The Europe Freeze Dried Fruits market is set to grow from an estimated USD 2,629.4 million in 2025 to USD 5,334.9 million by 2035, with a compound annual growth rate (CAGR) of 7.3% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 2,629.4 million |

| Projected Europe Value (2035F) | USD 5,334.9 million |

| Value-based CAGR (2025 to 2035) | 7.3% |

The freeze-dried fruit market in Europe is expanding rapidly as a result of both the increasing number of health-conscious consumers as well as the trend towards more convenient, nutrient-dense snack foods. Freeze-dry fruits now have a large percentage of the market due to the ever-growing demand for such food products among young, middle-aged, and older consumers. Freeze-dried fruits are particularly valued for their long expiration date, and they keep almost the same amount of nutrients, taste, and colour as compared to freshly dried fruits.

The most significant factor in this increase is the changing attitude toward snacking. A significant number of shoppers are now on the lookout for snacks that not only taste good but are also nutritious.

This is the reason why freeze-dried fruits are gaining from this tendency as they provide a clear, whole-food style to snacking, which is rich in vitamins, and antioxidants, as well as being a good fibre source. They are frequently added to smoothies, and cereals, or served as separate treats so that customers can have the feeling of eating fresh fruits for as long as the year, without the worries of them getting spoiled.

Explore FMI!

Book a free demo

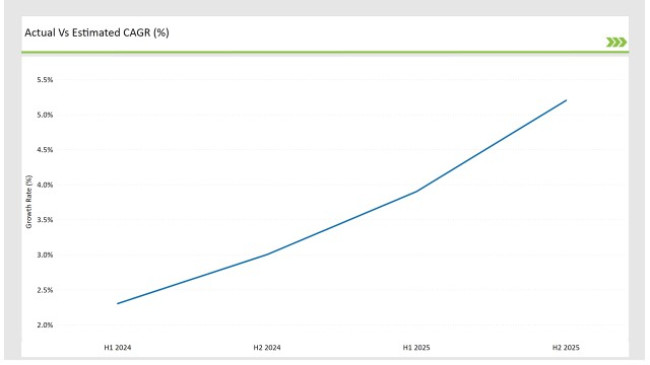

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Freeze Dried Fruits market. This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 2.3% |

| H2 (2024 to 2034) | 3.0% |

| H1 (2025 to 2035) | 3.9% |

| H2 (2025 to 2035) | 3.2% |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Freeze Dried Fruits market, the sector is predicted to grow at a CAGR of 2.3% during the first half of 2024, with an increase to 3.0% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 3.9% in H1 but is expected to rise to 5.2% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2024, followed by an increase of 20 basis points in the second half of 2024 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April 2024 | A major European freeze-dried fruit supplier launched a new product line featuring exotic fruits like dragon fruit and acai, aligning with the growing demand for diverse, nutrient-dense snacks. |

| March 2024 | A European freeze-dried fruit producer announced a partnership with local farmers to ensure sustainable sourcing of organic fruits, enhancing both the ecological footprint and product quality. |

| February 2024 | A leading European company expanded its production facility to increase the capacity for freeze-dried fruit production, driven by increasing demand for freeze-dried snacks. |

Increasing demand for healthy, convenient, and portable snacks

As health consciousness among European consumers is rising, the demand for healthy, convenient, and portable snacks has increased. Freeze-dried fruits have emerged as the favourite within this landscape because they retain most of the nutrients, flavour, and texture of fresh fruits but offer a longer shelf life.

Consumer busy lifestyles, particularly in urban centres, demand ready-to-carry non-perishable snackers that can be snuck into the hectic schedule of consumers. Such offerings create a ready solution for free-dried fruits, providing a healthy but tasty on-the-go snack that doesn't compromise on taste or health.

The market is also growing due to the increased trend of fitness and well-being. Smoothies, protein shakes, and energy bars have always received these fruits as a natural addition to their recipes, providing that natural burst of vitamins and antioxidants. Brands have picked on this trend with the production of several lines of freeze-dried fruit snacks for the active consumers.

Expanding Applications Beyond Food and Beverages

Freeze-dried fruits, apart from their applications in food and snacks, have also been used for newer applications in nutraceuticals, cosmetics, and even pet food. Due to the high concentration of vitamins, minerals, and antioxidants, they are now an attractive ingredient for dietary supplements, which can be processed into powders, capsules, or tablets. Supplements are increasing in popularity as consumer’s demand more functional ingredients, providing more than basic nutrition.

Freeze-dried fruits are utilized in the cosmetic industry for anti-aging, moisturizing, and soothing. Fruits that have high contents of antioxidants are particularly in demand; these are mostly berries and pomegranates, whose high antioxidant activities are used in combating free radicals, thus creating healthier skin. Pet food itself has also witnessed the use of freeze-dried fruits as a healthy addition to pet food, giving their pet that much-needed vitamin and antioxidant content which elevates their well-being.

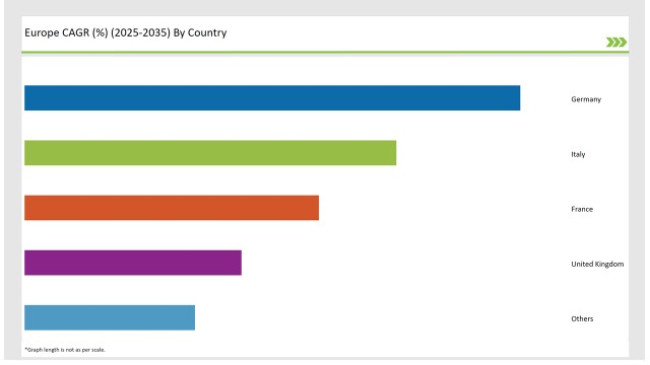

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 32% |

| Italy | 24% |

| France | 19% |

| United Kingdom | 14% |

| Others | 11% |

The major market for freeze-dried fruits in Europe comes from Germany due to the presence of a health-conscious consumer base and established demand for organic, plant-based food products. Therefore, this has become one of the leading sources for European focus on sustainability and local sourcing Many German consumers prefer clean-label products free from artificial preservatives and additives, which makes freeze-dried fruits a natural fit for the market.

In addition, the number of consumers in Germany who are looking for functional and nutrient-dense snacks has increased. This demand is met by the growing availability of freeze-dried fruits across retail channels, including health food stores, supermarkets, and online platforms.

Given the fact that the UK has a high percentage of vegans and vegetarians, this market can be considered a perfect destination for freeze-dried fruits as they answer to the growing demands for natural plant-based snacks. Freeze-dried fruits are the wholesome alternative for traditional sugary snacks and can be found nowadays in smoothies, energy bars, and a lot of functional foods.

Increasing demand in the food and nutraceutical sectors from rising interest in health and wellness also contributes to this market's growth. This is a rather common trend in the UK because of its massive population that demands health-based food products in the cities. On the other hand, the successful e-commerce ecosystem of the UK has streamlined consumer access to an immense portfolio of freeze-dried fruits, further fuelling demand.

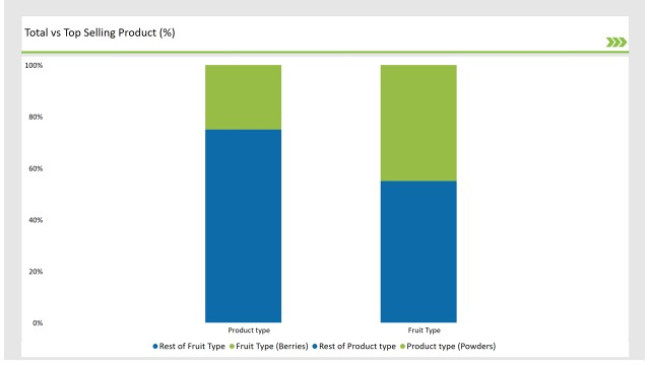

% share of Individual Categories Product type and Fruit Type in 2025

| Main Segment | Market Share (%) |

|---|---|

| Product type ( Powders ) | 25% |

| Remaining segments | 75% |

The major application area is nutraceuticals as these powders are used as active ingredients in supplements, energy drinks, protein powders, and meal replacement shakes. Freeze-dried fruit powders are highly concentrated in nutrients, making them well suited to products that aim to contribute to total wellness-from immune system support to promoting digestive health and energy levels.

An area of increasing interest that has also emerged in the food and beverage industry, freeze-dried fruit powders are used as flavour enhancers or to add a nutritional boost, especially in smoothies, snack bars, and baked goods. As people become more health conscious and interested in clean-label products, these powders will nicely keep up with the market because they contain no preservatives or artificial additives but simply natural ingredients.

| Main Segment | Market Share (%) |

|---|---|

| Fruit Type ( Berries ) | 45% |

| Remaining segments | 55% |

The berries segment is growing because of an increase in awareness of health and wellness among consumers. After all, it is well-known that berries possess a high concentration of antioxidants vitamins, and minerals. Freeze-dried strawberries, blueberries, and raspberries are a quick and healthy snack that retains nutrient-rich compounds but does not dispose of valuable components in fresh fruits. Their lightweight and shelf-stable nature makes them ideally suited for the on-the-go consumer, but also for culinary applications.

Freeze-dried berries have been utilized in smoothies, granola, baked goods, and so much more. These appeal to both consumers and food manufacturers because of their flexibility: they easily contribute to a wide range of final products. In addition, the trend of growing plant-based diets and clean eating has elevated the demand in freeze-dried berries as they serve as a natural sweetener and flavour enhancer.

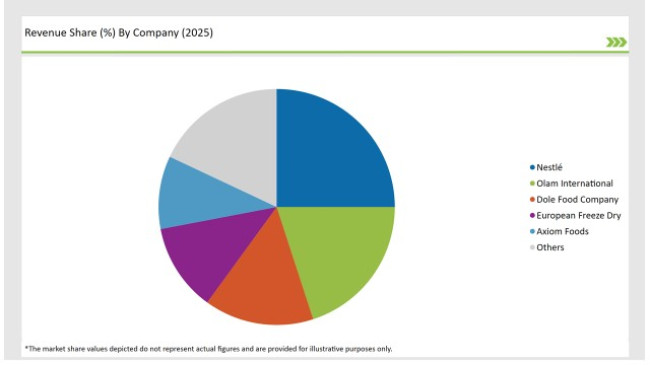

2025 Market share of Europe Freeze Dried Fruits manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Nestlé | 25% |

| Olam International | 20% |

| Dole Food Company | 15% |

| European Freeze Dry | 12% |

| Axiom Foods | 10% |

| Others | 18% |

Note: The above chart is indicative in nature

The European freeze-dried fruit market comprises a combination of large multinational corporations and smaller regional players. The Tier 1 companies that are at the top of the market include Olam Group, Freeze-Dry Foods Ltd, and The Real Fruit Company. They have a very wide distribution network and an extremely large portfolio of products. The companies are continually innovating and expanding their product lines to capture new market segments, such as beauty and nutraceuticals, that take advantage of changing consumer trends.

The regional market is mostly targeted by the Tier 2 companies, for example, the European-based freeze-dried fruit producers. Their niche products usually target specific consumer needs. Thus, these companies can differentiate their products by marketing organic, sustainably sourced products and using production processes that have specialized features for enhancing flavour and texture.

Tier 3 companies are more local, focusing on regional markets and specialized products. Even though they are smaller in size, these companies often represent an important source of innovation, offering unique offerings that cater to specific consumer segments.

The Europe Freeze Dried Fruits market is projected to grow at a CAGR of 7.3% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 5,334.9 million.

Key factors driving the freeze-dried fruits market in Europe include the increasing consumer demand for healthy and convenient snack options that retain nutritional value, as well as the growing popularity of freeze-dried ingredients in the food processing and culinary sectors. Additionally, the trend towards clean label products and natural ingredients is further fueling market growth.

Germany, Italy, and UK are the key countries with high consumption rates in the European Freeze Dried Fruits market.

Leading manufacturers include Nestlé, Olam International, Dole Food Company, European Freeze Dry, and Axiom Foods known for their innovative and sustainable production techniques and a variety of product lines.

As per Nature, the industry has been categorized into Organic, and Conventional.

As per Product Type, the industry has been categorized into Whole, Diced, and Powdered/Granulated.

As per End-User, the industry has been categorized into Food & Beverages Products, and Retail/Household.

As per Fruit Type, the industry has been categorized into Berries, Exotic & Tropical Fruits, and Orchard & Citrus Fruits.

As per Sales Channel, the industry has been categorized into Business to Business, and Business to Consumer.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

A Detailed Analysis of Brand Share Analysis for Herbs and Spices Industry

A detailed analysis of the Australia Bakery Ingredient Market and growth outlook covering product type, and application segment

USA Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Europe Aqua Feed Additives Market by Additive Type, Species, Ingredient, and Country through 2035

UK Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Herbs and Spices Market by Product Type, Form, End Use, and Country through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.