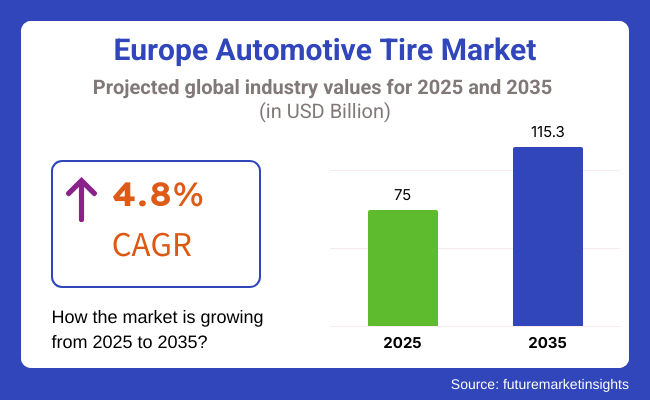

The European automotive tire market will be valued at USD 75 billion in 2025, reflecting a 12.3% increase from its 2023 valuation of USD 68.4 billion. With a much higher forecasted value of USD 115.3 billion in 2035, the market will experience a 4.8% annual growth rate (CAGR).

The European automotive tire market is poised to experience a tremendous boost, as it is driven by the ever-growing demand for replacement and original equipment (OE) tires. The constantly rising number of vehicles, coupled with the advancements in tire technology, which were only recently created, are the major driving forces behind market growth.

Moreover, consumers, car manufacturers, and fleet operators embark on the diversification of the market by introducing new ideas, such as higher performance, durable life span, and eco-friendliness in the tire selection process.

The EU's market is further defined by rapid progress towards eco-friendly and low-energy tire production, which is highly driven by the widespread deployment of electric cars (EVs). Companies are concentrating on R&D units and adopting cutting-edge technologies towards better durability, reduced fuel costs, and higher safety/performance.

The industry is also currently exhibiting a new trend of specialized tires for EVs, which are heavier and carry more torque but, at the same time, are more energy efficient. A prime obstacle that tires & wheel companies are currently contending with is the relentless surge in raw materials like rubber, steel, and oil prices.

Apart from being a huge part of production costs, the creation of these raw materials also results in unintended consequences, such as their rising prices affecting profits. To deal with these pressures and keep product quality at high levels, companies must implement disruptive innovation.

Furthermore, the European Union's undesirable obligation of strict fuel efficiency rules, tire labeling, and environmental sustainability has forced the manufacturers to improve their processes to reach conformity standards constantly. These regulations, on the one hand, actively contribute to the innovation of tires and the promotion of environmental sustainability; on the other hand, they create challenges in terms of cost and production efficiency.

Sustainability is becoming a significant aspect of the European automotive tire market, with manufacturers looking into methods of producing recycled rubber, bio-based compounds, and using the least energy in production.

The innovation of low-rolling-resistance tires, which enhance fuel efficiency and reduce carbon emissions, aligns with the company's commitment to environmental sustainability. Companies like Diamante and Firestone have been working hard to maintain the loyalty of their customers by undertaking ecological initiatives like the creation of green tires that not only provide performance but also benefit the environment.

To safety and driving dynamics, traction and handling are extremely important and usually receive high marks from manufacturers and consumers alike. They also usually place a heavy emphasis on durability and tread life, as that directly impacts how many times manufacturers and service providers have to maintain and replace them.

The retailers identified the importance of price/value for money, and all parties acknowledged that balancing price and quality is easier said than done (as it's medium for consumers and service providers).

Rated as moderate across the board, the impact of fuel efficiency remains significant but is generally a secondary consideration to overall vehicle performance. Manufacturers' and consumers' perceived quality and reliability make brand reputation quite valuable.

Environmental impact: moderate rating where service providers place less emphasis In essence, this table highlights how performance, cost, and sustainability considerations shape market decisions in the competitive European tire sector.

Between 2020 and 2024, the European automotive tire market evolved with technological advances, sustainability efforts, and the rise of electric vehicles (EVs). Demand for low-rolling-resistance EV tires grew, optimizing battery efficiency and durability.

Major producers launched specialized designs, while sustainability initiatives resulted in more bio-rubber applications and better recycling. Intelligent tires with sensors gained popularity, improving safety and fleet management. More stringent EU regulations also encouraged environmentally friendly materials and effective retreading solutions.

Between 2025 and 2035, the industry will turn towards fully bio-based, self-healing, and adaptive tires that adaptto performance in real-time. Predictive analytics powered by AI will enhance maintenance. At the same time, regulatory pressures will propel innovation in efficiency and safety. Wireless energy transfer for EV tires may increase battery range, and 3D printing will limit waste and allow for on-demand manufacturing.

Subscription services for tires will emerge, facilitating sustainability and resource efficiency throughout the sector.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Rising demand for fuel-efficient and all-season tires. | Strong shift toward sustainable, bio-based, and fully recyclable tires. |

| Growth in the adoption of electric vehicle (EV) increased the demand for low-rolling resistance tires. | Specialized tire development for EVs, including noise-reducing and self-sealing technologies. |

| Smart tires with basic TPMS (Tire Pressure Monitoring System) gained traction. | AI-integrated smart tires with real-time performance analytics and predictive maintenance features. |

| Expansion of retreading practices to reduce tire waste. | Advanced circular economy initiatives with tire-as-a-service models and enhanced recycling technologies. |

| Tighter EU emission rules and mandatory compliance on rolling resistance. | Additional regulatory consolidation with obligatory eco-friendly raw materials use and lifecycle monitoring. |

| Expanded market penetration of puncture-resistant and run-flat tires. | Adaptive tread and airless tires are gaining popularity with enhanced durability and performance. |

A significant portion of expenditure in the automotive tire industry is attributed to the pricing of raw materials, such as natural and synthetic rubber, carbon black, and steel cords. Natural rubber is also susceptible to climate conditions and disease outbreaks like HSR, while synthetic rubber is tied to oil prices, which contribute to price volatility.

Supply chain issues, like those experienced during the COVID-19 pandemic, can generate shortages and increase prices, harming tire producers and auto companies. More models mean more intense price competition - especially from budget Asian imports - which pressures European brands to hold the line on price while also delivering quality and innovation.

The EU has introduced anti-dumping duties on Chinese truck tires; however, competition from other cheap producers remains strong. Increasing regulatory risks: Stringent EU safety, rolling resistance, and noise level requirements (which challenge product development).

The tire industry is categorized within Europe into premium, mid-range, and budget divisions, each with its pricing structure. Model use value-based pricing: this includes premium brands like Michelin, Continental, and Pirelli that can command higher prices due to product benefits that deliver better performance, safety, and durability.

Many Asian imports, as well as budget brands, use penetration pricing as a way to access price-sensitive consumers and dealership sales. It creates a brand perception of premium, a quality higher than any normal tire while also dealing with the budget competition with budget brands owned by OEMs through sub-brands (for Example, Michelin -> All Seasons or BFGoodrich).

Seasonal demand affects the pricing dynamic; tire sales peak at the two-changing points of summer and winter, encouraging promotions such as "4 for 3" or rebates under the condition of purchase to increase sales.

Regional dynamics play a part in pricing as well, with a higher premium in markets with aggressive winter tire laws and a much more competitive environment in places where all-season tires are the norm.

Innovation is a driving factor in price differentiation, as newer features such as run-flat technology, noise-reducing compounds, and smart sensors can lead to higher price points. The manufacturers are also looking at different models to price tires, including subscription services for fleets and installment payment plans for shoppers.

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.8% |

| France | 6.5% |

| Italy | 6.4% |

| China | 4.8% |

| Spain | 6.3% |

| Netherland | 6.6% |

Germany is the largest European industry for automobile tires owing to its powerful automobile sector and increasing demand for ultra high-performance tires. With Germany being the base of top car makers like Volkswagen, BMW, and Mercedes-Benz, Germany's automobile sector plays a significant part in tire developments, particularly high-performance tires.

But German producers have been more reticent than some of their global competitors in transitioning to invest in future-generation tire technologies, such as run-flat tires, sensor-embedded intelligent tires, and noise-reducing tread designs, mainly out of consideration for driver comfort and vehicle efficiency.

The push from the German government to promote sustainability initiatives is the most important factor behind the market's development. The Federal Ministry for Economic Affairs and Climate Action is involved in sponsoring research into sustainable tire manufacturing processes, such as rubber recycling and using alternative raw materials to reduce environmental impact.

This focus on sustainability is increasingly important as Germany aims to achieve its climate targets by encouraging greener solutions across all sectors, including the automotive industry.

FMI believes that German auto tire sales are to witness a 6.8% CAGR during the projection years (2025 to 2035).

Growth Drivers in Germany

| Key Drivers | Details |

|---|---|

| Strong automobile industry | The strong automobile industry of Germany, incorporating luxury automobile cars like BMW, Audi, and Mercedes, fuels demand. |

| Investment in sustainability | The priority accorded by the government towards ecologically sustainable tire production, together with green technology, drives the expansion of the industry. |

| Demand for high-performance tires | Growing demand for performance and luxury cars propels demand for high-quality tires. |

The automobile tire industry in France is witnessing consistent growth, with the drive generated by the sale of electric vehicles (EVs) and tightening emission standards. France has spearheaded the drive to boost EV sales through the state subsidy to make EV buying easier.

These have involved tire manufacturers placing additional focus on producing energy-efficient, durable tires for electric cars, which are heavier and need substitute tires depending on the mode of propulsion that they use, which is the battery.

French tire giant Michelin has been an innovator for many years, with the company also being a pioneer of airless tire technology, which eliminates the requirement for inflation and is more durable.

Artificial intelligence (AI) has also been brought into Michelin operations, where AI-based systems for wear forecasting are used to enhance safety and provide cost-saving products for customers, something that can have significant effects on future tire technologies.

FMI projects the French automotive tire industry to expand at a 6.5% CAGR from 2025 to 2035.

Growth Drivers in France

| Key Drivers | Details |

|---|---|

| Electric vehicle (EV) growth | EV adoption progress creates demand for special-function tires to fulfill special performance requirements. |

| Tire technology development | Michelin's R&D in airless tires and wear forecasting using artificial intelligence (AI) sets technology trends. |

| Government incentives for EV adoption | Subsidies and supportive policies drive EV sales and, in turn, demand for purpose-specific tires. |

Italy's car tire industry is growing, spearheaded by the increased demand for luxury tires because of the existence of sports and luxury automobile producers like Ferrari, Lamborghini, and Maserati. These manufacturers require extremely resilient tires and exceptional traction to deliver the performance their vehicles are famous for.

For instance, Italian tire manufacturers like Pirelli are at the forefront of creating new-generation tire technologies that address such requirements.

Pirelli has been at the forefront of creating high-performance tire solutions, including using nano-materials, silica compounds, and advanced tread patterns to provide spatial stability at high speed and braking.

These technologies ensure better performance and boost safety and driving comfort, which are imperative for high-performance vehicles.

FMI thinks that the Italian automobile tire industry will grow at a 6.4% CAGR during the forecast period (2025 to 2035).

Growth Drivers in Italy

| Key Drivers | Details |

|---|---|

| Luxury car industry | The presence of high-performance car brands such as Ferrari and Lamborghini creates demand for high-end, long-lasting tires. |

| Technological innovations in tires | Pirelli's use of nano-materials and customized tread patterns boost its competitive advantage in the industry. |

| Strong car heritage | Italy's history with car production and motorsport is found to be favorable to the development of tthe ire industry. |

Spain's automobile tire sector is thriving, led by urbanization, increased car ownership, and electric vehicle (EV) network expansion. As consumers in Spain take up EVs in large numbers, there is a growing demand for sustainable and long-lasting tires. Companies are responding by producing fuel-efficient tires that save fuel and reduce carbon footprint and product life extension.

Further, industry participants such as Goodyear and Bridgestone are pioneers in creating smart tire monitoring solutions that enable individual drivers and fleet operators to achieve optimal tire performance. The technologies assist in reducing operating costs by monitoring tire wear and pressure levels, which guarantees better fuel consumption and extended tire life.

FMI expects the Spanish automotive tire industry to grow at a 6.3% CAGR during the forecast period (2025 to 2035).

Growth Drivers in Spain

| Key Drivers | Details |

|---|---|

| EV charging station expansion | The EVs and charging stations expansion creates demand for premium electric vehicle tires. |

| Sustainability emphasis | The heightened demand for sustainable, high-mileage tires pressures the development of new tire production processes. |

| Smart tire technology | Bridgestone and Goodyear's vehicle monitoring systems lower operational expenses and enhance efficiency. |

The Dutch automotive tire industry is expanding with the government's promotion of green mobility and low-emission transportation policies. The government's drive for electric vehicles (EVs) and encouraging sustainable transport modes has also pushed manufacturers to design tires that reduce rolling resistance and incorporate noise-absorbing tread designs.

This aligns with the country's vision of increasing environmental sustainability.

Companies like Michelin and Vredestein have led the way in developing green tire solutions, such as self-inflating tires and bio-based tires, that lower emissions and make the transport industry more sustainable.

With the Netherlands still leading the way in producing low-emission solutions, these innovations will be at the forefront of developing the future of the auto tire industry.

FMI opines that the Dutch automotive tire industry is expected to develop at a 6.6% CAGR during the study period (2025 to 2035).

Growth Drivers in the Netherlands

| Key Drivers | Details |

|---|---|

| Government initiative for EV adoption | EV-friendly policies directly generate demand for specialty tires. |

| Sustainability focus | The expansion of bio-based and low-resistance tires indicates the country's focus on being green. |

| Intelligent tire technology innovation | Vredestein and Michelin's foray into intelligent tires encourages efficiency and sustainability. |

Passenger Car tires are the highest-selling segment of the European automotive tire industry as it has been observed that there is increasing demand for all-season, fuel-efficient, and high-performance tires. With over 2.3 million units of EVs sold in Europe in 2023 alone, the development focus has centered around introducing low rolling resistance tires designed with maximizing battery range in mind.

Top manufacturers such as Michelin, Continental, and Bridgestone focus on eco-friendly tire solutions, utilizing sustainable resources like soybean oil and recycled rubber to comply with EU emissions regulations. So, too, are run-flat technology and noise-reducing compounds, which are becoming more prevalent these days, to make sure that the driving experience is a safe and comfortable one.

Light commercial vehicles (LCVs) play an important role in urban logistics, last-mile deliveries, and the day-to-day operations of small businesses, which in turn is driving demand for high-performance, high-mileage tires. The demand for LCV tires is also strengthened by the explosive growth in e-commerce and fleet electrification led by Amazon, DHL and UPS.

Snow tires are built specifically for low wear, improved load capacity, reduced fuel consumption, long-distance transport, and city transport. Tire makers, including both Goodyear and Pirelli, are also developing new LCV tire designs that focus on reinforced sidewall technology and new tread compounds that can more effectively meet the rigors inherent to an inner city driving environment.

Increasingly, in Europe, there are all-season tires, which promise reasonable performance, no matter the weather. For drivers that switch between summer and winter tires, the time savings to save up or the real estate to store tires is attractive enough that all-weather tires are an interesting option.

Matrix: Today, thanks to constant technological innovations, modern all-product tires combine better grip, durability, and fuel economy for passenger cars and light commercial vehicles (LCVs).

All-season models for wet and dry roads that meet all regulatory scope across European landdscape are offered by brands such as Michelin, with the Cross Climate series, and Goodyear and their Vector 4Seasons. Meanwhile, demand has surged in Western Europe, where mild winters do not require dedicated winter tires.

In regions with harsh winter climates, winter tires are definitely a necessity much of Scandinavia, Germany. Austria and Switzerland, where snow and ice-covered roads are routine. Specifically designed tread patterns and special rubber compounds allow these tires to offer superior traction, braking, and control at temperatures below 7°C.

Due to strict law regulations that require winter tires in various European countries (e.g., StVO §2 in Germany, which requires winter tires under icy conditions), the demand for it will remain strong. Comfort-friendly Siped & Studdles Winter Tire Toure Continental from Aurora, Pirelli from Italy, and Japan's Bridgestone are pioneering new envelopments in siped & straddles winter tires while ensuring that comfort is not compromised.

The Europe automotive tire industry is highly competitive, shaped by the rise of electric vehicle (EV) production, demand for fuel-efficient tires, and a strong sustainability agenda. Tire manufacturers are developing innovative materials, improved tread designs, and eco-friendly production processes in keeping with the new evolving regulatory standards and different consumer preferences.

The three effects under discussion are from multinational corporations that operate in certain regions of a country and emerging tech startup companies investing in advanced tire technologies to gain competitive advantages.

The study of all these overwhelming synergetic forces leads to the conclusion that the foremost tire companies like Michelin, Bridgestone, Continental, Pirelli, and Goodyear are the industry victors by their valuable R&D competency, elaborate distribution networks, and proprietary innovations in tires.

Additionally, they focus on the areas of sustainability feedstocks and low rolling resistance designs, and the newer smart technology in tiredness. However, regional converters or newer companies entering in the past few years have gained strength by providing specialized, worthy, eco-friendly, performance-oriented tire solutions for the segments of EV and high-end vehicles.

With industry players eager to move toward more environmentally friendly mobility solutions, the companies invested in recyclable materials, RFID-enabled smart tires, and energy-efficient manufacturing will eventually grab a firmer position in Europe's evolving automotive tire sector.

Market Share Analysis by Company

| Company Name | Estimated Market Share % |

|---|---|

| Michelin | 20-25% |

| Continental AG | 15-20% |

| Bridgestone Corporation | 12-16% |

| Goodyear Tire & Rubber Company | 10-14% |

| Pirelli & C. S.p.A | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/ Activities |

|---|---|

| Michelin | Manufactures energy-efficient tires using the latest tread technology and sustainable materials. |

| Continental AG | It mainly focuses on tires that use intelligence for functions like monitoring and performance adjustment. |

| Bridgestone Corporation | The company is developing run-flat and ultra-high-performance tires for electric vehicles and other luxury cars. |

| Goodyear Tire & Rubber Company | The company specializes in self-regenerating tread technology and AI-based predictive maintenance features. |

| Pirelli & C. S.p.A | Textile technology for tires is high-performance and motorsport rims with the latest traction control. |

Michelin (20-25%)

Michelin, the leading European automotive tire market player, is driving sustainability efforts by producing less fuel-dependent, longer-lasting tires with renewable materials and low-rolling-resistance technology.

Continental AG (15-20%)

Continental is the first company to present intelligent tire solutions, which consist of installing sensors that allow real-time monitoring of the tire's condition and adaptive traction control.

Bridgestone Corporation (12-16%)

Bridgestone is changing the world of tire technology with run-flat and ultra-high-performance tires specially designed for electric and premium vehicles, focusing on durability and energy efficiency.

Goodyear Tire & Rubber Company (10-14%)

Goodyear is researching self-regenerating tread technology, AI-powered tire analytics, and also smart tires that increase longevity and performance during diverse road conditions.

Pirelli & C. S.p.A (6-10%)

Pirelli has proven itself to be the leader in the high-performance and motorsport tire segment. Pirelli combines the most modern traction control, aerodynamics, and digital connectivity for an exceptional driving experience.

The market serves passenger cars, LCVs, HCVs, two/three-wheelers, and specialty vehicles, with passenger cars leading due to high consumer demand.

Tires are categorized into 35 to 55, 65 to 70, and 75 to 85 aspect ratios, influencing vehicle handling, comfort, and performance.

Natural rubber and synthetic rubber are used, with synthetic rubber gaining traction for its durability and temperature resistance.

The market includes all-season, winter, touring, and special tires, with all-season tires dominating due to their year-round usability.

Radial tires lead due to superior durability and fuel efficiency, while bias ply tires are used in heavy-duty applications.

Tires are sold through OEMs and the aftermarket, with aftermarket sales driven by replacement and upgrades.

Tubeless tires are widely preferred for their safety, efficiency, and reduced risk of sudden deflation, replacing traditional tube tires.

Key markets include Germany, Italy, France, the UK, Spain, the Netherlands, Luxembourg, Belgium, Russia, and the rest of Europe, with Germany and France leading due to strong automotive production.

The Europe automotive tire market is expected to generate USD 75 billion in revenue by 2025.

The market is projected to reach USD 115.3 billion by 2035, growing at a CAGR of 4.8% from 2025 to 2035.

Key manufacturers in the market include Bridgestone Corporation, Michelin, Continental AG, Pirelli & C. S.p.A, Yokohama Rubber Company Limited, Cheng Shin Rubber Ind. Co. Ltd, Goodyear Tire & Rubber Company, KUMHO TIRE Co., Inc., Nankang Rubber Tire Corp., Ltd., HANKOOK TIRE & TECHNOLOGY Co., Ltd, Toyo Tires, NEXEN TIRE, Sumitomo Rubber Industries (Dunlop Tires), Cooper Tire & Rubber Company, Elangperdana Tyre Industry (Accelera Radial), JK Tyre & Industries, Madras Rubber Factory (MRF), and Özka Tyres.

Germany, France, and the United Kingdom are expected to drive significant growth due to strong automobile production, rising demand for electric vehicles, and increasing adoption of high-performance tires.

Radial tires dominate the market due to their durability, fuel efficiency, and enhanced performance for passenger and commercial vehicles.

Table 01: Market Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 02: Market Value (US$ Billion) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 03: Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Tire Type

Table 04: Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Aspect Ratio

Table 05: Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Material Type

Table 06: Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Ply Type

Table 07: Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Sales Channel

Table 08: Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Tube Category

Table 09: Market Value (US$ Billion) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Regions

Table 10: Market Value (US$ Billion) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Regions

Table 11: Germany Market Value (US$ Billion) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Country

Table 12: Germany Market Value (US$ Billion) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 13: Germany Market Volume (US$ Billion) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 14: Germany Market Value (US$ Billion) and Volume (‘000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Tire Type

Table 15: Germany Market Value (US$ Billion) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Aspect Ratio

Table 16: Germany Market Value (US$ Billion) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Material Type

Table 17: Germany Market Value (US$ Billion) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Ply Type

Table 18: Market Value (US$ Billion) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Sales Channel

Table 19: Germany Market Value (US$ Billion) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Tube Category

Table 20: Italy Market Value (US$ Billion) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Country

Table 21: Italy Market Volume (‘000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 22: Italy Market Value (US$ Billion) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 23: Italy Market Value (US$ Billion) and Volume (Billion. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Tire Type

Table 24: Italy Market Value (US$ Billion) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Aspect Ratio

Table 25: Italy Market Value (US$ Billion) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Material Type

Table 26: Italy Market Value (US$ Billion) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Ply Type

Table 27: Italy Market Value (US$ Billion) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Sales Channel

Table 28: Italy Market Value (US$ Billion) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Tube Category

Table 29: France Market Value (US$ Billion) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Country

Table 30: France Market Volume (‘000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 31: France Market Value (US$ Billion) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 32: France Market Value (US$ Billion) and Volume (‘000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Tire Type

Table 33: France Market Value (US$ Billion) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Aspect Ratio

Table 34: France Market Value (US$ Billion) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Material Type

Table 35: France Market Value (US$ Billion) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Ply Type

Table 36: France Market Value (US$ Billion) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Sales Channel

Table 37: France Market Value (US$ Billion) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Tube Category

Table 38: United Kingdom Market Value (US$ Billion) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Country

Table 39: United Kingdom Market Volume (‘000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 40: United Kingdom Market Value (US$ Billion) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 41: United Kingdom Market Value (US$ Billion) and Volume (‘000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Tire Type

Table 42: United Kingdom Market Value (US$ Billion) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Aspect Ratio

Table 43: United Kingdom Market Value (US$ Billion) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Material Type

Table 44: United Kingdom Market Value (US$ Billion) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Ply Type

Table 45: United Kingdom Market Value (US$ Billion) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Sales Channel

Table 46: United Kingdom Market Value (US$ Billion) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Tube Category

Table 47: Spain Market Value (US$ Billion) and Volume (‘000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Country

Table 48: Spain Market Volume (‘000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 49: Spain Market Value (US$ Billion) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 50: Spain Market Value (US$ Billion) and Volume (‘000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Tire Type

Table 51: Spain Market Value (US$ Billion) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Aspect Ratio

Table 52: Spain Market Value (US$ Billion) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Material Type

Table 53: Spain Market Value (US$ Billion) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Ply Type

Table 54: Spain Market Value (US$ Billion) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Sales Channel

Table 55: Spain Market Value (US$ Billion) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Tube Category

Table 56: Netherlands Market Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 57: Netherlands Market Value (US$ Billion) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 58: Netherlands Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Tire Type

Table 59: Netherlands Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Aspect Ratio

Table 60: Netherlands Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Material Type

Table 61: Netherlands Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Ply Type

Table 62: Netherlands Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Sales Channel

Table 63: Netherlands Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Tube Category

Table 64: Luxembourg Countries Market Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 65: Luxembourg Countries Market Value (US$ Billion) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 66: Luxembourg Countries Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Tire Type

Table 67: Luxembourg Countries Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Aspect Ratio

Table 68: Luxembourg Countries Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Material Type

Table 69: Luxembourg Countries Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Ply Type

Table 70: Luxembourg Countries Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Sales Channel

Table 71: Luxembourg Countries Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Tube Category

Table 72: Belgium Market Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 73: Belgium Market Value (US$ Billion) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 74: Belgium Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Tire Type

Table 75: Belgium Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Aspect Ratio

Table 76: Belgium Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Material Type

Table 77: Belgium Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Ply Type

Table 78: Belgium Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Sales Channel

Table 79: Belgium Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Tube Category

Table 80: Russia Germany Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Country

Table 81: Russia Market Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 82: Russia Market Value (US$ Billion) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 83: Russia Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Tire Type

Table 84: Russia Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Aspect Ratio

Table 85: Russia Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Material Type

Table 86: Russia Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Ply Type

Table 87: Russia Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Sales Channel

Table 88: Russia Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Tube Category

Table 89: Rest of Market Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 90: Rest of Market Value (US$ Billion) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 91: Rest of Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Tire Type

Table 92: Rest of Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Aspect Ratio

Table 93: Rest of Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Material Type

Table 94: Rest of Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Ply Type

Table 95: Rest of Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Sales Channel

Table 96: Rest of Market Value (US$ Billion) and Volume (000'Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Tube Category

Figure 01: Market Historical Volume (000'Units), 2018 to 2022

Figure 02: Market Current and Forecast Volume), 2023 to 2033

Figure 03: Historical Market Size (US$ Billion) (2018 to 2022)

Figure 04: Market Absolute $ Opportunity Analysis (2018 to 2033)

Figure 05: Market Size (US$ Billion) & YOY Growth (%) (2023 to 2033)

Figure 06: Market Share and BPS Analysis by Vehicle Type - 2023 & 2033

Figure 07: Market Y-o-Y Growth Projections by Vehicle Type, 2023 to 2033

Figure 08: Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 09: Market Absolute $ Opportunity, 2023 to 2033, by Passenger Vehicle

Figure 10: Market Absolute $ Opportunity, 2023 to 2033, by LCV

Figure 11: Market Absolute $ Opportunity, 2023 to 2033, by HCV

Figure 12: Market Absolute $ Opportunity, 2023 to 2033, by 2/3Wheelers

Figure 13: Market Absolute $ Opportunity, 2023 to 2033, by Specialty Vehicle

Figure 14: Market Share and BPS Analysis by Tire Type - 2023 & 2033

Figure 15: Market Y-o-Y Growth Projections by Tire Type 2023 to 2033

Figure 16: Market Attractiveness by Tire Type, 2023 to 2033

Figure 17: Market Absolute $ Opportunity, 2023 to 2033, by All Season Tire

Figure 18: Market Absolute $ Opportunity, 2023 to 2033, by Winter Tire

Figure 19: Market Absolute $ Opportunity, 2023 to 2033, by

Figure 20: Market Absolute $ Opportunity, 2023 to 2033, by Special Purpose Tire

Figure 21: Market Share and BPS Analysis By Aspect Ratio- 2023 & 2033

Figure 22: Market Y-o-Y Growth Projections By Aspect Ratio, 2023 to 2033

Figure 23: Market Attractiveness By Aspect Ratio, 2023 to 2033

Figure 24: Market Absolute $ Opportunity, 2023 to 2033, by 35 to 55

Figure 25: Market Absolute $ Opportunity, 2023 to 2033, by 65 to 70

Figure 26: Market Absolute $ Opportunity, 2023 to 2033, by 75 to 85

Figure 27: Market Share and BPS Analysis By Material Type, 2023 & 2033

Figure 28: Market Y-o-Y Growth Projections By Material Type, 2023 to 2033

Figure 29: Market Attractiveness By Material Type, 2023 to 2033

Figure 30: Market Absolute $ Opportunity, 2023 to 2033, by Natural

Figure 31: Market Absolute $ Opportunity, 2023 to 2033, by Synthetic

Figure 32: Market Share and BPS Analysis By Ply Type, 2023 & 2033

Figure 33: Market Y-o-Y Growth Projections By Ply Type, 2023 to 2033

Figure 34: Market Attractiveness By Ply Type, 2023 to 2033

Figure 35: Market Absolute $ Opportunity, 2023 to 2033, by Radial

Figure 36: Market Absolute $ Opportunity, 2023 to 2033, by Bias

Figure 37: Market Share and BPS Analysis By Sales Channel, 2023 & 2033

Figure 38: Market Y-o-Y Growth Projections By Sales Channel, 2023 to 2033

Figure 39: Market Attractiveness By Sales Channel, 2023 to 2033

Figure 40: Market Absolute $ Opportunity, 2023 to 2033, by OEM

Figure 41: Market Absolute $ Opportunity, 2023 to 2033, by After Market

Figure 42: Market Share and BPS Analysis By Tube Category, 2023 & 2033

Figure 43: Market Y-o-Y Growth Projections By Tube Category, 2023 to 2033

Figure 44: Market Attractiveness By Tube Category, 2023 to 2033

Figure 45: Market Absolute $ Opportunity, 2023 to 2033, by Tube Type

Figure 46: Market Absolute $ Opportunity, 2023 to 2033, by Tubeless Tire

Figure 47: Market Share and BPS Analysis by Regions - 2023 & 2033

Figure 48: Market Y-o-Y Growth Projections by Regions, 2023 to 2033

Figure 49: Market Attractiveness by Regions, 2023 to 2033

Figure 50: Market Absolute $ Opportunity 2023 to 2033, by Germany

Figure 51: Market Absolute $ Opportunity 2023 to 2033, by Italy

Figure 52: Market Absolute $ Opportunity 2023 to 2033, by France

Figure 53: Market Absolute $ Opportunity 2023 to 2033, by United Kingdom

Figure 54: Market Absolute $ Opportunity 2023 to 2033, by Spain

Figure 55: Market Absolute $ Opportunity 2023 to 2033, by Netherlands

Figure 56: Market Absolute $ Opportunity 2023 to 2033, by Luxembourg Countries

Figure 57: Market Absolute $ Opportunity 2023 to 2033, by Belgium

Figure 58: Market Absolute $ Opportunity 2023 to 2033, by Russia

Figure 59: Market Absolute $ Opportunity 2023 to 2033, by Rest of Europe

Figure 60: Germany Market Share and BPS Analysis by Country - 2023 & 2033

Figure 61: Germany Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 62: Germany Market Attractiveness by Country, 2023 to 2033

Figure 63: Germany Market Share and BPS Analysis by Vehicle Type - 2023 & 2033

Figure 64: Germany Market Y-o-Y Growth Projections by Vehicle Type, 2023 to 2033

Figure 65: Germany Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 66: Germany Market Share and BPS Analysis by Tire Type - 2023 & 2033

Figure 67: Germany Market Y-o-Y Growth Projections by Tire Type 2023 to 2033

Figure 68: Germany Market Attractiveness by Tire Type, 2023 to 2033

Figure 69: Germany Market Share and BPS Analysis By Aspect Ratio- 2023 & 2033

Figure 70: Germany Market Y-o-Y Growth Projections By Aspect Ratio, 2023 to 2033

Figure 71: Germany Market Attractiveness By Aspect Ratio, 2023 to 2033

Figure 72: Germany Market Share and BPS Analysis By Material Type, 2023 & 2033

Figure 73: Germany Market Y-o-Y Growth Projections By Material Type, 2023 to 2033

Figure 74: Germany Market Attractiveness By Material Type, 2023 to 2033

Figure 75: Germany Market Share and BPS Analysis By Ply Type, 2023 & 2033

Figure 76: Germany Market Y-o-Y Growth Projections By Ply Type, 2023 to 2033

Figure 77: Germany Market Attractiveness By Ply Type, 2023 to 2033

Figure 78: Germany Market Share and BPS Analysis By Sales Channel,2023 & 2033

Figure 79: Germany Market Y-o-Y Growth Projections By Sales Channel, 2023 to 2033

Figure 80: Germany Market Attractiveness By Sales Channel, 2023 to 2033

Figure 81: Germany Market Share and BPS Analysis By Tube Category, 2023 & 2033

Figure 82: Germany Market Y-o-Y Growth Projections By Tube Category, 2023 to 2033

Figure 83: Germany Market Attractiveness By Tube Category, 2023 to 2033

Figure 84: Italy Market Share and BPS Analysis by Country - 2023 & 2033

Figure 85: Italy Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 86: Italy Market Attractiveness by Country, 2023 to 2033

Figure 87: Italy Market Share and BPS Analysis by Vehicle Type - 2023 & 2033

Figure 88: Italy Market Y-o-Y Growth Projections by Vehicle Type, 2023 to 2033

Figure 89: Italy Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 90: Italy Market Share and BPS Analysis by Tire Type - 2023 & 2033

Figure 91: Italy Market Y-o-Y Growth Projections by Tire Type 2023 to 2033

Figure 92: Italy Market Attractiveness by Tire Type, 2023 to 2033

Figure 93: Italy Market Share and BPS Analysis By Aspect Ratio- 2023 & 2033

Figure 94: Italy Market Y-o-Y Growth Projections By Aspect Ratio, 2023 to 2033

Figure 95: Italy Market Attractiveness By Aspect Ratio, 2023 to 2033

Figure 96: Italy Market Share and BPS Analysis By Material Type, 2023 & 2033

Figure 97: Italy Market Y-o-Y Growth Projections By Material Type, 2023 to 2033

Figure 98: Italy Market Attractiveness By Material Type, 2023 to 2033

Figure 99: Italy Market Share and BPS Analysis By Ply Type, 2023 & 2033

Figure 100: Italy Market Y-o-Y Growth Projections By Ply Type, 2023 to 2033

Figure 101: Italy Market Attractiveness By Ply Type, 2023 to 2033

Figure 102 : Italy Market Share and BPS Analysis By Sales Channel,2023 & 2033

Figure 103: Italy Market Y-o-Y Growth Projections By Sales Channel, 2023 to 2033

Figure 104: Italy Market Attractiveness By Sales Channel, 2023 to 2033

Figure 105: Italy Market Share and BPS Analysis By Tube Category, 2023 & 2033

Figure 106: Italy Market Y-o-Y Growth Projections By Tube Category, 2023 to 2033

Figure 107: Italy Market Attractiveness By Tube Category, 2023 to 2033

Figure 108: France Market Share and BPS Analysis by Country - 2023 & 2033

Figure 109: France Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 110: France Market Attractiveness by Country, 2023 to 2033

Figure 111: France Market Share and BPS Analysis by Vehicle Type - 2023 & 2033

Figure 112: France Market Y-o-Y Growth Projections by Vehicle Type, 2023 to 2033

Figure 113: France Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 114: France Market Share and BPS Analysis by Tire Type - 2023 & 2033

Figure 115: France Market Y-o-Y Growth Projections by Tire Type 2023 to 2033

Figure 116: France Market Attractiveness by Tire Type, 2023 to 2033

Figure 117: France Market Share and BPS Analysis By Aspect Ratio- 2023 & 2033

Figure 118: France Market Y-o-Y Growth Projections By Aspect Ratio, 2023 to 2033

Figure 119: France Market Attractiveness By Aspect Ratio, 2023 to 2033

Figure 120: France Market Share and BPS Analysis By Material Type, 2023 & 2033

Figure 121: France Market Y-o-Y Growth Projections By Material Type, 2023 to 2033

Figure 122: France Market Attractiveness By Material Type, 2023 to 2033

Figure 123: France Market Share and BPS Analysis By Ply Type, 2023 & 2033

Figure 124: France Market Y-o-Y Growth Projections By Ply Type, 2023 to 2033

Figure 125: France Market Attractiveness By Ply Type, 2023 to 2033

Figure 126 : France Market Share and BPS Analysis By Sales Channel,2023 & 2033

Figure 127: France Market Y-o-Y Growth Projections By Sales Channel, 2023 to 2033

Figure 128: France Market Attractiveness By Sales Channel, 2023 to 2033

Figure 129: France Market Share and BPS Analysis By Tube Category, 2023 & 2033

Figure 130: France Market Y-o-Y Growth Projections By Tube Category, 2023 to 2033

Figure 131: France Market Attractiveness By Tube Category, 2023 to 2033

Figure 132: United Kingdom Market Share and BPS Analysis by Country - 2023 & 2033

Figure 133: United Kingdom Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 134: United Kingdom Market Attractiveness by Country, 2023 to 2033

Figure 135: United Kingdom Market Share and BPS Analysis by Vehicle Type - 2023 & 2033

Figure 136: United Kingdom Market Y-o-Y Growth Projections by Vehicle Type, 2023 to 2033

Figure 137: United Kingdom Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 138: United Kingdom Market Share and BPS Analysis by Tire Type - 2023 & 2033

Figure 139: United Kingdom Market Y-o-Y Growth Projections by Tire Type 2023 to 2033

Figure 140: United Kingdom Market Attractiveness by Tire Type, 2023 to 2033

Figure 141: United Kingdom Market Share and BPS Analysis By Aspect Ratio- 2023 & 2033

Figure 142: United Kingdom Market Y-o-Y Growth Projections By Aspect Ratio, 2023 to 2033

Figure 143: United Kingdom Market Attractiveness By Aspect Ratio, 2023 to 2033

Figure 144: United Kingdom Market Share and BPS Analysis By Material Type, 2023 & 2033

Figure 145: United Kingdom Market Y-o-Y Growth Projections By Material Type, 2023 to 2033

Figure 146: United Kingdom Market Attractiveness By Material Type, 2023 to 2033

Figure 147: United Kingdom Market Share and BPS Analysis By Ply Type, 2023 & 2033

Figure 148: United Kingdom Market Y-o-Y Growth Projections By Ply Type, 2023 to 2033

Figure 149: United Kingdom Market Attractiveness By Ply Type, 2023 to 2033

Figure 150: United Kingdom Market Share and BPS Analysis By Sales Channel,2023 & 2033

Figure 151: United Kingdom Market Y-o-Y Growth Projections By Sales Channel, 2023 to 2033

Figure 152: United Kingdom Market Attractiveness By Sales Channel, 2023 to 2033

Figure 153: United Kingdom Market Share and BPS Analysis By Tube Category, 2023 & 2033

Figure 154: United Kingdom Market Y-o-Y Growth Projections By Tube Category, 2023 to 2033

Figure 155: United Kingdom Market Attractiveness By Tube Category, 2023 to 2033

Figure 156: Spain Market Share and BPS Analysis by Country, 2023 & 2033

Figure 157: Spain Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 158: Spain Market Attractiveness by Country, 2023 to 2033

Figure 159: Spain Market Share and BPS Analysis by Vehicle Type - 2023 & 2033

Figure 160: Spain Market Y-o-Y Growth Projections by Vehicle Type, 2023 to 2033

Figure 161: Spain Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 162: Spain Market Share and BPS Analysis by Tire Type - 2023 & 2033

Figure 163: Spain Market Y-o-Y Growth Projections by Tire Type 2023 to 2033

Figure 164: Spain Market Attractiveness by Tire Type, 2023 to 2033

Figure 165: Spain Market Share and BPS Analysis By Aspect Ratio- 2023 & 2033

Figure 166: Spain Market Y-o-Y Growth Projections By Aspect Ratio, 2023 to 2033

Figure 167: Spain Market Attractiveness By Aspect Ratio, 2023 to 2033

Figure 168: Spain Market Share and BPS Analysis By Material Type, 2023 & 2033

Figure 169: Spain Market Y-o-Y Growth Projections By Material Type, 2023 to 2033

Figure 170: Spain Market Attractiveness By Material Type, 2023 to 2033

Figure 171: Spain Market Share and BPS Analysis By Ply Type, 2023 & 2033

Figure 172: Spain Market Y-o-Y Growth Projections By Ply Type, 2023 to 2033

Figure 173: Spain Market Attractiveness By Ply Type, 2023 to 2033

Figure 174: Spain Market Share and BPS Analysis By Sales Channel,2023 & 2033

Figure 175: Spain Market Y-o-Y Growth Projections By Sales Channel, 2023 to 2033

Figure 176: Spain Market Attractiveness By Sales Channel, 2023 to 2033

Figure 177: Spain Market Share and BPS Analysis By Tube Category, 2023 & 2033

Figure 178: Spain Market Y-o-Y Growth Projections By Tube Category, 2023 to 2033

Figure 179: Spain Market Attractiveness By Tube Category, 2023 to 2033

Figure 180: Netherlands Market Share and BPS Analysis by Vehicle Type - 2023 & 2033

Figure 181: Netherlands Market Y-o-Y Growth Projections by Vehicle Type, 2023 to 2033

Figure 182: Netherlands Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 183: Netherlands Market Share and BPS Analysis by Tire Type - 2023 & 2033

Figure 184: Netherlands Market Y-o-Y Growth Projections by Tire Type 2023 to 2033

Figure 185: Netherlands Market Attractiveness by Tire Type, 2023 to 2033

Figure 186: Netherlands Market Share and BPS Analysis By Aspect Ratio- 2023 & 2033

Figure 187: Netherlands Market Y-o-Y Growth Projections By Aspect Ratio, 2023 to 2033

Figure 188: Netherlands Market Attractiveness By Aspect Ratio, 2023 to 2033

Figure 189: Netherlands Market Share and BPS Analysis By Material Type, 2023 & 2033

Figure 190: Netherlands Market Y-o-Y Growth Projections By Material Type, 2023 to 2033

Figure 191: Netherlands Market Attractiveness By Material Type, 2023 to 2033

Figure 192: Netherlands Market Share and BPS Analysis By Ply Type, 2023 & 2033

Figure 193: Netherlands Market Y-o-Y Growth Projections By Ply Type, 2023 to 2033

Figure 194: Netherlands Market Attractiveness By Ply Type, 2023 to 2033

Figure 195: Netherlands Market Share and BPS Analysis By Sales Channel,2023 & 2033

Figure 196: Netherlands Market Y-o-Y Growth Projections By Sales Channel, 2023 to 2033

Figure 197: Netherlands Market Attractiveness By Sales Channel, 2023 to 2033

Figure 198: Netherlands Market Share and BPS Analysis By Tube Category, 2023 & 2033

Figure 199: Netherlands Market Y-o-Y Growth Projections By Tube Category, 2023 to 2033

Figure 200: Netherlands Market Attractiveness By Tube Category, 2023 to 2033

Figure 201: Luxembourg Countries Market Share and BPS Analysis by Vehicle Type - 2023 & 2033

Figure 202: Luxembourg Countries Market Y-o-Y Growth Projections by Vehicle Type, 2023 to 2033

Figure 203: Luxembourg Countries Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 204: Luxembourg Countries Market Share and BPS Analysis by Tire Type - 2023 & 2033

Figure 205: Luxembourg Countries Market Y-o-Y Growth Projections by Tire Type 2023 to 2033

Figure 206: Luxembourg Countries Market Attractiveness by Tire Type, 2023 to 2033

Figure 207: Luxembourg Countries Market Share and BPS Analysis By Aspect Ratio- 2023 & 2033

Figure 208: Luxembourg Countries Market Y-o-Y Growth Projections By Aspect Ratio, 2023 to 2033

Figure 209: Luxembourg Countries Market Attractiveness By Aspect Ratio, 2023 to 2033

Figure 210: Luxembourg Countries Market Share and BPS Analysis By Material Type, 2023 & 2033

Figure 211: Luxembourg Countries Market Y-o-Y Growth Projections By Material Type, 2023 to 2033

Figure 212: Luxembourg Countries Market Attractiveness By Material Type, 2023 to 2033

Figure 213: Luxembourg Countries Market Share and BPS Analysis By Ply Type, 2023 & 2033

Figure 214: Luxembourg Countries Market Y-o-Y Growth Projections By Ply Type, 2023 to 2033

Figure 215: Luxembourg Countries Market Attractiveness By Ply Type, 2023 to 2033

Figure 216: Luxembourg Countries Market Share and BPS Analysis By Sales Channel,2023 & 2033

Figure 217: Luxembourg Countries Market Y-o-Y Growth Projections By Sales Channel, 2023 to 2033

Figure 218: Luxembourg Countries Market Attractiveness By Sales Channel, 2023 to 2033

Figure 219: Luxembourg Countries Market Share and BPS Analysis By Tube Category, 2023 & 2033

Figure 220: Luxembourg Countries Market Y-o-Y Growth Projections By Tube Category, 2023 to 2033

Figure 221: Luxembourg Countries Market Attractiveness By Tube Category, 2023 to 2033

Figure 222: Belgium Market Share and BPS Analysis by Vehicle Type - 2023 & 2033

Figure 223: Belgium Market Y-o-Y Growth Projections by Vehicle Type, 2023 to 2033

Figure 224: Belgium Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 225: Belgium Market Share and BPS Analysis by Tire Type - 2023 & 2033

Figure 226: Belgium Market Y-o-Y Growth Projections by Tire Type 2023 to 2033

Figure 227: Belgium Market Attractiveness by Tire Type, 2023 to 2033

Figure 228: Belgium Market Share and BPS Analysis By Aspect Ratio- 2023 & 2033

Figure 229: Belgium Market Y-o-Y Growth Projections By Aspect Ratio, 2023 to 2033

Figure 230: Belgium Market Attractiveness By Aspect Ratio, 2023 to 2033

Figure 231: Belgium Market Share and BPS Analysis By Material Type, 2023 & 2033

Figure 232: Belgium Market Y-o-Y Growth Projections By Material Type, 2023 to 2033

Figure 233: Belgium Market Attractiveness By Material Type, 2023 to 2033

Figure 234: Belgium Market Share and BPS Analysis By Ply Type, 2023 & 2033

Figure 235: Belgium Market Y-o-Y Growth Projections By Ply Type, 2023 to 2033

Figure 236: Belgium Market Attractiveness By Ply Type, 2023 to 2033

Figure 237: Belgium Market Share and BPS Analysis By Sales Channel,2023 & 2033

Figure 238: Belgium Market Y-o-Y Growth Projections By Sales Channel, 2023 to 2033

Figure 239: Belgium Market Attractiveness By Sales Channel, 2023 to 2033

Figure 240: Belgium Market Share and BPS Analysis By Tube Category, 2023 & 2033

Figure 241: Belgium Market Y-o-Y Growth Projections By Tube Category, 2023 to 2033

Figure 242: Belgium Market Attractiveness By Tube Category, 2023 to 2033

Figure 243: Russia Market Share and BPS Analysis by Country- 2023 & 2033

Figure 244: Russia Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 245: Russia Market Attractiveness by Country, 2023 to 2033

Figure 246: Russia Market Share and BPS Analysis by Vehicle Type - 2023 & 2033

Figure 247: Russia Market Y-o-Y Growth Projections by Vehicle Type, 2023 to 2033

Figure 248: Russia Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 249: Russia Market Share and BPS Analysis by Tire Type - 2023 & 2033

Figure 250: Russia Market Y-o-Y Growth Projections by Tire Type 2023 to 2033

Figure 251: Russia Market Attractiveness by Tire Type, 2023 to 2033

Figure 252: Russia Market Share and BPS Analysis By Aspect Ratio- 2023 & 2033

Figure 253: Russia Market Y-o-Y Growth Projections By Aspect Ratio, 2023 to 2033

Figure 254: Russia Market Attractiveness By Aspect Ratio, 2023 to 2033

Figure 255: Russia Market Share and BPS Analysis By Material Type, 2023 & 2033

Figure 256: Russia Market Y-o-Y Growth Projections By Material Type, 2023 to 2033

Figure 257: Russia Market Attractiveness By Material Type, 2023 to 2033

Figure 258: Russia Market Share and BPS Analysis By Ply Type, 2023 & 2033

Figure 259: Russia Market Y-o-Y Growth Projections By Ply Type, 2023 to 2033

Figure 260: Russia Market Attractiveness By Ply Type, 2023 to 2033

Figure 261: Russia Market Share and BPS Analysis By Sales Channel,2023 & 2033

Figure 262: Russia Market Y-o-Y Growth Projections By Sales Channel, 2023 to 2033

Figure 263: Russia Market Attractiveness By Sales Channel, 2023 to 2033

Figure 264: Russia Market Share and BPS Analysis By Tube Category, 2023 & 2033

Figure 265: Russia Market Y-o-Y Growth Projections By Tube Category, 2023 to 2033

Figure 266: Russia Market Attractiveness By Tube Category, 2023 to 2033

Figure 267: Rest of Market Share and BPS Analysis by Vehicle Type - 2023 & 2033

Figure 268: Rest of Market Y-o-Y Growth Projections by Vehicle Type, 2023 to 2033

Figure 269: Rest of Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 270: Rest of Market Share and BPS Analysis by Tire Type - 2023 & 2033

Figure 271: Rest of Market Y-o-Y Growth Projections by Tire Type 2023 to 2033

Figure 272: Rest of Market Attractiveness by Tire Type, 2023 to 2033

Figure 273: Rest of Market Share and BPS Analysis By Aspect Ratio- 2023 & 2033

Figure 274: Rest of Market Y-o-Y Growth Projections By Aspect Ratio, 2023 to 2033

Figure 275: Rest of Market Attractiveness By Aspect Ratio, 2023 to 2033

Figure 276: Rest of Market Share and BPS Analysis By Material Type, 2023 & 2033

Figure 277: Rest of Market Y-o-Y Growth Projections By Material Type, 2023 to 2033

Figure 278: Rest of Market Attractiveness By Material Type, 2023 to 2033

Figure 279: Rest of Market Share and BPS Analysis By Ply Type, 2023 & 2033

Figure 280: Rest of Market Y-o-Y Growth Projections By Ply Type, 2023 to 2033

Figure 281: Rest of Market Attractiveness By Ply Type, 2023 to 2033

Figure 282: Rest of Market Share and BPS Analysis By Sales Channel,2023 & 2033

Figure 283: Rest of Market Y-o-Y Growth Projections By Sales Channel, 2023 to 2033

Figure 284: Rest of Market Attractiveness By Sales Channel, 2023 to 2033

Figure 285: Rest of Market Share and BPS Analysis By Tube Category, 2023 & 2033

Figure 286: Rest of Market Y-o-Y Growth Projections By Tube Category, 2023 to 2033

Figure 287: Rest of Market Attractiveness By Tube Category, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Europe's Golden Generation Travel Market Size and Share Forecast Outlook 2025 to 2035

Europe Winter Tourism Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA