The Europe aluminum oxide market is anticipated to be valued at USD 2,978.3 million in 2025. It is expected to grow at a CAGR of 5.2% during the forecast period and reach a value of USD 4,891.5 million in 2035.

Key Market Metrics

| Metric | Value |

|---|---|

| Estimated Market Size in 2025 | USD 2,978.3 Million |

| Projected Market Size in 2035 | USD 4,891.5 Million |

| CAGR (2025 to 2035) | 5.2% |

In 2024, demand for the European aluminum oxide market continued to rise, pressuring the industry into a state of growth. The ceramics industry was one important user, with the ramp-up of the production of tiles and sanitary ware creating higher alumina demand. Electronic industries registered rising consumption in semiconductor and heat sink applications.

The abrasives industry, meanwhile, saw an increase in traction for applications in automotive and metalworking. However, raw material price fluctuations and supply chain constraints, particularly for high-purity alumina, have posed challenges for the industry. Smelting operations were impacted by environmental regulations and rising energy costs, prompting companies to seek eco-friendly production alternatives.

Between 2025 and 2035, the aluminum oxide industry is expected to expand significantly due to technological improvements in engineered ceramics, electronics, and medical devices. There will be increasing interest in alumina-based coatings for medical devices and advanced electronics. In addition, lightweight materials will penetrate higher demand in the automotive and aerospace industries.

Sustainability will remain high on the agenda of the aluminum oxide sector as companies invest in energy-efficient smelting technologies and recycled projects. Companies will ramp up investments into capacity and supply productivity to sustain the growth trajectory as demand spikes across multiple industry sectors.

Explore FMI!

Book a free demo

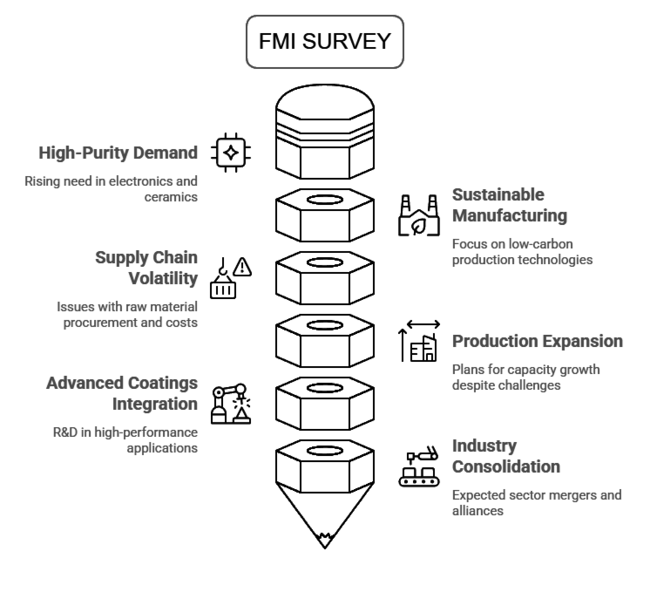

A recent survey conducted by Future Market Insights with key stakeholders in the Europe aluminum oxide industry revealed critical industry trends and challenges. More than 60% of the surveyed sample reported that high-purity aluminum oxide demand is soaring as the applications in electronics, ceramics, and medical implants continue to expand.

Industry representatives also underlined that sustainable and energy efficient manufacturing is now a primary differentiator as companies invest more in low-carbon alumina production technologies. Supply chain volatility was regarded as a pressing issue by the stakeholders, warehouses are facing instability due to fluctuations in raw material procurement and energy costs.

More than 45% of the responses indicated that production costs had been affected by disruptions in logistics and regulatory changes regarding the European Union's environmental framework. Despite challenges, 70% of manufacturers plan to expand production capacity over the next five years to meet growing demand.

Another central finding of the survey was a growing trend to integrate alumina in advanced coatings and engineered ceramics. Stakeholders informed about increased R&D investments toward new alumina-based formulations for high-performance applications in automobile, aerospace, and biomedical industries.

Companies focusing on innovative material science are expected to gain a competitive advantage in the years ahead. The outlook for the future sees leaders in the industry predicting further consolidation in the sector, and the strengthening of supply chains with alliances.

The competitive environment is expected to transform based on circular economy efforts, including alumina recycling and lower waste. Companies that embrace sustainable solutions proactively will find themselves well-positioned to ride out the course of regulatory scrutiny aimed at superintendence of the solutions.

Want to stay ahead in the evolving aluminum oxide market? Connect with our industry experts for tailored insights and strategic guidance.

Government regulations and certifications shape the Europe aluminum oxide market, impacting production, trade, and sustainability. Policies like REACH, EU ETS, and ISO standards ensure compliance, while country-specific laws add further requirements. Key focus areas include carbon emissions, waste management, and product safety, influencing industry operations and industry dynamics across Europe.

| Countries | Regulations & Certifications Impacting the Market |

|---|---|

| Germany | REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) mandates stringent safety assessments for aluminum oxide usage. - DIN EN ISO 9001 certification is required for quality management in aluminum oxide production. - Germany’s Carbon Border Adjustment Mechanism (CBAM) increases compliance costs for high-emission alumina imports. |

| France | Strict environmental laws under France’s Climate and Resilience Law require aluminum oxide manufacturers to lower carbon emissions. - ISO 14001 is essential for companies demonstrating environmental responsibility. - REACH compliance is mandatory for aluminum oxide used in industrial applications. |

| United Kingdom | Post-Brexit, aluminum oxide imports and exports must comply with UK REACH, a regulatory framework similar to the EU’s REACH. - CE and UKCA (UK Conformity Assessed) marking is necessary for aluminum oxide products used in industrial coatings and ceramics. - Energy-intensive industries, including alumina processing, must adhere to the UK Emissions Trading Scheme (UK ETS). |

| Italy | Compliance with EU Directive 2010/75/EU (Industrial Emissions Directive) is mandatory for reducing air pollution in aluminum oxide production. - UNI EN ISO 50001 certification is required for energy management in high-consumption industries. - Stricter recycling regulations encourage companies to adopt circular economy practices for alumina waste. |

| Spain | Royal Decree 293/2018 enforces stricter packaging waste management, impacting aluminum oxide packaging materials. - Companies must meet ISO 45001 for occupational health and safety in aluminum oxide manufacturing. - The Spanish Climate Change and Energy Transition Law pushes for lower industrial carbon footprints. |

| Netherlands | EU Emissions Trading System (EU ETS) regulations impose carbon costs on aluminum oxide producers. - Mandatory KIWA certification applies to aluminum oxide used in water treatment applications. - Government incentives encourage green alumina production through the Dutch Climate Agreement. |

| Belgium | EU REACH and CLP (Classification, Labelling, and Packaging) Regulations apply to aluminum oxide imports and manufacturing. - Flemish Environmental Legislation (VLAREM) sets strict waste management and air emission norms. - ISO 9001 and ISO 14001 certifications are widely adopted to ensure quality and sustainability. |

| Sweden | The Environmental Code (Miljöbalken) regulates emissions and industrial waste disposal affecting aluminum oxide processing. - Companies using aluminum oxide in medical and pharmaceutical applications must meet MDR (Medical Device Regulation - EU 2017/745). - Government policies incentivize sustainable energy use in aluminum oxide production. |

| 2020 to 2024 (Historical Performance) | 2025 to 2035 (Future Outlook) |

|---|---|

| Market growth was steady, driven by increasing demand for aluminum production and abrasives. | The industry is set for accelerated growth, fueled by advancements in electronics, medical applications, and engineered ceramics. |

| The COVID-19 pandemic disrupted supply chains, causing temporary slowdowns in manufacturing. | Strengthened supply chains and investments in localized production will enhance industry stability. |

| The rising adoption of lightweight aluminum in the automotive and aerospace industries drove demand for aluminum oxide. | Growth in electric vehicles (EVs) and sustainable aviation will further boost demand for high-purity alumina. |

| The electronics industry emerged as a key consumer, with increased use of alumina in semiconductors and LED lighting. | Electronics will remain the fastest-growing segment, driven by 5G infrastructure, IoT, and AI-powered devices. |

| Metallurgy and industrial applications dominated the market, with stable demand from metal refining and smelting. | Medical and nanotechnology applications will gain momentum, increasing the use of aluminum oxide in biomedical implants and coatings. |

| Regulatory policies such as EU REACH and EU ETS began influencing production standards. | Stricter carbon regulations and circular economy initiatives will drive the shift toward low-emission alumina production. |

Aluminum production remains the most lucrative application of aluminum oxide, driven by the rising demand for lightweight materials in the automotive and aerospace industries. As aluminum usage expands across sectors, the need for aluminum oxide in smelting and refining continues to grow.

Meanwhile, the electronics industry is the fastest-growing application segment, with a 6.2% CAGR, fueled by the increasing adoption of semiconductors, LEDs, and integrated circuits. The expanding use of abrasives and engineered ceramics is also contributing to industry growth.

The principal end-user sector is metallurgy, where aluminum oxide plays a role in metal refining, smelting, and alloy production. Yet the fastest-growing sector today is the electronics industry due to the increased consumption of smartphones, laptops, and energy-efficient LED lighting. The medical industry is also becoming more popular since aluminum oxide finds applications in dental implants, prosthetics, and surgical tools due to its biocompatibility and strength.

Powdered aluminum oxide leads the industry owing to its extensive applications in industrial processes, ceramics, and abrasives. However, nanoparticles are the fastest-growing product category, benefiting from advancements in nanotechnology and high-performance coatings. Their increasing usage in electronics, medical devices, and engineered materials is expected to drive demand further.

Since the demand for aluminum oxide has been growing in electronics, automotive, aerospace, and construction, active competition exists in this market where key players have intensified their competitive powers. Major players such as Almatis GmbH, Alteo, Hindalco Industries Ltd., Norsk Hydro ASA, Sasol Limited, Huber Engineered Materials, all of which are seeking to improve their industry positions to meet this rising demand for quality aluminum oxide.

Almatis GmbH is the largest player in this sector with 23-27% of share in 2024. This company follows innovation activities and sustainable development. In early 2024, it marketed a new high-purity aluminum oxide product line that was especially designed for advanced ceramics and electronics applications.

These products are reputed for excellent quality and performance. The strong distribution network of Almatis and its commitment to R&D activities have together consolidated its leading position. Alteo is about 18-21% of share in 2024. Since the company has considered technological progress as prime priority, it enabled the launch of a new range of specialty alumina products.

with enhanced thermal and mechanical properties. Launched in mid-2024, the products gained acceptance in industries such as automotive and aerospace due to durability and reliability. Alteo's continued emphasis on innovative solutions and customer satisfaction has allowed it to maintain its competitive edge and expand its customer base.

Hindalco Industries Ltd. accounts for around 14-17% of the share in 2024, with significant investments in R&D for aluminum oxide products aimed at construction use. This product, designed for high-performance applications, was welcomed because of its beneficial characteristics such as strength and environmental benefits. Innovation and sustainability form the core of Hindalco's strategy to realize significant industry capture.

As of 2024, Norsk Hydro ASA's share stands at 11-14%. The company has maintained its focus on the development of sustainable solutions within the aluminum oxide segment, launching new lines of recycled alumina products in partnership with firms within the industry. Norsk Hydro's strong commitment to sustainability and R&D propelled it to becoming a serious contender.

Sasol Limited's share in 2024 stands at an estimate of 9-11%. Recently, Sasol accelerated the commercialization of a high-performance aluminum oxide product line for industrial applications. Products designed for severe, harsh conditions- have found significant adoption in the concrete industry due to their durability and reliability. Sasol has had a very focused view in promoting certain solutions, thus carving for itself a distinguished space in the industry.

Huber Engineered Materials shares about 7-9% of the industry in the year 2024. The company has pursued strategic alliances, forming collaborations with technology companies to create custom aluminum oxide solutions for advanced applications. Huber's emphasis on innovation and collaboration has cemented its status as a trusted supplier of high-quality aluminum oxide.

Broader economic trends, including GDP growth, industrial expansion, and global trade dynamics shape the Europe aluminum oxide market. The region's focus on sustainability and green manufacturing is pushing the industry toward energy-efficient production methods and low-carbon technologies. Rising demand for lightweight materials in the automotive and aerospace sectors, especially with the shift to electric vehicles (EVs) and fuel-efficient aircraft, is driving aluminum oxide consumption.

The electronics sector is another major contributor by increasing demand for high-purity alumina through investments in semiconductor manufacturing, 5G infrastructure developments, and AI-powered devices. Moreover, the medical field sees an increasing usage of aluminum oxide in implants, dental ceramics, and surgical tools owing to the compatibility and the long-standing properties of the material.

Fluctuating prices of energy, supply chain disruption, and strict regulations by the EU on emissions and waste management pose further challenges. These notwithstanding, the industry is expected to grow steadily through 2035, buoyed by Europe's dedication to technological innovation and corresponding circular economy practices.

Growth Opportunities

Expansion in Electronics & Semiconductor Manufacturing

With the European Union investing in semiconductor self-sufficiency, stakeholders should collaborate with local chip manufacturers to supply high-purity aluminum oxide for wafers and insulators. Targeting 5G infrastructure, IoT devices, and AI-driven electronics will unlock long-term growth.

Capitalizing on Sustainable & Low-Carbon Production

Stricter EU ETS (Emissions Trading System) regulations are pushing industries toward low-carbon alumina production. Companies investing in renewable energy-powered refineries and closed-loop recycling of alumina waste will gain a competitive edge.

Rising Demand in the Medical & Bioceramics Sector

Aluminum oxide’s bio-inertness and durability make it a preferred material for dental implants, prosthetics, and orthopedic applications. Expanding strategic partnerships with European medical device manufacturers can drive new revenue streams.

Strategic Recommendations

Strengthen Local Supply Chains

Clarify whether this means acquiring mining firms, forming joint ventures, or securing long-term contracts.

Develop High-Purity Alumina (HPA) for Premium Applications

Companies should invest in R&D for high-purity aluminum oxide to tap into semiconductors, sapphire glass, and lithium-ion battery separators, all of which require advanced material specifications.

Leverage EU Funding for Green Innovation

The European Green Deal and Horizon Europe offer funding for sustainable material development. Securing grants for carbon-neutral production technologies can improve profitability while ensuring regulatory compliance.

Aluminum oxide is widely used in aluminum production, electronics, abrasives, engineered ceramics, and medical implants due to its high durability and thermal resistance.

The automotive, aerospace, electronics, metallurgy, and medical sectors are the primary consumers, with increasing adoption of EV batteries, semiconductors, and dental ceramics.

EU REACH regulations, carbon emission policies, and sustainability initiatives are pushing manufacturers to adopt low-carbon production methods and eco-friendly sourcing practices.

The growing use of 5G technology, AI-driven electronics, renewable energy storage, and high-performance coatings is significantly increasing demand.

Innovations in nanotechnology, bioceramics, and advanced manufacturing techniques are expanding usage in medical devices, aerospace coatings, and high-purity electronic components.

By product type, key segments are nanoparticles, powder, pellets, tablets, and sputtering targets.

Based on application, key segments are aluminum production, non-aluminum production, abrasives, engineered ceramics, corundum, and others.

Based on end use, the sector is segmented into medical, automotive, aerospace, metallurgy, electronics, and others.

Agricultural Fabrics Market Growth - Trends & Forecast 2025 to 2035

Asia Pacific Industrial Solvents Market Growth - Trends & Forecast 2025 to 2035

Asia Pacific Waterproofing Chemicals Market Growth - Trends & Forecast 2025 to 2035

Diamond Wire Market Size & Outlook 2025 to 2035

Thioesters Market Growth & Trends 2025 to 2035

The Self-Healing Materials Market is segmented by product, technology, and application from 2025 to 2035.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.