The Europe Fish Meal market is set to grow from an estimated USD 13,274.7 million in 2025 to USD 19,409.4 million by 2035, with a compound annual growth rate (CAGR) of 3.9% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 13,274.7 million |

| Projected Europe Industry Value (2035F) | USD 19,409.4 million |

| Value-based CAGR (2025 to 2035) | 3.9% |

Over the past few years, the European fish meal market has become very successful. This mainly is due to the increased need for high-quality protein sources that are used besides animal feed also for fertilizers.

Fish meal is a supplement that is made from fish like anchovy, menhaden, and other types of marine species. Because fish meal is one of the richest foods that can be fed to different species of fish, it is widely used in livestock and aquaculture, apart from etc industries.

The structure of the European fish meal sector is highly dispersed, with a proportion of international actors and local manufacturers. The chief actors in the market include large fish processing companies, like Austevoll Seafood, Cargill, and IFFCO. The companies adopt techniques, like vertical integration, which is a strategy that allows them to control the whole supply chain from fishing to fish meal production.

Austevoll Seafood is a case in point implementing a policy of student running, which means the fish that goes for their meal production is from fisheries obeying the rules. By taking care of the environment, Austevoll Seafood can offer its products to the public who are interested in European products that are traceable and eco-friendly.

Likewise, Cargill is strongly focused on manufacturing new fish meal products that will serve the separate needs of livestock and aqua farmers, which will ensure their dominating position in Europe.

Explore FMI!

Book a free demo

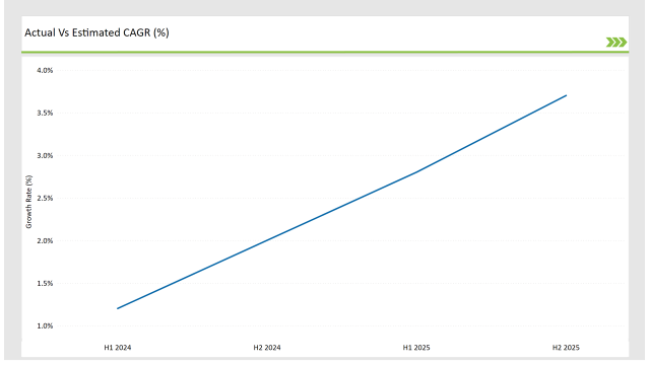

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Fish Meal market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 1.2% |

| H2 (2024 to 2034) | 2.0% |

| H1 (2025 to 2035) | 2.8% |

| H2 (2025 to 2035) | 3.7% |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Fish Meal market, the sector is predicted to grow at a CAGR of 1.2% during the first half of 2024, with an increase to 2.0% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 2.8% in H1 but is expected to rise to 3.7% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April-2024 | Product Launch - Austevoll Seafood introduced a new high-protein fish meal range aimed at improving growth rates in aquaculture. The new product is designed to cater specifically to the needs of farmed fish, increasing efficiency in aquaculture production. |

| March-2024 | Partnership - Cargill entered into a strategic partnership with local European aquaculture companies to provide specialized fish meal products. This collaboration is focused on developing tailor-made nutritional solutions for the aquaculture industry. |

| February-2024 | Expansion - IFFCO expanded its production facilities in Spain, increasing its ability to supply high-quality fish meal to the growing European animal feed market. This expansion aligns with their goal to enhance their regional market presence. |

Increasing Demand for High-Protein Fish Meals in Aquaculture

The rising demand for high-protein fish diets in aquaculture has turned fishmeal into a major component of the European fish sector. Companies are more than ever engaged in the production of high-protein fish meals designed to specifically meet the diet requirements of fish raised in aquaculture.

For example, Cargill has sourced a special line of fish meal products that are preferred by omega-3 consumers and that are necessary for the ideal growth of fish in aquaculture settings.

Austevoll Seafood has similarly been working on the enhancement of the protein content of its fish meals which are especially intended for the targeting segment of high-growth aquaculture. Their technique involves an elaborate research itinerary on the protein and amino acid composition which has shown a positive effect on the growth rate of farmed fish in salmon and trout farms.

Modifying the Consumption of Fish Meal Outside of Animal Feed

Although fish meal has been greatly used for animal feeds, recent market development seems to witness other applications nonconventional, especially in fertilizers and industrial uses. For example, IFFCO embarked on the journey to the European agriculture sector by promoting fish meal which is also corrupted as a high-quality organic fertilizer.

Their product is attached to the anchovy and menhaden fish and is used to purify soil and grow crops, thus, adhering to the trend of organic farming in Europe.

Additionally, industries such as Omega Protein, a subdivision of Cooke Aquaculture, have also been engaged in the use of fish meal in a range of bio products such as biofuels and as a source of essential oils and other biochemical.

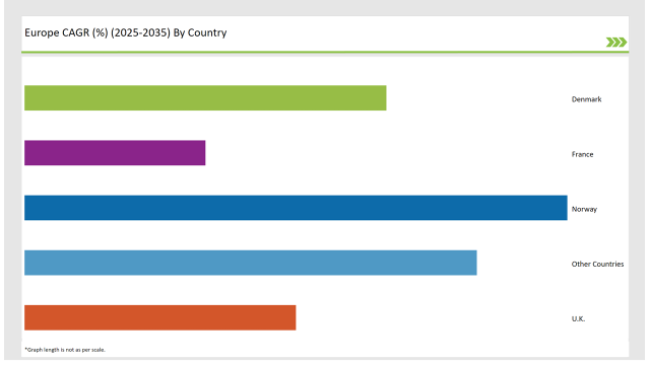

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Norway | 30% |

| Denmark | 20% |

| UK | 15% |

| France | 10% |

| Other Countries | 25% |

The country has strength in farmed fish culture, the target primarily remains on seabass, seabream, and trout. The higher quality fish meal will naturally increase the demand. Pescanova and Spazfish are Spanish companies that have been carrying these emanations.

Pescanova stands as one of the highest-producing producers of quality fish meals in Spain. The company has focused on premium fish meal production since farmed fish have higher nutritional requirements.

Specialized formulations of fish feed improve the immunity of the fish, resulting in better survival rates and improved market value. The expansion success of the company in Europe was supported by Spain's geographical location and its connection with the major hubs of fishing and aquaculture in the Mediterranean.

Norway is the other European nation that stands out as a fish meal industry growing with strength with its tremendous fisheries and aquaculture. Companies, such as Marine Harvest, and Norsildmel are at the forefront of this growth and take on the work by centering their strategy on producing high-quality products based on fish meal both to the home market and to international markets.

Marine Harvest, now called Mowi, is one of the largest fishmeal producers in Norway and places significant emphasis on the production of fish meal that complies with the high sustainability standards European regulators demand.

The company has consequently invested in the latest technology to ensure that its fish meal is not only the most nutritionally efficient but also produced in a very eco-efficient manner. Norsildmel has, through specialization in high-protein fish meal products, managed to find its niche in the European market. The company specializes in the production of menhaden fish meal, which is an essential source of omega-3 fatty acids.

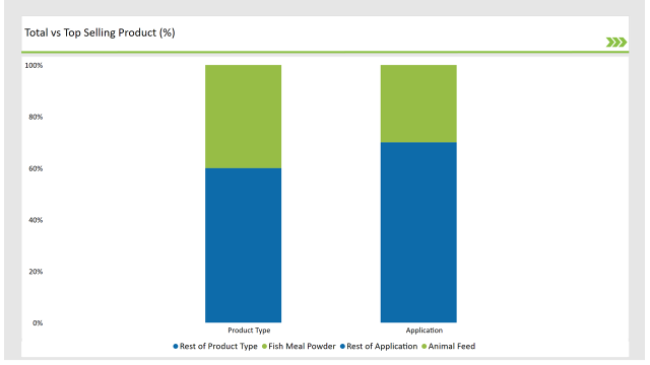

% share of Individual Categories Application and Product Type in 2025

| Main Segment | Market Share (%) |

|---|---|

| Application (Animal Feed) | 30% |

| Remaining segments | 70% |

Animal food is the most popular and the fastest-growing use of fish flour in Europe, and it also occupies a huge part of the fish flour market. Fish flour is a major protein source for some livestock, especially for poultry and pigs, where the addition of fish flour directly correlates the Brown & Feed Efficiency. The companies that drive this segment are Cargill and Aller Aqua which deliver modified fish meal solutions to boost the nutritional value of animal feed.

Cargill launched a comprehensive package of fish meal products that are specific to many animal species. In addition, the growing switch towards implementing sustainable animal feed practices has triggered many new product inventions.

For instance, Aller Aqua developed a sustainable fish meal product that diminishes the environmental impact of fish farms while maintaining the necessary high-quality nutritional value for animal feed.

| Main Segment | Market Share (%) |

|---|---|

| Product Type (Fish Meal Powder) | 40% |

| Remaining segments | 60% |

Fish meal powder is the biggest expanding sub-segment in the European fish meal market as it is versatile and very nutritious. The Feeds, especially the ones in aquaculture and livestock, use fish meal powder which is a rich source of protein and essential amino acids.

As the need for more sustainable and high-quality protein sources continues to grow, fish meal powder becomes a go-to option for feed producers choosing to gain more weight and health in their animals.

The continuous focus on aquaculture practices in addition to the forming awareness of the advantages of fish meal powder in fish health and growing rates side by side has had a considerable impact on the increase of its market share.

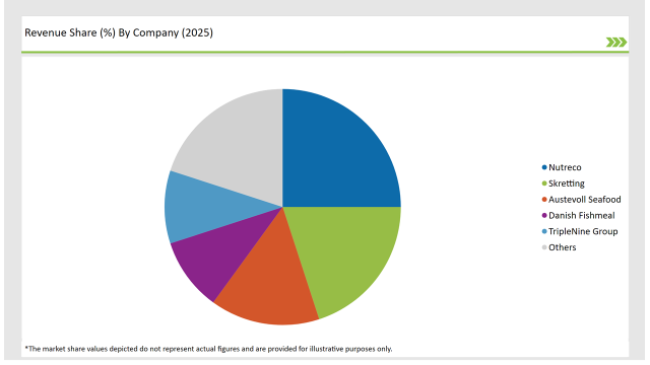

2025 Market share of Europe Fish Meal manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Nutreco | 25% |

| Skretting | 20% |

| Austevoll Seafood | 15% |

| Danish Fishmeal | 10% |

| TripleNine Group | 10% |

| Others | 20% |

Note: The above chart is indicative in nature

The fish meal business in Europe is very much fragmented, with the presence of all sorts of manufacturers ranging from Tier 1 featuring global players to Tier 3 local suppliers. The market is ruled by Tier 1 companies like Austevoll Seafood and Cargill, which are examples of such companies.

They have the necessary resources for R&D and a worldwide distribution network, which enables them to keep a firm grip on a great portion of the market. They also are the first to sustainability and innovation, which is the reason why this aspect of competitiveness is their strength.

Tier 2 statutes like Aller Aqua and Norsildmel devote their resources to regional production and particular customer needs. These companies are more reputable in the fish species they provide and also deal with other products specific to niche markets such as organic or environmentally friendly fish farming.

Local fish meal producers that are Tier 3 companies/or other local fish meal producers are Tier 3 companies, generally speaking, may operate on a smaller scale, but they are still important players in their local markets. These businesses are focused on providing fish meal products that are high-quality and cheap, therefore, forming business relationships with smaller local companies.

The Europe Fish Meal market is projected to grow at a CAGR of 3.9% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 19,409.4 million.

Key factors driving the European fish meal market include the increasing demand for high-quality protein in animal feed and aquaculture, as well as a growing emphasis on sustainable and environmentally friendly sourcing practices. Additionally, the rise in pet ownership and the demand for premium pet food products further contribute to market growth.

Norway, Denmark, and UK are the key countries with high consumption rates in the European Fish Meal market.

Leading manufacturers include Nutreco, Skretting, Austevoll Seafood, Danish Fishmeal, and TripleNine Group known for their innovative and sustainable production techniques and a variety of product lines.

As per Product Type, the industry has been categorized into Fish Meal Powder, Fish Meal Pellets, Fish Oil, and Fish Protein Hydrolysate.

As per Application, the industry has been categorized intoAquaculture, Animal Feed, Pet Food, Fertilizers, and Nutraceuticals.

As per Source, the industry has been categorized into Wild-Caught Fish, Farmed Fish, Bycatch, and Processing By-products.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

A Detailed Analysis of Brand Share Analysis for Herbs and Spices Industry

A detailed analysis of the Australia Bakery Ingredient Market and growth outlook covering product type, and application segment

USA Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Europe Aqua Feed Additives Market by Additive Type, Species, Ingredient, and Country through 2035

UK Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Herbs and Spices Market by Product Type, Form, End Use, and Country through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.