The Europe Animal Feed Additives market is set to grow from an estimated USD 14,783.2 million in 2025 to USD 26,654.9 million by 2035, with a compound annual growth rate (CAGR) of 6.1% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 14,783.2 million |

| Projected Europe Value (2035F) | USD 26,654.9 million |

| Value-based CAGR (2025 to 2035) | 6.1% |

The European animal feed ingredients market is realizing steadfast growth on account of the increasing requirement for quality, nutritionally balanced, and sustainably produced feed solutions. Manufacturers, in their effort to meet livestock health, productivity, and feed efficiency, are including scientifically formulated feed ingredients that are more efficient than the regular ones to increase the nutritional intake and performance of livestock, aquaculture, pets, and equine animals.

The movement of the industry toward plant-based and specialty feed ingredients that are more environmentally friendly, promote animal welfare and have better digestibility is what we are seeing as the regulatory boards, which are trying to achieve both feed safety and sustainability, advocate for.

The increase of interest in sources of plant protein, functional feed additives, and precision nutrition strategies is the animal feed revolution in Europe. Animal feed manufacturers in Europe are chiefly targeting the reduction of antibiotics, intestinal health, and pace of feed conversion by innovations such as aquaculture feed, specialty pet formulations, and organic feed ingredients.

Explore FMI!

Book a free demo

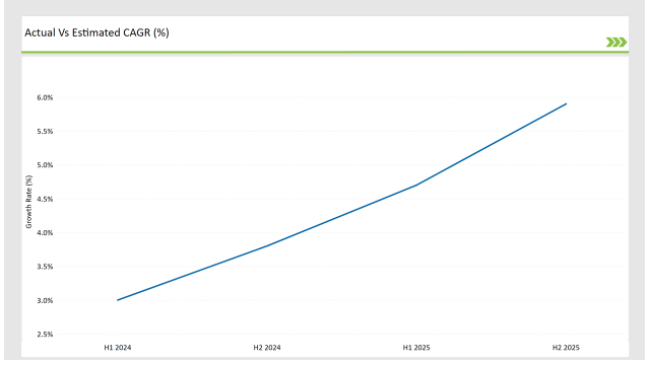

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Animal Feed Additives market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2023 to 2033) | 3.0% |

| H2 (2023 to 2033) | 3.8% |

| H1 (2024 to 2034) | 4.7% |

| H2 (2024 to 2034) | 5.9% |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Animal Feed Additives market, the sector is predicted to grow at a CAGR of 3.0% during the first half of 2023, with an increase to 3.8% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 4.7% in H1 but is expected to rise to 5.9% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2023 to the first half of 2024, followed by an increase of 20 basis points in the second half of 2024 compared to the second half of 2023.

| Date | Development/M&A Activity & Details |

|---|---|

| April-24 | Cargill launched a plant-based protein concentrate for livestock and aquaculture feed in the European market. |

| March-24 | ADM acquired a specialty feed ingredient manufacturer to strengthen its presence in the European pet and equine feed sector. |

| February-24 | Evonik expanded its precision fermentation capabilities to develop sustainable amino acid-based feed solutions. |

| January-24 | Alltech partnered with European dairy farms to introduce probiotic and prebiotic feed additives for improved ruminant health. |

Rising Demand for Alternative Protein Sources and Plant-Powered Feed Components

The increasing emphasis on ecological balance and the bid to lessen reliance on animal-based protein sources have led to a dramatic increase in the demand for plant-based and alternative feed proteins in Europe. Plant-based feeds include such key ingredients as soybean meal, rapeseed meal, peas, and sunflower meal, which are incorporated into the diets of not just livestock but also aquaculture animals.

As the EU continues to champion the idea of using less imported soy, manufacturers are turning to regional crop-based protein alternatives, which, along with increased feed security, will also help to cut carbon footprint.

The introduction of single-cell proteins (SCP), algae-based proteins, and insect meal has also been a major factor as they have solidified the market's move toward sustainability and efficiency of resources.

Manufacturers like Calysta, Innova feed, and Protix are making investments in fermentation-based protein production and in this way, they are riffing on the traditional idea of animal feeds to make poultry, aquaculture, and pet food ingredients highly digestible and nutrient-dense.

Technological Innovations in Functional Feed Additives and Tailored Nutrition

The animal feed space is being revolutionized in Europe by the addition of such functional feed additives as probiotics, prebiotics, and the enzyme-based solutions. The major feed manufacturers like DSM, Evonik, and All tech have been taking the lead in the development of enzymes, peptides, and amino acid-based solutions to optimize the feed conversion ratios (FCR) and consequently cut nitrogen and phosphorus excretion in the animal production processes.

The integration of big data analytics, AI-driven feed formulation, and smart feeding systems is differently enabling feed formulation strategies, realized as species-specific and nutrient-delivery-system being customized.

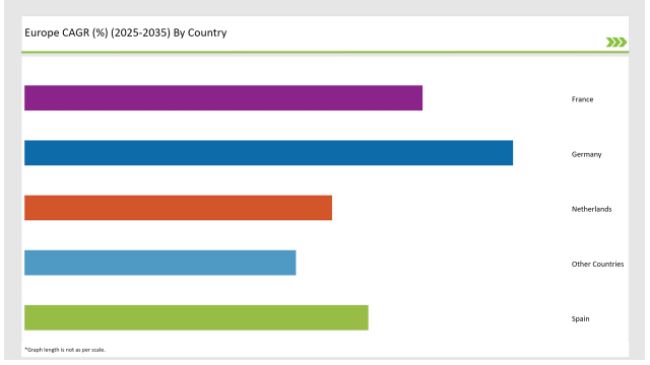

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 27% |

| Spain | 19% |

| Netherlands | 17% |

| France | 22% |

| Other Countries | 15% |

The Netherlands has earned its right as the world leader in the sustainable animal feed production scene, especially the aquaculture and specialty pet feed. The European Union has zeroed in on the cutting down of the greenhouse gases produced by livestock and aquaculture and Dutch firms work to get such alternatives as insect meal, microalgae, and single-cell proteins.

The health of Dutch relations in aquaculture has accelerated the chances for investments in the fermentation-container proteins and functional feed additives that push the fish-copolymer, immune systems, and digestibility dental factors ahead, thus making feed waste a trivial component in fish sector operational costs. Protix and DSM companies are the driving force among others in new feed nanoscale manufacturing, ensuring both sustainable and high-nutrient feed ingredients.

Poland has rapidly turned itself into an important market force in the European livestock feed industry due to the high levels of meat production and the growing demand for nutritionally enhanced feed formulations.

The country is one of the major players in poultry, swine, and dairy farming forcing the Polish feed manufacturers to utilize high-value protein sources and enzyme-based additives, along with natural growth promoters to optimize feed conversion rates and ensure the sustainability of animal production.

In Poland, livestock farming has seen the most pronounced organic and antibiotic-free trend through the introduction of feed formulations with plant protein concentrates, algae-based nutrients, and fermented amino acids.

The switching from the current technology to digital and the fortification technology which is a requirement for the agriculture sector are the driving forces for the start of the path to Poland's transformation into a territory for research on cost-efficient and novel livestock feed.

% share of Individual Categories Additive Type and Form in 2025

| Main Segment | Market Share (%) |

|---|---|

| Additive Type (Organic) | 25% |

| Remaining segments | 75% |

This is the result of widespread concerns about ecological sustainability, the need for a cheap source of protein, and the regulatory restrictions imposed by governmental agencies on the traditional animal feed supply.

The crop species like soybean, wheat, barley, and rapeseed are frequently found in mixtures for livestock, aquaculture, and pet food with the benefits being the provision of high digestibility, environmental protection, and economic efficiency.

As the European Union emphasizes the need for soy sourcing with no deforestation, the manufacturers have started to use more local protein sources such as lupin, sunflower meal, and peas in the feed formulations. Furthermore, fermentation-derived plant proteins and algae-based proteins that are high in amino acids and are more easily digested have become more interesting.

| Main Segment | Market Share (%) |

|---|---|

| End Use Application (Ready-to-eat Meals) | 35% |

| Remaining segments | 65% |

The livestock feed segment is the dominant market sector and the key drivers of this demand are the poultry, swine, and ruminant industries. Feed manufacturers are working on precision nutrition strategies that not only help feed conversion ratios, improve immune function but also promote animal well-being as consumers become more concerned about animal meat quality, feed efficiency, and antibiotic-free animal production.

Functional feed additives that are incorporated into livestock feed such as probiotics, prebiotics, organic acids, and essential oils are now replacing antibiotic growth promoters (AGPs) and optimizing gut microbiota balance. In addition, mineral-fortified feed solutions that are added with zinc, selenium, and amino acids are improving disease resistance and promoting livestock growth.

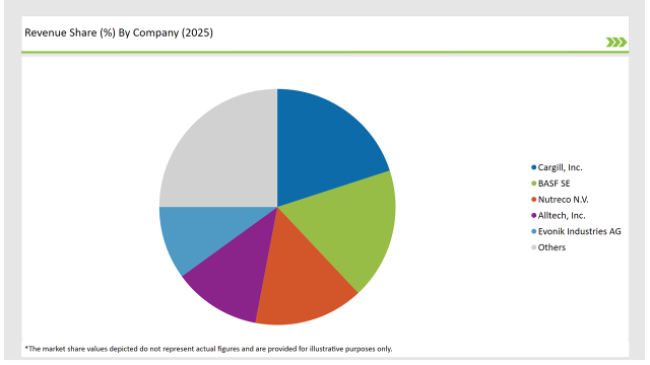

2025 Market share of Europe Animal Feed Additives manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Cargill, Inc. | 20% |

| BASF SE | 18% |

| Nutreco N.V. | 15% |

| Alltech , Inc. | 12% |

| Evonik Industries AG | 10% |

| Others | 25% |

Note: The above chart is indicative in nature

The European animal feed ingredients market is characterized by a fierce rivalry, with global and regional feed manufacturers setting their priorities as innovation, sustainability, and cost efficiency. The major lifted brands such as Cargill, ADM, Evonik, DSM, and All tech notably dominate the market under the horsepower scheme of strategic partnerships, acquisitions, and beyond-the-competition-feeding formulation technologies that they have.

Companies with the newly emerging need for precise nutrition and alternative protein sources are taking out extensive funds in vacuum innovations, fermentation-based feeding proteins, and digital feeding systems which are the first to come to raise feed performance levels and sustainability. The technological revolution in the food chain is driven by enzyme-based feed enhancement, feed optimization via AI, and personalized feeding strategies.

The newly formed alliances of collaborative data analysis and automated feed monitoring systems are securing the bioavailability of adequate nutrients about the optimal gut health, and animal efficiency across the livestock and aquaculture systems. Besides, the focus on the sustainable sourcing of raw materials and carbon-neutral feed production has led to considerable investments in circular bio economy practices through the reduction of feed waste and the reusing of agricultural by-products into high-value feed materials.

The Europe Animal Feed Additives market is projected to grow at a CAGR of 6.1% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 26,654.9 million.

Key factors driving the Europe animal feed additives market include the increasing demand for high-quality animal protein and the growing focus on animal health and nutrition, which enhances feed efficiency and productivity. Additionally, stringent regulations regarding animal welfare and food safety are prompting the adoption of innovative feed additives to improve livestock health and performance.

Germany, Spain, France, and UK are the key countries with high consumption rates in the European Animal Feed Additives market.

Leading manufacturers include Cargill, Inc., BASF SE, Nutreco N.V., Alltech, Inc., and Evonik Industries AG known for their innovative and sustainable production techniques and a variety of product lines.

As per Additive Type, the industry has been categorized into Technological Additives (Preservatives, Emulsifiers, and Others), and Sensory Additives (Sweeteners, Lutein, and Others, Nutritional Additives).

As per Form, the industry has been categorized into Powder, Granules, and Liquid.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

A Detailed Analysis of Brand Share Analysis for Herbs and Spices Industry

A detailed analysis of the Australia Bakery Ingredient Market and growth outlook covering product type, and application segment

USA Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Europe Aqua Feed Additives Market by Additive Type, Species, Ingredient, and Country through 2035

UK Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Herbs and Spices Market by Product Type, Form, End Use, and Country through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.