The Europe Allergen Free Food market is set to grow from an estimated USD 15,068.0 million in 2025 to USD 28,316.7 million by 2035, with a compound annual growth rate (CAGR) of 6.5% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 15,068.0 million |

| Projected Europe Value (2035F) | USD 28,316.7 million |

| Value-based CAGR (2025 to 2035) | 6.5% |

In the last few years, the Europe-based allergen-free food market has been in robust growth because of increased awareness among consumers about food allergies, intolerances, and sensitivities. Allergen-free food products are specially developed to avoid certain common allergens like gluten, dairy, nuts, eggs, and soy that are present in most foods and provide a safer alternative for the consumer with allergies or sensitivities.

Other factors contributing to the fast growth rate of the market include increasing incidents of food allergies and intolerance and greater awareness among consumers concerning the adverse effects of allergens on health. Especially, demand for gluten-free, dairy-free, and nut-free products has been significant in patient populations with conditions such as celiac disease, lactose intolerance, and nut allergies.

The European market will continue to expand as consumers begin to take an interest in healthier eating and preventive health management, much like the trend around the globe, where consumers are focusing more on health and wellness in the food they choose. The structure of the industry is diversified by large international companies such as Nestlé S.A., Danone S.A., and Unilever, besides smaller regional companies.

These major companies have responded to the high and growing demand for allergen-free products by introducing such products to their portfolio or launching new, more specific ones. These tactics most often consist of innovation, offering more products, and expanding into the whole geographic space of Europe.

Explore FMI!

Book a free demo

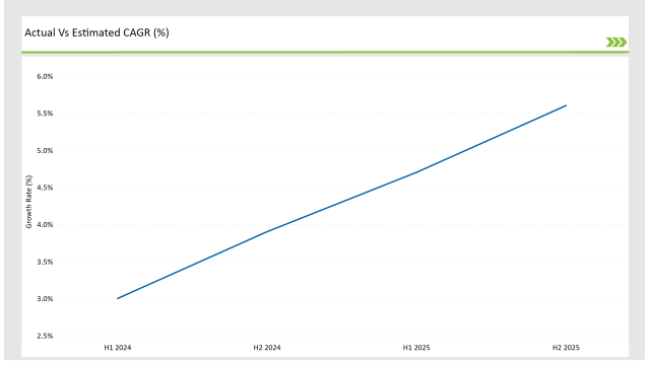

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Allergen Free Food market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2023 to 2033) | 3.0% |

| H2 (2023 to 2033) | 3.9% |

| H1 (2024 to 2034) | 4.7% |

| H2 (2024 to 2034) | 5.6% |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Allergen Free Food market, the sector is predicted to grow at a CAGR of 3.0% during the first half of 2023, with an increase to 3.9% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 4.7% in H1 but is expected to rise to 5.6% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2023 to the first half of 2024, followed by an increase of 20 basis points in the second half of 2024 compared to the second half of 2023.

| Date | Development/M&A Activity & Details |

|---|---|

| April-2024 | New Product Launch : A major player, Nestlé S.A. , launched a new line of dairy-free snacks, aimed at expanding its presence in the allergen-free market and catering to growing consumer demand for dairy alternatives. |

| March-2024 | Strategic Partnership : Danone S.A. entered into a strategic partnership with regional players to enhance the distribution network of its allergen-free products, increasing availability across Europe. |

| February-2024 | Packaging Innovation : Unilever introduced eco-friendly packaging for its allergen-free frozen food range, aligning with the increasing consumer demand for sustainable solutions without compromising product safety. |

Innovative Solutions for Gluten-Free Products: Tailored Nutrition for Specific Dietary Needs

This market has developed and grown dramatically within the category of allergen-free food: innovation is what's seen particularly about gluten-free in line with diagnosed individuals, mostly by increasing diagnosed individuals suffering from celiac disease or sensitivity towards gluten.

Indeed, this product market differs widely compared to how gluten-free food used to taste about a decade ago - extremely limited, to be precise, and tasteless compared to traditional equivalents. One notable innovation is the use of ancient grains such as quinoa, buckwheat, and amaranth as alternative gluten-free flours.

These grains not only give a healthy choice for sensitive individuals to gluten but also improve nutritional value and have higher proteins and fibre than others. A lot of brands like Dr.Schär, and War burtons have specialized in making their gluten-free bread and pasta resembling more like that of the traditionally baked wheat with an identical flavour.

Dairy-Free Alternatives: The Shift Toward Plant-Based Options

The rising interest in plant-based diets and the increasing population of people diagnosed with lactose intolerance drive innovation in the dairy-free allergen-free food market segment. Dairy-free products, particularly milk, cheese, and yogurt alternatives, have experienced rapid growth due to advances in plant-based ingredients such as oats, almonds, and soy.

Companies are now coming up with a wide variety of dairy-free beverages, many of which are fortified with important nutrients like calcium, vitamin D, and protein, so consumers have a nutritious alternative to traditional dairy products.

Alpro and Oatly are leaders in this field and continue to increase their offerings and market presence in Europe. Meanwhile, dairy-free desserts and snacks also grew with brands such as So Delicious releasing ice creams and yogurts that almost mirror the richness and creaminess of their traditional dairy counterparts. With the ever-increasing demand for dairy alternatives, the market is today shifting to more sustainable raw materials.

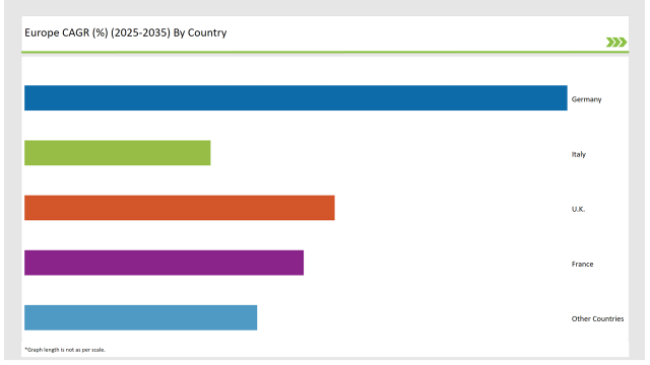

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 35% |

| Italy | 12% |

| UK | 20% |

| France | 18% |

| Other Countries | 15% |

The leading markets for European allergen-free foods have included Germany. Its customers are showing considerable demand for products free from gluten, dairy, and nuts. Levels of awareness of food allergies, intolerance, and sensitivity are growing.

That demand has become the force to push forward in demanding these specially formulated foods without common allergens. Being one of the largest economies in Europe, Germany has found international as well as local food manufacturers investing in the development and production of allergen-free products.

Germany has been particularly ahead in terms of research and development of gluten-free foods. Companies like Dr.Schär have played an important role in producing high-quality gluten-free bread, pasta, and other baked goods. About the demands of the consumer, German manufacturers are offering a range of allergen-free options catering to specific dietary requirements, such as lactose-free and vegan.

Moreover, German food companies are starting to include newer ingredients like quinoa and millet in their gluten-free products to boost the nutritional values of their gluten-free products to ensure that those products are safe and healthy as well.

The United Kingdom has emerged as a prime market for allergen-free food, particularly for dairy-free and plant-based products. It is worth noticing that in the past few years, such products have witnessed immense popularity.

The growing vegan and flexitarian movements in the UK are proliferating the demand for allergen-free dairy alternatives, such as plant-based milk, cheeses, and yogurt. The health and ethical reasons for dairy-free products among UK consumers include concerns over lactose intolerance, animal welfare, and other reasons.

Companies like Alpro and Oatly have capitalized on this trend by expanding their product ranges and developing new, innovative dairy-free offerings that cater to both taste and nutritional needs. Among all these, Britain has seen tremendous growth in non-dairy snacks, including dairy-free cookies and chocolate, plus ice cream in the UK appealing to consumers craving allergen-free indulgence yet not sacrificing flavours.

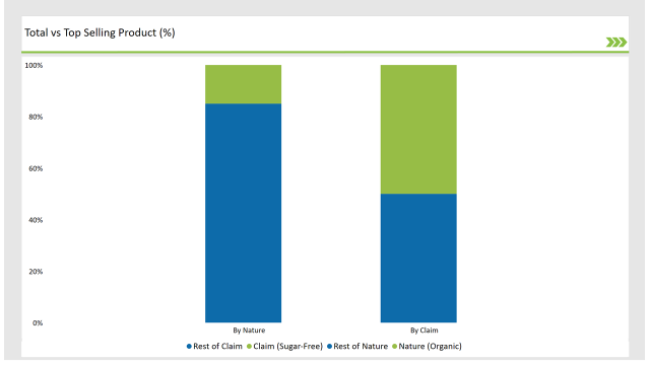

% share of Individual Categories Form and Claim in 2025

| Main Segment | Market Share (%) |

|---|---|

| Nature (Organic) | 15% |

| Remaining segments | 85% |

With organic products accounting for a major share, the European energy gel market is at the forefront of growth as consumers are showing a tendency to choose health-conscious items more than ever. The major factor of this trend is the consciousness of the public who have to understand that organic ingredients are not only more beneficial to health but they also make a positive impact on environmental sustainability.

Sportspeople and people who are keeping fit are becoming more aware of the products they are taking, and so they are looking for energy gels that compete with their eating style of mostly natural and sometimes clean food.

The organic energy gels are often made from top-notch quality raw materials which are free of synthetic additives. This fact is very important to the consumers who are looking after their health and wellness well. In addition, people are forming a habit of consuming a plant-based diet, which gives more boost to the demand for organic products since a lot of consumers are on the lookout for energy sources that fit their dietary preferences.

| Main Segment | Market Share (%) |

|---|---|

| Claim (Sugar-Free) | 50% |

| Remaining segments | 50% |

The sickening truth of the negative health effects arising from excess sugar consumption, obesity, and diabetes made it clear to many athletes and fitness lovers to consider using sugar-free energy gels that can deliver the energy they need without some extra calories. The majority of the products on the market use natural sweeteners or sugar substitutes only, which makes the process of enjoying energy gels without falling back on the diet much easier for consumers.

This is compounded by the ever-increasing popularity of low-carb and ketogenic diets which in turn has resulted in a large number of people pushing for sugar-free goods, as they want things that fit their diet. By creating products that do not include sugar while still tasting and performing exceptionally, brands make a profit on this trend.

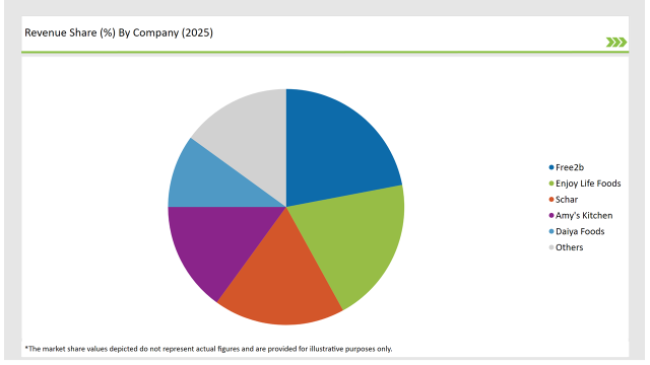

2025 Market share of Europe Allergen Free Food manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Free2b | 22% |

| Enjoy Life Foods | 20% |

| Schar | 18% |

| Amy's Kitchen | 15% |

| Daiya Foods | 10% |

| Others | 15% |

Note: The above chart is indicative in nature

The allergen-free food market in Europe is quite distinctive as it shows a characteristic of being heterogeneous with a mix of large multinationals and local players working together to meet the continuous demand for allergy-free foods.

The major competitive players in the market are Nestlé S.A., Danone S.A., and Unilever, as they have the privilege of being it through the scope of research and development, large distribution networks, and a considerable proportion of the market that they control. These firms have found a way to introduce allergen-free products into their current line, thus ensuring they follow the changes in the dietary requirements of the Europeans.

Their strategies mostly comprise developed products, mass marketing campaigns, and long-distance trades to supply allergen-free foods to a diverse group of consumers. On the other side, the Alpro and Oatly companies are Tier 2, which mainly deal in allergen-sensitive goods, especially the dairy-free and plant-based range. These companies are now stronger regional players as they are constantly innovating new dairy-free products to satisfy high demand.

Tier 3 firms, which often have less than 10 people on the team and mostly on a local basis, are the other vital players in the market since they have specialty channels and assemble diet plans or recipes for customers.

The Europe Allergen Free Food market is projected to grow at a CAGR of 6.5% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 28,316.7 million.

Key factors driving the allergen-free food market in Europe include the increasing prevalence of food allergies and intolerances among consumers, leading to a higher demand for safe and suitable food options. Additionally, growing awareness of health and wellness, along with the rise of clean label products, is further fueling the market's expansion.

Germany, France, and UK are the key countries with high consumption rates in the European Allergen Free Food market.

Leading manufacturers include Free2b, Enjoy Life Foods, Schar, Amy's Kitchen, and Daiya Foods known for their innovative and sustainable production techniques and a variety of product lines.

As per Nature, the industry has been categorized into Organic, and Conventional.

As per Product Type, the industry has been categorized into Chocolate and Beverages, Processed Meat & Poultry, and Others.

As per Claim, the industry has been categorized into Sugar Free, GMO Free, Others.

Industry analysis has been carried out in key countries of Germany, U.K., France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

Aquafeed Enzymes Market Analysis by Enzyme Type, Form, Aquatic Animal, and Region Through 2035

Chickpea Milk Market Analysis by Category, Flavor and End Use Through 2025 to 2035

Coconut Butter Market Analysis by End-use Application Sales Channel Through 2025 to 2035

Hydrotreated Vegetable Oil Market Analysis by Type and Application Through 2035

Children’s Health Supplement Market Analysis by Product Type, Application and Age Group Through 2025 to 2035.

Hyaluronic Acid Supplement Market Product, Type, Application, Distribution Channel and Others Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.