The Europe Human Milk Oligosaccharides Market is set to grow from an estimated USD 26.6 million in 2025 to USD 46.7 million by 2035, with a compound annual growth rate (CAGR) of 5.8% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 26.6 million |

| Projected Europe Value (2035F) | USD 46.7 million |

| Value-based CAGR (2025 to 2035) | 5.8% |

The European human milk oligosaccharides (HMO) market has been growing at an enormous rate over the last couple of years. The reasons supporting this growth are mainly the increased demand for infant nutrition, expansion in the wellness sector, and the discovery of new applications.

HMOs are naturally occurring in human breast milk and play a critical role in the development of a baby's immune system and gut microbiota. They offer a range of health benefits, including prebiotic properties, antimicrobial effects, and immune modulation.

Due to these tremendous health benefits, interest in HMO-based products has increased especially in infant formula, dietary supplements, and functional foods and beverages. The big players in this market include Nestlé, Abbott, and FrieslandCampina.

These companies lead the market based on their long-standing presence in the nutrition and healthcare sectors. Their approach, therefore, revolves around developing infant formula products from HMOs as premium and niche nutrition for babies. Further driving the market has been collaboration and partnerships.

Explore FMI!

Book a free demo

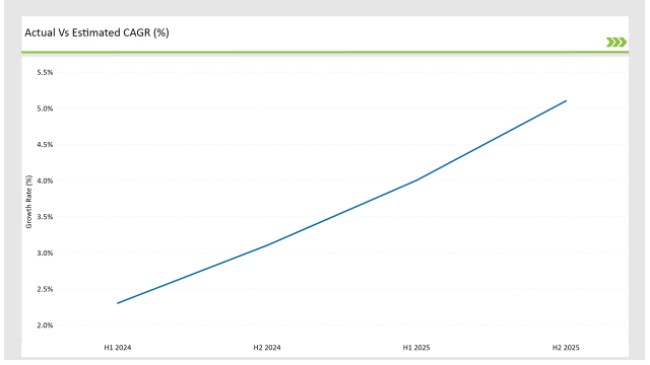

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Human Milk Oligosaccharides market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 2.3% (2024 to 2034) |

| H2 2024 | 3.1% (2024 to 2034) |

| H1 2025 | 4.0% (2025 to 2035) |

| H2 2025 | 5.1% (2025 to 2035) |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Human Milk Oligosaccharides market, the sector is predicted to grow at a CAGR of 2.3% during the first half of 2024, with an increase to 3.1% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 4.0% in H1 but is expected to rise to 5.1% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2024 compared to the second half of 2025.

| Date | Development/M&A Activity & Details |

|---|---|

| April 2024 | Launch of HMO-Enriched Infant Formula: Nestlé launched a new line of infant formula enriched with human milk oligosaccharides to support the development of the immune system and gut microbiota in infants. |

| March 2024 | Innovative HMO in Functional Foods: FrieslandCampina introduced a new functional beverage line incorporating HMOs, targeting adults with digestive health and immune support benefits. |

| February 2024 | Breakthrough in Synthetic HMO Production: A major advancement in synthetic production methods was announced by a European biotech company, allowing for cost-effective, large-scale production of HMOs for multiple applications. |

HMO-Based Infant Formula Revolutionizes Infant Nutrition

Increasingly, HMOs have become a fundamental element for infant nutrition and have recently been added to infant formula products. The benefits of HMOs are mainly seen in developing gut microbiota, improving the immune system, and preventing infections that help in setting the stage for healthy early childhood development. Growing awareness among parents and caregivers about the prebiotic benefits offered by infant formula fuels higher demand.

HMO-enriched infant formula that mimics many health properties of breast milk has been a focus of research and development for the biggest players in the industry, such as Nestlé and Abbott. These companies focused on the optimal extraction of HMOs both from bovine and human milk and also from microbial fermentation in pursuit of sustainable and more scalable formulations.

HMOs in Functional Foods and Beverages for Gut Health and Immunity

Human milk oligosaccharides are not only important in the nutrition of the infant but are increasingly being added into functional foods and beverages for adults concerning immune and digestive health. This innovative approach draws the attention of many in the European market, where there is a growing trend toward personalized nutrition. Increasingly, consumers are seeking products that provide more than just fundamental nutrition.

There is growing interest in the use of ingredients that support longer-term health and wellness. There is perceived to be a natural and effective way by which functional foods and beverages containing HMOs can boost one's immunity as well as gut health, as HMOs possess prebiotic properties that help nourish beneficial gut bacteria.

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 30% |

| Italy | 15% |

| UK | 20% |

| France | 25% |

| Other Countries | 10% |

Germany seems to be at the top amongst the largest, fastest-growing markets for human milk oligosaccharides. The country provides a strong pharmacy and healthcare field, along with a high perception of health consciousness and nutrition requirements, which augments the acceptance of HMO-enriched products. Additionally, Germany features a well-developed healthcare infrastructure allowing the adoption of innovative ingredients as HMO in infant nutrition and functional foods supplemented by dietary support.

This demand for infant formulas containing HMOs has become very high because parents are interested in alternatives that closely resemble breast milk and can offer the benefits it provides. In addition, German consumers are increasingly becoming more aware of prebiotics as a way of improving gut health and immunity. As such, functional foods and beverages containing HMOs have gained popularity. Companies such as Nestlé and Abbott have set up a robust base in Germany, exploiting the market's potential with customized products.

France is another important player in the European HMO market, with a growing adoption of HMO-enriched products in both the infant nutrition and functional food sectors. The French market has been particularly receptive to premium nutrition products, with increasing demand for infant formula that closely mimics the benefits of breast milk. This can be attributed to the fact that HMOs possess immune-enhancing and gut health-promoting properties, thereby increasing their attraction to the French market.

Since French consumers have lately become conscious about digestive health and immunity, there is an increasing trend toward functional foods and beverages enriched with HMO. France also boasts significant research and development in the field of food and biotechnology industries and facilitates innovations related to HMO.

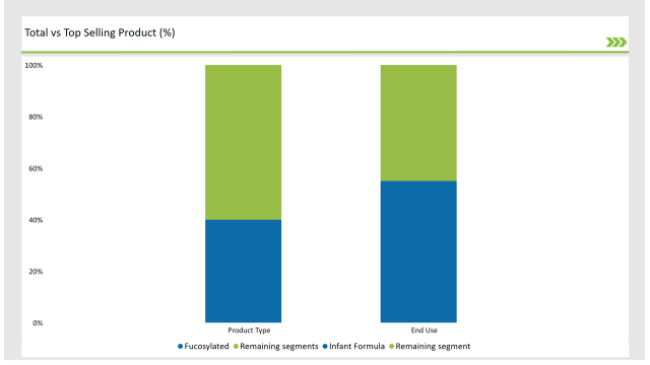

% share of Individual Categories Product Type and End-Use in 2025

| Main Segment | Market Share (%) |

|---|---|

| Product Type (Fucosylated) | 40% |

| Remaining segments | 60% |

Fucosylated Human Milk Oligosaccharides Lead Growth in the European Market

The European market for fucosylated human milk oligosaccharides is advancing at a swift pace owing to the popularity of the new health benefits and functional properties of these oligosaccharides. In addition, fucosylated HMOs are prebiotics that promote the growth of beneficial gut bacteria, strengthen the gut, and improve immunity.

As awareness of the significance of gut microbiota for the general health remains on the increase, fucosylated HMOs have increasingly been identified with improving infant formulas in such a manner that they closely match the composition of human breast milk.

Additionally, the demand for fucosylated HMOs will be driven further by the increase in the tendency of parents looking for high-quality, nutritionally complete infant formulas that offer optimum health benefits for their children. In order to answer this demand, manufacturers place fucosylated HMOs in their products, considering the evolution in the needs of health-conscious consumers.

Increasing the scope of research and development on oligosaccharides leads to innovations that enhance fucosylated HMOs in functionality and bioavailability. As the market is ever expanding, fucosylated human milk oligosaccharides are expected to play a role in shaping the destiny of the future for infants' nutrition in Europe.

| Main Segment | Market Share (%) |

|---|---|

| End-Use (Infant Formula) | 55% |

| Remaining segments | 45% |

Infant Formula Most Significant Growth Driver for Europe Human Milk Oligosaccharides Market

Infant formula is the biggest contributor to the growth in the European human milk oligosaccharides market, accounting for a large share due to the increased demand for high quality nutrition for infants. The nutritional benefits of HMOs have made parents prefer infant formulas containing these oligosaccharides, which are similar in composition to human breast milk. HMOs are known to help support immune health, promote balance in gut microbiota, and enhance overall infant development, which makes them a sought-after ingredient in infant nutrition.

Manufacturers have come up with innovated infant formulas that mimic these health benefits that have increased as a result of breastfeeding awareness, and this increases the demand. In addition, the rising level of lactose intolerance and other dietary restrictions that some parents enforce on their babies have increased demand for special baby formulas rich in HMOs.

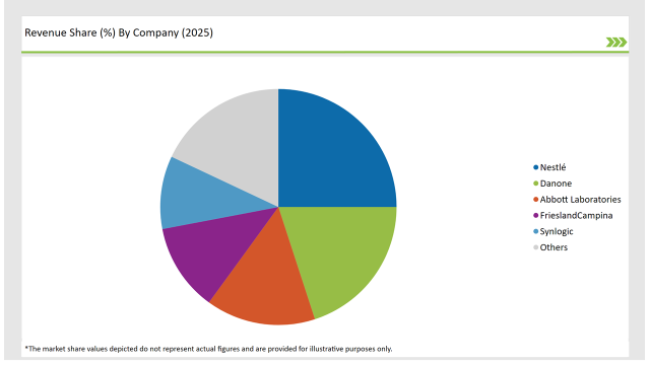

2025 Market share of Europe Human Milk Oligosaccharides manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Nestlé | 25% |

| Danone | 20% |

| Abbott Laboratories | 15% |

| FrieslandCampina | 12% |

| Synlogic | 10% |

| Others | 18% |

Note: The above chart is indicative in nature

The European HMO market encompasses major, well-established companies along with innovative biotech firms. The Tier 1 companies at the forefront of the HMO market include Nestlé, Abbott, and FrieslandCampina, among others, that possess significant market shares in infant formula and functional foods.

All of these have significantly invested in product development using leveraging large-scale R&D capabilities as well as broad geographical distribution. They are using this approach to add HMOs into premium product lines: health-conscious consumers who focus on immune and gut health.

These players also include large numbers of small, Tier 2 companies- like DSM or Glycom-on whom European major opportunities depend strongly: They specialize in high-class production of quality HMO via microbial fermentation processes and are successful. Those are innovation-friendly HMO production companies looking at cooperation also with food- and beverage corporations for broad usage. Tier 3 is also an integral part of the HMO market - smaller, yet playing a vital role.

Providing localized solutions to customers, niche applications like dietary supplements, and cosmetics, are being accentuated. A competitive landscape is represented by the market structure, where the big players compete with small innovative start-ups vying for chances to cash in on the increased demand for HMO-enriched products in Europe.

The Europe Human Milk Oligosaccharides market is projected to grow at a CAGR of 5.8% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 46.7 million.

Key factors driving the European human milk oligosaccharides market include the increasing demand for infant formulas that closely mimic the nutritional profile of breast milk and the growing awareness of the health benefits associated with HMOs, such as improved gut health and immune support. Additionally, rising consumer interest in natural and functional ingredients in infant nutrition is further propelling market growth.

Germany, France, and UK are the key countries with high consumption rates in the European Human Milk Oligosaccharides market.

Leading manufacturers include Nestlé, Danone, Abbott Laboratories, FrieslandCampina, and Synlogic known for their innovative and sustainable production techniques and a variety of product lines.

As per Product Type, the industry has been categorized into Fucosylated Silylated, Non-fucosylated, Neutral.

As per End Use, the industry has been categorized into Infant Formula, an d Dietary Supplements.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

Feed Attractants Market Analysis by Composition, Functionality, Livestock, Packaging Type and Sales Channel Through 2035

Dairy Protein Crisps Market Flavor, Packaging, Application and Distribution Channel Through 2025 to 2035

Bouillon Cube Market Analysis by Type and Distribution Channel Through 2035

Food Fortification Market Analysis by Type, Process and Application Through 2035

Fermented Feed Market Analysis by Product Type, Livestock and Fermentation Process Through 2035

Dead Sea Mineral Market Analysis by Source, End-use and Distribution Channel Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.