The Europe Herbs and Spices market is set to grow from an estimated USD 37,999.9 million in 2025 to USD 54,122.8 million by 2035, with a compound annual growth rate (CAGR) of 3.6% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 37,999.9 million |

| Projected Europe Value (2035F) | USD 54,122.8 million |

| Value-based CAGR (2025 to 2035) | 3.6% |

The herbs and spices market in Europe is on the verge of rapid development between 2025 and 2035 since it is being driven by the rise in demand for consumer goods from global cultures, clean-label products, and natural ingredients. With an ever-increasing emphasis on health and wellness, people in Europe are resorting to the fact that herbs and spices can be used as the best choice without including any man-made additives.

This aspect of herbs and spices is even more glamorous because they are the key items in the region's culinary cultures, where herbs and spices are also used in traditional dishes along with the growing rate of adoption of exotic flavors from Asia, the Middle East, and Latin America. The government is consistently assisting in the provision of funding toward green-label products, grown organically which is ultimately transforming the herbs and spices sector into traditional agriculture.

The European market is on the move towards advanced technology in this sector such as encapsulation, and freeze-drying. In addition, the European food and beverage sector is more focused due to the introduction of functional and medicinal drinks, which in turn causes the need for medicinal and aromatic herbs to rise. With the increased use of herbs and spices in various sectors, including food, beverages, personal care, and pharmaceuticals, the market in Europe is set to undergo substantial expansion in the future.

Explore FMI!

Book a free demo

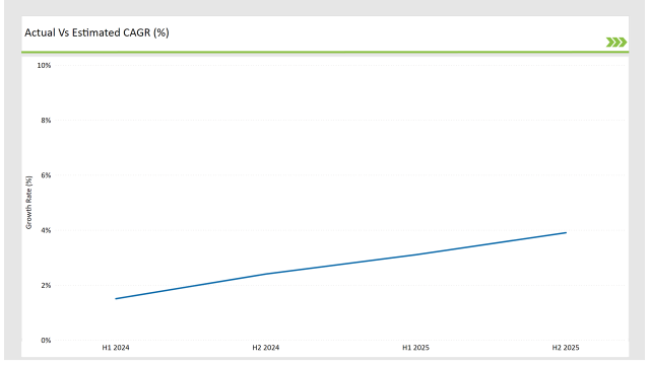

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Herbs and Spices market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 1.5% |

| H2 (2024 to 2034) | 2.4% |

| H1 (2025 to 2035) | 3.1% |

| H2 (2025 to 2035) | 3.9% |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Herbs and Spices market, the sector is predicted to grow at a CAGR of 1.5% during the first half of 2024, with an increase to 2.4% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 3.1% in H1 but is expected to rise to 3.9% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 24-March | Expansion of Organic Farming- Olam Food Ingredients announced the expansion of organic turmeric and ginger farming projects in Spain to meet the growing demand for sustainably sourced herbs and spices. |

| 15-February | Acquisition- McCormick & Company, a global leader in flavor and spice production, announced the acquisition of a prominent European spice company. This strategic move is aimed at expanding McCormick's product offerings and enhancing its competitive position in the European market. The acquisition allows McCormick to integrate the acquired company's unique spice blends, regional specialties, and established distribution networks into its existing portfolio. |

Market trend towards clean label and organic herbs and spices

The European herb and spice market is changing in a dynamic paradigm change toward clean-label and organic products. It highlights the fact that herb and spice consumers are leaning more toward no-added-artificial-chemical, pesticide-free, and genetically modified substances. The upsurge of organic farming across Europe is the decisive factor in the availability of organic herbs and spices that are sustainable, high quality, and fairly collected.

Germany, France, and the Netherlands are at the forefront of this industry, rigorously implementing traceability and certification standards. The trade is dominated by very popular organic herbs such as basil, oregano, and turmeric, which are used both in cooking and for medicinal purposes.

This trend is not only confined to single households but has also extended into restaurants and hotels where chefs and restaurant owners are opting for clean-label ingredients to please consumers' demands. At the same time, retailers are joining the mission by expanding their range of brands to include certified organic herbs and spices resulting in increased competition among producers to innovate and improve quality standards.

Utilization of Processing Techniques for Improvement of Quality

The advancements in different technologies in the processing industry are the driving force behind the improvement of the quality and shelf life of herbs and spices in Europe. The application of techniques such as freeze-drying, vacuum drying, and cryogenic grinding are the main factors responsible for keeping the natural flavours, colours, and nutrients in herbs and spices at their maximum.

Moreover, companies also turn to encapsulation technologies which help to use spices like saffron and nutmeg in advanced culinary and pharmaceutical applications by keeping these products fresh. The implementation of automation and AI in processing facilities is improving efficiency and also has reduced contamination risks so that the producers meet with the problems of risking compliance with the strict European food safety regulations.

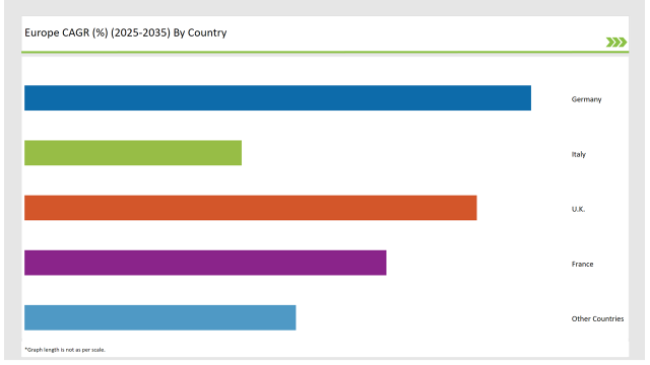

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 30% |

| Italy | 12% |

| UK | 22% |

| France | 16% |

| Other Countries | 20% |

Germany is the heart of the European market for herbs and spices because of the continuous driving force of its strong inclination towards organic agriculture and sustainability. The country's citizens are known to have a taste for high-grade natural ingredients, which has in turn increased the consumption of organic spices such as cumin, turmeric, and paprika.

With the manufacturers involving herbs and spices in gourmet foods, sauces, and marinades, the food processing industry is one of the major contributors playing a significant role for this reason. The retail sector, particularly supermarket chains such as Edeka and REWE, forms the other significant factor contributing to the promotion of premium and sustainably sourced spices.

The United Kingdom is also a rising market for herbs and spices. Its culturally diverse food and prepared food consumption are the reason why the United Kingdom has been such a growing market for herbs and spices. Its vibrant food scene has driven the consumption of exotic spices like cardamom, garam masala, and harissa. Retailers and food manufacturers have aligned themselves with this trend by suggesting ready-to-use dressing marinades and spice blends that resemble specific cuisines from all over the globe.

The UK market also exhibits interest in single-origin spices which reflect the consumers' inclination towards authenticity as well as high quality. E-commerce platforms have played a fundamental role in the provision of niche products as they have enabled people, who are interested in trying out a huge assortment of different herbs and spices from all corners of the world. In addition to this, the meal kit and ready-to-eat product revolution have facilitated a more prevalent use of herbs and spices and a more convenient type of delivery.

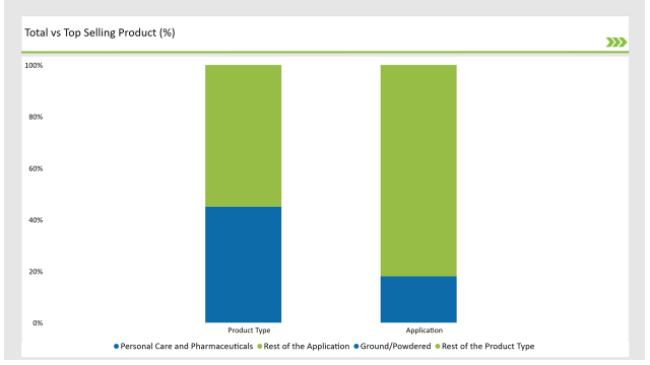

% share of Individual categories by Product Type and Applications in 2025

| Main Segment | Market Share (%) |

|---|---|

| Product Type (Ground/Powdered) | 45% |

| Remaining segments | 55% |

The ground or powdered herbs and spices segment shows high growth, boosted by their suitability and widespread demand in culinary and industrial processing. Powdered turmeric, ginger, and cinnamon are the most preferred options because they contain functional attributes such as anti-inflammation and antioxidant properties. In the food and beverages sector, the grounding of spices helps to prepare many seasoning blends used in baked items and golden milk products.

In addition, their ease of use and longer shelf life make them a popular choice for home cooks and food manufacturers alike. Conclusively, powder forms also have a rank in pharmaceutical and personal care where accurate dosing and easy absorption into products like capsules and creams are critical.

| Main Segment | Market Share (%) |

|---|---|

| Application (Personal Care and Pharmaceuticals) | 18% |

| Remaining segments | 82% |

Functional foods and drinks are emerging drivers of strength for the herbs and spices market in Europe. Turmeric, ginger, and cinnamon-based medicinal value-added products are gaining higher demand lately with rising health-conscious consumerism.

Health bars, fortified beverages, and herbal teas with the essence of these spices are constantly attracting health-conscious consumers. Innovations of herbs and spices, along with protein powder and energy drink products, are part of the new products for manufacturers that target the changing desires of consumers. New research on the medical benefits of every herb and spice drives the growth of the segment, ensuring that innovation in products is on a constant arrival basis.

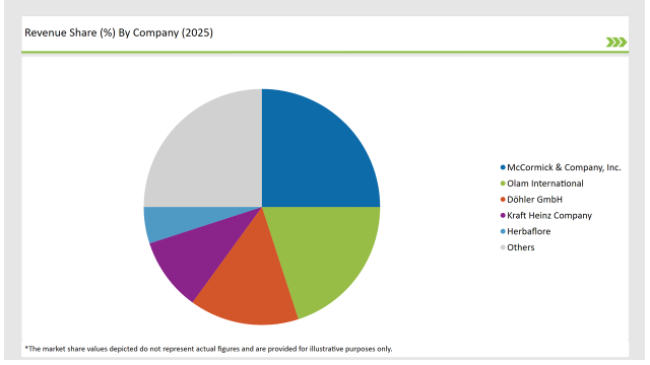

2025 Market share of Europe Herbs and Spices manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| McCormick & Company, Inc. | 25% |

| Olam International | 20% |

| Döhler GmbH | 15% |

| Kraft Heinz Company | 10% |

| Herbaflore | 5% |

| Others | 25% |

Note: The above chart is indicative in nature

The market of herbs and spices in Europe is relatively fragmented. McCormick & Company, Fuchs Group, and Symrise top the market in terms of high market shares because they have huge and advanced distribution channels and R&D structures. The large players in this market are working on further extension of their products through acquisition and partnership and a steady supply chain to ensure that consumers get high-quality herbs and spices at all times.

The local players are growing more prominent with the niche market as well as products that come uniquely from a certain region. In the Eastern European region, there is a special production of dill and parsley herbs. The oregano, thyme, and rosemary markets are dominated by the Mediterranean region.

The market's competition is influenced even more because of organic and sustainable product demands, as well as increasing calls for green and eco-friendly agriculture and processing techniques on companies' part. The development of consumer preferences is expected to drive growth across all segments, with increased competition and innovation being the result in the market.

The Europe Herbs and Spices market is projected to grow at a CAGR of 3.6% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 54,122.8 million.

Key factors driving the European herbs and spice market include increasing consumer demand for natural and organic products, as well as a growing interest in culinary diversity and health benefits associated with herbs and spices. Additionally, the rise of home cooking and gourmet food trends further fuels market growth.

Germany, and France, are the key countries with high consumption rates in the European Herbs and Spices market.

Leading manufacturers include McCormick & Company, Inc., Olam International, Döhler GmbH, Kraft Heinz Company known for their innovative and sustainable production techniques and a variety of product lines.

As per Product Type, the industry has been categorized into Herbs, Spices, Paprika (Hot Pepper), and Cumin.

As per Form, the industry has been categorized into Powder & Granules, Flakes, Paste, Whole or Fresh

As per End Use, the industry has been categorized into Food and Beverages, Food Service, and Retail Sales.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

A detailed analysis of the Australia Bakery Ingredient Market and growth outlook covering product type, and application segment

Comprehensive Analysis of Europe Aqua Feed Additives Market by Additive Type, Species, Ingredient, and Country through 2035

USA Aqua Feed Additives Market Analysis from 2025 to 2035

Comprehensive Analysis of Europe Fish Meal Market by Product Type, Application, Source, and Country through 2035

Comprehensive Analysis of ASEAN Fish Meals Market by Product Type, by Application, Source, and Region through 2035

A Detailed Analysis of Brand Share Analysis for Fungal Protein Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.