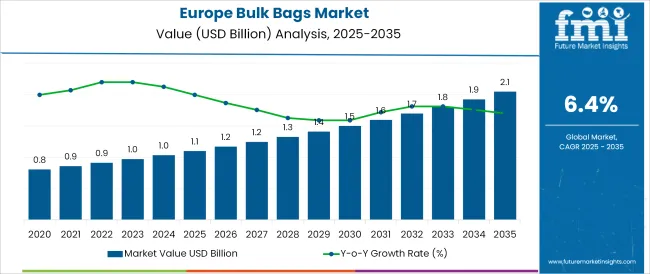

The Europe Bulk Bags Market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 2.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period.

The Europe bulk bags market is undergoing consistent growth, propelled by rising demand for cost-effective, sustainable, and efficient bulk packaging solutions across key industries. As highlighted in packaging industry journals, corporate sustainability reports, and logistics association publications, bulk bags are increasingly being adopted due to their reusability, space efficiency, and ability to handle a wide range of materials while reducing environmental impact compared to traditional rigid containers.

Regulatory pressure to minimize packaging waste and promote circular economy practices has further supported their uptake, particularly in agriculture, chemicals, and food processing sectors. Innovations in material strength, safety features, and hygiene standards have enhanced their suitability for sensitive and high-volume applications. Future growth is expected to be shaped by automation-compatible designs, improved load bearing capabilities, and alignment with corporate ESG commitments, all of which are paving the way for broader adoption and integration into modern supply chains.

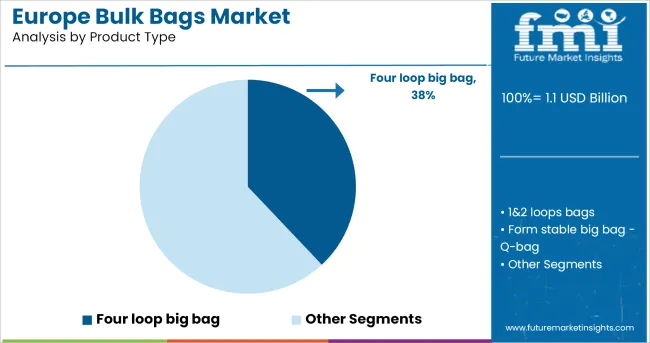

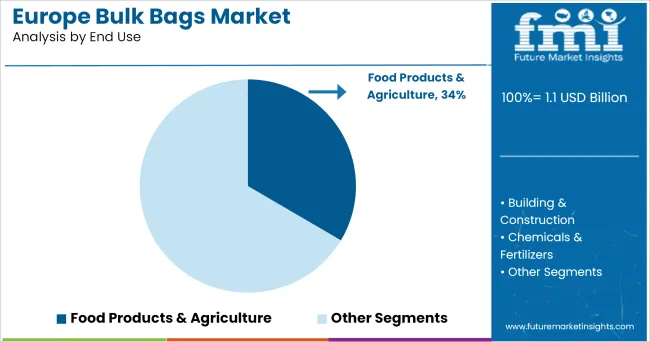

The market is segmented by Product Type and End Use and region. By Product Type, the market is divided into Four loop big bag, 1&2 loops bags, Form stable big bag - Q-bag, Anti-static big bag - Antistatic Bag, Big bag with valve Cross Corner Bag, and UN Big bag - Food Bag. In terms of End Use, the market is classified into Food Products & Agriculture, Building & Construction, Chemicals & Fertilizers, Pharmaceuticals, and Mining.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by product type, the four loop big bag is projected to command strong 38.0% strong of the total market revenue in 2025, securing its position as the leading product type. This dominance has been attributed to the structural advantages of four loop designs, which have enabled higher load stability, improved lifting safety, and enhanced stacking efficiency.

Industry reports and manufacturer statements indicate that these bags offer superior handling capabilities with standard forklifts and cranes, making them the preferred choice in high volume and heavy duty operations. Their versatility in accommodating a wide range of products from fine powders to granules along with compliance with European safety and hygiene regulations, has further strengthened their market position.

The ability to reuse these bags multiple times, coupled with improved cost efficiency and lower risk of damage during transport, has reinforced their widespread adoption across industrial and agricultural supply chains.

Segmented by end use, the food products and agriculture segment is forecast to hold 33.5% of the Europe bulk bags market revenue in 2025, maintaining its leadership. This prominence has been driven by the critical need for hygienic, durable, and cost effective packaging solutions in these sectors.

According to agricultural trade associations and food industry sustainability reports, bulk bags have become indispensable for transporting grains, seeds, fertilizers, sugar, and other food ingredients, offering superior protection from contamination and moisture.

The segment’s growth has also been supported by stringent EU regulations on food safety and traceability, which have accelerated the shift toward certified, food-grade packaging materials. Farmers, cooperatives, and food processors have increasingly favored bulk bags for their operational efficiency, reduced storage requirements, and ease of transport. Furthermore, the growing emphasis on reducing single-use plastics and promoting reusable alternatives has solidified the food products and agriculture segment’s leadership in driving demand for bulk bags in Europe.

The need for bulk shipping and storing of industrial chemicals & materials in distribution centers and warehouses have been creating opportunities for bulk bags sales. According to The Flexible Intermediate Bulk Container Association (FIBCA), bulk bags also known as “big bags, and “bulk sacks,” were first manufactured in the late 1950s or early 1960s. The manufacturing in Europe picked up in the mid-1970s during the oil crisis.

From then ahead industries are preferring bulk bags for transporting majority shipping materials. Chemicals & fertilizers and food products & agriculture industries have remained key end users of bulk bags. Demand from these industries is expected to remain consistent, favoring the overall expansion of the market.

Furthermore, the increasing demand for multipurpose and spill proof delivery is resulting in growing demand for bulk bags. These bulk bags are considered ideal for keeping consignments safe from any untoward incident. End users are aiming at tackling the demand for both economic transport and effective storing of the bulk products. This has helped flexible and folding bulk bags gain increasing traction. Also the additional benefit offered bin terms of reducing shipping costs during return trip and confirmed quality of the stored product are aiding growth.

According to FMI’s study, sales of bulk bags amplified 1.2 times during 2020 and 2020. Bulk bags are largely used for storing and transportation of large amounts of solid and semi-solid substrates such as mining, chemicals and agriculture products. On the other hand, the high quality woven polypropylene based bulk bags are extremely useful for pharmaceutical and food storage, which ensures optimum freshness of the consumable products. Together, industrial food products & agriculture and chemicals & fertilizers industries are expected to hold major chunk in the Europe market during the forecast period.

Increasing trade of pharmaceutical products and chemical materials among various European countries has been registered. In response to this, manufacturers are now focusing on the hygienic bulk bags packaging to ensure product safety. This expected to favour the expansion of the market within Europe.

Bulk bags ensure easy transportation of large capacities of raw materials and products with loops attached to their tops. Besides this, they are made up of same proportions of load pallets which results in easy movement of the bags using forklifts. These foldable and reusable bulk bags are considered ideal packing resolutions for returnable transport packaging as they utilize less space during return trip and minimize carriage cost.

As per FMI analysis, higher productivity margin is predictable with the extended use of big sized, greater value reusable bulk bags which are cost efficient over small bags with shorter life spans. In the chemicals & fertilizers industry, anti-static type of bulk bags are chosen in bulk packaging for transportation of powder, ignitable speck of dust, and other materials. All these factors are estimated to expand the bulk bags market at a growth rate of 3.5% in next decade.

Rising demand for standardized packing is supporting the bulk bags sales. Form stable big bag (Q-bag) to cross corner big bags, sales across diverse industries is projected to surge, enabling growth in the market. These types of bulk bags fulfil the industry norms and are permitted for transportation of various industrial goods and raw materials because they offer a high degree of safe working loads (SWLs) with excellent durability.

From a manufacturing perspective, the application of Q-bag and cross corner bulk bags helps in attaining economies of scale. The structure of the cross corner bulk bags helps in sustaining a square shape when filled, particularly a bulk bag with baffles. Additionally, durable, lightweight, and reliable features of these bulk bag ensures convenient usage and disposal while shipping and transportation.

Use of sustainable and recyclable materials for manufacturing of bulk bags is trending, which is predicted to impact the consumption at great extent. The shift from using oil-based raw materials to sustainable materials for the developing bulk bags is likely to create growth opportunities for players. Stringent regulations and environment concerns have been encouraging manufacturers to aim at innovations.

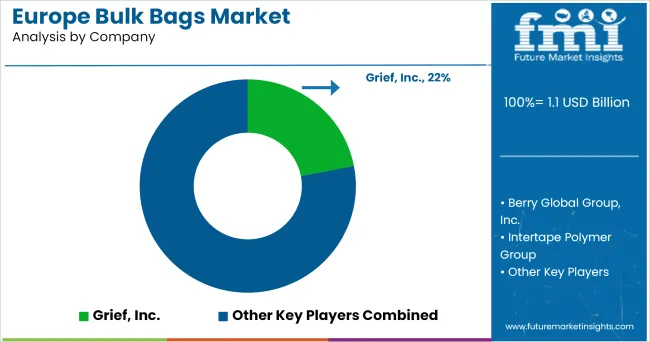

Some of the leading companies operating in the Europe bulk bags market such as Greif Inc., Berry Global Group, Inc., Intertape Polymer Group, Conitex Sonoco, and others are offering bulk bag with highest level of sustainability for their eco-conscious customers. Some of the other players who are either new entrants or operating with smaller production capacities including DIV Trades d.o.o., PLASTCHIM-T AD, and others are focusing on research and development to keep pace with prevailing trends.

In 2024, according to the European Bioplastics Association, Europe accounted for almost 1/4th of the global bioplastic manufacturing capacity, posing plentiful of opportunities for the bulk bag manufactures to build their products with these sustainable materials.

Therefore, major players are producing bulk bags which are UN Certified and providing sterilized bulk bags to the food & agriculture and pharmaceutical industries. Additionally, end use industries are exhibiting increasing inclination towards the use of lightweight shipping solutions.

Some of the established players such as Conitex Sonoco, LC Packaging International BV, and some emerging players including BAG Corp. and DIV Trades d.o.o. are providing UN Certified Bulk Bags in the Europe market. All these factors are further anticipated to boost the sales of the bulk bags in the Europe.

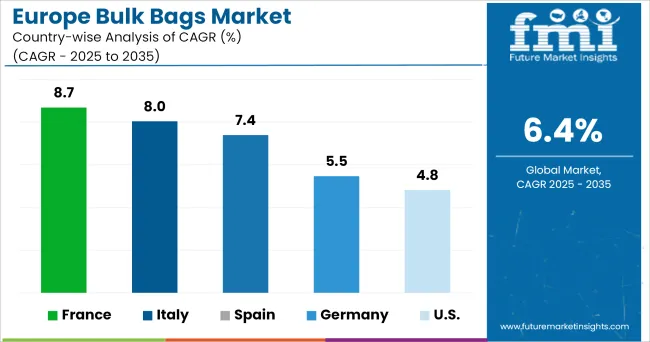

As per European Federation of Pharmaceutical Industries and Associations, in 2020, Germany exported nearly 15% of the global drugs and medicines to rest of the world. The demand for UN certified and other bulk bags in Germany is expected to remain high, thanks to the growing export and advances of drugs and medicines in the country.

As per FMI analysis, Germany accounted for nearly 14% market share in Europe bulk bags consumption. The increasing capacity of transportation of drugs and medicines is creating need for sterilized storage of end products. Furthermore, the presence of top pharmaceutical companies such as Novartis Pharma GmbH, Roche Pharma, Bayer Vital GmbH and others is also reinforcing the growth of bulk bags market.

Trade activities of these products with various countries are expected to create lucrative growth prospects in the coming years.

As per the European Chemical Industry Council, with USD 0.8 billion of revenues and USD 22.8 billion value added in 2020, chemical industry is the UK’s second largest manufacturing sector followed by food and beverage processing sector. The UK’s chemical industry is active in all key sector including petrochemicals, basic inorganics, agrochemicals, polymers, paints, and of industrial fields including fuel additives, lubricants, construction chemicals and others.

The demand for bulk bags in the UK is estimated to increase by 1.4 times of current market value in next decade. Increasing production activities are expected to fuel the demand for bulk bags in the UK Furthermore, the presence of companies such as Euroflex FIBC Limited, RDA Bulk Packaging Ltd, Sackmaker J&HM Dickson Ltd, and others has been aiding the overall expansion of the market.

According an FMI, handling cargo has increased by 3.0% in Russia in 2020 compared to 2020. This volume of cargo yearly handled by ports in Russia, accounted to 840.3 Million tons. Besides this, according to United Nations Conference on Trade and Development, Russia’s coal exports hold around 11% of the global market share Euroflex FIBC Limited in 2020. The availability of major international ports such as The Port of St. Petersburg, The Port of Novorossiysk, and others have resulted in increased coastal trades with other countries, thereby driving the bulk bags market in the country.

CONROP, s.r.o. (Czech Republic), DIV Trades d.o.o. (Serbia), TiszaTextil Plastic Processing and Sales LTD. (Hungary), PLASTCHIM - T AD (Bulgaria), and Romtextil SA (Romania) are top players operating in the Eastern Europe region. Eastern Europe has fresh produce of organic food products. Shipping of these organic products across various regions will further strengthen the use of bulk bags in this region.

Bulk bags are most suitable for the export of food products in economical manner. They are now slowly replacing the use corrugated boxes or fiber drum in the region, as more and more new players are entering the bulk bags market. Use of the bulk bags for the shipping of products, is anticipated to create growth opportunities in Eastern Europe.

By product type, 1&2 loops bags are the most preferred bulk bag followed by four loop big bag used in Europe. 1&2 loops bags are the most attractive among end-use industries as these offer cost-effectiveness and easy-to-handle features for food, agriculture, and fertilizer transportation, and other applications. The segment is estimated to hold around 1/4th of the market share in Europe by 2024. However, with the changing consumer preferences for multipurpose packaging solutions, they are inclined towards the use of form stable big bag and UN Big bag. Due to which the 1&2 loops bags segment is projected to loss nearly 320 BPS by the end of forecast period.

On the other hand, the UN Big bags (food bag) segment is expected to have BPS change of +230 by 2035. The UN Big bag segment is expected to present incremental $ opportunity of USD 125 Million due to rising usage of bulk bags for food and pharmaceutical products storage and transportation.

The UN big bag (food bag) segment is estimated to hold more than 12% value share in the Europe bulk bag market and expected to rise by 230 BPS by the end of 2035.

As per FMI analysis, the segment will gain from the rising need for space saving and economical returnable transportation of food, pharmaceutical and agriculture products in the Europe markets. These UN certified bulk bags are multipurpose and improve handling and transportation in more efficient way, in turn improving material handling system and supply chain.

Several manufacturers are focusing on research and development and product innovations to make their products stand out from others. Manufacturers are specializing in fast turn-around, shorter lead times, and tailored production of bulk bags.

Big players such as Berry Global Group Inc., Greif Inc. and Intertape Polymer Group are focusing on product launches to gain competitive edge. For instance, in 2024, Greif Inc. has launched SealGuard, the next generation of FIBC, a step change in bulk bag performance. SealGuard is simply made from polyethylene (PE) which makes it easily recyclable.

Also, several other companies are focusing on sustainable development by manufacturing bulk bags made of bio-polymers. Some are even using recycled materials to achieve their sustainability goals.

Some of the leading companies operating in the market are:

*The list is not exhaustive, and only for representational purposes. Full competitive intelligence with SWOT analysis available in the report.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Million for value and Million Units for Volume |

| Key Countries Covered | Germany, Spain, Italy, France, UK, Benelux, Nordic, Russia, Poland, and Rest of Europe |

| Key Segments Covered | Product Type, End Use, and Country |

| Key Companies Profiled | Grief, Inc.; Berry Global Group, Inc.; Intertape Polymer Group; Conitex Sonoco; LC Packaging International BV; Bag Corp; Sackmaker J&HM Dickson Ltd; Emmbi Industries Ltd; RDA Bulk Packaging Ltd; Conrop, s.r.o.; MANICARDI srl; Sokuflex Behälter GmbH; Bulk Containers Europe BV; DIV Trades d.o.o.; TiszaTextil Plastic Processing and Sales LTD.; PLASTCHIM-T AD; Pera Plastic Czech s.r.o.; Romtextil SA; EUROFLEX FIBC LIMITED; BLOCKX GROUP |

| Report Coverage | Market Forecast, brand share analysis, competition intelligence, DROT analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global europe bulk bags market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the europe bulk bags market is projected to reach USD 2.1 billion by 2035.

The europe bulk bags market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in europe bulk bags market are four loop big bag, 1&2 loops bags, form stable big bag - q-bag, anti-static big bag - antistatic bag, big bag with valve cross corner bag and un big bag - food bag.

In terms of end use, food products & agriculture segment to command 33.5% share in the europe bulk bags market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Type-C Bulk Bags Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Type-C Bulk Bags Companies

Ventilated Bulk Bags Market Analysis by Construction, Strip Fabrics, Application, and Region Forecast Through 2035

Europe Ecommerce Paper Bags Market Analysis – Trends & Forecast 2024-2034

Western Europe Intermediate Bulk Container Market Growth – Trends & Forecast 2023-2033

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Bulk Bag Market Forecast and Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Bulk Terminal Market Forecast and Outlook 2025 to 2035

Bulk Molding Compounds Market Size and Share Forecast Outlook 2025 to 2035

Bulk Bag Unloaders Market Size and Share Forecast Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA