, encouraging capital investment in lactic acid manufacturing plants.

The recent improvements in PLA formulations that exhibit enhanced properties and market usability, created by companies such as Corbion and BASF, will enable PLA-based products to span applications ranging from food packaging to consumer electronics.

A significant factor motivating retailers and brand owners to adopt PLA-based packaging solutions, consequently fueling market expansion, is the rising consumer awareness and demand for eco-friendly alternatives. This trend is more pronounced in nations such as Germany, France, and the Netherlands, where state initiatives actively promote the transition from petrochemicals to bio-based materials.

Expansion of Lactic Acid Use in Functional Food & Beverage Industry

The European lactic acid market is undergoing strong expansion, fueled by increasing demand for natural, clean-label components in functional food and drink products. With consumers focusing on gut health and digestive well-being, lactic acid generated through fermentation is being utilized more in probiotic-rich items such as yogurt, kefir, and fermented plant-based substitutes.

Its dual function as both a natural preservative and pH stabilizer corresponds with Europe’s strict food safety regulations and resistance to artificial additives. Moreover, the rise of plant-based products has driven the development of dairy-free functional drinks enriched with lactic acid to improve shelf life and health advantages. Regulatory backing from EFSA and sustainability trends (utilizing renewable feedstocks for production) additionally strengthen adoption.

The market is expected to expand at a CAGR of 6-8% until 2030, as producers invest in R&D to enhance uses in immunity-enhancing and functional formulations, reinforcing lactic acid's position in Europe’s health-oriented food sector.

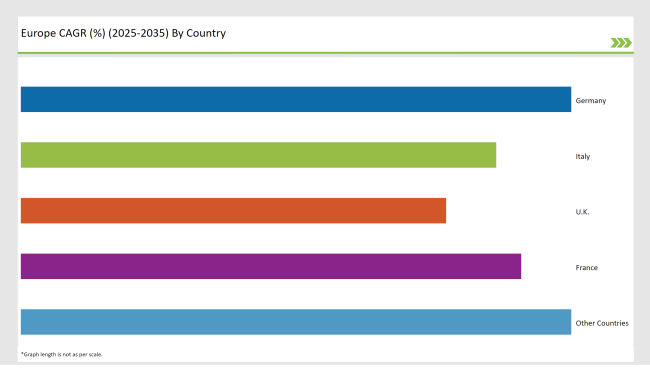

The following table shows the estimated growth rates of the top fourmarkets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The functional food and beverage sector has become a very significant driver in the growth of the lactic acid market. It reflects how consumers, particularly in the UK, are changing their preferences for healthier lifestyle choices. The enhanced demand for probiotic-rich products, especially the fermented foods and beverages, opens vast opportunities for the use of lactic acid.

This coincides with a rise in British consumers' consciousness of health through products that aid digestive health as well as strengthening the immune system. In the UK market, lactic acid is widely used in dairy substitutes, sports nutrition items, and preserved food products.

The growing demand for plant-based products has also increased demand because producers employ lactic acid for preservation purposes and also for flavoring these alternatives. The clean-label trend has further driven the market's growth, as lactic acid works as a natural preservative, thus sustaining consumer demand for minimally processed components.

The stringent food safety regulations and quality standards in the UK have positioned lactic acid as a favorite component, mainly for ready-to-eat foods and beverages that still enjoy immense demand in the British market oriented toward convenience. Besides, the growing consumption of lactic acid in personal care products and pharmaceutical applications has created different growth opportunities and, thus improved its market footprint in the UK.

The French personal care and pharmaceutical industries have achieved strong growth in lactic acid usage, fueled by the nation's focus on scientifically proven and natural ingredients. France's premium beauty market, especially in cosmetic ingredients, has extensively used lactic acid owing to its scientifically-demonstrated exfoliating and moisturizing benefits. Large French cosmetics companies have formulated their skincare products using alpha-hydroxy acids (AHAs), and lactic acid is the central ingredient.

French companies have increased research and development of drug delivery systems and pharmaceutical applications of lactic acid in the pharmaceutical industry. Advanced uses in wound healing products and controlled-release pharmaceuticals have been achieved in France, owing to its high-level pharmaceutical infrastructure and focus on innovation. This is in line with France's pharmaceutical profile and as a leading European healthcare market.

The merger of traditional French pharmacy products (parapharmacie) with natural ingredients has established a distinctive market niche in which lactic acid features prominently. French consumers' preference for products with natural origin and scientific performance has prompted manufacturers to produce high-tech products containing lactic acid.

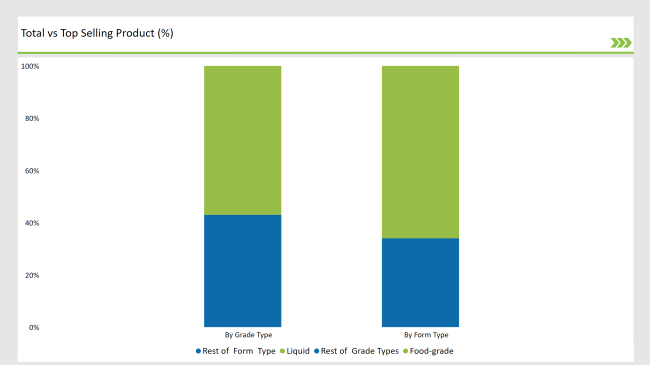

% share of Individual categories by Grade Type and Form Type in 2025

The European food-grade lactic acid sector holds market supremacy, mainly influenced by strict food safety laws and a rising consumer preference for natural food additives. This superiority is observed in key markets such as Germany, France, and the Netherlands, where food producers emphasize top-notch preservation methods.

The growth of the food-grade segment is additionally fueled by the rising clean-label trend in European countries, where producers are proactively substituting synthetic preservatives with natural options.

The rise in plant-based food items throughout Europe has led to greater demand for food-grade lactic acid, which plays several roles in these compositions, such as preservation and flavor improvement. The stringent regulations of the European Union on food additives have made food-grade lactic acid a favored option due to its established safety record and natural source.

Moreover, the growth of fermented food items, especially in Nordic nations and Germany, has maintained the robust market presence of food-grade lactic acid, given its essential contribution to traditional fermented foods such as sauerkraut and pickled veggies.

Liquid lactic acid has a very high market share of 60.4%, which can largely be attributed to its very good handling properties, which are very much sought after in a wide range of industries, and its extensive potential applications across industries.

The use of the liquid form of the compound is most apparent and prevalent in Western European countries, where food and beverage manufacturers highly value its ease of use, which facilitates easy incorporation with existing production processes used in manufacturing.

This very high demand for liquid lactic acid is very apparent in top markets like Germany, France, and Italy, where extensive food processing operations require efficient incorporation of ingredients into their products.

The very good solubility characteristics of the liquid form make it very much sought after by European beverage manufacturers, particularly in the fast-growing functional beverage market that has become very fashionable. In the European dairy industry, liquid lactic acid is preferred and used for its ease of incorporation into a wide range of recipes for yogurt, cheese, and fermented milk products.

The pharmaceutical and personal care industries in countries like France and Switzerland also exhibit a high demand for liquid lactic acid due to its accurate dosing capabilities and uniform distribution characteristics, which are very critical to their respective applications.

2025 Market share of Europe Lactic Acid manufacturers

Note: The above chart is indicative in nature

The European lactic acid market exhibits moderate concentration, with key players like Corbion NV, BASF SE, and Galactic holding substantial market shares. These industry leaders maintain their market dominance through extensive distribution networks, strong research capabilities, and strategic partnerships.

Regional and local manufacturers such as Henan Jindan Lactic Acid and Musashino Chemical have carved out their positions by focusing on specialized market segments and offering innovative, sustainable lactic acid solutions. Major players including Corbion NV and BASF SE are actively expanding their production capacities to meet the rising demand for natural preservation solutions and fermentation applications.

These companies are also investing heavily in research and development to enhance product functionality and application versatility while addressing specific industry requirements across the food, pharmaceutical, and personal care sectors.

The Europe Lactic Acid market is projected to grow at a CAGR of 3.2% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 5,373.0 million.

Key factors driving the Europe Lactic Acid market include increasing health consciousness and demand for natural alternatives, alongside regulatory changes and consumer preferences for low-calorie options. Additionally, trends in the food and beverage industry and sustainability concerns are influencing market dynamics.

Germany, the UK, and France are key countries with high consumption rates in the European Lactic Acid market.

Leading manufacturers include Corbion NV, BASF SE, Galactic, and Henan Jindan Lactic Acid Company, known for their innovative and sustainable production techniques and a variety of product lines.

As per Form Type, the industry has been categorized into Liquid, Powder, and Granules.

As per Source Type, the industry has been categorized into Synthetic and Natural/Bio-based.

As per Application, the industry has been categorized into Food & Beverages, Personal Care, Pharmaceutical, Industrial, Animal Feed, and Biodegradable Polymers.

As per grade, the industry has been categorized into Food Grade, Industrial Grade, and Pharmaceutical Grade.

As per category, the industry has been divided into High-Intensity Lactic Acid and Low-Intensity Lactic Acid.

Industry analysis has been carried out in key countries of Germany, the UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and the Rest of Europe.

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Comprehensive Analysis of Pet Dietary Supplement Market by Pet Type, by Product Type, By Application, and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.