The Europe Dehydrated Onions market is set to grow from an estimated USD 113.0 million in 2025 to USD 187.5 million by 2035, with a compound annual growth rate (CAGR) of 5.7% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 113.0 million |

| Projected Europe Value (2035F) | USD 187.5 million |

| Value-based CAGR (2025 to 2035) | 5.7% |

The European market for dehydrated onions is expanding steadily as consumer preferences continue to evolve towards convenience, health-conscious choices, and longer shelf-life food products.

Dehydrated onions, available in various forms such as flakes, powder, granules, rings, and paste, offer a cost-effective and efficient way to add flavour to food without the need for refrigeration. This market is driven by changing consumer habits and increasing demand across the different food sectors, including ready-to-eat meals, snacks, and sauces.

Dehydrated onions are an ideal solution for the food industry because they have an extended shelf life, can be stored with ease, and present themselves as a versatile ingredient that enhances flavour. Their use in soups, seasonings, sauces, and snacks adds them as an essential ingredient in various food applications.

It is also noted that dried onions are valued, especially in seasoning and snack lines, because their addition to manufactured foods can supply flavour intensity as well as flavour consistency.

Increased awareness in the European market is also linked to the fact that dehydrated vegetables bring many health benefits. Onions are particularly famous for their rich antioxidant properties like flavonoids, which further contribute to preventing inflammation and contributing to heart health.

Explore FMI!

Book a free demo

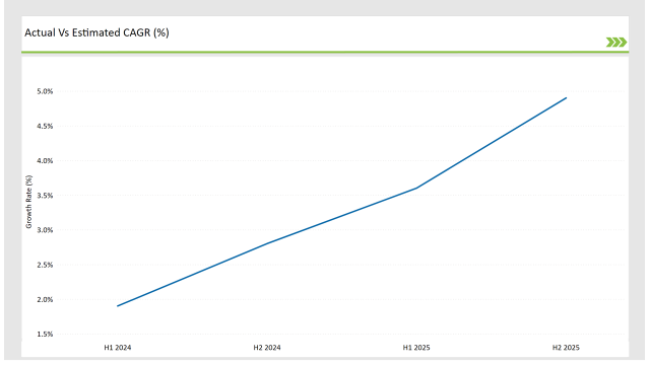

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Dehydrated Onions market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 1.9% |

| H2 (2024 to 2034) | 2.8% |

| H1 (2025 to 2035) | 3.6% |

| H2 (2025 to 2035) | 4.9% |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Dehydrated Onions market, the sector is predicted to grow at a CAGR of 1.9% during the first half of 2024, with an increase to 2.8% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 3.6% in H1 but is expected to rise to 4.9% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April-2024 | Product Line Launch: Organic Dehydrated Onion Flakes launched by Company X, catering to the growing demand for clean-label ingredients in food products. These flakes are certified USDA Organic and EU Organic, targeting the organic food segment in Europe. |

| March-2024 | Expansion of Production: Company Y expanded its production facility in Eastern Europe to meet rising demand for dehydrated onion powder, specifically in the snack industry. The move aims to optimize production and improve distribution capabilities across the European market. |

| February-2024 | Strategic Acquisition: Company Z, a key player in the dehydrated onion market, acquired a leading dehydrated onion supplier, enhancing its market reach and broadening its product offerings. The acquisition is expected to strengthen the company's position in the European market, particularly in the organic product category. |

Adoption of Organic and Clean Label Products

The dried onion market in Europe is bearing witness to a significant transformation as customers are increasingly leaning toward organic and clean-label products. This phenomenon is a result of consumer’s increasing worries regarding food safety, health, and the environment.

Organic food items are considered a healthier option, as they are cultivated without the use of harmful pesticides and they are better for nature compared to food produced traditionally. Concerning this issue, European enterprises are taking the lead in the production of organic dehydrated onions to satisfy consumer needs.

Dehydrated organic onions have already made their way into a variety of food items, including spices, snacks, soups, and even ready-to-eat products. Several notable participants in the dehydrated onion market, for instance, Olam Group, have shown their reactions to this trend through the release of organic dehydrated onions which is to the rising consumer demand for healthier and ecological food choices.

Plant-Based and Vegan Food Products as Key Drivers

A plant-based diet and vegan food the products form the determinant drivers of the ongoing expansion of the market in the European region. The growing number of people opting for a vegetarian diet is resulting in the need for plant-based food items, and food companies are therefore upping their production. Dehydrated onions are not only a great alternative to meat but also a great way to add flavour in plant-based recipes.

Vegan eaters are on the lookout for foods that contain ingredients that are as close to nature as possible and yet still have very few preservatives. Dehydrated onion flakes and powders are often used in ready-to-eat plant-based meals, spices, and snacks to give delicious rich, savoury flavours.

As demand grows for vegan foods, producers such as restaurants will increasingly seek out dehydrated onions as an essential part of cooking in plant-based settings. Consequently, changes will be adopted by food companies in terms of innovative technology creating products such as plant-based snacks with dehydrated onions.

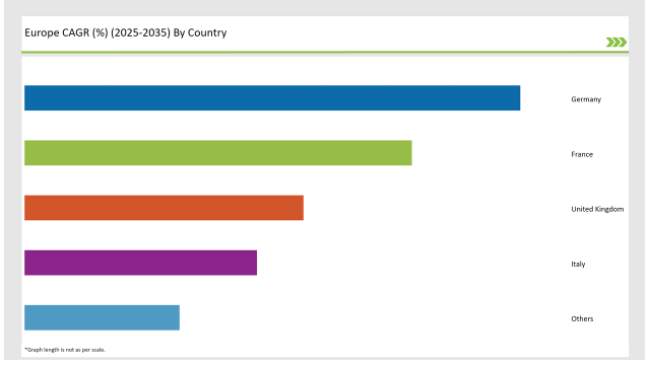

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 32% |

| France | 25% |

| United Kingdom | 18% |

| Italy | 15% |

| Others | 10% |

Germany tops the chart as one of the most profitable and biggest markets in Europe for dehydrated onions alone solely due to the existence of a good food processing industry and the demand for convenience foods in the country.

There appears to be an adamant love of the Germans for the packaged and ready-to-cook meals that encompass much of dehydrated ingredients such as onions because of taste and time-saving features. The strongest boost of the German market comes from the trend of soups, sauces, seasonings, and snack products that widely contain dehydrated onions in different forms.

Germany’s food sector is known for its creativity, and food companies are today’s constantly pushing the boundaries to mix dehydrated onions in their products that fit new consumer tastes and preferences. The trend toward plant-based diets naturally has to the rise of organic dehydrated onion demand as vegan and vegetarian products are particularly subject to it.

France, a country that is well-known for its cooking culture and the use of natural products, is now facing a big push in the organic food sector. Such evidence is visible in the dehydrated onion market, where an addition of organic dehydrated onion is constantly replacing conventional types in the choice of French consumers. The increased attention to health and sustainability has given rise to the use of organic raw materials in food, and so it is with dehydrated onions.

The French are inclined to pay extra for food products that are free of pesticides, artificial additives, and genetically modified organisms (GMOs). This trend on the demand for organic dehydrated onions is immensely preeminent in the foodservice sector, where organic and clean-label products are in great need.

Companies are now diverting their investments in the production of organic and eco-friendly farming practices while obtaining certifications that guarantee consumers who want "green" and "clean-label" food.

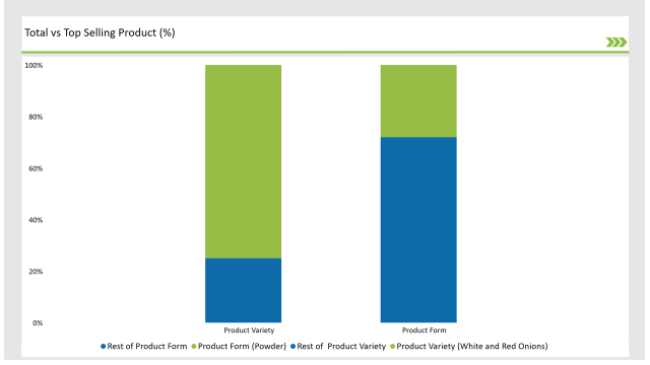

% share of Individual Categories Product Variety and Product Form in 2025

| Main Segment | Market Share (%) |

|---|---|

| Product Variety (White and Red Onions) | 75% |

| Remaining segments | 25% |

White onions are gaining exceptional growth in the European dehydrated onions market, mainly due to their utility and wide applications in various recipes. Because white onions possess a sweet flavour, they get easily used for many recipes which include soups, sauces, and seasonings; they also tend to retain much of their nutrition and flavour once dehydrated, making them a very useful product for food manufacturers and home cooks too.

More recently, the red onions segment has also grown, as it has the colour and slightly sweeter flavour profile. Red onions are increasingly used in gourmet cooking and specialty products to appeal to consumers seeking unique flavours and visual appeal in their meals. The growing consumer trend of adopting plant-based diet patterns and clean eating is contributing further to the demand for dehydrated red onions.

| Main Segment | Market Share (%) |

|---|---|

| Product Form (Powder) | 28% |

| Remaining segments | 72% |

Dehydrated onion powder represents the largest and most established segment in the market for dehydrated onions within Europe. Because of its excellent shelf life and ability to provide the natural taste of onions in a variety of food applications, it is considered one of the most popular ones.

Dehydrated onion powder is used by many in the preparation of soups, sauces, dressings, and seasoning mixes because the flavour can be enhanced without requiring refrigeration.

This category is further driven by the increasing trend of consumer demand for processed and convenience foods. Manufacturers are increasingly using dehydrated ingredients, such as onion powder, to save preparation time while keeping flavour and quality on par with fresh forms.

Dehydrated onion powder is also a critical component in seasoning blends in the snack industry, which gives depth to flavours for savoury chips, dips, and other snacks.

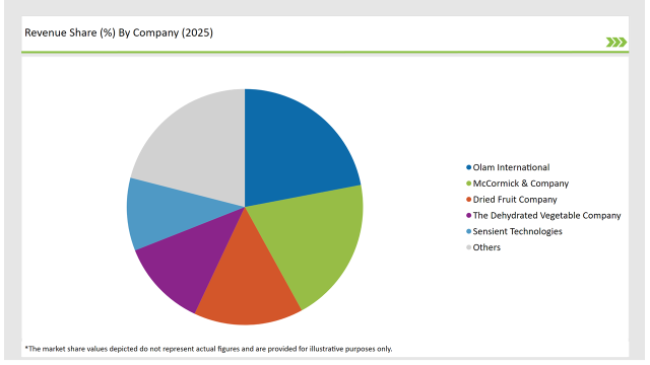

2025 Market share of Europe Dehydrated Onions manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Olam International | 22% |

| McCormick & Company | 20% |

| Dried Fruit Company | 15% |

| The Dehydrated Vegetable Company | 12% |

| Sensient Technologies | 10% |

| Others | 21% |

Note: The above chart is indicative in nature

The European dehydrated onion market is primarily concentrated as the Tier 1 companies account for most of the market share. The market is chiefly ruled by companies like Olam Group, Van Drunen Farms, and The Dehydration Company, which take leverage of their well-stretched distribution networks with a wide variety of products to fill the needs of their customers.

Having such strong positions, these Tier 1 companies can finance their activities in R&D and innovation, which in turn leads to the introduction of new dehydration onion fruits in the market as well as the evolution of the production processes that meet the requirements of the consumers in Europe.

The regional players are also included, in terms of Tier 2 company module, which again tend to deliver the goods essentially. For instance, the companies like Agromex and Nature's Power focus on niche areas, such as organic, and premium dehydration of onions.

They specialize in providing organic, clean label demand products, thereby making economic gains thanks to their competitiveness in local market knowledge.

Tier 3 companies are most of the time small locals that target specific geographic areas. They are usually smaller players with customized demand and high standards that cater to specific food manufacturers. Nevertheless, they are under heavy pressure from the major players particularly regarding the pricing and product diversity factors.

The Europe Dehydrated Onions market is projected to grow at a CAGR of 5.7% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 187.5 million.

Key factors driving the dehydrated onions market in Europe include the increasing demand for convenient and long-lasting food products that require minimal preparation, as well as the growing popularity of dehydrated ingredients in the food processing and culinary sectors. Additionally, the rising trend of healthy eating and the use of natural flavor enhancers are further boosting market growth.

Germany, France, and Netehrlands are the key countries with high consumption rates in the European Dehydrated Onions market.

Leading manufacturers include Olam International, McCormick & Company, Dried Fruit Company, The Dehydrated Vegetable Company, and Sensient Technologies known for their innovative and sustainable production techniques and a variety of product lines.

As per Product Variety, the industry has been categorized into White Onions, Red Onions, Pink Onions, Hybrid Onions.

As per Product Form, the industry has been categorized into Chopped, Minced, Granules, Powder, Flakes, Others.

As per Processing Technology, the industry has been categorized into Air Drying, Freeze Drying, Microwave Drying, Others

As per End Use Application, the industry has been categorized into B2B(Direct), Food Service, Retail(B2C).

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

Sports Nutrition Market Share Analysis – Trends, Growth & Forecast 2025-2035

UK Sports Nutrition Market Report – Growth, Demand & Innovations 2025-2035

USA Sports Nutrition Market Trends – Demand, Size & Forecast 2025-2035

Australia Sports Nutrition Market Outlook – Trends, Growth & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.