The Europe Hydrolyzed Vegetable Protein market is set to grow from an estimated USD 451.4 million in 2025 to USD 834.3 million by 2035, with a compound annual growth rate (CAGR) of 6.3% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 451.4 million |

| Projected Europe Value (2035F) | USD 834.3 million |

| Value-based CAGR (2025 to 2035) | 6.3% |

The Europe Hydrolyzed vegetable protein market is fostering its substantial growth from 2025 to 2035 owing to strong vegetable protein alternatives demand, clean-label, and functional food ingredient preferences, and burgeoning applications in food and animal nutrition. Hydrolyzed vegetable protein, which is made from soy, wheat, pea, rice, flax, and corn, is the main ingredient in many formulations, for example, meat alternatives and fortified foods.

Sustainable, allergen-free, and high-protein plant-based ingredients are the key factors driving the increasing food and nutritional supplement sectors' demand for HVP as a flavour enhancer, texturizer, and protein booster. The development of enzymatic hydrolysis and fermentation processes has helped the manufacturers in making the HVP not only more soluble but also effectively digestible and with an enriched umami flavour, thus creating a wider spectrum of their applications in processed food, commercial kitchens, and dietary supplements.

Besides that, the technological improvements in the hydrolysis process, which are paired with the rising tendency of non-GMO and organic plant-based protein sources, have been the major reason for the market's growth. Consumers' demand for high-protein, allergen-free, and gluten-free food products is on the rise, and HVP is now not only being used in soups, snacks, sauces, and seasonings but also has become a crucial ingredient in meat substitutes with the help of HVP.

Explore FMI!

Book a free demo

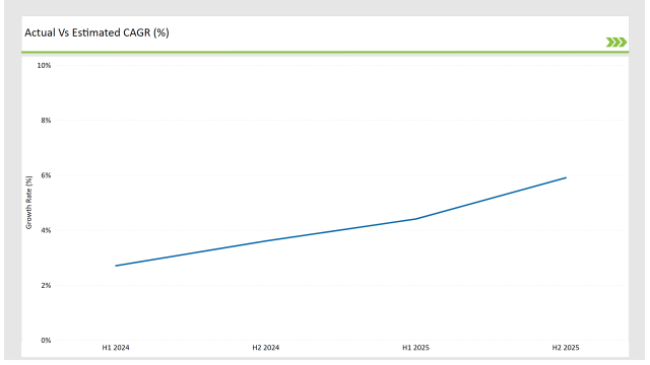

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Hydrolyzed Vegetable Protein market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 2.7% (2024 to 2034) |

| H2 2024 | 3.6% (2024 to 2034) |

| H1 2025 | 4.4% (2025 to 2035) |

| H2 2025 | 5.9% (2025 to 2035) |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Hydrolyzed Vegetable Protein market, the sector is predicted to grow at a CAGR of 2.7% during the first half of 2024, with an increase to 3.6% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 4.4% in H1 but is expected to rise to 5.9% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April 24 | Product Innovation - Kerry Group introduced a low-sodium Hydrolyzed soy protein for use in savoury food formulations. |

| March 24 | Sustainability Initiatives - Cargill launched a certified organic wheat Hydrolyzed protein with enhanced solubility. |

| February 24 | Expansion of Processing Capacity - ADM expanded its HVP production facility to cater to the increasing demand for plant-based protein enhancers. |

| January 24 | Strategic Partnerships - Roquette partnered with leading food manufacturers to integrate pea Hydrolyzed protein into alternative meat applications. |

Upsurge in Hydrolyzed Vegetable Protein in Clean-Label and Functional Foods

The rapid shift towards the use of clean-label ingredients, formulations rich in protein, and the proliferation of plant-based foods is the most important factor contributing to the rise of the Hydrolyzed vegetable protein (HVP) market in Europe. HVP-based umami flavouring solutions are being used increasingly by food manufacturers in place of synthetic flavour enhancers and artificial additives, thus addressing consumer concerns about health and following the rules of the authorities.

Companies like Kerry Group, ADM, and Cargill are directing their funds toward enzyme-modified hydrolysis innovations dedicated to the improvement of the taste, texture, and nutritional profile of plant proteins. The fact that HVP can serve as a natural substitute for monosodium glutamate (MSG) has resulted in its wider usage in soups, seasonings, processed snacks, and plant-based meats.

Introduction of Hydrolyzed Vegetable Protein in Alternative Proteins and Nutritional Supplements

Apart from their traditional usage in flavour-enhancing, HVP has now begun to find applications in high-protein alternative foods and dietary supplements. With the rise in demand for functional protein sources in the areas of meal replacements, sports nutrition, and gut-health-focused formulations, HVP is now known as the most versatile and best-digestible protein source.

Companies such as Roquette and Cargill are enlisted as developers of high-purity Hydrolyzed plant proteins that improve protein absorption, satiety, and amino acid balance. Hydrolyzed pea, rice, and flax proteins are popular for their functional properties, such as emulsification, water-binding, and solubility, which make them suitable candidates for use in nutraceutical products. Besides, the use of HVP-based protein fortification is being advanced in clinical nutrition and food formulations for the elderly by providing easily digestible proteins to people with dietary restrictions.

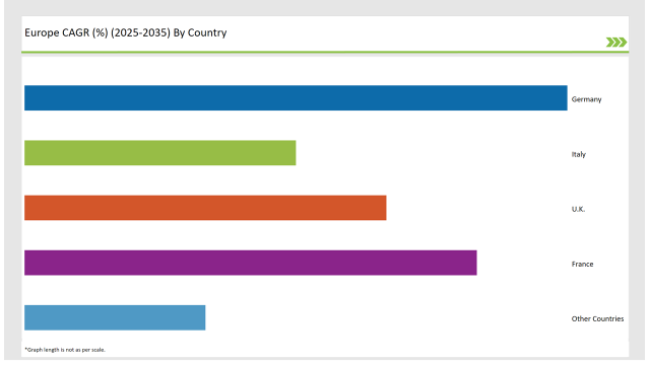

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 30% |

| Italy | 15% |

| UK | 20% |

| France | 25% |

| Other Countries | 10% |

Germany is among the dominant markets for HVP in Europe, primarily due to the rise in consumer demand for clean-label, sustainable, and high-protein food ingredients. Catalysed by governmental sustainability programs, the German plant-based food industry has sharply increased the demand for HVP in alternative meat products, functional snacks, and high-protein meal solutions.

ADM and Roquette are developing their HVP production capacity in Germany, and customized protein hydrolyses developed for meat substitutes, soups, and sauces, in particular, are being launched. The awareness of gut health and allergen-friendly diets among consumers has prompted German manufacturers to invest in non-GMO and hypoallergenic Hydrolyzed vegetable proteins, which will make these products more available to health-conscious consumer segments.

Hydrolyzed vegetable protein is in higher demand throughout France, especially in premium gourmet food and processed food formulations. HVP-based umami enhancers in soups, sauces, and plant-based cheese products by the culinary industry in the country ensure flavours and nutritional density.

Companies like Kerry Group and Cargill are expanding their clean-label solutions based on HVP, with a focus on low-sodium, organic, and MSG-free flavour-enhancing applications. In the French processed food industry, there is a growing use of Hydrolyzed soy and wheat proteins to increase protein content and texture in meat analogues and plant-based ready meals.

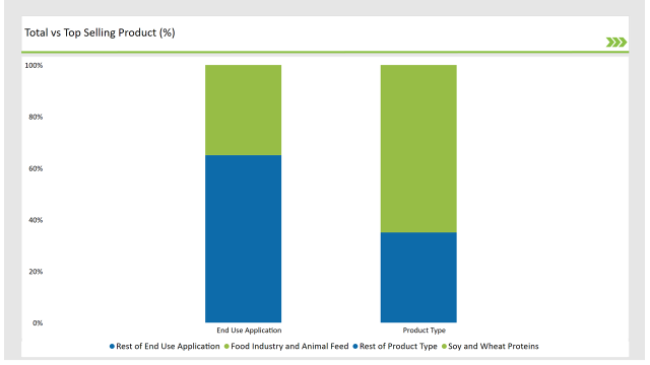

% share of Individual Categories Product Type and End-Use Application in 2025

| Main Segment | Market Share (%) |

|---|---|

| Product Type (Soy and Wheat Proteins) | 65% |

| Remaining segments | 35% |

Soy and Wheat Proteins are the Drivers of Expansion with Pea and Rice Getting Adoption

The market leader in soy protein is the biggest value of non-HGTP soybean protein. It is prevalent because soy Hydrolyzed protein has high levels of umami, is a cheap ingredient, and contains an essential amino acid profile. Besides, organizations like ADM and Kerry Group have expanded the range of non-GMO soy protein to the cleanliness demand of the market for food formulations.

Wheat protein is one of the prominent ingredients used in processed foods, plant-based dairy alternatives, and baked goods. The characteristic of wheat hydrolysates not having taste and functional properties makes them a good choice for texture-enhancing applications in gluten-based and gluten-free formulations.

The chia, flax, and corn market share is also increasing mainly in health-functional foods, sports nutrition, and dairy replacements because of the rise in consumer demand for sustainable and allergen-free protein sources.

| Main Segment | Market Share (%) |

|---|---|

| End Use Application (Food Industry and Animal Feed) | 35% |

| Remaining segments | 65% |

The Food Industry and Animal Feed Expand the Place of HVP

The HVP market is mostly led by the household sector where the families inject Hydrolyzed proteins in lentils, beans, sauces, and soups for flavour and protein enrichment. The expansion of plant-based diets and flexitarian lifestyles has driven the household consumption of HVP-based seasonings, meat substitutes, and instant meal products.

The commercial sector managed by restaurants, catering businesses, and QSRs are the ones that utilize HVP for texture enhancement, flavour development, and protein fortification. Areas such as the vegan and vegetarian menu existing perspectives of HVP as an artificial flavour enhancer substitute is a popular trend to reduce sodium-rich seasonings.

The food industry uses HVP for products such as processed foods, savoury snacks, meat substitutes, and plant-based dairy products. With prominent consumers such as Roquette and Kerry Group who boost new formulas based on Hydrolyzed protein, the market area has accelerated with a new demand for functional, high-protein ingredients for snack bars, protein shakes, and fortified food products.

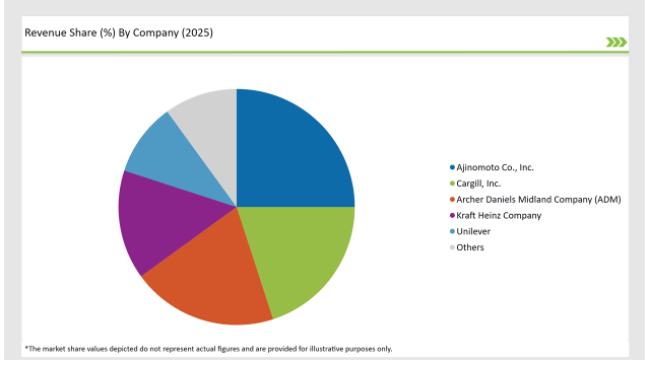

2025 Market share of Europe Hydrolyzed Vegetable Protein manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Ajinomoto Co., Inc. | 25% |

| Cargill, Inc. | 20% |

| Archer Daniels Midland Company (ADM) | 20% |

| Kraft Heinz Company | 15% |

| Unilever | 10% |

| Others | 10% |

Note: The above chart is indicative in nature

The Europe Hydrolyzed vegetable protein (HVP) market includes some major players such as Kerry Group, ADM, Cargill, Roquette, and Tate&Lyle forming the industry through technological developments, diversification of products, and large-scale production capacity.

Kerry Group is concentrating on the development of allergen-free and low-sodium HVP formulations, thus entering the clean-label food sector. The expansion of HVP production facilities by ADM and Cargill is a part of their collaboration to ensure a regular supply of food manufacturers and animal feed producers. Roquette, a leader in pea and rice protein hydrolysis innovations, is meeting the demand for non-GMO, plant-based protein solutions.

The entry of start-ups and mid-sized companies into the market with organic and functional HVP variants, especially in the sports nutrition and fortified food segments is visible. The new companies are finding their place in hydrolysis through R&D which increases protein bioavailability and thus enriches the functional properties of the protein.

The Europe Hydrolyzed Vegetable Protein market is projected to grow at a CAGR of 6.3% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 834.3 million.

Key factors driving the European Hydrolyzed vegetable protein market include the increasing demand for plant-based protein sources due to health and dietary trends, as well as the growing popularity of clean-label products among consumers. Additionally, the rise in vegetarian and vegan diets is fuelling the need for versatile protein ingredients in food formulations.

Germany, France, and UK are the key countries with high consumption rates in the European Hydrolyzed Vegetable Protein market.

Leading manufacturers include Ajinomoto Co., Inc., Cargill, Inc., Archer Daniels Midland Company (ADM), Kraft Heinz Company, and Unilever known for their innovative and sustainable production techniques and a variety of product lines.

As per Form, the industry has been categorized into Chunks, Slice, Flakes, and Granules.

As per Product Type, the industry has been categorized into Soy Protein, Wheat Protein, Pea Protein, Rice Protein, Chia Protein, Flax Protein, and Corn protein.

As per End Use, the industry has been categorized into Household, Commercial, Food Industry, and Animal Feed.

As per Distribution Channel, the industry has been categorized into Direct, and Indirect.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.